TIDM88E

RNS Number : 6281W

88 Energy Limited

27 April 2021

27(th) April 2021

This announcement contains inside information

88 Energy Limited

Operations Update

88 Energy Limited ("88 Energy" or the "Company", ASX:88E,

AIM:88E, OTC:EEENF) is pleased to provide the following update

related to its operations on the North Slope of Alaska.

Highlights

-- Testing commenced on sidewall cores, cuttings, mud gas and fluid samples from Merlin-1

o Results expected over next 2 - 10 weeks

-- Initial mapping of additional prospective zones encountered in Merlin-1 encouraging

-- Results on acreage adjacent to Icewine have positive implications

Details

Sidewall cores, mud gas and fluid samples taken from Merlin-1

are now undergoing testing to determine oil saturation, oil typing,

PVT characteristics, porosity, permeability and rock mechanics.

Cuttings will also go through a Volatiles Analysis Service ("VAS")

to assist with the interpretation of the results from the well.

The rough schedule of testing and results is as follows:

-- Core photography (white and UV light) and geological descriptions 2-3 weeks

-- Isotope analysis of mud gas 2-4 weeks

-- VAS on cuttings 2-4 weeks

-- Results from centrifugal spin out of oil samples from select cores 3-4 weeks

-- Routine core analysis including saturations from Dean Stark 4-8 weeks

-- Fluid analysis with oil geochemistry 5-10 weeks

These results will then be integrated into a final petrophysical

interpretation.

During the drilling of Merlin-1 several prospective zones were

encountered that had previously been unmapped. These zones

exhibited good shows with potential for pay, subject to results

from the testing mentioned above. An initial mapping exercise has

indicated that these zones may be of similar magnitude in terms of

volumetric range as the originally targeted primary zones. Further

work is required to confirm this; however, the early work is

encouraging.

Project Icewine

88 Energy has also been closely monitoring activity nearby to

the northern border of its Project Icewine acreage, where a flow of

light oil from the Kuparuk has been reported from the Talitha-A

well. (See Pantheon Resources AIM:PANR press release dated 19(th)

April 2021). Additional insights into the wettability of the

Kuparuk formation have also been highlighted as part of the results

from Talitha-A, which may have positive ramifications for 88E's

previous interpretation of this horizon. All three wells drilled by

88 Energy at Project Icewine have encountered good quality

reservoir in the Kuparuk formation, with indications of

hydrocarbons. These had previously been interpreted as likely gas

condensate or residual oil and no mapped targets had been

identified, as this was not a play that 88E had been pursuing. The

results at Talitha-A are highly encouraging regionally for the

Kuparuk, including across Project Icewine, and the 88E internal

geoscience team is now re-assessing the potential across our

acreage.

It is also evident that several of the other prospective

horizons encountered in Talitha-A, where pay has been interpreted

by Pantheon, extend into Project Icewine acreage.

Managing Director, David Wall, commented: "The oil shows and

other encouragement seen in the Merlin-1 well bodes well for the

potential at Project Peregrine and we look forward to providing the

results from the laboratory analysis over the coming weeks.

It is also highly positive to see pay zones and a flow rate of

light oil achieved from zones on adjacent acreage that are also

prospective at Project Icewine, where an internal review has

commenced to determine the significance of the neighbouring

results."

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 35

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified

Geologist/Geophysicist who has sufficient experience that is

relevant to the style and nature of the oil prospects under

consideration and to the activities discussed in this document. Dr

Staley has reviewed the information and supporting documentation

referred to in this announcement and considers the resource and

reserve estimates to be fairly represented and consents to its

release in the form and context in which it appears. His academic

qualifications and industry memberships appear on the Company's

website and both comply with the criteria for "Competence" under

clause 3.1 of the Valmin Code 2015. Terminology and standards

adopted by the Society of Petroleum Engineers "Petroleum Resources

Management System" have been applied in producing this

document.

About Project Peregrine

Project Peregrine is located in the NPR-A region of the North

Slope of Alaska and encompasses 195,000 contiguous acres. It is

situated on trend to recent discoveries in a newly successful play

type in topset sands in the Nanushuk formation. 88 Energy has a

100% working interest in the project that will reduce to 50% post

the completion of funding as part of a recent farm-in, whereby 88E

is carried on the first US$10m (of an initially estimated US$12.6m

total cost) for the Merlin-1 well.

The Merlin-1 well was spudded in March 2021 and targeted 645

million barrels of gross mean prospective resource(#) . Wireline

logging at Merlin-1 is now complete and interpretation of results

is underway. A second well, Harrier-1, is planned to be drilled in

2022 and is targeting gross mean prospective resource of 417

million barrels(#) .

Independent Resource Assessment(#)

Project Peregrine: Alaska Unrisked Net Entitlement to 88E Prospective

North Slope Oil Resources (MMstb)

Prospectus (Probabilistic Low Best High Mean COS

Calculations) (1U) (2U) (3U)

---------- ---------- --------- --------- ------

Merlin (Nanushuk) 41 270 1,463 645 37%

---------- ---------- --------- --------- ------

Harrier (Nanushuk) 48 207 940 417 24%

---------- ---------- --------- --------- ------

Harrier Deep (Torok) 42 267 1,336 574 20%

---------- ---------- --------- --------- ------

Prospects Total 1,636

---------- ---------- --------- --------- ------

(#) Please refer to release dated 23 February 2021 for full

details with respect to the Prospective Resource estimate,

associated risking and applicable Cautionary Statement.

Each of the Merlin and Harrier prospects is located on trend to

an existing discovery, in the same play type (Nanushuk topsets).

This has de-risked the prospects considerably and resulted in a

relatively high independently estimated geologic chance of

success.

Cautionary Statement: The estimated quantities of petroleum that

may be potentially recovered by the application of a future

development project relate to undiscovered accumulations. These

estimates have both an associated risk of discovery and a risk of

development. Further exploration, appraisal and evaluation are

required to determine the existence of a significant quantity of

potentially movable hydrocarbons.

The below graphics can be found in the pdf version of this

announcement available from the Company's website;

- Graphic 1: Multiple stacked sand bodies within thick Nanushuk section in Merlin-1

- Graphic 2: Kuparuk and Theta West Prospects on adjacent acreage to Project Icewine

- Graphic 3: Shelf Margin Deltaic Extension into Project Icewine

- Graphic 4: Project Peregrine and Recent Nanushuk Discoveries

- Graphic 5: Merlin-1 - on trend to large Willow oil field

Media and Investor Relations:

88 Energy Ltd Tel: +61 8 9485 0990

Dave Wall, Managing Director Email: admin@88energy.com

Finlay Thomson, Investor Relations Tel: +44 7976 248471

EurozHartleys Ltd Tel: + 61 8 9268 2829

Dale Bryan

Cenkos Securities Tel: + 44 131 220 6939

Neil McDonald/Derrick Lee

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFISSRIRFIL

(END) Dow Jones Newswires

April 27, 2021 02:00 ET (06:00 GMT)

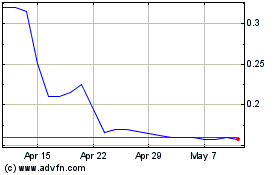

88 Energy (LSE:88E)

Historical Stock Chart

From Mar 2024 to Apr 2024

88 Energy (LSE:88E)

Historical Stock Chart

From Apr 2023 to Apr 2024