Aave Declines, Vitals Levels To Keep An Eye On

February 28 2023 - 5:00PM

NEWSBTC

Aave Price noted a fresh decline on the daily chart as the coin

slipped below the $80 price zone. Over the last 24 hours, the

altcoin traveled south and lost 4.2% of its value. As anticipated,

after the altcoin formed a death cross, where the long-term moving

average crossed (200-Simple Moving Average) above the short-term

moving average (50-Simple Moving Average), the altcoin registered

another significant fall in price. The technical outlook also

maintained bearishness on the daily chart. Buyers lost confidence

after the coin failed to stay above the $80 mark, so demand did not

rise. Another push from the sellers and the bears will be entirely

back. Related Reading: Ethereum Whales Shake Off Market

Uncertainty, Break 7-Year Accumulation Record The bulls could take

charge even now if the altcoin moved above the immediate price

ceiling. Broader market weakness might not let the major altcoins

secure gains on their respective charts. The altcoin will continue

to lose value on the daily chart if the price doesn’t manage to

stop receding from the $78 mark. Aave Price Analysis: One-Day Chart

The altcoin fell from the $80 mark and was exchanging hands at

$79.40 at the time of writing. Aave was close to its support level

of $78. Falling below that level will cause Aave to park at $74 and

then at $64. Aave’s two crucial price floors stood at $78 and $64.

The overhead resistance for Aave was $82 and then $89. If the

altcoin breaches the $89 mark, the bulls will take over the

market’s price action. The amount of Aave traded in the last

session was red after the coin noted a fall in buying strength.

Technical Analysis The Relative Strength Index slipped below the

half-line to demonstrate bearishness in consonance. The presence of

buyers was lower than that of sellers, according to the indicator.

Buyers seemed to have lost confidence in the asset as Aave

continued to trade in a range over the past two months. Aave price

also fell below the 20-Simple Moving Average (SMA) line. This

reading meant that sellers were driving the price momentum in the

market. Only if Aave toppled over the $80 mark would the price of

the asset move above the 20-SMA line, which would then start a

recovery for the altcoin. At press time, the altcoin also formed

sell signals, meaning the price could dip again soon. The Moving

Average Convergence Divergence depicted red histograms underneath

the neutral line indicating that traders could sell the asset. The

indicator reads price momentum and trend reversals. Related

Reading: Aave Might Retrace Further Due To This Formation On Its

Chart The Chaikin Money Flow measures the number of capital inflows

and outflows. The indicator remained above the zero line, implying

that the capital inflows were still greater than outflows. The

bears will remain in control of the price unless the altcoin takes

its price above the 20-SMA line. Featured Image From UnSplash,

Charts From TradingView.com

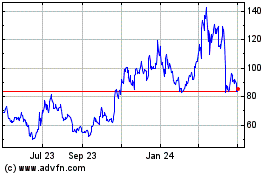

Aave Token (COIN:AAVEUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

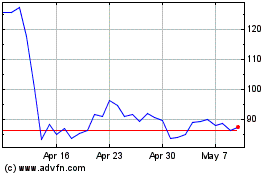

Aave Token (COIN:AAVEUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024