UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 1, 2019

BERRY GLOBAL GROUP, INC.

(Exact name of registrant as specified in charter)

|

Delaware

|

1-35672

|

20-5234618

|

|

(State of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

101 Oakley Street

Evansville, Indiana 47710

(Address of principal executive offices / Zip Code)

(812) 424-2904

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act.

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act.

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act.

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act.

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

BERY

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act. ☐

Introductory Note

On July 1, 2019, Berry Global Group, Inc. (the “Company”) completed its previously announced acquisition (the “Acquisition”) of all of the outstanding shares of RPC Group Plc, a public company

incorporated in England and Wales (“RPC”).

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Release of Escrow Proceeds

On June 5, 2019, Berry Global Escrow Corporation (the “Escrow Issuer”), a wholly owned indirect subsidiary of the Company, issued (i) $1,250,000,000 aggregate principal amount of 4.875% first priority

senior secured notes due 2026 (the “First Priority Notes”) pursuant to an indenture, dated as of June 5, 2019 (the “First Priority Notes Indenture”), between the Escrow Issuer and U.S. Bank, National Association as trustee and collateral agent (the

“Trustee”) and (ii) $500,000,000 aggregate principal amount of 5.625% second priority senior secured notes due 2027 (the “Second Priority Notes” and together with the First Priority Notes, the “Notes”) pursuant to an indenture, dated as of June 5,

2019 (the “Second Priority Notes Indenture” and together with the First Priority Notes Indenture, the “Indentures”), between the Escrow Issuer and the Trustee, as trustee and collateral agent. On June 5, 2019, pursuant to the Indentures, the Issuer

deposited into escrow accounts with U.S. Bank National Association, as escrow agent, the gross proceeds from the First Priority Notes and the Second Priority Notes.

In connection with the completion of the Acquisition, on July 1, 2019 (the “Escrow Release Date”), the gross proceeds of the Notes were released to Berry Global, Inc. (“BGI”), a wholly owned

subsidiary of the Company. Also on the Escrow Release Date, in relation to the release of the proceeds from escrow, (i) by entry into a supplemental indenture with respect to the First Priority Notes Indenture (the “First Priority Notes Supplemental

Indenture”) among BGI, the Escrow Issuer, the Company, certain subsidiaries of the Company (the “Guarantor Subsidiaries”) and the Trustee, BGI assumed the Escrow Issuer’s obligations under the First Priority Notes and the Escrow Issuer was released

from the obligations thereunder, and the First Priority Notes became fully and unconditionally guaranteed, jointly and severally, on a first priority senior secured basis, by the Guarantor Subsidiaries and by Berry on an unsecured basis, and (ii) by

entry into a supplemental indenture with respect to the Second Priority Notes Indenture (the “Second Priority Notes Supplemental Indenture”, and together with the First Priority Notes Supplemental Indenture, the “Supplemental Indentures”) among BGI,

the Escrow Issuer, the Company, the Guarantor Subsidiaries and the Trustee, BGI assumed the Escrow Issuer’s obligations under the Second Priority Notes and the Escrow Issuer was released from the obligations thereunder, and the Second Priority Notes

became fully and unconditionally guaranteed, jointly and severally, on a second priority senior secured basis, by the Subsidiary Guarantors, and by Berry on an unsecured basis.

The foregoing descriptions of the Supplemental Indentures do not purport to be complete and are qualified in their entirety by reference to the actual text of the Supplemental Indentures, which are

filed herewith as Exhibits 4.1 and 4.2 and are incorporated herein by reference.

Incremental Term Loans

On July 1, 2019, the Company, BGI and certain of its subsidiaries entered into an Incremental Assumption Agreement and Amendment with Credit Suisse AG, Cayman Islands Branch, as Administrative Agent,

and Goldman Sachs Bank USA as the Initial Term U Lender and the Initial Term V Lender to borrow incremental amounts of $4,250,000,000 (the “Term U Loan”) and €1,075,000,000 (the “Term V Loan” and together with the Term U Loan, the “Term Loans”) under

BGI’s existing term loan credit agreement. The Term U Loan bears interest at the option of BGI at LIBOR plus 2.50% per annum or the Alternative Base Rate plus 1.50% per annum. The Term V Loan bears interest at EURIBOR plus 2.50% per annum. The Term

U Loan and the Term V Loan mature on July 1, 2026, and are subject to customary amortization. If certain specified repricing events occur prior to January 1, 2020, BGI will pay a fee to the applicable lenders equal to 1.00% of the outstanding

principal amount of the Term U Loan and/or the Term V Loan subject to such repricing event.

The proceeds of the Term U Loan and the Term V Loan were used to refinance BGI’s existing Term S Loans, fund a portion of the cash consideration due in respect of the Acquisition, pay off or otherwise

satisfy certain outstanding RPC indebtedness, and pay costs and expenses of the Acquisition.

The Incremental Assumption Agreement and Amendment amended BGI’s existing term loan credit agreement and certain agreements related thereto to permit Berry Plastics Canada, Inc. to make borrowings

under the Canadian Tranche previously disclosed and described in a Current Report on Form 8-K filed on May 6, 2019 by the Company.

The foregoing description of the Incremental Assumption Agreement and Amendment does not purport to be complete and is qualified in its entirety by reference to the actual text of the Incremental

Assumption Agreement and Amendment, which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On July 1, 2019, the Company completed its previously announced acquisition (the “Acquisition”) of the entire outstanding share capital of RPC, for aggregate consideration of approximately $6.5 billion, including refinancing of RPC’s net debt, subject to

closing adjustments. The Acquisition was implemented by way of a court-sanctioned Scheme of Arrangement under Part 26 of the UK Companies Act 2006 (the “Companies Act”) and under the UK City Code on Takeovers and Mergers (the “City Code”).

On March 8, 2019, the Company issued an announcement (the “UK Announcement”) pursuant to Rule 2.7 of the City Code disclosing the terms of an all-cash firm offer for the entire issued and to be issued

share capital of RPC. Under the terms of the offer, RPC shareholders were entitled to receive 793 pence in cash for each RPC share (implying a value of approximately £3.3 billion).

The Acquisition and refinancing of RPC’s net debt was funded in part with the net proceeds of the Notes and the Term Loans described in Item 1.01 of this Current Report on Form 8-K.

The foregoing description of the Acquisition does not purport to be complete and is qualified in its entirety by reference to the UK Announcement and the Co-operation Agreement entered into in

connection with the Acquisition, which are filed as Exhibit 2.1 and Exhibit 2.2, respectively, to this Current Report on Form 8-K and are incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement of a Registrant.

|

The information set forth under Item 1.01 above is incorporated by reference into this Item 2.03.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Effective July 1, 2019, the Company appointed Jean-Marc Galvez to the position of President - Consumer Packaging - International Division. Since 2015, Mr. Galvez, age 52, has held multiple positions of increasing

responsibility with the Company. Mr. Galvez most recently served as the Company’s President - Consumer Packaging Division, a position he held since 2017, and President - Europe, Middle East, India and Africa, a position he held from 2015 to 2017. Prior

to that, he was President - EMEIA Global Building and Geosynthetics for AVINTIV, Inc., which the Company acquired in 2015, from 2014 to 2015.

In addition, effective July 1, 2019, the Company appointed Bill Norman to the position of President - Consumer Packaging - North America Division. Since 1993, Mr. Norman, age 47, has held multiple positions of increasing

responsibility with the Company. Mr. Norman most recently served as the Company’s Executive Vice President - Consumer Packaging Commercial Operations, which he recently assumed after having served as Executive Vice President & General Manager -

Consumer Packaging Food since 2016, and President - Rigid Open Top Division, a position he held from 2014 to 2016.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(a) Financial statements of business acquired.

The Company intends to file the financial statements of RPC required by this Item no later than 71 calendar days after the date that this Current Report on Form 8-K is required to be filed.

(b) Pro forma financial information.

The Company intends to file the pro forma financial information reflecting the Acquisition required by this Item no later than 71 calendar days after the date that this Current Report on Form 8-K is required to be filed.

(d) Exhibits.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

|

|

|

|

4.1

|

|

Supplemental Indenture, among Berry Global Group, Inc., Berry Global, Inc., Berry Global Escrow Corporation, each of the parties identified as a Subsidiary Guarantor thereon, and U.S. Bank National Association, as Trustee, relating to the

4.875% First Priority Senior Secured Notes due 2026, dated July 1, 2019

|

|

4.2

|

|

Supplemental Indenture, among Berry Global Group, Inc., Berry Global, Inc., Berry Global Escrow Corporation, each of the parties identified as a Subsidiary Guarantor thereon, and U.S. Bank National Association, as Trustee, relating to the

5.625% Second Priority Senior Secured Notes due 2027, dated July 1, 2019

|

|

10.1

|

|

Incremental Assumption Agreement and Amendment, among Berry Global Group, Inc., Berry Global, Inc. and certain subsidiaries of Berry Global, Inc., as Loan Parties, Credit Suisse AG, Cayman Islands Brand, as Administrative Agent, Goldman

Sachs Bank USA, as Initial Term U Lender, and Goldman Sachs Bank USA, as Initial Term V Lender, dated as of July 1, 2019.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

Berry Global Group, Inc.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

July 2, 2019

|

By:

|

/s/ Jason K. Greene

|

|

|

|

Name:

|

Jason K. Greene

|

|

|

|

Title:

|

Executive Vice President, Chief Legal Officer

and Secretary

|

|

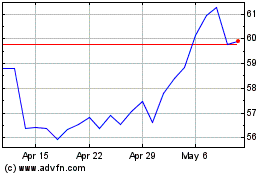

Berry Global (NYSE:BERY)

Historical Stock Chart

From Mar 2024 to Apr 2024

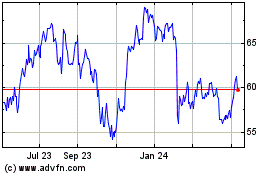

Berry Global (NYSE:BERY)

Historical Stock Chart

From Apr 2023 to Apr 2024