Copper Lake Resources Ltd. (TSX-V: CPL, Frankfurt: W0I) ("Copper

Lake" or the "Company") announces that, subject to regulatory

approval, the Company intends to complete a non-brokered private

placement (the “Offering”) for aggregate gross proceeds of up to

$132,500. The Offering will be comprised of up to 2,500,000

Flow-Through Units (“FT Units”) at a price of $0.020 per FT Unit

and 5,500,000 Non Flow-Through Units (“NFT Units”) at a price of

$0.015 per Unit. Each FT Unit will consist of one flow-through

common share and one full common share purchase warrant (a

“Warrant”), with each Warrant being exercisable at $0.05 for two

years. Each NFT Unit will consist of one non flow-through

common share and one full common share purchase warrant (a

“Warrant”), with each Warrant being exercisable at $0.05 for two

years. The Offering is being made subject to the grant of a

discretionary waiver of the TSX Venture Exchange’s (“TSXV”) minimum

$0.05 pricing requirement (the “Waiver”). The Offering is not

subject to any minimum aggregate subscription. Subject to

certain limitations discussed below, the Offering is open to all

existing shareholders of the Company as well as pursuant to other

available prospectus exemptions. The Offering is subject to

TSXV final acceptance.

Assuming the Offering is fully subscribed, the

Company intends to allocate the proceeds as follows: approximately

$52,500 for current liabilities, $32,500 for general working

capital purposes, and $50,000 for qualifying Canadian exploration

expenditures on its Marshall Lake project. The Company has

previously raised a total of $367,500 under the discretionary

waiver of the TSXV, and this Offering will bring the total to the

$500,000 maximum available under the discretionary waiver.

Although the Company intends to use the proceeds

of the Offering as described above, the actual allocation of net

proceeds may vary from the uses set forth above, depending on

future operations or unforeseen events or opportunities. If

the Offering is not fully subscribed, the Company will apply the

proceeds of the Offering to the above uses in priority and in such

proportions as the board of directors of the Company determine is

in the best interests of the Company.

Depending on demand and regulatory requirements,

a portion of the Offering may be made in accordance with the

provisions of the existing shareholder exemption (the “Existing

Shareholder Exemption”) pursuant to BC Instrument 45-534. In

addition to conducting the Offering pursuant to the Existing

Shareholder Exemption, the Offering will also be conducted among

close personal friends and business associates of directors and

officers of the Company.

The Company has set February 28, 2020 as the

record date (the “Record Date”) for the purpose of determining

shareholders entitled to purchase Units. The aggregate

acquisition cost to a subscriber under the Existing Shareholder

Exemption cannot exceed $15,000 unless the subscriber has obtained

advice from a registered investment dealer regarding the

suitability of the investment.

If subscriptions received for the Offering based

on all available exemptions exceed the maximum Offering amount of

$132,500, subscriptions will be accepted at the discretion of the

Company on a pro rata basis, such that it is possible that a

subscription received from a shareholder may not be accepted by the

Company if the Offering is over-subscribed. In accordance

with the Existing Shareholder Exemption, the Company confirms there

is no material fact or material change related to the Company which

has not been generally disclosed.

Existing shareholders of the Company are

directed to contact the Company for further information concerning

subscriptions for Shares pursuant to the Existing Shareholder

Exemption, as follows:

Contact person:

Terrence MacDonald Telephone: 416-561-3626 Email:

tmacdonald@copperlakeresources.com

Closing of the Offering is anticipated to occur

on or before March 20, 2020, and is subject to receipt of

acceptance by the TSX Venture Exchange. All securities

issuable will be subject to a four-month hold period following the

closing of the Offering. A finder’s fee of cash, shares or finder’s

warrants, or a combination thereof, may be paid to eligible finders

with respect to any portion of the Offering that is not subscribed

by existing shareholders.

About Copper Lake

Resources

Copper Lake Resources Ltd. is a publicly traded

Canadian company currently focused on advancing properties located

in Ontario, Canada.

The Marshall Lake high-grade VMS copper, zinc,

silver and gold property, located just north of Geraldton, Ontario,

comprises an area of approximately 104 square km and is accessible

by all-season road. Copper Lake has an option to increase its

interest to 87.5% from its current 75% interest.

In addition to the original Marshall Lake

property above, Marshall Lake also includes the Sollas Lake and

Summit Lake properties, which are 100% owned by the Company and are

not subject to any royalties. The Sollas Lake property

consists of 20 claim cells comprising an area of 4 square km on the

east side of the Marshall Lake property where historical EM

airborne geophysical surveys have outlined strong conductors on the

property hosted within the same favourable felsic volcanic units.

The Summit Lake property currently consists of 100 claim cells

comprising an area of 20.5 square km, is accessible year round, and

is located immediately west of the original Marshall Lake

property.

Copper Lake has a 71.41% interest in the Norton

Lake nickel, copper, cobalt, PGM property, located in the southern

Ring of Fire area, is approximately 100 km north of the Marshall

Lake Property, and has a NI 43-101 compliant measured and indicated

resource of 2.26 million tonnes @ 0.67% Ni, 0.61% Cu, 0.03% Co and

0.46 g/t Pd.

The Company also has an option agreement to

acquire up to 100% of four separate Ontario properties in the

Kenora and Patricia mining belt: Queen Alexandra Gold Property, the

Mine Lake Gold Property, the Grand Chibougamau Gold Property and

the Centrefire-Redhat Gold-Copper Property.

On behalf of the Board of

Directors,

| Copper

Lake Resources Ltd. |

CHF Capital Markets |

| Terry MacDonald, CEO |

Cathy Hume,

CEO |

| (416) 561-3626 |

(416)

868-1079 x 231 |

| tmacdonald@copperlakeresources.com |

cathy@chfir.com |

www.copperlakeresources.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

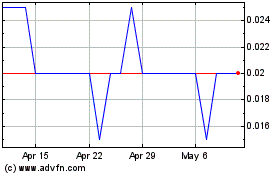

Copper Lake Resources (TSXV:CPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

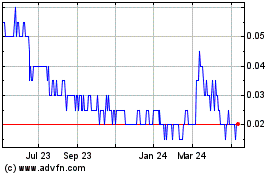

Copper Lake Resources (TSXV:CPL)

Historical Stock Chart

From Apr 2023 to Apr 2024