false

0001072627

0001072627

2023-11-07

2023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 7, 2023

KINGSWAY FINANCIAL SERVICES INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation)

|

001-15204

(Commission File Number)

|

85-1792291

(IRS Employer Identification No.)

|

10 S. Riverside Plaza, Suite 1520, Chicago IL 60606

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (312) 766-2144

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

KFS

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 Results of Operations and Financial Condition.

On November 7, 2023, Kingsway Financial Services Inc. (the “Company”) issued a press release regarding its financial results for the three and nine-month period ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K provided under this Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Exhibit Description

99.1 Press Release titled “Kingsway Reports Third Quarter 2023 Financial Results”

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

KINGSWAY FINANCIAL SERVICES INC. |

|

|

|

|

|

|

|

|

|

|

|

| Date: November 7, 2023 |

By:

|

/s/ Kent A. Hansen

|

|

|

|

|

Kent A. Hansen, Chief Financial Officer |

|

|

|

|

|

|

Exhibit 99.1

KINGSWAY REPORTS THIRD QUARTER 2023 FINANCIAL RESULTS

Management to Host Conference Call Today at 5 p.m. ET

Chicago (November 7, 2023) - (NYSE: KFS) Kingsway Financial Services Inc. (“Kingsway” or the “Company”) today announced its operating results for the three and nine months ended September 30, 2023.

Third Quarter 2023 Consolidated Financial Highlights

| |

●

|

Consolidated revenue increased 11% to $24.8 million for the three months ended September 30, 2023, compared to $22.4 million in prior year period

|

| |

o

|

Extended Warranty revenue was $17.3 million in the third quarter of 2023 compared to $18.6 million in the third quarter of 2022; $0.7 million of the $1.3 million decrease was attributable to PWSC, which was sold in July 2022

|

| |

o

|

KSX revenue increased by 97% to $7.5 million in the third quarter of 2023, compared to $3.8 million for the third quarter of 2022, primarily due to the inclusion of CSuite and SNS, which were acquired in November 2022

|

| |

●

|

Consolidated net loss was $0.68 for the three months ended September 30, 2023, compared to net income of $37.3 million in the prior year period. The third quarter of 2022 included a net gain of $37.9 million on the sale of PWSC.

|

| |

●

|

Adjusted consolidated EBITDA was $2.3 million for the three months ended September 30, 2023, compared to $3.6 million in the prior year period

|

| |

o

|

Combined operating income for the Extended Warranty segment and KSX segment was a total of $2.8 million compared to a total of $3.2 million in the third quarter of 2022 (2022 includes $0.15 million from PWSC)

|

| |

o

|

Combined pro forma adjusted EBITDA for the Extended Warranty segment and KSX segment was a total of $3.2 million compared to a total of $4.55 million in the third quarter of 2022 (pro forma excludes the results of PWSC);

|

| |

■

|

The 2022 results include $1.0 million of investment gains at IWS and $0.1 million of a reserve release related to its GAP product

|

| |

■

|

In addition, Extended Warranty results were lower compared to Q3 2022 due to higher vehicle service agreement claims and lower revenue; Trinity continues to be impacted by historically long lead times for components and parts

|

| |

o

|

KSX segment results for Q3 2023 benefitted from the inclusion of CSuite and SNS, which were both acquired in November 2022

|

| |

●

|

Twelve month run-rate adjusted EBITDA for the operating companies is $19 million to $20 million, which reflects the lower Extended Warranty results that are offset by the inclusion of the recent acquisitions of SPI, DDI and NICR

|

Recent Business Highlights

| |

●

|

Acquired Systems Products International, Inc. (“SPI”), a privately held vertical market software company for $2.8 million in an all-cash transaction that is expected to be immediately accretive. In conjunction with the acquisition of SPI, established Vertical Market Solutions, LLC (“VMS”) creating a platform for future vertical market software acquisitions.

|

| |

●

|

Signed Definitive Purchase Agreement to acquire National Institute of Clinical Research, Inc. (“NICR”), a provider of clinical trial site management and recruitment services, for $7.9 million

|

| |

●

|

Acquired Digital Diagnostics Imaging, Inc. (“DDI”), a privately held provider of cardiac monitoring telemetry services, for $11.0 million in an all-cash transaction that is expected to be immediately accretive

|

| |

●

|

Appointed Miles Mamon as the newest Operator-in-Residence (“OIR”) in the Company’s Kingsway Search Xclerator ("KSX") segment, bringing the total number of current OIRs to two

|

John T. Fitgerald, President and Chief Executive Officer of Kingsway, said, “Our third quarter results were largely in-line with our expectations with revenue up 11%, primarily on growth in our Kingsway Search Xcelerator business from recent acquisitions. During the quarter and after the quarter ended, we also completed two M&A transactions and announced a third, that we expect to close in the first quarter of 2024. We are excited about the progress we are making at KSX. We continue to seek opportunities to expand our KSX business and provide attractive returns for our shareholders on capital invested through acquisitions.”

“In Extended Warranty, revenues were down a little more than 3% on a comparable basis and we saw an increase in paid claims as persistent inflationary pressures impacted profitability in the third quarter. While our cost of claims was up year-over-year, claims were down 5.4% sequentially. Macro-level headwinds related to cost and availability of credit along with high prices for used cars remain as near-term overhangs to this business. Despite this, Extended Warranty had its strongest quarter this year.

Recent Financing Highlights

| |

●

|

Through October 31, 2023, the Company repurchased 1,093,861 of its warrants and 250,927 shares of its common stock at a combined cost of $5.9 million under its securities repurchase program; $4.1 million of remaining securities repurchases could be made through March 22, 2024 under the current plan

|

| |

●

|

Year-to-date exercises of 3,331,661 warrants (Q1 1,258,840; Q2 53,101; Q3 2,019,720) resulting in $16.7 million of cash to the Company; the warrants expired on September 15, 2023, and the Company has zero warrants outstanding

|

| |

●

|

Principal debt payments of $1.2 million in the quarter; the Company now has total net debt of $20.8 million as of September 30, 2023, compared with $37.9 million as of December 31, 2022

|

Conference Call and Webcast

Management will host a conference call at 5 p.m. Eastern Time today to discuss the results and host a live Q&A session. Additionally, investors may also submit questions via email to: James@HaydenIR.com.

Conference Call Information

Date: Tuesday, November 7, 2023

Time: 5 p.m. Eastern Time

Toll Free: 888-506-0062; Code: 153431

International: 973-528-0111; Code: 153431

Live Webcast Link: https://www.webcaster4.com/Webcast/Page/2928/49387

Conference Call Replay Information

Toll Free: 877-481-4010

International: 919-882-2331

Replay Passcode: 49387

Replay Webcast Link: https://www.webcaster4.com/Webcast/Page/2928/49387

About the Company

Kingsway is a holding company that owns or controls subsidiaries primarily in the extended warranty and business services industries. The common shares of Kingsway are listed on the New York Stock Exchange under the trading symbol "KFS."

The Company serves the extended warranty industry through its operating subsidiaries IWS (iwsgroup.com), Penn Warranty (pennwarranty.com), Preferred Warranties (preferredwarranties.com) and Trinity Warranty Solutions (trinitywarranty.com).

The Company serves the business services industry through its operating subsidiaries CSuite (csuitefinancialpartners.com), Ravix (ravixgroup.com), Secure Nursing Service (securenursing.com) SPI Software (spisoftware.com) and Digital Diagnostics, Inc (ddimagingusa.com/about-us/).

Non U.S. GAAP Financial Measure

Management believes that non-GAAP adjusted EBITDA, when presented in conjunction with comparable GAAP measures, provides useful information about the Company's operating results and enhances the overall ability to assess the Company's financial performance. Management uses non-GAAP adjusted EBITDA, together with other measures of performance under GAAP, to compare the relative performance of operations in planning, budgeting and reviewing the performance of its business. Non-GAAP adjusted EBITDA allows investors to make a more meaningful comparison between the Company’s core business operating results over different periods of time. Management believes that non-GAAP adjusted EBITDA, when viewed with the Company's results under GAAP and the accompanying reconciliations, provides useful information about the Company's business without regard to potential distortions. By eliminating potential differences in results of operations between periods caused by the factors listed in the attached schedules, Management believes that non-GAAP adjusted EBITDA can provide useful additional basis for comparing the current performance of the underlying operations being evaluated. Investors should consider this non-GAAP measure in addition to, not as a substitute for or as superior to, financial reporting measures prepared in accordance with GAAP. Investors are encouraged to review the Company's financial results prepared in accordance with GAAP to understand the Company's performance taking into account all relevant factors.

Forward-Looking Statements

This press release may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. Words such as "expects," "believes," "anticipates," "intends," "estimates," "seeks" and variations and similar words and expressions are intended to identify such forward-looking statements; however, the absence of any such words does not mean that a statement is a not a forward-looking statement. Such forward-looking statements relate to future events or future performance, but reflect Kingsway management's current beliefs, based on information currently available. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the section entitled "Risk Factors" in the Company's 2022 Annual Report on Form 10-K and subsequent Form 10-Qs and Form 8-Ks filed with the Securities and Exchange Commission. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Additional Information

Additional information about Kingsway, including a copy of its Annual Reports can be accessed on the EDGAR section of the U.S. Securities and Exchange Commission's website at www.sec.gov, on the Canadian Securities Administrators' website at www.sedar.com, or through the Company's website at www.kingsway-financial.com.

|

For Media Inquiries:

Hayden IR

James Carbonara

(646) 755-7412

james@haydenir.com

|

For Company Inquiries:

Kingsway Financial Services Inc.

Kent Hansen, CFO

(312) 766-2163

khansen@kingsway-financial.com

|

Kingsway Financial Services Inc.

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Adjusted EBITDA

(in thousands)

(UNAUDITED)

| |

|

Twelve Months Ended

|

|

|

For the Three Months Ended

|

|

| |

|

9/30/2023

|

|

|

9/30/2023

|

|

|

6/30/2023

|

|

|

3/31/2023

|

|

|

12/31/2022

|

|

|

GAAP Net Income (Loss)

|

|

$ |

8,158 |

|

|

$ |

(675 |

) |

|

$ |

(1,667 |

) |

|

$ |

27,839 |

|

|

$ |

(17,339 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations

|

|

|

15,339 |

|

|

|

(122 |

) |

|

|

(110 |

) |

|

|

(107 |

) |

|

|

15,678 |

|

|

Gain on extinguishment of debt (1)

|

|

|

(31,616 |

) |

|

|

— |

|

|

|

— |

|

|

|

(31,616 |

) |

|

|

— |

|

|

Gain on sale of PWSC (2)

|

|

|

(342 |

) |

|

|

(342 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Changes in fair value; realized gains/losses (3)

|

|

|

(2,155 |

) |

|

|

174 |

|

|

|

(1,225 |

) |

|

|

145 |

|

|

|

(1,249 |

) |

|

Employee related expenses (4)

|

|

|

1,900 |

|

|

|

479 |

|

|

|

368 |

|

|

|

383 |

|

|

|

670 |

|

|

Other items (5)

|

|

|

4,090 |

|

|

|

334 |

|

|

|

1,633 |

|

|

|

591 |

|

|

|

1,532 |

|

|

Depreciation, amortization, tax and interest expense

|

|

|

14,447 |

|

|

|

2,450 |

|

|

|

2,780 |

|

|

|

5,164 |

|

|

|

4,053 |

|

|

Total Non-GAAP Adjustments

|

|

|

1,663 |

|

|

|

2,973 |

|

|

|

3,446 |

|

|

|

(25,440 |

) |

|

|

20,684 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjusted EBITDA

|

|

$ |

9,821 |

|

|

$ |

2,298 |

|

|

$ |

1,779 |

|

|

$ |

2,399 |

|

|

$ |

3,345 |

|

| |

|

Twelve Months Ended

|

|

|

For the Three Months Ended

|

|

| |

|

9/30/2022

|

|

|

9/30/2022

|

|

|

6/30/2022

|

|

|

3/31/2022

|

|

|

12/31/2021

|

|

|

GAAP Net Income (Loss)

|

|

$ |

33,847 |

|

|

$ |

37,273 |

|

|

$ |

(2,365 |

) |

|

$ |

(2,504 |

) |

|

$ |

1,443 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations

|

|

|

(2,366 |

) |

|

|

1,670 |

|

|

|

(786 |

) |

|

|

(1,495 |

) |

|

|

(1,755 |

) |

|

Gain on sale of PWSC (2)

|

|

|

(26,447 |

) |

|

|

(26,447 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Changes in fair value; realized gains/losses (3)

|

|

|

(8,025 |

) |

|

|

(12,951 |

) |

|

|

2,479 |

|

|

|

2,035 |

|

|

|

412 |

|

|

Employee related expenses (4)

|

|

|

2,675 |

|

|

|

321 |

|

|

|

507 |

|

|

|

1,155 |

|

|

|

692 |

|

|

Other items (5)

|

|

|

(60 |

) |

|

|

184 |

|

|

|

86 |

|

|

|

(630 |

) |

|

|

300 |

|

|

Depreciation, amortization, tax and interest expense

|

|

|

11,790 |

|

|

|

3,573 |

|

|

|

3,218 |

|

|

|

2,461 |

|

|

|

2,538 |

|

|

Total Non-GAAP Adjustments

|

|

|

(22,433 |

) |

|

|

(33,650 |

) |

|

|

5,504 |

|

|

|

3,526 |

|

|

|

2,187 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjusted EBITDA (6)

|

|

$ |

11,414 |

|

|

$ |

3,623 |

|

|

$ |

3,139 |

|

|

$ |

1,022 |

|

|

$ |

3,630 |

|

|

Other reductions (7)

|

|

$ |

944 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

944 |

|

|

$ |

- |

|

|

(1)

|

Gain on extinguishment of debt consists of a $31.6 million gain related to the repurchase of TruPs debt having a principal amount of $75.5 million and results from removing the fair value of the debt ($56.1 million), deferred interest payable ($23.0 million) and accumulated other comprehensive income ($27.2 million) liabilities; the trust preferred debt repurchase options ($17.7 million) and accrued income receivable ($0.6 million) assets. See Note 11 "Debt," to the unaudited consolidated interim financial statements, for further discussion

|

|

(2)

|

Gain on sale of PWSC, net of transaction expenses that are included in consolidated operating expenses, as well as income taxes associated with the sale. The Company estimates that had the gain not occurred, the Company would have recorded a tax benefit; therefore taxes of $6.1 million are included in this line item for the three months ended 9/30/22.

|

|

(3)

|

Includes realized and unrealized gains and losses on non-core investments; change in the fair value of subordinated debt (net of the portion of the change attributable to instrument-specific credit risk); unrealized gain on the change in fair value of the trust preferred security options; and change in the fair value of the Ravix earn-out (changes in fair value recorded as other income or expense).

|

|

(4)

|

Employee related expenses includes charges relating to severance and consulting agreements pertaining to former key employees; non-cash expense arising from the grant and modification of stock-based awards to employees; and costs associated with employees assisting during a transition period and are not expected to be replaced once transition period has ended (approximately one year from acquisition date).

|

|

(5)

|

Other items include: legal expenses associated with the Company’s defense against significant litigation matters; acquisition-related expenses; expense relating to the settlement of all remaining Amigo claims; and other non-recurring items.

|

|

(6)

|

Includes the results of PWSC through the date of sale (end of July 2022).

|

|

(7)

|

The three months ended 3/31/2022 include a non-cash net charge of $0.9 million relating to change in estimate in accounting for IWS deferred revenue and deferred contract costs associated with vehicle service contract administration fees.

|

Kingsway Financial Services Inc.

Reconciliation of Extended Warranty Segment Operating Income to Non-GAAP Adjusted EBITDA

and Pro Forma Non-GAAP Adjusted EBITDA

(in thousands)

(UNAUDITED)

| |

|

Twelve Months Ended

|

|

|

For the Three Months Ended

|

|

| |

|

9/30/2023

|

|

|

9/30/2023

|

|

|

6/30/2023

|

|

|

3/31/2023

|

|

|

12/31/2022

|

|

|

GAAP Operating Income for Extended Warranty segment

|

|

$ |

7,361 |

|

|

$ |

1,778 |

|

|

$ |

1,392 |

|

|

$ |

1,432 |

|

|

$ |

2,759 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income (1)

|

|

|

953 |

|

|

|

273 |

|

|

|

256 |

|

|

|

231 |

|

|

|

193 |

|

|

Gain (loss) on sale of investments (2)

|

|

|

101 |

|

|

|

14 |

|

|

|

12 |

|

|

|

98 |

|

|

|

(23 |

) |

|

Depreciation

|

|

|

244 |

|

|

|

57 |

|

|

|

62 |

|

|

|

64 |

|

|

|

61 |

|

|

Total Non-GAAP Adjustments

|

|

|

1,298 |

|

|

|

344 |

|

|

|

330 |

|

|

|

393 |

|

|

|

231 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjusted EBITDA for Extended Warranty segment

|

|

$ |

8,659 |

|

|

$ |

2,122 |

|

|

$ |

1,722 |

|

|

$ |

1,825 |

|

|

$ |

2,990 |

|

| |

|

Twelve Months Ended

|

|

|

For the Three Months Ended

|

|

| |

|

9/30/2022

|

|

|

9/30/2022

|

|

|

6/30/2022

|

|

|

3/31/2022

|

|

|

12/31/2021

|

|

|

GAAP Operating Income for Extended Warranty segment

|

|

$ |

10,446 |

|

|

$ |

2,461 |

|

|

$ |

2,936 |

|

|

$ |

1,723 |

|

|

$ |

3,326 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income (1)

|

|

|

369 |

|

|

|

145 |

|

|

|

96 |

|

|

|

76 |

|

|

|

52 |

|

|

Gain (loss) on sale of investments (2)

|

|

|

960 |

|

|

|

961 |

|

|

|

(16 |

) |

|

|

(4 |

) |

|

|

19 |

|

|

Depreciation

|

|

|

326 |

|

|

|

70 |

|

|

|

87 |

|

|

|

74 |

|

|

|

95 |

|

|

Total Non-GAAP Adjustments

|

|

|

1,655 |

|

|

|

1,176 |

|

|

|

167 |

|

|

|

146 |

|

|

|

166 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjusted EBITDA for Extended Warranty segment

|

|

$ |

12,101 |

|

|

$ |

3,637 |

|

|

$ |

3,103 |

|

|

$ |

1,869 |

|

|

$ |

3,492 |

|

|

PWSC operating income (3)

|

|

|

(1,440 |

) |

|

|

147 |

|

|

|

(737 |

) |

|

|

(298 |

) |

|

|

(552 |

) |

|

PWSC depreciation (3)

|

|

|

(55 |

) |

|

|

(8 |

) |

|

|

(25 |

) |

|

|

(11 |

) |

|

|

(11 |

) |

|

Pro forma Non-GAAP adjusted EBITDA for Extended Warranty segment

|

|

$ |

10,606 |

|

|

$ |

3,776 |

|

|

$ |

2,341 |

|

|

$ |

1,560 |

|

|

$ |

2,929 |

|

|

Other reductions (4)

|

|

$ |

944 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

944 |

|

|

$ |

- |

|

(1) Investment income arising as part of Extended Warranty segment’s minimum holding requirements.

(2) Realized Gains (losses) resulting from investments either held in trust as part of Extended Warranty segment’s minimum holding requirements or from the deployment of excess cash.

(3) Amounts relating to the sale of PWSC (end of July 2022) in order to remove PWSC from all periods presented.

(4) The three months ended 3/31/2022 include a non-cash net charge of $0.9 million relating to change in estimate in accounting for IWS deferred revenue and deferred contract costs associated with vehicle service contract administration fees.

Kingsway Financial Services Inc.

Reconciliation of KSX Segment Operating Income to Non-GAAP Adjusted EBITDA

(in thousands)

(UNAUDITED)

| |

|

Twelve Months Ended

|

|

|

For the Three Months Ended

|

|

| |

|

9/30/2023 |

|

|

9/30/2023 |

|

|

6/30/2023 |

|

|

3/31/2023 |

|

|

12/31/2022 |

|

|

GAAP Operating Income for KSX segment

|

|

$ |

5,322 |

|

|

$ |

1,003 |

|

|

$ |

1,616 |

|

|

$ |

1,577 |

|

|

$ |

1,126 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee costs (1)

|

|

|

322 |

|

|

|

87 |

|

|

|

78 |

|

|

|

87 |

|

|

|

70 |

|

|

Total Non-GAAP Adjustments

|

|

|

322 |

|

|

|

87 |

|

|

|

78 |

|

|

|

87 |

|

|

|

70 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjusted EBITDA for KSX segment

|

|

$ |

5,644 |

|

|

$ |

1,090 |

|

|

$ |

1,694 |

|

|

$ |

1,664 |

|

|

$ |

1,196 |

|

| |

|

Twelve Months Ended

|

|

|

For the Three Months Ended

|

|

| |

|

9/30/2022

|

|

|

9/30/2022

|

|

|

6/30/2022

|

|

|

3/31/2022

|

|

|

12/31/2021

|

|

|

GAAP Operating Income for KSX segment

|

|

$ |

2,906 |

|

|

$ |

723 |

|

|

$ |

893 |

|

|

$ |

806 |

|

|

$ |

484 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee costs (1)

|

|

|

236 |

|

|

|

55 |

|

|

|

55 |

|

|

|

55 |

|

|

|

71 |

|

|

Total Non-GAAP Adjustments

|

|

|

236 |

|

|

|

55 |

|

|

|

55 |

|

|

|

55 |

|

|

|

71 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP adjusted EBITDA for KSX segment

|

|

$ |

3,142 |

|

|

$ |

778 |

|

|

$ |

948 |

|

|

$ |

861 |

|

|

$ |

555 |

|

(1) Costs associated with employees assisting during a transition period and are not expected to be replaced once transition period has ended (approximately one year from acquisition date).

v3.23.3

Document And Entity Information

|

Nov. 07, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

KINGSWAY FINANCIAL SERVICES INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 07, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-15204

|

| Entity, Tax Identification Number |

85-1792291

|

| Entity, Address, Address Line One |

10 S. Riverside Plaza

|

| Entity, Address, Address Line Two |

Suite 1520

|

| Entity, Address, City or Town |

Chicago

|

| Entity, Address, State or Province |

IL

|

| Entity, Address, Postal Zip Code |

60606

|

| City Area Code |

312

|

| Local Phone Number |

766-2144

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

KFS

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001072627

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

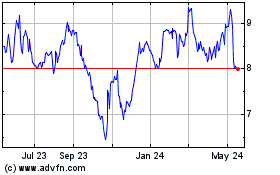

Kingsway Financial Servi... (NYSE:KFS)

Historical Stock Chart

From Apr 2024 to May 2024

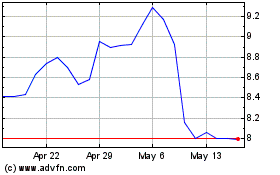

Kingsway Financial Servi... (NYSE:KFS)

Historical Stock Chart

From May 2023 to May 2024