Did A Bitcoin “Zig-Zag” Shake Out The Crypto Market?

June 15 2022 - 4:33PM

NEWSBTC

Bitcoin price is shockingly close to its former 2017 peak, causing

widespread panic, fear, and despair across the crypto market. But

could the violent move down be a text book zig-zag correction? And

if so, what does this mean for the crypto market next? Bitcoin

Price Action Follows Deadly Zig-Zag Pattern Despite the narrative

from 2020 forward that Bitcoin and cryptocurrencies had matured has

an asset class, the recent collapse reminded the world that digital

assets remain speculative. Speculative assets are driven by

pure emotion, since there aren’t ideal ways to fundamentally price

Bitcoin yet. Most on-chain signals remained bullish despite a more

than 70% fall from the peak set in November of last year, for

example. Price action might better be predicted based on Elliott

Wave Theory, first discovered in the 1930s by Ralph Nelson Elliott.

According to Wikipedia, “Elliott Wave Principle posits that

collective trader psychology, a form of crowd psychology, moves

between optimism and pessimism in repeating sequences of intensity

and duration. These mood swings create patterns in the price

movements of markets at every degree of trend or time scale.”

Related Reading | Bitcoin Drops To 18-Months Lows, Has The

Market Seen The Worst Of It? More simply put, bull and bear phases

alternate in a predictable manner through what Elliott referred to

as “waves.” The theory outlines that markets move up between a

motive phase and corrective phase. Motive waves are primary cycles

consisting of 5 total sub-waves. Waves 1, 3, and 5 are impulse

waves in the primary market trend direction, while waves 2 and 4

are corrective phases. When wave 5 completes, the motive wave (a

bull market cycle) moves into a corrective wave (and bear market).

Motive waves can come in varying shapes, and corrections can be

downright confusing. However, the latest correction in Bitcoin

could be a textbook zig-zag correction, according to how the

pattern unfolded from a sentiment standpoint. BTCUSD could have

completed a zig-zag correction | Source: BTCUSD on TradingView.com

Will BTCUSD Finally Get A Relief Rally? The zig-zag pattern is a

3-wave corrective structure labeled as ABC and subdivides into a

535 pattern. The first move down, labeled A, is a 5-wave impulse

move based on raw emotions. Wave B is characterized as moving up in

this case, sucking in new bullish positions that are ultimately

taken out in the C-wave move down. C-waves of a zig-zag are also

impulse moves driven by panic and fear. When they complete, the

market can move up again. It is difficult to imagine at this point

in the pattern that a reversal is possible given the extreme switch

in investor sentiment, but that’s often when recoveries emerge from

disbelief. Related Reading | Bitcoin Weekly RSI Sets Record For

Most Oversold In History, What Comes Next? Since Elliott Wave

Theory focuses on patterns of investor sentiment switching back and

forth from bear to bull and vice-versa, the patterns can be used to

profit but are typically only identifiable once completed and long

in hindsight. Is the recent downward spiral nothing more than a

downward zig-zag pattern that might have just come to completion?

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC

Telegram for exclusive daily market insights and technical analysis

education. Please note: Content is educational and should not

be considered investment advice. Featured image from

iStockPhoto, Charts from TradingView.com

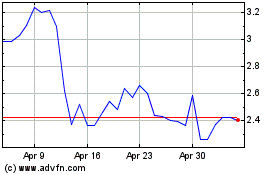

Waves (COIN:WAVESUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Waves (COIN:WAVESUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024

Real-Time news about Waves (Cryptocurrency): 0 recent articles

More Waves News Articles