Bitcoin Wyckoff And Elliott Wave Predict This Next Price Move

April 25 2023 - 3:40AM

NEWSBTC

The Bitcoin (BTC) price has been trading in a range between $27,000

and $28,000 since Friday last week, with $27,800 currently being

the most important resistance level to kick off a move to the

upside. As recently as last Tuesday, BTC was trading above $30,000

before plunging more than 10%. However, Wyckoff and Elliott Wave

analysts agree that the move is not a cause for concern. According

to trader and market psychology coach Christopher Inks, a minimum

target of $42,350 is expected for Bitcoin as part of its next

bounce. Here’s What Wyckoff Analysis Says About The State Of

Bitcoin The Wyckoff method was invented by Richard Wyckoff in the

early 1930s and proposes to read the market using causal

fundamentals that actually predict market movements. The

accumulation and distribution schemes are probably the most popular

part of Wyckoff’s work in the crypto and Bitcoin community. The

models break down the accumulation and distribution phases into

five phases (A through E), along with several Wyckoff events. Inks

writes in his analysis that Bitcoin is most likely in an

accumulation according to the Wyckoff method. “The Elliott Wave

count may or may not be correct locally. We want to see an

impulsive breakout above that ascending red dashed resistance to

signal that the wave ((ii)) flat structure may be complete, but a

breakout above wave (b) is required to add confidence to that

count,” writes Inks, who shared the chart below. If Inks’ count is

correct, then another breakout has the daily pivot as its target.

This means that the wave ((iii)) of 3 from here has a minimum

target of $42,350 per Bitcoin. According to the analyst, this

theory is also supported by the fact that the RSI on the daily

chart is currently showing a hidden bullish divergence, with

confirmation that it is complete still pending. Related Reading:

Standard Chartered Predicts Bitcoin Could Reach $100,000 By End of

2024 In addition, the Stoch RSI on the daily chart has moved back

into the oversold area, so a breakout from the oversold area would

further support the assumption that the wave ((ii)) is complete,

the analyst says and concludes: We can also note the red parabola.

While price remains above that curved line we should continue to

expect higher, overall, rather than a larger pullback. Let’s see if

we can get that rally from somewhere around this area. Related

Reading: Why Bitcoin May Have Completed The “Perfect” Pullback Todd

Butterfield of the Wyckoff Stock Market Institute agrees with Inks.

In his latest analysis, Butterfield writes that Bitcoin experienced

a sharp sell-off on low volume last week – as expected. This is

“another low-risk buying opportunity,” according to the renowned

analyst. The technometer is at 38.5 for BTC/USD and 40.4 for

BTC/USDT. Via Twitter, he commented: Bitcoin has not reached

oversold and the price action had me staying on the sidelines for a

moment. An oversold Technometer is not a close your eyes and buy,

but an indication that we could be forming a bottom, or due for

some sideways/higher. At press time, the BTC price stood at

$27,236, moving once again closer to the lower end of the range,

probably for one more sweep of the low. Featured image from iStock,

chart from TradingView.com

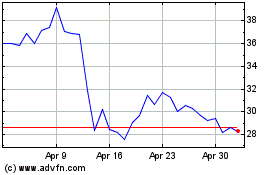

Dash (COIN:DASHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dash (COIN:DASHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024