Crowdfunding - Amendment to Offering Statement (c/a)

November 17 2022 - 11:39AM

Edgar (US Regulatory)

schemaVersion:

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete.

The reader should not assume that the information is accurate and complete.

|

Form C: Issuer Information

Issuer Information

| Name of Issuer: | Emo Capital Corp. |

| Check box if Amendment is material and investors will have five business days to reconfirm | ☐ |

| Describe the Nature of the Amendment: | Company revised its business plan and changed intermediary. Because company now has its specific plan and started operation, so we need to update our company status. |

Legal Status of Issuer:

| |

| Form: | Corporation |

| Jurisdiction of Incorporation/Organization: |

NEVADA

|

| Date of Incorporation/Organization: | 08-17-2006 |

Physical Address of Issuer:

| |

| Address 1: | 10409 PACIFIC PALISADES AVE |

|

| City: | LAS VEGAS |

| State/Country: |

NEVADA

|

| Mailing Zip/Postal Code: | 89144 |

| Website of Issuer: | www.emrgt.com |

| Is there a Co-issuer? | ☐ Yes

☒ No

|

Intermediary through which the Offering will be Conducted:

| |

| CIK: | 0001665160 |

| Company Name: | StartEngine Capital LLC |

| Commission File Number: | 007-00007 |

Form C: Offering Information

Offering Information

|

Amount of compensation to be paid to the intermediary,

whether as a dollar amount or a percentage of the offering amount,

or a good faith estimate if the exact amount is not available at the time of the filing,

for conducting the offering, including the amount of referral and any other fees associated with the offering:

| Eight percent (8%) of funds raised |

|

Any other financial interest in the issuer held by the intermediary, or any arrangement for the intermediary to acquire such an interest:

| None |

|

Type of Security Offered:

| Common Stock |

|

Target Number of Securities to be Offered:

| 30000000 |

| Price (or Method for Determining Price): | Conversion price equals to 75% of the 30-day average bid price of the underlying common stock before the closing date of this offering (representing a 25% discount) as then quoted on the OTC Link ATS. |

| Target Offering Amount: | 107000.00 |

| Maximum Offering Amount (if different from Target Offering Amount): | 250000.00 |

| Oversubscriptions Accepted: | ☒ Yes

☐ No

|

|

If yes, disclose how oversubscriptions will be allocated:

| Other |

|

Provide a description:

| At issuer's discretion |

|

Deadline to reach the Target Offering Amount:

| 08-14-2023 |

|

NOTE: If the sum of the investment commitments does not equal

or exceed the target offering amount at the offering deadline,

no securities will be sold in the offering, investment commitments will be cancelled and committed funds will be returned.

|

Form C: Annual Report Disclosure Requirements

Annual Report Disclosure Requirements

| Current Number of Employees: | 0.00 |

| Total Assets Most Recent Fiscal Year-end: | 0.00 |

| Total Assets Prior Fiscal Year-end: | 0.00 |

| Cash and Cash Equivalents Most Recent Fiscal Year-end: | 0.00 |

| Cash and Cash Equivalents Prior Fiscal Year-end: | 0.00 |

| Accounts Receivable Most Recent Fiscal Year-end: | 0.00 |

| Accounts Receivable Prior Fiscal Year-end: | 0.00 |

| Short-term Debt Most Recent Fiscal Year-end: | 1281.00 |

| Short-term Debt Prior Fiscal Year-end: | 0.00 |

| Long-term Debt Most Recent Fiscal Year-end: | 60415.00 |

| Long-term Debt Prior Fiscal Year-end: | 60415.00 |

| Revenue/Sales Most Recent Fiscal Year-end: | 0.00 |

| Revenue/Sales Prior Fiscal Year-end: | 0.00 |

| Cost of Goods Sold Most Recent Fiscal Year-end: | 0.00 |

| Cost of Goods Sold Prior Fiscal Year-end: | 0.00 |

| Taxes Paid Most Recent Fiscal Year-end: | 0.00 |

| Taxes Paid Prior Fiscal Year-end: | 0.00 |

| Net Income Most Recent Fiscal Year-end: | 0.00 |

| Net Income Prior Fiscal Year-end: | 0.00 |

|

Using the list below, select the jurisdictions in which the issuer intends to offer the securities:

| -

ALABAMA

-

ALASKA

-

ARIZONA

-

ARKANSAS

-

CALIFORNIA

-

COLORADO

-

CONNECTICUT

-

DELAWARE

-

DISTRICT OF COLUMBIA

-

FLORIDA

-

GEORGIA

-

HAWAII

-

IDAHO

-

ILLINOIS

-

INDIANA

-

IOWA

-

KANSAS

-

KENTUCKY

-

LOUISIANA

-

MAINE

-

MARYLAND

-

MASSACHUSETTS

-

MICHIGAN

-

MINNESOTA

-

MISSISSIPPI

-

MISSOURI

-

MONTANA

-

NEBRASKA

-

NEVADA

-

NEW HAMPSHIRE

-

NEW JERSEY

-

NEW MEXICO

-

NEW YORK

-

NORTH CAROLINA

-

NORTH DAKOTA

-

OHIO

-

OKLAHOMA

-

OREGON

-

PENNSYLVANIA

-

PUERTO RICO

-

RHODE ISLAND

-

SOUTH CAROLINA

-

SOUTH DAKOTA

-

TENNESSEE

-

TEXAS

-

UTAH

-

VERMONT

-

VIRGINIA

-

WASHINGTON

-

WEST VIRGINIA

-

WISCONSIN

-

WYOMING

-

ALBERTA, CANADA

-

BRITISH COLUMBIA, CANADA

-

MANITOBA, CANADA

-

NEW BRUNSWICK, CANADA

-

NEWFOUNDLAND, CANADA

-

NOVA SCOTIA, CANADA

-

ONTARIO, CANADA

-

PRINCE EDWARD ISLAND, CANADA

-

QUEBEC, CANADA

-

SASKATCHEWAN, CANADA

-

YUKON, CANADA

-

CANADA (FEDERAL LEVEL)

|

Form C: Signature

Signature

Pursuant to the requirements of Sections 4(a)(6) and 4A of the Securities Act of 1933 and Regulation Crowdfunding (§ 227.100-503),

the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form C and has duly caused this Form to be signed on its behalf by the duly authorized undersigned.

|

| Issuer | Signature | Title |

|---|

|

#Emo Capital Corp. | Junhua Guo | President |

Pursuant to the requirements of Sections 4(a)(6) and 4A of the Securities Act of 1933 and Regulation Crowdfunding

(§ 227.100-503), this Form C has been signed by the following persons in the capacities and on the dates indicated.

|

| Signature | Title | Date |

|---|

|

#Junhua Guo | President | 11-17-2022 |

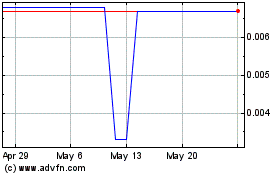

Emo Capital (PK) (USOTC:NUVI)

Historical Stock Chart

From Mar 2025 to Apr 2025

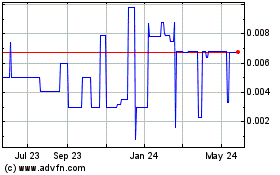

Emo Capital (PK) (USOTC:NUVI)

Historical Stock Chart

From Apr 2024 to Apr 2025