Hunting PLC (“Hunting” or “the Company” or “the Group”) Major OCTG Order

May 15 2024 - 1:05AM

Business Wire

Hunting secures record $145 million OCTG order from Middle East

National Oil Company.

Highlights

- Record $145 million OCTG order received from Middle East

NOC.

- Revenue expected to be recognised from late Q4 2024 and into

2025.

- Group sales order book has increased to a record c.$665 million

(including this new order).

- Supports Hunting’s 2030 Strategy to deliver revenue and profit

growth through OCTG and in geographies such as the Middle

East.

- Given the quantum of this order, management now expects EBITDA

to be towards the top end of its current guidance of $125-135

million for 2024.

Hunting PLC (LSE:HTG), the global engineering group, is

delighted to announce that it has secured a $145 million OCTG order

with a Middle East National Oil Company through our distributor

in-country.

The order comprises a large quantity of premium OCTG casing, to

be supplied by Hunting via its end-to-end integrated OCTG supply

chain in Asia Pacific. The casing will be threaded with Hunting’s

proprietary SEAL-LOCK premium connection technology at its

facilities across Asia Pacific, with revenue expected to be

recognised from late Q4 2024 and into 2025.

Hunting has leading-edge manufacturing capabilities across Asia

Pacific, India and the Middle East and since 2019 has invested to

establish a leading strategic supply chain, manufacturing capacity

and connection technology offering to support the Group’s

international OCTG growth ambitions and to support this and other

key customers’ operational needs across this important region.

Delivering the highest quality OCTG products on time together with

Hunting’s unsurpassed service offering remains key to the Group’s

success.

Including this new order, the Group’s sales order book has

increased to c.$665 million, which is the highest in the Company’s

history and provides strong earnings visibility for the Group’s

Asia Pacific operating segment and OCTG product group into

2025.

Given the quantum of this order, management now expects EBITDA

to be towards the top end of its current guidance of $125-135m for

2024. Given the timing of revenue recognition and working capital

movements, more detailed guidance for full year 2024 will be

provided in the Company’s H1 2024 Trading Statement.

The order supports the Hunting 2030 Strategy to deliver revenue

and profit growth through its OCTG product line, particularly in

geographies such as the Middle East where drilling activity

continues to be strong and is likely to be so to the end of the

decade.

The order will be funded from the Group’s existing $150 million

Asset Based Lending facility and, in addition, accelerated

receivable solutions and bank acceptance bonds are also being put

in place to shorten the overall cash conversion cycle. Previous

guidance on working capital efficiency targets remains

unchanged.

Hunting PLC’s next Trading Statement will be announced on

Tuesday 9 July 2024.

Commenting on the OCTG order win, Jim Johnson, Hunting’s Chief

Executive, said:

“We would like to thank our customer for this order and look

forward to working with them over the coming months as we deliver

on this material order.

“This OCTG order win is the largest in the Company’s history and

underscores our Hunting 2030 strategic ambitions, combining our

leading premium connection technology and strong end-to-end

integrated supply chain in Asia Pacific. The Group’s OCTG product

team has worked incredibly hard to qualify the OCTG feedstock and

connections technology with today’s announcement is testament to

their stellar work collaborating with our many stakeholders.

“Furthermore, the order enhances Hunting’s order book to its

highest ever backlog, which provides strong visibility on earnings

for the OCTG product line and Group as a whole, thereby

underpinning management’s confidence in the outlook.”

Notes to Editors:

About Hunting PLC

Hunting is a global engineering group that provides

precision-engineered equipment and premium services, which add

value for our customers. Established in 1874, it is a premium

listed public company traded on the London Stock Exchange. The

Company maintains a corporate office in Houston and is

headquartered in London. As well as the United Kingdom, the Company

has operations in China, Indonesia, Mexico, Netherlands, Norway,

Saudi Arabia, Singapore, United Arab Emirates and the United States

of America.

The Group reports in US dollars across five operating segments:

Hunting Titan; North America; Subsea Technologies; Europe, Middle

East and Africa (“EMEA”) and Asia Pacific.

Hunting PLC’s Legal Entity Identifier is

2138008S5FL78ITZRN66.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514479704/en/

Hunting PLC Jim Johnson, Chief Executive Bruce Ferguson,

Finance Director Tel: +44 (0) 20 7321 0123

Buchanan Ben Romney Barry Archer Tel: +44 (0)

20 7466 5000

or lon.IR@hunting-intl.com

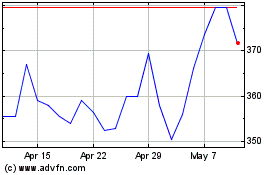

Hunting (LSE:HTG)

Historical Stock Chart

From Mar 2025 to Apr 2025

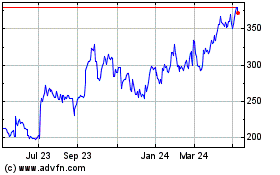

Hunting (LSE:HTG)

Historical Stock Chart

From Apr 2024 to Apr 2025