TIDMCCZ

RNS Number : 8124A

Castillo Copper Limited

04 June 2021

04 June 2021

CASTILLO COPPER LIMITED

("Castillo" or the "Company")

Castillo raises GBP6.4m to ramp up developing Mt Oxide and

Zambia Projects

Castillo Copper Limited (LSE and ASX: CCZ), a base metal

explorer primarily focused on copper across Australia and Zambia,

is delighted to announce that it has successfully raised A$11.7m

(GBP6.4m) before costs from institutional and sophisticated

investors in Australia and the UK. This funding will enable

Castillo to accelerate developing the core Mt Oxide and key Zambia

Projects which aligns with its strategic intent to transform into a

mid-tier copper group.

Highlights

-- Ample funding, A$11.7m (GBP6.4m) before costs, has been

secured to rapidly progress developing core projects in Australia

and Zambia

-- Pleasingly, the Placement was well supported by current and

new institutional and sophisticated investors in Australia and the

UK

-- Work will shortly commence on a comprehensive drilling

campaign across three priority prospects within the flagship Mt

Oxide Project in the Mt Isa copper-belt:

o Big One Deposit - A 26 drill-hole campaign for 2,828m has been

finalised and is designed to extend known mineralisation proximal

to the 1,200m strike event

o Arya and Sansa Prospects - An expanded programme is now being

formulated to fully drill-test all known shallow and deep bedrock

conductors

-- Notably, there has been a significant resurgence of interest

in the Mt Isa copper-belt which reflects several positive factors,

including:

o Prevailing copper price, near 10-year highs, due to global

concerns regarding forward demand - driven by green stimulus and

greater take-up of electric vehicles - will create a persistent

supply deficit; and

o Upcoming IPO of 29Metals on the ASX - owner of the operating

Capricorn Copper Mine circa 7km south-west of the Mt Oxide Project

- within the next few weeks

-- Across Zambia's copper-belt, development work will focus on

advancing the Luanshya and Mkushi Projects which have definitive

surface anomalies and are proximal to producing copper mines

-- Castillo will issue 278,395,961 New Shares at a price of

$0.042 (GBP0.023) per share, representing an 11% discount to the

last 15-day trading VWAP, and one free attaching listed option for

every 2 New Shares subscribed for, exercisable at A$0.08

(GBP0.044), expiring 12 July 2024

Simon Paull, Managing Director of Castillo Copper, said: "Due to

strong demand from current and new institutional investors in

Australia and the UK, we now have ample funds to ramp up our

exploration efforts. Over the next few months, we will test-drill

multiple copper targets across the Big One Deposit, Arya and Sansa

Prospects within our core Mt Oxide Project. Concurrently, we intend

to expedite exploration programmes at the Luanshya and Mkushi

Projects in Zambia. The Board now has significantly higher

confidence that 2021 will be a transformative year for Castillo

Copper."

DEVELOPING A MID-TIER COPPER GROUP

With adequate funding now secured, Castillo is well positioned

to deliver on its strategic intent to transform into a mid-tier

copper group. The immediate priority is to accelerate developing

the flagship Mt Oxide Project in Queensland's copper-belt and,

concurrently, the Luanshya and Mkushi Projects across Zambia's

copper-belt.

Drilling commencing at Mt Oxide Project

With all logistics now in place, work is set to start on a

comprehensive drilling campaign at three prospects within the Mt

Oxide Project:

o Big One Deposit - A 26 drill-hole campaign for 2,828m has been

finalised and designed to extend known mineralisation proximal to

the 1,200m strike event; and

o Arya and Sansa Prospects - An expanded programme is now being

formulated to fully drill-test all known shallow and deep bedrock

conductors.

There has been a significant resurgence of interest in the Mt

Isa copper-belt, especially with the copper price at near 10-year

highs. In addition, the upcoming listing of high-profile 29Metals

on the ASX, which owns the producing Capricorn Copper Mine circa

7km south-west of the Mt Oxide Project, has had a positive

impact.

Zambia

Across Zambia's copper-belt, the primary focus will be on

advancing the Luanshya and Mkushi Projects which are proximal to

producing copper mines. In addition, significant surface sampling

has enabled sizeable anomalous areas to be defined which should

facilitate identifying test-drill targets once a geophysics

campaign has been completed.

PLACEMENT TERMS

The Placement was taken up by current and new sophisticated and

institutional investors from Australia and the UK raising circa

A$11.7m (GBP6.4m) before costs. The lead broker and manager to the

Placement was CPS Capital Group Pty Ltd. Brokerage fees in relation

to the Placement were on standard commercial terms and can be seen

in the Appendix 3B released to the ASX today. The Placement was not

under written.

Castillo will issue a total of 278,395,961 New Shares at $0.042

(GBP0.023) per share. 140,592,523 New Shares will be issued using

the Company's existing 7.1 capacity, 97,502,707 New Shares will be

issued using the Company's existing 7.1A capacity and 40,300,731

New Shares will be issued upon obtaining shareholder approval in a

General Meeting to be called in due course.

Castillo will issue a total of 157,041,087 Listed Options, all

of which are subject to shareholder approval which will be sought

at the above-mentioned general meeting, on the following terms:

- 14,425,063 Broker options: Strike $0.08 strike, Expiry 12 July 2024 (1)

- 3,418,043 Broker options: Strike GBP0.044 strike, Expiry 12 July 2024 (2)

- 109,523,808 Free attaching options: Strike $0.08 strike, Expiry 12 July 2024 (1)

- 28,483,696 Free attaching options: Strike GBP0.044 strike, Expiry 12 July 2024 (2)

- 1,190,477 Director options: Strike $0.08 strike, Expiry 12 July 2024 (1)

(1) Refer to Appendix A for term and conditions of the options

(2) Refer to Appendix B for term and conditions of the options

The Placement price per share of $0.042 (GBP0.023) represents an

11% discount to the last 15-day trading VWAP of $0.047

(GBP0.026).

Next Steps

-- Commence drilling at the Big One Deposit and finalise

test-drill targets for the Arya and Sansa Prospects within the Mt

Oxide Project.

In addition to this release, a PDF version of this report with

supplementary information can be found on the Company's website:

https://castillocopper.com/investors/announcements/

Appendix 3B

Castillo advises that an Appendix 3B has been issued to the

Australian Securities Exchange ("ASX") and is available on the

Company's website :

https://castillocopper.com/investors/announcements/

For further information, please contact:

Castillo Copper Limited +61 8 6558 0886

Simon Paull (Australia), Managing Director

Gerrard Hall (UK), Director

SI Capital Limited (Financial Adviser and

Corporate Broker) +44 (0)1483 413500

Nick Emerson

Luther Pendragon (Financial PR) +44 (0)20 7618 9100

Harry Chathli, Alexis Gore, Joe Quinlan

About Castillo Copper

Castillo Copper Limited is an Australian-based explorer

primarily focused on copper across Australia and Zambia. The group

is embarking on a strategic transformation to morph into a mid-tier

copper group underpinned by its core projects:

-- The Mt Oxide project in the Mt Isa copper-belt district,

north-west Queensland, which delivers significant exploration

upside through having several high-grade targets and a sizeable

untested anomaly within its boundaries in a copper-rich region.

-- Four high-quality prospective assets across Zambia's

copper-belt which is the second largest copper producer in

Africa.

-- A large tenure footprint proximal to Broken Hill's

world-class deposit that is prospective for

zinc-silver-lead-copper-gold.

-- Cangai Copper Mine in northern New South Wales, which is one

of Australia's highest grading historic copper mines.

The group is listed on the LSE and ASX under the ticker

"CCZ."

Competent Person Statement

The information in this report that relates to Exploration

Results for "Mt Oxide Project" is based on information compiled or

reviewed by Mr Mark Biggs. Mr Biggs is both a shareholder and

director of ROM Resources, a company which is a shareholder of

Castillo Copper Limited. ROM Resources provides ad hoc geological

consultancy services to Castillo Copper Limited. Mr Biggs is a

member of the Australian Institute of Mining and Metallurgy (member

#107188) and has sufficient experience of relevance to the styles

of mineralisation and types of deposits under consideration, and to

the activities undertaken, to qualify as a Competent Person as

defined in the 2012 Edition of the Joint Ore Reserves Committee

(JORC) Australasian Code for Reporting of Exploration Results, and

Mineral Resources. Mr Biggs holds an AusIMM Online Course

Certificate in 2012 JORC Code Reporting. Mr Biggs also consents to

the inclusion in this report of the matters based on information in

the form and context in which it appears.

APPIX A: AUSTRALIAN LISTED OPTIONS - RIGHTS ATTACHING

The New Options intended to be granted under this Placement will

be granted under the following terms and conditions:

Entitlement

The New Options entitle the holder to subscribe for one Share

upon exercise of each New Option.

Exercise Price and Expiry Date

The New Options have an exercise price of $0.08 (Exercise Price)

and an expiry date of 5.00pm (WST) on 12 July 2024 (Expiry

Date).

Exercise Period

The New Options are exercisable at any time on or prior to the

Expiry Date. If a New Option is not exercised before the Expiry

Date it will automatically lapse (and thereafter be incapable of

exercise).

Notice of Exercise

The New Options may be exercised by notice in writing to the

Company (Notice of Exercise) and payment of the Exercise Price for

each New Option being exercised.

Exercise Date

A Notice of Exercise is only effective on and from the later of

the date of receipt of the Notice of Exercise and the date of

receipt by the Company as cleared funds of the payment of the

Exercise Price for each New Option being exercised in cleared funds

(Exercise Date).

Shares issued on exercise

Shares issued on exercise of the New Options rank equally with

the then issued shares of the Company .

Quotation of Shares on exercise

Application will be made by the Company to ASX for quotation of

the Shares issued upon the exercise of the New Options.

Timing of issue of Shares

Within 15 Business Days after the later of the following:

(i) the Exercise Date; and

(ii) when excluded information in respect to the Company (as

defined in section 708A(7) of the Corporations Act) (if any) ceases

to be excluded information,

(iii) the Company will:

(iv) allot and issue the Shares pursuant to the exercise of the

New Options;

(v) if required, give ASX a notice that complies with section

708A(5)(e) of the Corporations Act or lodge a prospectus with ASIC

that qualifies the Shares for resale under section 708A(11) of the

Corporations Act; and

(vi) apply for Official Quotation on ASX of Shares issued

pursuant to the exercise of the New Options.

Participation in new issues

There are no participation rights or entitlements inherent in

the New Options and New Option holders will not be entitled to

participate in new issues of capital offered to Shareholders during

the currency of the New Options. However, the Company will ensure

that for the purposes of determining entitlements to any such

issue, the record date will be at least five Business Days after

the issue is announced. This will give New Option holders the

opportunity to exercise their New Options prior to the date for

determining entitlements to participate in any such issue.

Adjustment for bonus issue of Shares

If the Company makes a bonus issue of Shares or other securities

to existing Shareholders (other than an issue in lieu or in

satisfaction of dividends or by way of dividend reinvestment):

(i) the number of Shares which must be issued on the exercise of

a New Option will be increased by the number of Shares which the

New Option holder would have received if the Optionholder had

exercised the New Option before the record date for the bonus

issue; and

(ii) no change will be made to the Exercise Price.

Adjustment for rights issue

If the Company makes an issue of Shares pro rata to existing

Shareholders there will be no adjustment of the Exercise Price of a

New Option.

Adjustment for reorganisation

If there is any reconstruction of the issued share capital of

the Company, the rights of the New Options may be varied to comply

with the Listing Rules which apply to the reconstruction at the

time of the reconstruction.

Quotation of New Options

The Company will apply for Official Quotation of the New Options

on ASX.

Options transferable

If the New Options do not become listed Options, then they are

transferable provided that the transfer of the New Options complies

with section 707(3) of the Corporations Act. Should the New Options

become listed Options in accordance with paragraph above, the New

Options will be transferable in accordance with relevant market

rules.

APPENDIX B: UK LISTED OPTIONS - RIGHTS ATTACHING

The New Options intended to be granted under this Placement will

be granted under the following terms and conditions:

Entitlement

The New Options entitle the holder to subscribe for one Share

upon exercise of each New Option.

Exercise Price and Expiry Date

The New Options have an exercise price of GBP0.044 (Exercise

Price) and an expiry date of 5.00pm (WST) on 12 July 2024 (Expiry

Date).

Exercise Period

The New Options are exercisable at any time on or prior to the

Expiry Date. If a New Option is not exercised before the Expiry

Date it will automatically lapse (and thereafter be incapable of

exercise).

Notice of Exercise

The New Options may be exercised by notice in writing to the

Company (Notice of Exercise) and payment of the Exercise Price for

each New Option being exercised.

Exercise Date

A Notice of Exercise is only effective on and from the later of

the date of receipt of the Notice of Exercise and the date of

receipt by the Company as cleared funds of the payment of the

Exercise Price for each New Option being exercised in cleared funds

(Exercise Date).

Shares issued on exercise

Shares issued on exercise of the New Options rank equally with

the then issued shares of the Company .

Quotation of Shares on exercise

Application will be made by the Company to ASX for quotation of

the Shares issued upon the exercise of the New Options.

Timing of issue of Shares

Within 15 Business Days after the later of the following:

(i) the Exercise Date; and

(ii) when excluded information in respect to the Company (as

defined in section 708A(7) of the Corporations Act) (if any) ceases

to be excluded information,

the Company will:

(iii) allot and issue the Shares pursuant to the exercise of the

New Options;

(iv) if required, give ASX a notice that complies with section

708A(5)(e) of the Corporations Act or lodge a prospectus with ASIC

that qualifies the Shares for resale under section 708A(11) of the

Corporations Act; and

(v) apply for Official Quotation on ASX of Shares issued

pursuant to the exercise of the New Options.

Participation in new issues

There are no participation rights or entitlements inherent in

the New Options and New Option holders will not be entitled to

participate in new issues of capital offered to Shareholders during

the currency of the New Options. However, the Company will ensure

that for the purposes of determining entitlements to any such

issue, the record date will be at least five Business Days after

the issue is announced. This will give New Option holders the

opportunity to exercise their New Options prior to the date for

determining entitlements to participate in any such issue.

Adjustment for bonus issue of Shares

If the Company makes a bonus issue of Shares or other securities

to existing Shareholders (other than an issue in lieu or in

satisfaction of dividends or by way of dividend reinvestment):

(i) the number of Shares which must be issued on the exercise of

a New Option will be increased by the number of Shares which the

New Option holder would have received if the Optionholder had

exercised the New Option before the record date for the bonus

issue; and

(ii) no change will be made to the Exercise Price.

Adjustment for rights issue

If the Company makes an issue of Shares pro rata to existing

Shareholders there will be no adjustment of the Exercise Price of a

New Option.

Adjustment for reorganisation

If there is any reconstruction of the issued share capital of

the Company, the rights of the New Options may be varied to comply

with the Listing Rules which apply to the reconstruction at the

time of the reconstruction.

Quotation of New Options

The Company will apply for Official Quotation of the New Options

on ASX.

Options transferable

If the New Options do not become listed Options, then they are

transferable provided that the transfer of the New Options complies

with section 707(3) of the Corporations Act. Should the New Options

become listed Options in accordance with the paragraph above, the

New Options will be transferable in accordance with relevant market

rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIMBTMTTMMRB

(END) Dow Jones Newswires

June 04, 2021 02:00 ET (06:00 GMT)

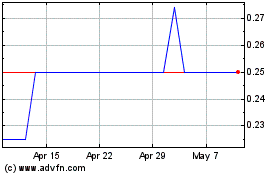

Castillo Copper (LSE:CCZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Castillo Copper (LSE:CCZ)

Historical Stock Chart

From Apr 2023 to Apr 2024