TIDMCLON

RNS Number : 0532Z

Clontarf Energy PLC

19 May 2021

19(th) May 2021

Clontarf Energy plc

("Clontarf" or "the Company")

Preliminary Results for the Year Ended 31 December 2020

Clontarf Energy, the oil and gas exploration company focused on

Ghana and Bolivia today announces its preliminary results for the

year ending 31 December 2020.

The Company expects to shortly publish its 2020 Annual Report

& Accounts and a further update will be made in this regard as

and when appropriate.

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014 .

For further information please visit http://clontarfenergy.com or contact:

Clontarf Energy

John Teeling, Chairman

David Horgan, Director +353 (0) 1 833 2833

Nominated & Financial Adviser

Strand Hanson Limited

Rory Murphy

Ritchie Balmer

Georgia Langoulant +44 (0) 20 7409 3494

Broker

Novum Securities Limited

Colin Rowbury +44 (0) 207 399 9400

Public Relations

Blytheweigh - PR

Megan Ray +44 (0) 207 138 3206

Alice McLaren +44 (0) 207 138 3553

Madeleine Gordon-Foxwell +44 (0) 207 138 3206

Teneo

Luke Hogg

Alan Tyrrell +353 (0) 1 661 4055

Ciara Wylie +353 (0) 1 661 4055

Statement Accompanying the Final Results

As I wrote the Chairman's Statement one year ago the world was

in a turbulent state. Thousands dying, the world economy imploding

and nothing but doom and gloom everywhere. One year later, thanks

to the brilliant minds of two Turkish doctors and one Hungarian

creating the MRNA vaccines, two of the three, female, there is hope

and optimism. Technology and production facilities were mobilised

to do in months what previously took years. Already economies are

opening up, and indeed booming. World growth rates for 2021 are

being revised upwards and in those countries with high levels of

vaccinations, growth rates will surpass anything seen in recent

decades. For commodities, unprecedented falls in demand are being

replaced by rapid growth. There is discussion of a Super Cycle in

commodities.

Exploration companies live on hope and optimism. As well as

hope, we sell romance, mystery and potential. The collapse in

exploration was understandable and the lifeblood of speculative

investing has yet to return, though there are a few positive

signs.

Clontarf is an early stage explorer. Clontarf has ongoing

interests in an oil block offshore Ghana and in proposals for

lithium brine in Bolivia. You will note in the Review of Operations

that we have revisited Chad, an emerging oil producer, and are part

of a consortium bidding for offshore acreage in Nigeria.

For more than a decade we have tried to ratify a 2010 agreement

on Tano block 2A offshore Ghana (60% Clontarf). It is a good block

which explains why various interests want to be involved. Progress

had been made in late 2019 and early 2020, however the cessation of

international travel has stopped essential meetings. Zoom and

telephone calls continue but face to face meetings are required.

After more than a decade of frustration I cannot offer a timetable

to a solution. But the Tano acreage offers upside.

Lithium in Bolivia is a very exciting possibility. The battle

between Petrol / Diesel and Electric Engines is won by Electric

Vehicles. It will take time and there will be delays but within the

foreseeable future automobiles will be electric.

Electric engines need lithium. It is in scarce supply. Bolivia

is known to hold 60% of world resources in the form of lithium

brines in numerous salt pans high in the Andes. Therein lies some

of the issues. The deposits are often at elevations above 14,000

feet with no infrastructure, little water and lower oxygen - not

easy. Further some of the brines contain elements which make

processing to battery grade lithium difficult. Clontarf have worked

for a decade with various authorities in Bolivia. In recent times

we have focused on smaller salt pans containing higher grades and

purer brines. We have worked with the current authorities to submit

proposals acceptable to the government who are keen to maintain

majority control. We have brought skills to the country and believe

that we can work together to develop the lithium industry. It will

happen, we would like to be part of it.

Two decades ago we were active in Chad, a landlocked country in

the Sahel Desert. Oil was discovered and developed by

multinationals. Problems arose and development stalled. We have

returned to the country and believe that significant opportunities

exist. Working with local partners we have presented non-binding

proposals to the Chadian authorities to acquire an exploration

block. It is early stage and there is no guarantee that a

successful outcome will be achieved. Further updates will be

provided if appropriate.

Similarly, in Nigeria, we are once again active. We are part of

a local consortium which has submitted a non-binding bid for an

offshore block. Again, it is early stage and there is no guarantee

that a successful outcome will be achieved. Further updates will be

provided if appropriate.

Conclusion

The world is in a far better state now than this time last year.

Hope has replaced fear. Once again spending is rising as pent-up

demand bursts forth. The oil price is at a level attractive to new

investment. The structural move to electric vehicles (EVs) offers

major possibilities for lithium producers.

Exploration companies spend money usually without any revenue.

Clontarf is fortunate with a listed share which has significant

market liquidity which allows the raising of fresh capital. We are

fully funded, after a recent funding in May 2021, for at least the

next eighteen months.

John Teeling

Chairman

18(th) May 2021

CLONTARF ENERGY PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2020

2020 2019

GBP GBP

Administrative expenses (361,308) (308,535)

LOSS FOR THE YEAR BEFORE TAXATION (361,308) (308,535)

Income tax expense - -

LOSS AFTER TAX AND TOTAL

COMPREHENSIVE INCOME FOR THE YEAR (361,308) (308,535)

Loss per share - basic and

diluted (0.05p) (0.04p)

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER 2020

2020 2019

GBP GBP

ASSETS:

NON CURRENT ASSETS

Intangible assets 915,117 850,789

915,117 850,789

CURRENT ASSETS

Other receivables 1,786 3,344

Cash and cash equivalents 89,423 301,292

91,209 304,636

TOTAL ASSETS 1,006,326 1,155,425

LIABILITIES:

CURRENT LIABILITIES

Trade payables (66,140) (56,195)

Other payables (1,300,567) (1,180,567)

(1,366,707) (1,236,762)

TOTAL LIABILITIES (1,366,707) (1,236,762)

NET LIABILITIES (360,381) (81,337)

EQUITY

Called-up share capital 1,792,450 1,792,450

Share premium 10,900,373 10,900,373

Retained deficit (13,157,083) (12,795,775)

Share based payment

reserves 103,879 21,615

TOTAL EQUITY (360,381) (81,337)

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2020

Called-up Share Based

Share Share Payment Retained

Capital Premium Reserve Deficit Total

GBP GBP GBP GBP GBP

At 1 January

2019 1,792,450 10,900,373 191,646 (12,677,836) 206,633

Share options

vested - - 20,565 - 20,565

Share options

expired - - (190,596) 190,596 -

Loss for the

year and

total

comprehensive

income - - - (308,535) (308,535)

At 31 December

2019 1,792,450 10,900,373 21,615 (12,795,775) (81,337)

Share options

vested - - 82,264 - 82,264

Loss for the

year and - - - (361,308) (361,308)

total

comprehensive

income

-

At 31 December

2020 1,792,450 10,900,373 103,879 (13,157,083) (360,381)

Share premium

The share premium reserve comprises of a premium arising on the

issue of shares. Share issue expenses are deducted against the

share premium reserve when incurred.

Share based payment reserve

The share based payment reserve arises on the vesting of share

options under the share option plan. Share options expired are

reallocated from share based payment reserve to retained deficit at

their grant date fair value.

Retained deficit

Retained deficit comprises of losses incurred in the current and

prior years.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 31 DECEMBER 2020

2020 2019

GBP GBP

CASH FLOW USED IN OPERATING

ACTIVITIES

Loss for the year (361,308) (308,535)

Share options vested 51,415 20,565

Foreign exchange gains 102 4,697

(309,791) (283,273)

MOVEMENTS IN WORKING CAPITAL

Increase in trade and other

payables 99,945 80,057

Decrease in trade and other

receivables 1,558 565

101,503 80,622

NET CASH USED IN OPERATING

ACTIVITIES (208,288) (202,651)

CASH FLOWS USED IN INVESTING

ACTIVITIES

Additions to exploration and

evaluation assets (3,479) (2,924)

NET CASH FROM INVESTING

ACTIVITIES (3,479) (2,924)

NET DECREASE IN CASH AND CASH

EQUIVALENTS (211,767) (205,575 )

Cash and cash equivalents at

beginning of the financial year 301,292 511,564

Effect of foreign exchange rate

changes (102) (4,697)

CASH AND CASH EQUIVALENTS

AT OF THE FINANCIAL YEAR 89,423 301,292

Notes:

1. ACCOUNTING POLICIES

There were no changes in accounting policies from those used to

prepare the Group's Annual Report for financial year ended 31

December 2019. The financial statements have been prepared in

accordance with International Financial Reporting Standards and

IFRSs as adopted by the European Union and in accordance with the

Companies Act 2006.

2. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year available to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted earnings per share is computed by

dividing the loss after taxation for the year by the weighted

average number of ordinary shares in issue, adjusted for the effect

of all dilutive potential ordinary shares that were outstanding

during the year.

The following table sets out the computation for basic and

diluted earnings per share (EPS):

2020 2019

GBP GBP

Numerator

For basic and diluted EPS (361,308) (308,535)

Denominator

For basic and diluted EPS 716,979,964 716,979,964

Basic EPS (0.05p) (0.04p)

Diluted EPS (0.05p) (0.04p)

The following potential ordinary shares are anti-dilutive and

are therefore excluded from the weighted average number of shares

for the purpose of the diluted earnings per share:

No. No

Share options 40,500,000 40,500,000

3. GOING CONCERN

The Group incurred a loss for the year of (GBP361,308) (2019:

GBP308,535), had net current liabilities of GBP1,275,498 (2019:

GBP932,126) and net liabilities of (GBP360,381) (2019: GBP81,337)

at the balance sheet date. These conditions, as well as those noted

below, represent a material uncertainty that may cast doubt on the

Group's ability to continue as a going concern.

Included in current liabilities is an amount of GBP1,300,567

(2019: GBP1,180,567) owed to directors in respect of directors'

remuneration due at the balance sheet date. The directors have

confirmed that they will not seek settlement of these amounts in

cash for a period of at least one year after the date of approval

of the financial statements or until the Group has generated

sufficient funds from its operations after paying its third party

creditors.

The Group had a cash balance of GBP89,423 (2019: GBP301,292) at

the balance sheet date. The directors have prepared cashflow

projections for a period of at least 12 months from the date of

report which indicate that the group will require additional

finance to fund working capital requirements and develop existing

projects. The cashflow projections include any anticipated impacts

of the Covid-19 pandemic on the Group. The scale and duration of

these impacts remain uncertain as at the date of this report,

however they are not significantly impacting the Group's

operations. As the Group is not revenue or cash generating it

relies on raising capital from the public market. On 6(th) May 2021

the group raised GBP500,000 by placing 153,846,153 new ordinary

shares. Further details are outlined in note 9.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include the adjustments that would

result if the Group and Company were unable to continue as a going

concern.

4. INTANGIBLE ASSETS

2020 2019

Group Group

Exploration and GBP GBP

evaluation

assets:

Cost:

At 1 January 8,561,001 8,528,077

Additions

during the

year 64,328 32,924

At 31 December 8,625,329 8,561,001

Impairment:

At 1 January 7,710,212 7,710,212

Impairment - -

during the

year

At 31 December 7,710,212 7,710,212

Carrying Value:

At 1 January 850,789 817,865

At 31 December 915,117 850,789

Segmental 2020 2019

analysis

Group Group

GBP GBP

Bolivia 62,074 16,225

Ghana 853,043 834,564

915,117 850,789

Exploration and evaluation assets relate to expenditure incurred

in prospecting and exploration for lithium, oil and gas in Bolivia

and Ghana. The directors are aware that by its nature there is an

inherent uncertainty in exploration and evaluation assets and

therefore inherent uncertainty in relation to the carrying value of

capitalised exploration and evaluation assets.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanian government.

The Company is in negotiations with the Vice-Ministry of

Electrical High Technologies and the State Lithium Company in

Bolivia on exploration and development of salt-lakes in accordance

with law. Samples have been analysed and process work is

underway.

The directors believe that there were no facts or circumstances

indicating that the carrying value of intangible assets may exceed

their recoverable amount and thus no impairment review was deemed

necessary by the directors. The realisation of these intangibles

assets is dependent on the successful discovery and development of

economic deposit resources and the ability of the Group to raise

sufficient finance to develop the projects.

It is subject to a number of potential significant risks, as set

out below:

-- licence obligations;

-- exchange rate risks;

-- uncertainties over development and operational costs;

-- political and legal risks, including arrangements with

Governments for licences, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- title to assets;

-- financial risk management;

-- going concern;

-- ability to raise finance; and

-- operational and environmental risks.

Included in the additions for the year are GBP60,849 (2019:

GBP30,000) of directors' remuneration. The remaining balance

pertains to the amounts capitalised to the respective projects held

by the entity.

5. TRADE PAYABLES

2020 2019

Group Group

GBP GBP

Trade payables 40,140 38,195

Other accruals 26,000 18,000

66,140 56,195

It is the Company's normal practice to agree terms of

transactions, including payment terms, with suppliers and provided

suppliers perform in accordance with the agreed terms, payment is

made accordingly. In the absence of agreed terms it is the

Company's policy that payment is made between 30 - 40 days. The

carrying amount of trade and other payables approximates to their

fair value.

6. OTHER PAYABLES

2020 2019

Group Group

GBP GBP

Amounts due to directors 1,300,567 1,180,567

1,300,567 1,180,567

Other payables relate to amounts due for directors' remuneration

of GBP1,300,567 (2019: GBP1,180,567) accrued but not paid at year

end.

7. CALLED-UP SHARE CAPITAL

Allotted, called-up and fully paid:

Number Share Capital Share Premium

GBP GBP

At 1

January

2019 716,979,964 1,792,450 10,900,373

Issued - - -

during

the year

At 31

December

2019 716,979,964 1,792,450 10,900,373

Issued - - -

during

the year

At 31

December

2020 716,979,964 1,792,450 10,900,373

Share Options

A total of 40,500,000 share options were in issue at 31 December

2020 (2019: 40,500,000). These options are exercisable, at prices

ranging between 0.70p and 0.725p, up to seven years from the date

of granting of the options unless otherwise determined by the

board.

8. SHARE BASED PAYMENTS

The Group issues equity-settled share-based payments to certain

directors and individuals who have performed services for the

Group. Equity-settled share-based payments are measured at fair

value at the date of grant. Shares issued to individuals and

directors will vest 3 years from the period that the awards

relate.

Fair value is measured by the use of a Black-Scholes model.

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of

grant.

2020 2019

Weighted Weighted

average average

30/06/2020 exercise price 30/06/2019 exercise price

Options in pence Options in pence

Outstanding at beginning of year 40,500,000 0.7 8,900,000

4.25

Issued - - 40,000,000 0.7

Expired - - (8,400,000) 4.25

Outstanding at end of the year 40,500,000 0.7 40,500,000 0.7

Exercisable at end of the year 27,166,667 0.7 13,833,333 0.7

During the prior year 40,000,000 options were granted with a

fair value of GBP246,788. These fair values were calculated using

the Black-Scholes valuation model. These options will vest over a 3

year period and will be capitalized or expensed on a straight line

basis over the vesting period.

The inputs into the Black-Scholes valuation model were as

follows:

Grant 2 October 2019

Weighted average share price at date of grant (in pence)

0.7p

Weighted average exercise price (in pence) 0.7p

Expected volatility 116.23%

Expected life 7 years

Risk free rate 1.3%

Expected dividends none

Expected volatility was determined by management based on their

cumulative experience of the movement in share prices.

The terms of the options granted do not contain any market

conditions within the meaning of IFRS 2.

The Group capitalised expenses of GBP30,849 (2019: GBPNil) and

expensed costs of GBP51,415 (2019: GBP 20,565) relating to

equity-settled share-based payment transactions during the

year.

9. POST BALANCE SHEET EVENTS

On 6 May 2021 the Company announced that it had raised

GBP500,000 via the placing of 153,846,153 ordinary shares with new

and existing investors at a price of 0.325p per placing share.

10. ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held on Wednesday

23(rd) June 2021 at Granite Exchange, 5-6 Kildare St, Newry BT34

1DQ at 11.00 am. Further information, including the Notice of AGM,

will be provided shortly.

11. GENERAL INFORMATION

The financial information set out above does not constitute the

Company's audited financial statements for the year ended 31

December 2020 or the year ended 31 December 2019. The financial

information for 2019 is derived from the financial statements for

2019 which have been delivered to the Registrar of Companies. The

auditors had reported on the 2019 statements; their report was

unqualified with an emphasis of matter in respect of considering

the adequacy of the disclosures made in the financial statements

concerning the valuation of intangible assets, and did not contain

a statement under section 498(2) or 498(3) of the Companies Act

2006. The financial statements for 2020 will be delivered to the

Registrar of Companies.

A copy of the Company's Annual Report and Accounts for 2020 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise, shareholders will be notified that the

Annual Report will be available on the website

www.clontarfenergy.com . Copies of the Annual Report will also be

available for collection from the Company's registered office,

Suite 1, 3(rd) Floor, 11-12 St. James's Square, London, SW1Y

4LB.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAKSPFASFEFA

(END) Dow Jones Newswires

May 19, 2021 02:00 ET (06:00 GMT)

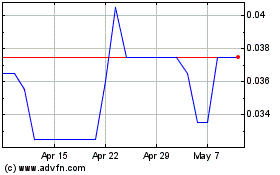

Clontarf Energy (LSE:CLON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clontarf Energy (LSE:CLON)

Historical Stock Chart

From Apr 2023 to Apr 2024