Simply Better Brands Corp. ("

SBBC" or the

"

Company") (TSX Venture: SBBC) announces its

financial results for the quarter ended June 30, 2021. All amounts

are expressed in United States dollars unless otherwise noted.

Certain metrics, including those expressed on an adjusted basis,

are non-IFRS measures, see "Non-IFRS Measures" below.

Corporate Developments

Purekana, LLC ("Purekana"), a subsidiary of the

Company, entered into a partnership with Chemesis International

Inc. ("Chemesis") - On April 13, 2021, Purekana entered into a

brand partnership with Chemesis, a leading cannabis and CBD

retailer, under which Purekana’s industry-leading CBD products will

become available at hundreds of proprietary Chemesis kiosks

throughout the United States.

Acquisition of Nirvana Group LLC ("Nirvana") -

On April 28, 2021, the Company completed the acquisition of

Nirvana, a Florida-based company specializing in the development,

manufacturing, and distribution of all-natural pet wellness

products and which includes the BudaPets brand.

Corporate Name Change - On May 3, 2021, the

Company changed its name to "Simply Better Brands Corp." and

adopted "SBBC" as its new trading symbol for its common shares.

Financing - On May 4, 2021, the Company issued a

promissory note for cash proceeds of $630,000. The promissory note

bears interest at 9% per annum and matures on May 4, 2022. At the

maturity date, the note holder may convert the promissory note to

the common shares of the Company at the price of the volume weighed

average price ("VWAP") of the Company’s common shares on the TSX

Venture Exchange (the "Exchange") during the 15 days trading days

immediately preceding the maturity date.

Acquisition of Tru Brands Inc. ("TRU Brands") -

On March 3, 2021, the Company entered into a binding term sheet

(the "Tru Brands LOI") to acquire 100% of the issued and

outstanding shares of Tru Brands. TRU Brands products are available

at Costco Canada East locations in Ontario, Quebec, Nova Scotia,

New Brunswick, and Newfoundland and Labrador. Tru Brands also plans

to expand the sales channels, including the expansion commitments

into approximately 800 Shoppers Drug Mart locations and Rexall,

Metro, and Loblaws locations.

On August 17, 2021 (the "Tru Brands Closing

Date"), the Company completed the acquisition. Under the terms of

the acquisition, the Company acquired 24,586,477 shares of common

stock with $0.001 par value per share of Tru Brands and 25,000,000

shares of Series A preferred stock with $0.001 par value per share

of Tru Brands, and satisfied certain outstanding indebtedness of

Tru Brands for an aggregate purchase consideration of $7,500,000,

paid in the form of issuance of the Company’s shares to the

shareholders and debtholders of Tru Brands, calculated on the basis

of the VWAP of the Company’s shares on the Exchange determined

based on the 10 trading days immediately preceding the Tru Brands

Closing Date. In connection with the acquisition, the Company

issued 89,462 common shares as finder’s fee.

The Company’s stock option, restricted share

unit ("RSU") and deferred share unit (the "DSU") plan (the

"Incentive Plan") - The Incentive Plan was approved at the

Company's annual general and special shareholder meeting held on

July 15, 2021.

Acquisition of Crisp Management Group Inc.

("CMG"). On August 20, 2021, the Company entered into a non-binding

term sheet (the "CMG Term Sheet") to acquire 60% of CMG to focus on

the sale and distribution of CBD and Hemp products through

Breakaway Music Festivals in North America as well as through

E-commerce. Pursuant to the terms of the CMG Term Sheet, the

Company will acquire 60% of the outstanding shares of CMG for

USD$500,000, to be satisfied through the issuance of common shares

of the Company at a price per share equal to the ten (10) trading

day VWAP of the shares on the Exchange in the ten (10) trading days

immediately prior to the closing date of the transaction. It is

expected that the share consideration will be subject to escrow,

with 15% releasable every four months in the first 20-month after

the closing date, and the remaining 25% releasable 24 months from

the closing date.

RESULTS OF OPERATIONS

|

|

For the six months ended |

|

expressed in millions except for |

June 30, 2021 |

|

June 30, 2020 |

|

|

earnings (loss) per share |

$ |

|

$ |

|

| Revenue |

5.6 |

|

7.8 |

|

| Gross margin (in $) |

3.4 |

|

5.0 |

|

| Gross margin (in %) |

61% |

|

64% |

|

| Operating expenses |

4.9 |

|

4.6 |

|

| Other income (expenses) |

(0.4 |

) |

- |

|

| Net income (loss) |

(1.9 |

) |

0.5 |

|

| Earnings (loss) per share |

|

|

|

- Basic |

(0.1 |

) |

1.2 |

|

|

- Diluted |

(0.1 |

) |

1.2 |

|

| |

|

|

|

expressed in millions except for |

June 30, 2021 |

|

December 31, 2020 |

|

|

dividend per share |

$ |

|

$ |

|

| Total assets |

21.2 |

|

12.1 |

|

| Total non-current financial

liabilities |

25.1 |

|

21.3 |

|

|

Dividend per share |

- |

|

- |

|

The net loss for the second quarter of 2021 was

$1.3 million compared to a net income of $0.3 million for the

second quarter of 2020.

The net loss for the six months ended June 30,

2021 was $1.9 million compared to a net income of $0.5 million

during the six months ended June 30, 2020.

Revenue

| |

For the three months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions |

$ |

% |

|

$ |

% |

|

$ |

% |

|

|

Direct to consumer |

2.9 |

94% |

|

3.6 |

90% |

|

(0.7 |

) |

-19% |

|

| Business to

business |

0.2 |

6% |

|

0.4 |

10% |

|

(0.2 |

) |

-50% |

|

|

|

3.1 |

100% |

|

4.0 |

100% |

|

(0.9 |

) |

-23% |

|

| |

For the six months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions |

$ |

% |

|

$ |

% |

|

$ |

% |

|

|

Direct to consumer |

5.2 |

93% |

|

7.2 |

92% |

|

(2.0 |

) |

-28% |

|

| Business to

business |

0.4 |

7% |

|

0.6 |

8% |

|

(0.2 |

) |

-33% |

|

|

|

5.6 |

100% |

|

7.8 |

100% |

|

(2.2 |

) |

-28% |

|

The Company’s revenue is generated by two

segments, Direct to Consumer ("DTC") and Business to Business

("B2B").

Revenue for the second quarter of 2021 was $3.1

million, of which $2.9 million (94%) and $0.2 million (6%) was

generated from the DTC and B2B, respectively, compared to $4.0

million, of which $3.6 million (90%) and $0.4 million (10%) was

generated from the DTC and B2B, in the second quarter of 2020.

Gross revenue excludes sales discount for the second quarter of

2021 and 2020 was $3.2 million and $4.1 million, respectively. The

Company’s discount was increased to an average of 31% in the second

quarter of 2021 compared to 24% in the second quarter of 2020

reflecting the increased competition the Company experienced in the

CBD market.

Revenue for the six months ended June 30, 2021

was $5.6 million, of which $5.2 million (93%) and $0.4 million (7%)

was generated from the DTC and B2B, respectively, compared to $7.8

million, of which $7.2 million (92%) and $0.6 million (8%) was

generated from the DTC and B2B, during the six months ended June

30, 2020. Gross revenue excludes sales discount for the second

quarter of 2021 and 2020 was $7.6 million and $9.8 million,

respectively. The Company’s discount was increased to an average of

26% during the six months ended June 30, 2021 compared to 20%

during the six months ended June 30, 2020 reflecting the increased

competition the Company experienced in the CBD market. No B.S.

Skincare was acquired on February 18th and as a result

approximately $1.3 million of sales were reflected in the

consolidated sales for six months ended June 30, 2021.

The decrease in revenue of $0.9 million (22%) in

the second quarter of 2021 and $2.2 million during the six months

ended June 30, 2021 was mainly due to the increase in competition

of the online CBD sales and higher discounts (31% in the second

quarter of 2021 and 26% for the six months ended June 30, 2021

compared to 24% in the second quarter of 2020 and 20% for the six

months ended June 30, 2020) as well as the negative impact of the

Covid 19 health crisis that negatively impacted offline sales as

retailers were closed for a good portion of 2020 and reluctant to

add new vendors to their existing CBD product SKUs.

Cost of goods sold

| |

For the three months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions |

$ |

% |

|

$ |

% |

|

$ |

% |

|

|

Product costs |

0.9 |

70% |

|

0.9 |

65% |

|

- |

|

0% |

|

| Merchant processing

fees |

0.2 |

15% |

|

0.3 |

21% |

|

(0.1 |

) |

-33% |

|

| Fulfillment

costs |

0.2 |

15% |

|

0.2 |

14% |

|

- |

|

0% |

|

|

|

1.3 |

100% |

|

1.4 |

100% |

|

(0.1 |

) |

-7% |

|

| |

For the six months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions |

$ |

% |

|

$ |

% |

|

$ |

% |

|

|

Product costs |

1.4 |

63% |

|

1.7 |

62% |

|

(0.3 |

) |

-18% |

|

| Merchant processing

fees |

0.3 |

14% |

|

0.5 |

19% |

|

(0.2 |

) |

-40% |

|

| Fulfillment

costs |

0.5 |

23% |

|

0.5 |

19% |

|

- |

|

0% |

|

|

|

2.2 |

100% |

|

2.7 |

100% |

|

(0.5 |

) |

-19% |

|

Cost of goods sold includes the product cost,

merchant processing fees, and fulfillment and delivery costs.

Product costs may vary directly based on hemp's crop price and the

CBD derivatives from the crops. Merchant processing fees may be

affected by the CBD industry's risk and customer data security and

fraud. Fulfillment costs are mainly driven by the delivery costs

with the main courier companies.

Cost of goods sold was $1.3 million (includes

the product costs of $0.9 million (70%), merchant processing fees

of $0.2 million (15%) and fulfillment costs of $0.2 million (15%))

compared to $1.4 million (includes the product costs of $0.9

million (65%), merchant processing fees of $0.3 million (21%) and

fulfillment costs of $0.2 million (14%)) in the second quarter of

2021 and 2020, respectively.

Cost of goods sold was $2.2 million (includes

the product costs of $1.4 million (63%), merchant processing fees

of $0.3 million (14%) and fulfillment costs of $0.5 million (23%))

compared to $2.7 million (includes the product costs of $1.7

million (62%), merchant processing fees of $0.5 million (19%) and

fulfillment costs of $0.5 million (19%)) during the six months

ended June 30, 2021, and 2020, respectively.

The decrease in cost of goods sold of $0.1

million (7%) and $0.5 million (19%) in the second quarter of 2021

and six months ended June 30, 2021, respectively was primarily due

to the decrease in revenue.

Gross profit

| |

For the three months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions |

$ |

% |

|

$ |

% |

|

$ |

|

% |

|

|

Gross profit |

1.8 |

58% |

|

2.6 |

65% |

|

(0.8 |

) |

-31 |

% |

| |

For the six months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions |

$ |

% |

|

$ |

% |

|

$ |

|

% |

|

|

Gross profit |

3.4 |

61% |

|

5.0 |

64% |

|

(1.6 |

) |

-32 |

% |

Gross profit for the second quarter of 2021 was

$1.8 million (58%) compared to $2.6 million (65%) in the second

quarter of 2020.

Gross profit for the six months ended June 30,

2021 was $3.4 million (61%) compared to $5.0 million (64%) for the

six months ended June 30, 2020.

Gross profit margin % was negatively impacted by

the increase in discount during the second quarter of 2021 and the

six months ended June 30, 2021. The gross margin decreases of $0.8

and $1.6 in the second quarter of 2021 and the six months ended

June 30, 2021, respectively, compared prior periods was mainly due

to lower sales experienced in for the six months ended June 30,

2021.

Operating expenses

Followings are the breakdown of the major

operating expenses in the presented period:

| |

For the three months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions * |

$ |

% |

|

$ |

% |

|

$ |

|

% |

|

| Customer service

support |

- |

0% |

|

0.1 |

4% |

|

(0.1 |

) |

-100% |

|

| General and

administrative expenses |

0.2 |

7% |

|

0.1 |

4% |

|

0.1 |

|

100% |

|

| Marketing

expense |

1.2 |

43% |

|

1.2 |

52% |

|

- |

|

0% |

|

| Professional

fees |

0.3 |

11% |

|

0.5 |

22% |

|

(0.2 |

) |

-40% |

|

| Regulatory and filing

fees |

0.1 |

4% |

|

- |

0% |

|

0.1 |

|

100% |

|

| Salaries and

wages |

0.9 |

32% |

|

0.3 |

13% |

|

0.6 |

|

200% |

|

| Other items

** |

0.1 |

3% |

|

0.1 |

5% |

|

(0.0 |

) |

0% |

|

|

|

2.8 |

100% |

|

2.3 |

100% |

|

0.5 |

|

22% |

|

*Items in each presented period with a balance

below $0.1M are either combined as "Other Items" or excluded from

the table above.**Other items including items with a balance below

$0.1M and rounding adjustment.

Operating costs for the second quarter of 2021

were $2.8 million, an increase of $0.5 million (22%), compared to

$2.3 million in the second quarter of 2020.

The majority of the operating costs incurred in

the second quarter of 2021 were marketing expenses of $1.2 million

(43%) and salaries and wages of $0.9 million (32%). Of the $0.9

million in salaries and wages, $0.1 million was one time salary and

wages expenses (management bonuses). Salaries and wages excluding

the one-time amount of $0.1 million was comparable to salaries and

wages in the first quarter of 2021 ($0.7 million). The majority of

the operating costs incurred in the second quarter of 2020 were

marketing expenses of $1.2 million (52%), professional fees of $0.5

million (22%) and salaries and wages of $0.3 million (13%).

Compared to the second quarter of 2020, the increase in salaries

and wages of $0.6 million (200%) was mainly related to the increase

in the company's full-time employees in the sales and marketing

operations.

As the Company pursued its growth strategy

through mergers and acquisitions it incurred regulatory filing fees

of $0.1 million as well as legal expenses related to the

acquisitions. The professional fees incurred in the second quarter

of 2020 was mainly related to the acquisition of Purekana.

| |

For the six months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions * |

$ |

% |

|

$ |

% |

|

$ |

|

% |

|

| Customer service

support |

0.1 |

2% |

|

0.1 |

2% |

|

- |

|

0% |

|

| General and

administrative expenses |

0.4 |

8% |

|

0.3 |

7% |

|

0.1 |

|

33% |

|

| Marketing

expense |

2.1 |

43% |

|

2.7 |

59% |

|

(0.6 |

) |

-22% |

|

| Professional

fees |

0.5 |

10% |

|

0.7 |

15% |

|

(0.2 |

) |

-29% |

|

| Salaries and

wages |

1.6 |

33% |

|

0.7 |

15% |

|

0.9 |

|

129% |

|

| Regulatory and filing

fees |

0.2 |

4% |

|

- |

0% |

|

0.2 |

|

100% |

|

| Other items

** |

- |

0% |

|

0.1 |

2% |

|

(0.1 |

) |

-100% |

|

|

|

4.9 |

100% |

|

4.6 |

100% |

|

0.3 |

|

7% |

|

*Items in each presented period with a balance

below $0.1M are either combined as "Other Items" or excluded from

the table above.**Other items including items with a balance below

$0.1M and rounding adjustment.

Operating costs for the six months ended June

30, 2021 were $4.9 million, an increase of $0.3 million (7%),

compared to $4.6 million for the six months ended June 30,

2020.

The majority of the operating costs incurred

during the six months ended June 30, 2021 were marketing expenses

of $2.1 million (43%), professional fees of $0.5 (10%) and salaries

and wages of $1.6 million (33%). The majority of the operating

costs incurred during the six months ended June 30, 2020 were

marketing expenses of $2.7 million (59%), professional fees of $0.7

million (15%) and salaries and wages of $0.7 million (15%).

Compared to the six months ended June 30, 2020, the increase in

salaries and wages of $0.9 million (129%) was mainly related to the

increase in the company's full-time employees in the sales and

marketing operations.

As the Company pursued its growth strategy

through mergers and acquisitions it incurred listing and regulatory

filing fees of $0.2 million as well as legal expenses related to

the acquisitions. The professional fees incurred during the six

months ended June 30, 2020 was mainly related to the acquisition of

Purekana.

Other income (expenses)

The following are the breakdown of the major

operating expenses in the presented period:

| |

For the three months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions * |

$ |

|

% |

|

$ |

% |

|

$ |

|

% |

|

|

Finance costs |

(1.0 |

) |

250% |

|

- |

0% |

|

(1.0 |

) |

100% |

|

| Fair value adjustment

of derivative liability |

0.6 |

|

-150% |

|

- |

0% |

|

0.6 |

|

100% |

|

|

|

(0.4 |

) |

100% |

|

- |

0% |

|

(0.4 |

) |

100% |

|

*Items in each presented period with a balance

below $0.1M are either combined as "Other Items" or excluded from

the table above.**Other items including items with a balance below

$0.1M and rounding adjustment.

| |

For the six months ended |

|

|

| |

June 30, 2021 |

June 30, 2020 |

Change in |

|

expressed in millions * |

$ |

|

% |

|

$ |

% |

|

$ |

|

% |

|

| Finance

costs |

(1.6 |

) |

400% |

|

- |

0% |

|

(1.6 |

) |

100% |

|

| Fair value adjustment

of derivative liability |

1.1 |

|

-275% |

|

- |

0% |

|

1.1 |

|

100% |

|

| Other items

** |

0.1 |

|

-25% |

|

- |

0% |

|

0.1 |

|

100% |

|

|

|

(0.4 |

) |

100% |

|

- |

0% |

|

(0.4 |

) |

100% |

|

*Items in each presented period with a balance

below $0.1M are either combined as "Other Items" or excluded from

the table above.**Other items including items with a balance below

$0.1M and rounding adjustment.

Finance costsFinance costs of $1.0 million in

the second quarter of 2021 was mainly related to the accretion of

interest regarding the convertible notes, lease obligation, loan

payable, preferred shares, promissory notes and provision of

earn-out payments. No such accretion of interest was recognized in

the second quarter of 2020.

Finance costs of $1.6 million during the six

months ended June 30, 2021 was mainly related to the accretion of

interest regarding the convertible notes, lease obligation, loan

payable, preferred shares, promissory notes and provision of

earn-out payments. No such accretion of interest was recognized

during the six months ended June 30, 2020.

Gain on remeasurement of derivative liabilityThe

Company recognized a gain on remeasurement of derivative liability

of $0.6 and $1.1 million in the second quarter of 2021 and in the

six months ended June 30, 2021, respectively, pursuant to IFRS 9:

Financial Instruments. The Company is required to remeasure the

fair value of the derivative liability at each reporting period.

Any changes in the derivative liability's fair value are recognized

in the income statement as a gain or loss. The gain/loss on

remeasurement of derivative liability is driven by different

factors such as share price of the Company, risk-free interest rate

and foreign exchange rate.

Earnings before Interest, Taxes,

Depreciation, and Amortization ("EBITDA") and Adjusted EBITDA

(Non-GAAP Measures)

EBITDA and Adjusted EBITDA are non-GAAP measures

used by management that are not defined by IFRS. EBITDA and

Adjusted EBITDA do not have a standardized meaning prescribed by

IFRS and therefore may not be comparable to similar measures

presented by other issuers. Management believes that EBITDA and

Adjusted EBITDA provide meaningful and useful financial information

as these measures demonstrate the operating performance of the

business excluding non-cash charges.

The most directly comparable measure to EBITDA

and Adjusted EBITDA calculated in accordance with IFRS is

net loss. The following table presents the EBITDA and Adjusted

EBITDA for the second quarter of 2021 and 2020 and the six months

ended June 30, 2021 and 2020, and a reconciliation of same to net

income (loss):

| |

For the three months ended |

|

|

| |

June 30, |

|

June 30, |

|

|

| |

2021 |

|

2020 |

Change in |

|

expressed in millions * |

$ |

|

$ |

$ |

|

% |

|

| Net income

(loss) |

(1.3 |

) |

0.3 |

(1.6 |

) |

-533% |

|

| Add

(less): |

|

|

|

|

|

Finance costs |

1.0 |

|

- |

1.0 |

|

100% |

|

| EBITDA |

(0.3 |

) |

0.3 |

(0.6 |

) |

-200% |

|

| Add

(less): |

|

|

|

|

|

Fair value adjustment of derivative liability |

(0.6 |

) |

- |

(0.6 |

) |

100% |

|

|

Adjusted EBITDA |

(0.9 |

) |

0.3 |

(1.2 |

) |

-400% |

|

The Adjusted EBITDA loss for the second quarter

is driven by the following factors: (1) operating loss of No BS

Skincare subsidiary ($0.2 million), (2) regulatory, listing fees

and legal fees related to business acquisitions ($0.2 million), and

(3) operating loss at Purekana ($0.5 million). Of the $0.5 million

operating loss at Purekana, $0.1 million was due to one-time salary

related costs.

| |

For the six months ended |

|

|

| |

June 30, |

June 30, |

|

|

| |

2021 |

|

2020 |

Change in |

|

expressed in millions * |

$ |

|

$ |

$ |

|

% |

|

| Net income

(loss) |

(1.9 |

) |

0.5 |

(2.4 |

) |

-480% |

|

| Add

(less): |

|

|

|

|

|

Finance costs |

1.6 |

|

- |

1.6 |

|

100% |

|

| EBITDA |

(0.3 |

) |

0.5 |

(0.8 |

) |

-160% |

|

| Add

(less): |

|

|

|

|

|

Fair value adjustment of derivative liability |

(1.1 |

) |

- |

(1.1 |

) |

100% |

|

|

Adjusted EBITDA |

(1.4 |

) |

0.5 |

(1.9 |

) |

-380% |

|

The Adjusted EBITDA loss during the six months

ended June 30, 2021 by the following factors: (1) operating loss of

No BS Skincare subsidiary ($0.3 million), (2) regulatory, listing

fees and legal fees related to business acquisitions ($0.2

million), and (3) operating loss at Purekana ($0.9 million). Of the

$0.9 million operating loss at Purekana, $0.1 million was due to

higher fulfillment and delivery costs in the first quarter which

have subsequently being reduced in the second quarter and $0.1

million in one-time salary related costs.

LIQUIDITY AND CAPITAL RESOURCES

|

As at |

June 30, |

December 31, |

|

|

2021 |

|

2020 |

|

|

expressed in millions * |

$ |

|

$ |

|

| ASSETS |

|

|

| Current

assets |

|

|

| Cash |

5.0 |

|

8.3 |

|

| Accounts receivable |

0.4 |

|

0.2 |

|

| Other receivable |

0.3 |

|

- |

|

| Loan receivable |

0.4 |

|

0.4 |

|

| Prepaid expenses |

1.3 |

|

1.9 |

|

| Inventory |

1.5 |

|

0.8 |

|

| Other items ** |

(0.1 |

) |

0.1 |

|

| Total current

assets |

8.8 |

|

11.7 |

|

| Non-current

assets |

12.4 |

|

0.4 |

|

| TOTAL

ASSETS |

21.2 |

|

12.1 |

|

| |

|

|

|

LIABILITIES |

|

|

| Current

liabilities |

|

|

| Accounts payable and accrued

liabilities |

(0.7 |

) |

(0.7 |

) |

| Current portion of derivative

liability |

(0.4 |

) |

- |

|

| Current portion of lease

obligation |

(0.1 |

) |

(0.1 |

) |

| Current portion of promissory

note |

(7.3 |

) |

(3.7 |

) |

| Current portion of provision

of earn-out payments |

(0.9 |

) |

- |

|

| Other items ** |

- |

|

- |

|

| Total current

liabilities |

(9.4 |

) |

(4.5 |

) |

| Long term

liabilities |

(25.1 |

) |

(21.3 |

) |

| TOTAL

LIABILITIES |

(34.5 |

) |

(25.8 |

) |

| |

|

|

| WORKING

CAPITAL |

(0.6 |

) |

7.2 |

|

*Items in each presented period with a balance

below $0.1M are either combined as "Other Items" or excluded from

the table above.**Other items including items with a balance below

$0.1M and rounding adjustment.

The Company’s primary liquidity and capital

requirements are for inventory and general corporate working

capital purposes. The Company currently has a cash balance of $5.0

million as of June 30, 2021 coupled with cash flows from

operations, will provide capital to support the planned growth of

the business and for general corporate working capital purposes.

The Company’s working capital decreased from 7.2 million as of

December 31, 2020 to working capital deficiency of $0.6 as of June

30, 2021. The Company continues to focus on improving its working

capital position through a number of initiatives including better

payment terms with key vendors, taking advantage of early payment

options with its offline customers and negotiating lower costs with

its key vendors.

The Company’s working capital requirements

fluctuate from period to period depending on, among other factors,

key consumer holidays (second and fourth quarter each year), new

product introductions and vendor lead times. The Company’s

principal working capital needs include accounts receivable,

inventory, prepaid expenses, and accounts payable.

Purekana is subject to externally imposed

capital requirements in connection with its loan. The Loan contains

a financial covenant for the debt service coverage ratio (the "Debt

Service Coverage Ratio") of Purekana at the end of each calendar

year during the term of the loan should not be less than 1.2.

Pursuant to the Loan, the Debt Service Coverage Ratio is defined as

the quotient of Purekana’s EBITDA for each annual reporting period

divided by a ten-year amortization of the Loan amount which is the

sum of the interest expense for the reporting period and the

scheduled principal payments made with respect to the Loan amount

for the reporting period. The Adjusted EBITDA is defined as the

unadjusted EBITDA adjusted for any non-recurring, one-time, or

irregular items. Purekana was in compliance with these capital

requirements as at December 31, 2020.

The Company’s ability to fund operating expenses

will depend on its future operating performance which will be

affected by general economic, financial, regulatory, and other

factors including factors beyond the Company’s control (See "Risk

and Uncertainties" in the Company's MD&A for the three and six

months ended June 30, 2021).

Management continually assesses liquidity in

terms of the ability to generate sufficient cash flow to fund the

business. Net cash flow is affected by the following items: (i)

operating activities, including the level of amounts receivable,

accounts payable, accrued liabilities and unearned revenue and

deposits; (ii) investing activities (iii) financing activities.

OUTSTANDING SHARE DATA

As at June 30, 2021, the Company had 21,496,896

common shares (December 31, 2020 – 21,016,875) common shares issued

and outstanding.

During the six months ended June 30,

2021

- 5,160,469 common shares released

from escrow.

- 22,500 warrants were exercised for

cash proceeds of $23,636 (CA$30,000).

- Issued 457,521 common shares for

conversion of the convertible notes.

Subsequent to June 30, 2021

- The Company granted 1,351,030

options with an exercise price of $5.70 to its officers, employees

and consultants. The options are exercisable for a period of five

years.

- The Company issued 904,100 RSUs to

its directors, employees and consultants.

- The Company issued 491,000 common

shares for the RSUs.

- 1,561,407 common shares were issued

in connection with the acquisition of Tru Brands.

As at the date hereof, the Company had

23,530,403 common shares issued and outstanding.

In addition, as at the date hereof, the Company

had 1,351,030 stock options and 413,100 RSUs issued and

outstanding.

SUBSEQUENT EVENTS

- On July 27, 2021, the Company

granted 1,351,030 options with an exercise price of $5.70 to its

officers, employees and consultants. The options are exercisable

for a period of five years.

- On July 27, 2021, the Company

issued 904,100 RSUs to its directors, employees and

consultants.

- On August 17, 2021, the Company

completed the Acquisition of Tru Brands.

- On August 20, 2021, the Company

entered into the CMG Term Sheet with CMG.

- The Company issued 491,000 common

shares for the RSUs.

- 1,561,407 common shares were issued

in connection with the acquisition of Tru Brands.

- The Company repaid $500,000

including interest of the promissory note issued in connect with

the acquisition of No B.S.

OUTLOOK

The Company change of its name to Simply Better

Brands Corp., highlighting the Company’s transition from a CBD and

plant-based wellness company to that of a global health, wellness

and lifestyle company. "Simply Better Brands" reflects the

Company’s commitment to promoting healthy and active lifestyles

while building the brands which make them possible. In addition to

expanding its majority-owned CBD subsidiary brand, Purekana, the

Company has over the past five months made or announced strategic

acquisitions in industry-leading health, wellness, beauty, pet and

lifestyle brands and companies. The Company expects to continue to

seek out additional merger and acquisition (M&A) opportunities

in these industry sectors to drive top line growth and

profitability.

- Wellness Business - The wellness business is driven by the

Company’s holdings in Purekana, a leading CBD brand. In the back

half of 2021, we plan to prioritize three sources of growth: direct

to consumer optimization, retail outlet penetration, and

international expansion. We maintain a strong direct to consumer

(D2C) position, as consumers buy online at a greater rate during

the pandemic. To accelerate our D2C sales, we are incrementally

investing in a proven customer acquisition strategy. We also see

sequential monthly improvement in our CBD specialty retail channel

with continued distribution expansion. We are encouraged by our

monthly sales progress in this offline business channel and as a

result are hiring additional sales staff to pursue additional sales

opportunities. The effects of Covid 19 impacted the adoption of CBD

in large brick & mortar retail outlooks, signally slower than

anticipated growth in this class of trade, in the second half of

2021. Our international sales growth in key markets including the

UK, the EU and Latin America in 2021 is progressing and we expect

to launch our CBD products in the fourth quarter of 2021. Sales to

Latin America and UK are expected to commence in the fourth quarter

as well. With the acquisition of Nirvana, we also plan to launch

our pet CBD products in the fourth quarter of 2021. As the result

of a weaker first half of 2021, we don’t expect 30-40% sales growth

in this sector in 2021. We do expect 18-20% growth in the wellness

sector in the second half of 2021 based on the traction of sales

initiatives we are currently seeing and the expected international

sales that will commence in the fourth quarter. We also are

continually working on merger and acquisition opportunities that

could positively impact our fourth quarter sales in the wellness

sector depending on the timing of the close of these

transactions.

- Beauty Business - The beauty business is driven by the

company’s No B.S. brand. We are expecting flat growth in this brand

in 2021. We have a major international sales growth initiative that

we expect to launch in late 2021, however any impact on sales would

be in 2022.

- Plant Based Food - TRU Brands acquisition closed in August of

2021. We are expecting the contribution to SBBC consolidated sales

to be material starting in the fourth quarter of 2021 driven by

successful placement of the bars in the Canadian and US market with

large retailers including Costco, Loblaws and Shoppers Drug

Mart.

- Other Market Sectors - The Company is currently evaluating

other markets for consumer offerings characterized by strong growth

and appeal to its core customer segments. The Company is focused on

building a direct-to-consumer platform catering to Millennial and

Gen Z consumers.

- Operating Synergies - The Company will continue to focus on

realizing operating synergies across its portfolio of consumer

brands. This includes e-commerce platforms, finance and

administration, fulfillment and marketing synergies. The Company

has made progress in all areas during the first half of 2021 and

expects this success to continue during the second half of

2021.

About Simply Better Brands

Corp.

Simply Better Brands Corp. leads an

international omni-channel platform with diversified assets in the

emerging plant-based and holistic wellness consumer product

categories. The Company’s mission is focused on leading innovation

for the informed Millennial and Generation Z generations in the

rapidly growing plant-based, natural, and clean ingredient space.

The Company continues to focus on expansion into high-growth

consumer product categories including CBD products, plant-based

food and beverage, and the global pet care and skin care

industries. For more information on Simply Better Brands Corp.,

please visit:

https://www.simplybetterbrands.com/investor-relations.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact Information

Simply Better Brands Corp.Brian MeadowsChief Financial Officer+1

(855) 553-7441ir@simplybetterbrands.com

Forward-Looking Information

Certain statements contained in this news

release constitute "forward-looking information" and "forward

looking statements" as such terms are used in applicable Canadian

securities laws. Forward-looking statements and information are

based on plans, expectations and estimates of management at the

date the information is provided and are subject to certain factors

and assumptions, including, that the Company’s financial condition

and development plans do not change as a result of unforeseen

events and that the Company obtains regulatory approval.

Specifically, this news release contains

forward-looking statements relating to, but not limited to:

completion of proposed acquisitions; expansion capabilities of

PureKana, Nirvana, No BS skincare and TRU Brands; expansion and

marketing plans for the Company and its subsidiaries; the Company's

plans for continued M&A activity in specific industry sectors

to drive top line growth and profitability; projected results of

operations during 2021, including specific sales growth targets and

industry growth targets; the effects of COVID-19 on retail; planned

international sales growth in key markets; sales growth in the

beauty industry; the Company's plan to build a direct-to-consumer

platform catering to Millennial and Gen-Z consumers; operating

synergies; the Company's acquisition activities; growth of

opportunities in the Company's business segments, including

wellness, beauty, plant based foods, and others.

The material factors and assumptions used to

develop the forward-looking statements herein include, but are not

limited to, the following: (i) the impact of the COVID-19 pandemic;

(ii) the regulatory climate in which the Company operates; (iii)

the sales success of the Company’s products; (iv) the success of

sales and marketing activities; (v) the Company’s ability to

complete acquisitions; (vi) there will be no significant reduction

in the availability of qualified and cost-effective human

resources; (vii) new products will continue to be added to the

Company’s portfolio; (viii) consumer demand for the Company

products will continue to grow in the foreseeable future; (ix)

there will be no significant barriers to the acceptance of the

Company’s products in the market; (x) the Company will be able to

maintain compliance with applicable contractual and regulatory

obligations and requirements; (xi) there will be adequate liquidity

available to the Company to carry out its operations; (xii)

products do not develop that would render the Company’s current and

future product offerings undesirable and the Company is otherwise

able to minimize the impact of competition and keep pace with

changing consumer preferences; and (xiii) the Company will be able

to successfully manage and integrate acquisitions and take

advantage of synergies from acquisitions.

The Company’s forward-looking statements are

subject to risks and uncertainties pertaining to, among other

things, the adverse impact of the COVID-19 pandemic to the

Company's operations, supply chain, distribution chain, and to the

broader market for the Company's products, revenue fluctuations,

nature of government regulations (both domestic and foreign),

economic conditions, loss of key customers, retention and

availability of executive talent, competing products, common share

price volatility, loss of proprietary information, product

acceptance, internet and system infrastructure functionality,

information technology security, cash available to fund operations,

availability of capital, international and political

considerations, the successful integration of acquired businesses,

and including but not limited to those risks and uncertainties

discussed in the Company’s other filings with securities

regulators. The impact of any one risk, uncertainty, or factor on a

particular forward-looking statement is not determinable with

certainty as these are interdependent, and the Company’s future

course of action depends on management’s assessment of all

information available at the relevant time. Except to the extent

required by law, the Company assumes no obligation to publicly

update or revise any forward-looking statements made in this press

release, whether as a result of new information, future events, or

otherwise. All subsequent forward-looking statements, whether

written or oral, attributable to the Company or persons acting on

the Company’s behalf, are expressly qualified in their entirety by

these cautionary statements.

These foregoing lists are not exhaustive.

Additional information on these and other factors which could

affect the Company's operations or financial results are included

in the Company’s other public documents on file with the Canadian

Securities regulatory authorities on www.sedar.com"

www.sedar.com.

The above summary of assumptions and risks

related to forward-looking statements in this news release has been

provided in order to provide shareholders and potential investors

with a more complete perspective on the Company's current and

future operations and such information may not be appropriate for

other purposes. There is no representation by the Company that

actual results achieved will be the same in whole or in part as

those referenced in the forward-looking statements and the Company

does not undertake any obligation to update publicly or to revise

any of the included forward-looking statements, whether as a result

of new information, future events or otherwise, except as may be

required by applicable securities law.

This news release contains financial outlook

information about prospective results of operations, which are

subject to the same assumptions, risk factors, limitations and

qualifications as set forth in the above paragraphs. The financial

outlook information was approved by management as of the date of

this news release and was provided for the purpose of providing

further information about the Company’s anticipated future business

operations. Readers are cautioned that reliance on such information

may not be appropriate for other purposes. The Company disclaims

any intention or obligation to update or revise any financial

outlook information contained in this news release, whether as a

result of new information, future events or otherwise, unless

required by applicable securities law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

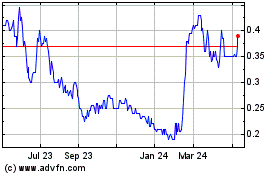

Simply Better Brands (TSXV:SBBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

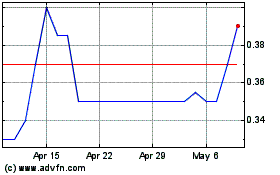

Simply Better Brands (TSXV:SBBC)

Historical Stock Chart

From Apr 2023 to Apr 2024