Directa Plus PLC Results of Placing (3006K)

December 12 2018 - 9:30AM

UK Regulatory

TIDMDCTA

RNS Number : 3006K

Directa Plus PLC

12 December 2018

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE EU MARKET ABUSE REGULATION (596/2014). UPON THE PUBLICATION OF

THE ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS

INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN ARE

RESTRICTED AND ARE NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY JURISDICTION IN WHICH

THE SAME WOULD BE UNLAWFUL.

12 December 2018

DIRECTA PLUS PLC

("Directa Plus", the "Company", or the "Group")

Results of Placing

Directa Plus (AIM: DCTA), a producer and supplier of

graphene-based products for use in consumer and industrial markets,

is pleased to announce the result of the Bookbuild announced

earlier today.

A total of 6,300,000 new Ordinary Shares in the Company have

been placed by Cantor Fitzgerald Europe and N+1 Singer at a price

of 50 pence per share (the "Placing Price") (consisting of

4,256,000 Firm Placing Shares and 2,044,000 Conditional Placing

Shares) raising gross proceeds of GBP3.15 million.

The Placing Shares will represent approximately 14.3 per cent.

of the existing Ordinary Shares.

Admission

Application has been made to the London Stock Exchange for the

Firm Placing Shares to be admitted to trading on AIM ("First

Admission"). It is expected that First Admission will become

effective and that dealings in the Firm Placing Shares, will

commence at 8.00 a.m. on 17 December 2018.

Application will also be made to the London Stock Exchange for

the Conditional Placing Shares to be admitted to trading on AIM

("Second Admission"). On the assumption that, amongst other things,

Resolutions 1 and 2 are passed by Shareholders at the General

Meeting, it is expected that Second Admission will become effective

and that dealings in the Conditional Placing Shares will commence

at 8.00 a.m. on 9 January 2019 (being the business day following

the General Meeting).

Circular and Notice of General Meeting

The Company will shortly publish a circular (the "Circular") in

connection with the Conditional Placing and Open Offer, which will

contain a notice convening the General Meeting in order to approve

certain matters necessary to implement the Conditional Placing and

the Open Offer. Full details of the Open Offer, to be undertaken at

the Issue Price, will also be included in the Circular. A further

announcement in connection with publication of the Circular will be

made in due course.

Sir Peter Middleton, Non-executive Chairman, commented

"We are delighted by the level of support we have received for

the Placing from both existing and new institutional investors. The

Placing Price of 50 pence means no discount to yesterday's closing

price and represents in the Board's view a positive endorsement by

the professional investment community of Directa Plus's technology

and prospects.

"The shares available in the Open Offer will allow our loyal

private shareholders to participate on the same terms as the

Placing investors. I thank our existing holders for their support

and look forward to welcoming our new investors to Directa

Plus."

Total Voting Rights

Following the issue of the Firm Placing Shares, the Company's

issued share capital will comprise 48,468,827 Ordinary Shares. The

total number of voting rights in the Company will be 48,468,827.

This figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company under the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority.

All capitalised terms in this announcement are as defined in the

Company's announcement released at 11.30 a.m. this morning.

For further information please visit

http://www.directa-plus.com/ or contact:

Directa Plus plc +39 02 36714458

Giulio Cesareo, CEO

Marco Ferrari, CFO

Cantor Fitzgerald Europe (Nominated Adviser

and Joint Broker) +44 20 7894 7000

Rick Thompson, Philip Davies, Will Goode

(Corporate Finance)

Caspar Shand Kydd (Sales)

N+1 Singer (Joint Broker) +44 20 7496 3069

Mark Taylor, Lauren Kettle (Corporate Finance)

Mia Gardner (Corporate Broking)

Tavistock (Financial PR and IR) +44 20 7920 3150

Simon Hudson, Sophie Praill, Edward Lee

About Directa Plus

Directa Plus is principally focussed on the two sectors in which

it has a strong commercial advantage through developed and launched

products and a technological lead: environmental (based on our

Grafysorber(R) product) and textiles (based on our G+ products). In

addition, the Company will continue to pursue opportunities in

elastomers and composites (including tyres and asphalt), also using

G+ products. All Directa Plus products are hypoallergenic,

non-toxic and sustainably produced.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIELLFFVLFLFBQ

(END) Dow Jones Newswires

December 12, 2018 10:30 ET (15:30 GMT)

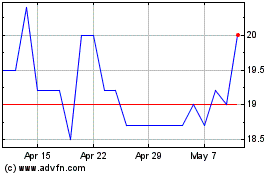

Directa Plus (LSE:DCTA)

Historical Stock Chart

From Apr 2024 to May 2024

Directa Plus (LSE:DCTA)

Historical Stock Chart

From May 2023 to May 2024