U.S. Dollar Slides Amid Fed Rate Cut Speculation

September 15 2024 - 10:21PM

RTTF2

The U.S. dollar weakened against other major currencies in the

Asian session on Monday amid growing expectations of interest rate

cuts by the Federal Reserve and other central banks.

The U.S. Federal Reserve is all set to announce its first

interest rate cut for more than four years on Wednesday, but the

size of cut is shaping up to be a close call.

Recent U.S. inflation data has partly offset optimism the U.S.

Fed will lower rates more aggressively, but the central bank is

still expected to continue cutting rates over the next several

months.

The Bank of England is expected to leave rates on hold at 5.00

percent on Thursday and investors would be watching for a decision

over the pace of its bond sales.

The Bank of Japan meets on Friday and is widely expected to hold

rates steady, but a majority of economists still expect an increase

by year-end. Meanwhile, Asian stocks made a cautious start to the

week, with markets in mainland China, South Korea and Japan closed

for holidays.

China is closed for Mid-Autumn Festival, South Korea is closed

for Chuseok Thanksgiving Day, Malaysia is closed for Malaysia Day

and Indonesia is closed for Prophet Muhammad's birthday.

Growth worries returned to the fore after Chinese factory

output, retail sales and investment numbers for August all missed

expectations.

In the Asian trading today, the U.S. dollar fell to nearly a

14-month low of 139.95 against the yen, from Friday's closing value

of 140.82. The greenback may test support near the 139.00

region.

Against the euro and the pound, the greenback dropped to 10-day

lows of 1.1105 and 1.3163 from last week's closing quotes of 1.1076

and 1.3122, respectively. If the greenback extends its downtrend,

it is likely to find support around 1.12 against the euro and 1.33

against the pound.

The greenback slipped to 0.8453 against the Swiss franc, from

Friday's closing value of 0.8489. On the downside, 0.82 is seen as

the next support level for the greenback.

Against Australia, the New Zealand and the Canadian dollars, the

greenback edged down to 0.6731, 0.6181 and 1.3566 from last week's

closing quotes of 0.6703, 0.6156 and 1.3585, respectively. The next

possible downside targets for the greenback are seen around 0.68

against the aussie, 0.63 against the kiwi and 1.33 against the

loonie.

Looking ahead, Eurozone external trade for July and labor cost

for the second quarter are slated for release in the European

session.

In the New York session, Canada manufacturing sales data for

July, new motor vehicles sales data for July, U.S. New York Empire

State manufacturing index for September and U.S. NOPA crush report

are due to be released in the New York session.

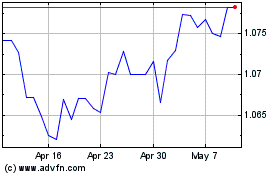

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Aug 2024 to Sep 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Sep 2023 to Sep 2024