Tug Of War Between Bulls And Bears, Will Bitcoin Price Retest $19,000?

August 31 2022 - 4:41PM

NEWSBTC

The price of Bitcoin (BTC) has continued to struggle against Tether

(USDT) as bulls and bears are caught in a tug of war regarding

where Bitcoin price should be headed as we approach the monthly

close. Bitcoin’s (BTC) price showed so much steam, but it seems

like it was just a bull trap for many investors and traders. (Data

from Binance) Related Reading: Crypto Market Stays In Deep Fear As

Bitcoin Continues To Struggle Bitcoin (BTC) Price Analysis On The

Weekly Chart Bitcoin’s (BTC) price has shown so much strength

trying to hold above $19,500 in the past few days, with the price

bouncing immediately as it drops into the sub $19,800 on several

occasions. The price of BTC has continued to show strength, trying

to break above $20,500 despite being rejected; the BTC price needs

to break this area acting as resistance for bulls to have the

chance of pushing the price higher to a region of $22,000. BTC is

currently trading below its resistance, stopping the price from

trending higher; if BTC cannot break past this resistance of

$20,800, we could see the price revisiting the support region at

$19,000, acting as a demand zone for most investors. Weekly

resistance for the price of BTC – $20,800. Weekly support for the

price of BTC – $19,000. Price Analysis Of BTC On The Daily (1D)

Chart The price of BTC found its daily low at $19,500; as the price

bounced off from that region, BTC’s price has remained strong,

trading above $19,000, not allowing bears to take the price

lower. Despite being rejected recently from the $20,500 mark,

BTC price has shown great bullish strength, not retesting the

support region of $19,000 as this would favor bears. The price of

BTC is trading at $20,100 below the daily 50-day and 200-day

Exponential Moving Average (EMA). The 50 and 200 EMA correspond to

prices of $22,200 and $30,000, respectively, acting as resistances

for the price of BTC to trend higher. If the BTC price breaks and

holds above the $22,200 corresponding to the 50 EMA, we could see

the price trending higher to $23,000. If BTC’s price fails to break

above its resistances, then prices would find more momentum at its

support of $19,000 or even lower. Daily (1D) resistance for the BTC

price – $22,200, $30,000. Daily (1D) support for the BTC price –

$19,000. Price Analysis Of BTC On The Four-Hourly (4H) Chart The

price of BTC on the 4H chart has continued to look bearish, trying

to hold above the support area at $19,000. BTC price currently

trades below the 50 EMA on the 4H chart, with more sellers willing

to push the price lower. After forming a bullish divergence on the

4H chart as the price was oversold, the BTC price bounced from

$19,500 to $20,000, but the price was unable to break above the 50

EMA, acting as resistance for the BTC price; the 50 EMA price

corresponds to the support at $20,600. The Relative Strength Index

(RSI) for BTC on the 4H chart is below 50, indicating less buy

order volume for the BTC price. BTC’s monthly close would give us a

broader view of the next movement of Bitcoin price and where the

market is headed. Four-Hourly (4H) resistance for the BTC price –

$20,600. Four-Hourly (4H) support for the BTC price – $19,000.

Related Reading: Algorand (ALGO) Posts Double-Digit Price Drops In

Last 30 Days Featured Image From zipmex, Charts From

TradingView.com

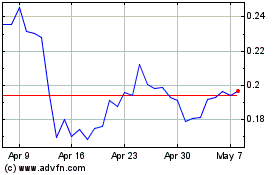

Algorand (COIN:ALGOUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Algorand (COIN:ALGOUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024