Jade Power Reports 2022 Results

May 02 2023 - 3:02PM

Jade Power Trust ("Jade Power" or the "Trust") (TSXV: JPWR.H) is

pleased to report its financial results for the year ended 2022.

All amounts are expressed in Canadian Dollars unless otherwise

noted.

Highlights1

- On November 22,

2022, the Trust completed the sale of all of its wind, solar and

hydro operating assets for a net purchase price of €66 million (CAD

$90.7 million). Total cash proceeds on the disposition net of cash

in subsidiaries were €59.5 million (CAD $81.9 million). The gain on

the disposition of the operating assets was $43.4 million exclusive

of transaction costs of $6.2 million.

- On November 28,

2022, the Trust announced the declaration of a Special Initial

Distribution to Unitholders from the net available proceeds from

the sale of the operating assets. A total of $72.1 million was paid

to Unitholders on December 12, 2022 in respect to the Special

Initial Distribution.

Included in the reported financial results below

are operating results from the previously owned operating assets up

to November 22, 2022:

- Energy

generation of 146,638 MWh for the year compared to 153,044 MWh for

the previous year of 2021. Energy generation of 19,572 MWh for the

fourth quarter of 2022, representing energy generated up to the

date of the disposition of the operating assets, compared to 43,146

MWh for the comparable period in 2021.

- Revenue for the

year ended December 31, 2022, was $16.9 million. This compares to

$18.7 million of revenue for the comparable year ended December 31,

2021. Revenue for the three months ended December 31, 2022, was

$2.1 million. This compares to $4.8 million for the comparable

three months ended December 31, 2021.

- Net income for

the year ended December 31, 2022 was $35.5 million, or $1.59 per

Unit. This compares to $3.7 million, or $0.16 per Unit for the year

ended December 31, 2021. Net income for the three months ended

December 31, 2022 was $33.3 million, or $1.50 per Unit. The

compares to a net loss of $0.8 million, or $(0.04) per Unit for the

comparative three months ended December 31, 2021. Net income for

the year ended and quarter ended December 31, 2022 includes a gain

$43.4 million pursuant to the Sale Transaction.

David Barclay, Chairman and Chief Executive

Officer of Jade Power, commented,

“I would like to thank our Unitholders for their

support. 2022 has proven to be a monumental year for Jade Power.

Through the sale of our assets, we believe, we have delivered on

the best value opportunity to our Unitholders. As previously

announced, it is our intention to distribute all of the net

proceeds received from the Sale Transaction less a reserve to be

held to operate the Trust for a period of time. Although the exact

payment date and value of future special distributions is not

determinable at this time, we look forward to maximizing value to

Unitholders.”

For further information, please

contact:

| David BarclayChairman and

Chief Executive Officer+1

954-895-7217david.barclay@bellsouth.netinfo@jadepower.com |

|

|

About Jade Power

Jade Power Trust (“Jade Power” or the “Trust”)

is an unincorporated open-ended limited purpose trust established

under the laws of the Province of Ontario Prior to the sale of its

operating assets, the Trust, through its subsidiaries, generated

and sold electricity. Following the closing of the Sale

Transaction, the listing of the trust units (“Units”) in the

capital of the Trust was transferred to the NEX Board (“NEX”) of

the TSX Venture Exchange (the “TSXV") as a result of the Trust no

longer meeting certain of the TSXV’s continuous listing

requirements. The trading of the Units on NEX became effective at

the opening of trading on December 2, 2022. The Trust qualifies as

a "mutual fund trust" and not a “SIFT trust” (each as defined under

the Income Tax Act (Canada) (the "Tax Act").” All

material information about the Trust may be found under Jade

Power's issuer profile at www.sedar.com.

Forward-Looking Statements

Statements in this press release contain

forward-looking information. Such forward-looking information may

be identified by words such as "anticipates", "plans", "proposes",

"estimates", "intends", "expects", "believes", "may" and "will".

The forward-looking statements are founded on the basis of

expectations and assumptions made by the Trust. Details of the risk

factors relating to Jade Power and its business are discussed under

the heading "Business Risks and Uncertainties" in the Trust's

annual Management's Discussion & Analysis for the year ended

December 31, 2022, a copy of which is available on Jade Power's

SEDAR profile at www.sedar.com. Most of these factors are

outside the control of the Trust. Investors are cautioned not to

put undue reliance on forward-looking information. These statements

speak only as of the date of this press release. Except as

otherwise required by applicable securities statutes or regulation,

Jade Power expressly disclaims any intent or obligation to update

publicly forward-looking information, whether as a result of new

information, future events or otherwise.

Neither the NEX nor its regulation services

provider (as that term is defined in the policies of the NEX)

accepts responsibility for the adequacy or accuracy of this

release.

1 All per Unit amounts for the comparative periods have been

restated to reflect the 10:1 Unit consolidation effective September

23, 2021.

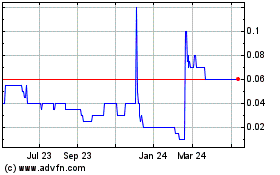

Jade Power (TSXV:JPWR.H)

Historical Stock Chart

From Apr 2024 to May 2024

Jade Power (TSXV:JPWR.H)

Historical Stock Chart

From May 2023 to May 2024