false

0001637736

0001637736

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): February 28, 2024

ELECTRAMECCANICA

VEHICLES CORP.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada |

001-38612 |

98-1485035 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

6060

Silver Drive

Third

Floor

Burnaby,

British

Columbia, Canada |

|

V5H 0H5 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (604) 428-7656

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common

Shares, no par value |

SOLO |

The

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On February 28, 2024, ElectraMeccanica Vehicles

Corp. (the “Company”) entered into a sale and purchase agreement with Solo Automotive, Inc. (the “Purchaser”).

Jerry Kroll, a former member of the Company’s board of directors (the “Board”), is the principal of the Purchaser. Pursuant

to the terms of the agreement, the Company has agreed to transfer two G2 SOLO and one non-operational Sparrow showroom vehicles on an

“as is, where is” basis, along with certain SOLO-related assets, including, among other things, certain parts, tools, documentation

and intellectual property, to the Purchaser. In consideration for such transfer, Mr. Kroll has agreed,

among other things, to vote all common shares of the Company beneficially owned by him in favor of each of the proposals set forth

in the Company’s definitive proxy statement, filed with the U.S. Securities and Exchange Commission on February 13, 2024, for the

Company’s upcoming special meeting of shareholders on March 20, 2024 (the “ElectraMeccanica Special Meeting”), including

the proposal to approve the proposed arrangement (the “Arrangement Proposal”) with

Xos, Inc. (“Xos”). As of the date of this Current Report on Form 8-K, Mr. Kroll beneficially

owned approximately 5.4 million common shares of the Company.

On February 28, 2024, Mr. Kroll also entered

into a voting support and lock-up agreement with Xos pursuant to which Mr. Kroll has agreed,

among other things, not to dispose of any shares of Xos’ common stock received as consideration in connection with the Arrangement

for 90 days following the effective date of the Arrangement, in addition to voting support for the Arrangement Proposal.

On March 1, 2024, the

Company issued a press release announcing Mr. Kroll’s voting commitment for the proposals to be considered at the ElectraMeccanica

Special Meeting, including the Arrangement Proposal. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated

herein by reference in its entirety.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date: March 1, 2024 |

ELECTRAMECCANICA VEHICLES CORP. |

| |

|

|

| |

By: |

/s/ Michael Bridge |

| |

|

Michael Bridge |

| |

|

General Counsel and Corporate Secretary |

Exhibit

99.1

MESA, Ariz., March 1, 2024

(GLOBE NEWSWIRE) -- ElectraMeccanica (NASDAQ: SOLO) (“ElectraMeccanica”), a designer and assembler of electric vehicles,

announced today that founder and former board member Jerry Kroll has agreed to vote in favor of the ElectraMeccanica’s proposed

combination with Xos, Inc. (NASDAQ: XOS) (“Xos”), a leading electric truck manufacturer

and fleet electrification services provider, at the upcoming special meeting of ElectraMeccanica shareholders on Wednesday, March

20th.

“My

goal was always to be involved with a company that could play a meaningful role in putting the last gas station out of business. I believe

combining ElectraMeccanica with Xos will create an entity that contributes to doing just that,” said Kroll. He continued, “Zero-emission

commercial vehicles are a smart application of EV technology. There is clear market demand, and the ownership economics make solid business

sense for fleet operators. Ultimately, I’m voting my shares in support of a transaction that I believe will not only create economic

value but also fulfill a mission that I remain passionately committed to.”

ElectraMeccanica CEO, Susan

E. Docherty, commented “Jerry’s support speaks to the strong potential of our proposed combination with Xos. As both a founder

with a clear vision and a significant shareholder, Jerry shares our belief that a transaction with Xos represents an opportunity to participate

in Xos’ anticipated future growth. Xos’ commercial vehicles are in the hands of some of the nation’s largest fleets.

Xos provides a great product that its customers love, and we are excited about what lies ahead as the company scales to meet demand from

commercial fleet operators.”

Additional information about the proposed

combination, including information about how shareholders may vote, can be found at: ir.emvauto.com.

Shareholders who have questions

or need assistance with voting their shares should contact ElectraMeccanica’s proxy solicitation agents:

Canada: Laurel Hill Advisory

Group - 1-877-452-7184 or assistance@laurelhill.com

United States: Mackenzie

Partners - 1-800-322-2885 or proxy@mackenziepartners.com

About ElectraMeccanica

ElectraMeccanica (NASDAQ:

SOLO) is a designer and assembler of environmentally efficient electric vehicles that will enhance the urban driving experience, including

commuting, delivery and shared mobility.

Additional Information

and Where to Find It

Xos and ElectraMeccanica have mailed a joint

proxy statement/management information circular (the “Joint Proxy Statement/Circular”) and a proxy card to Xos’ stockholders

and ElectraMeccanica’s shareholders as of the record date established for voting on the matters related to the proposed transaction

(the “Arrangement”) and any other matters to be voted on at the special meetings of Xos’ stockholders and ElectraMeccanica’s

shareholders, respectively. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/CIRCULAR

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), AS APPLICABLE, AND ANY OTHER DOCUMENTS THAT XOS AND ELECTRAMECCANICA WILL FILE WITH

THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE "SEC") IN CONNECTION WITH THE PROPOSED TRANSACTION, OR INCORPORATE BY REFERENCE

IN THE JOINT PROXY STATEMENT/CIRCULAR AND MANAGEMENT INFORMATION CIRCULARS, AS APPLICABLE, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. Security holders may obtain free copies of the joint preliminary and definitive proxy statements and management

information circulars (including any amendments or supplements thereto) and any other relevant documents filed by Xos and ElectraMeccanica

with the SEC in connection with the proposed transaction (when they become available) on the SEC’s website at www.sec.gov, on the

Canadian System for Electronic Document Analysis and Retrieval+ website at https://www.sedarplus.ca/, on Xos’ website at www.xostrucks.com,

by contacting Xos’ investor relations via email at investors@xostrucks.com, on ElectraMeccanica’s website at https://ir.emvauto.com,

or by contacting ElectraMeccanica’s Investor Relations via email at IR@emvauto.com, as applicable.

Non-Solicitation

This communication will not

constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor will there

be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction.

Safe Harbor Statement

This press release includes

“forward-looking statements” within the meaning of U.S. federal securities laws and applicable Canadian securities laws.

These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by words or expressions such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “estimates,” “may,” “will,” “projects,”

“could,” “should,” “would,” “seek,” “forecast,” or other similar expressions.

Forward-looking statements represent current judgments about possible future events, including, but not limited to statements regarding

expectations or forecasts of business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates,

and beliefs relating to the proposed transaction between ElectraMeccanica and Xos, such as statements regarding the combined operations

and prospects of ElectraMeccanica and Xos, the current and projected market, growth opportunities and synergies for the combined company,

and the timing and completion of the proposed transaction, including the satisfaction or waiver of all the required conditions thereto.

These forward-looking statements are based upon the current beliefs and expectations of the management of ElectraMeccanica and are subject

to known and unknown risks and uncertainties. Factors that could cause actual events to differ include, but are not limited to:

| ● | ElectraMeccanica’s

ability to maintain its net cash balance prior to the effective time of the Arrangement; |

| ● | the ability of the combined company to further penetrate the

U.S. market; |

| ● | the total addressable market of Xos’ business; |

| ● | general economic conditions in the markets where Xos operates; |

| ● | the expected timing of any regulatory approvals relating to

the proposed transaction, the businesses of ElectraMeccanica and Xos and of the combined

company and product launches of such businesses and companies; |

| ● | non-performance of third-party vendors and contractors; |

| ● | risks related to the combined company’s ability to successfully

sell its products and the market reception to and performance of its products; |

| ● | ElectraMeccanica’s, Xos’, and the combined company’s

compliance with, and changes to, applicable laws and regulations; |

| ● | ElectraMeccanica’s, Xos’, and the combined company’s

limited operating history; |

| ● | the combined company’s ability to manage growth; |

| ● | the combined company’s ability to obtain additional financing; |

| ● | the combined company’s ability to expand product offerings; |

| ● | the combined company’s ability to compete with others

in its industry; |

| ● | the combined company’s ability to protect its intellectual

property; |

| ● | ElectraMeccanica’s, Xos’, and the combined company’s

ability to defend against legal proceedings; |

| ● | the combined company’s success in retaining or recruiting,

or changes required in, its officers, key employees or directors; |

| ● | the combined company’s ability to achieve the expected

benefits from the proposed transaction within the expected time frames or at all; |

| ● | the incurrence of unexpected costs, liabilities or delays relating

to the proposed transaction; |

| ● | the satisfaction (or waiver) of closing conditions to the consummation

of the proposed transaction, including with respect to the approval of Xos’ stockholders

and ElectraMeccanica’s shareholders; |

| ● | the occurrence of any event, change or other circumstance or

condition that could give rise to the termination of the definitive arrangement agreement; |

| ● | the effect of the announcement or pendency of the transaction

on the combined company’s business relationships, operating results and business generally;

and |

| ● | other economic, business,

competitive, and regulatory factors affecting the businesses of the companies generally,

including but not limited to those set forth in ElectraMeccanica’s filings with the

SEC, including in the “Risk Factors” section of ElectraMeccanica’s Annual

Report on Form 10-K filed with the SEC on April 17, 2023, ElectraMeccanica’s Quarterly

Report on Form 10-Q filed with the SEC on November 3, 2023 and any subsequent SEC filings,

and those set forth in Xos’ filings with the SEC, including in the “Risk Factors”

section of Xos’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023

and any subsequent SEC filings. These documents with respect to ElectraMeccanica can be accessed

on ElectraMeccanica’s website at https://ir.emvauto.com/filings/sec-filings/default.aspx

and these documents with respect to Xos can be accessed on Xos’ web page at https://www.xostrucks.com/investor-overview/

by clicking on the link “SEC Filings.” |

Readers are cautioned not

to place undue reliance on forward-looking statements. It is uncertain whether any of the events anticipated by the forward-looking statements

will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of ElectraMeccanica,

Xos or the combined company. Forward-looking statements speak only as of the date they are made, and ElectraMeccanica undertakes no obligation

to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events, or other

factors that affect the subject of these statements, except where expressly required to do so by law.

Contacts

Investors and Media:

ElectraMeccanica Contact:

John Franklin

ir@emvauto.com

v3.24.0.1

Cover

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity File Number |

001-38612

|

| Entity Registrant Name |

ELECTRAMECCANICA

VEHICLES CORP.

|

| Entity Central Index Key |

0001637736

|

| Entity Tax Identification Number |

98-1485035

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Address, Address Line One |

6060

Silver Drive

|

| Entity Address, Address Line Two |

Third

Floor

|

| Entity Address, City or Town |

Burnaby

|

| Entity Address, State or Province |

BC

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

V5H 0H5

|

| City Area Code |

604

|

| Local Phone Number |

428-7656

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Shares, no par value

|

| Trading Symbol |

SOLO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

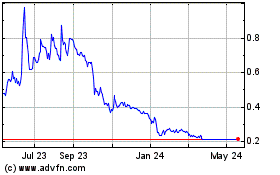

Electrameccanica Vehicles (NASDAQ:SOLO)

Historical Stock Chart

From Mar 2025 to Apr 2025

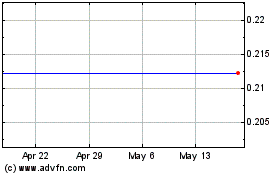

Electrameccanica Vehicles (NASDAQ:SOLO)

Historical Stock Chart

From Apr 2024 to Apr 2025