TIDMAEMC

RNS Number : 9913G

Aberdeen Emerging Markets Inv Co Ld

30 July 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO, THE UNITED STATES, AUSTRALIA,

CANADA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY JURISDICTION

FOR WHICH THE SAME COULD BE UNLAWFUL .

The information communicated in this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this information is considered to be in the public

domain.

30 July 2021

Aberdeen Emerging Markets Investment Company Limited

LEI: 213800RIA1NX8DP4P938

Proposals for a change of investment policy to an All China

investment mandate, combination with Aberdeen New Thai Investment

Trust and tender offer

The Board of Aberdeen Emerging Markets Investment Company

Limited (the "Company" or "AEMC") is pleased to announce a

comprehensive set of proposals as set out below (the "Proposals")

which it believes will benefit the Company's Shareholders going

forward. The proposals include a change of investment policy from

investing in emerging markets on a fund of funds basis to investing

directly in the equities of Chinese companies, a merger with

Aberdeen New Thai Investment Trust ("New Thai"), and a tender offer

for up to 15% of the Company's shares.

Key benefits of the Proposals

-- Move to investing directly in Chinese equities, which the

Board sees as underserved despite China being the world's second

largest economy;

-- Access to the highly successful Aberdeen Standard

Investments' equities team specialising in China, locally based in

Shanghai and Hong Kong;

-- Move away from a fund of funds structure to direct investment

in equities, which the board expects to improve the attractiveness

of the Company's shares to its core investor base;

-- Merger with New Thai to help improve liquidity and free float

and, reduce fixed costs per share;

-- Tender offer to provide an opportunity for shareholders

seeking to realise all or part of their investment.

Background to the Proposals

As was discussed in the recent interim results, the Board has

been actively considering changes to the Company. Whilst the

Company's investment performance has been very commendable over a

long period of time, in the well-populated emerging markets

investment funds sector, the attractiveness of the Company's shares

has been adversely affected by the current aversion to fund of fund

structures and consequent look-through costs, particularly amongst

wealth managers. This has resulted in an overly concentrated share

register with limited free float, presently calculated at

approximately 16%. One consequence of this has been the Board's

inability to undertake a determined buy back campaign to address

the discount to net asset value at which the shares have traded in

the stock market. In preparing these Proposals the Board has sought

to address these issues comprehensively and so secure a sound

long-term future for the Company.

Proposals

Change of investment policy to an All China mandate

The Board has noted that, although China now ranks as the second

largest economy in the world, there are relatively few listed

closed end fund offerings in the UK specialising in investment into

companies based, or with substantial operations, in China.

The Board conducted a thorough selection process before deciding

to appoint Aberdeen Standard Investments ("ASI") to manage the

Company under this proposed investment mandate.

With over GBP4 billion invested in Chinese equities as at 31

March 2021, ASI has a strong record of performance (both absolute

and relative) witnessed in its Aberdeen Standard Luxembourg

registered SICAV I China A and All China equity funds. ASI has been

investing in China for almost 30 years, and has a large team based

in Shanghai and Hong Kong, supported by team members in Singapore.

ASI also brings a strong record of ESG integration into its

investment processes and engagement with investment managers

supported by on-desk ESG specialists, together with a very strong

track record of investment in China. ASI's Chinese equities team of

thirteen is complemented by three on-desk ESG specialists and

underpinned by ASI's global footprint with its central ESG team of

20+ based in Edinburgh. ASI is acknowledged as industry leading

with an A+ ESG rating from UN PRI.

ASI believes that several key themes are providing interesting

opportunities in China:

-- rising affluence is leading to fast growth in premium

consumption in areas including education, travel, and food and

beverage;

-- growing integration amid the widespread adoption of

technology means a bright future for plays on e-commerce, gaming,

cybersecurity and data centres supporting cloud services;

-- growing prosperity means structural growth for consumer

finance, increasing investor participation on stock exchanges, and

a need for financial protection - especially given the

under-penetration of life insurance;

-- rising disposable incomes are driving demand for healthcare products and services;

-- policy makers globally are committing to a greener and lower

carbon world and China, presently the world's largest emitter of

greenhouse gases, is expected to have a transformational role to

play. Plays on renewable energy, batteries, electric vehicles,

related infrastructure, and environmental management all have a

bright future. 'Grid parity' will be game-changing.

The Company's portfolio will be high conviction with an

estimated 30 to 60 holdings, with exposure to small companies. The

model portfolio has approx. 60% invested in the China A Shares

market and will evolve over time. The same portfolio reflects ASI's

ESG strengths, with a higher rating and lower carbon profile than

the MSCI China All Shares Index (in Sterling terms), with this

being the Company's proposed benchmark (both as measured by

MSCI).

The Managers will manage the Company's portfolio so that it does

not include any company currently sanctioned under the Chinese

Military-Industrial Complex Companies, or CMIC, list as per

Executive Order 14032. ASI will monitor the position for any future

developments associated with this list of companies, any change to

compliance with this approach would be communicated to the

market.

Combination with New Thai

The Board is also delighted to announce that terms have been

agreed for a combination of the Company with New Thai. New Thai's

Board, like that of the Company, has been considering a move to an

All China investment mandate and consequently the boards, following

discussions with major shareholders, consider that it would be

beneficial for both companies to combine. The combination, if

approved by each company's shareholders, will be implemented

through a scheme of reconstruction pursuant to section 110 of the

Insolvency Act 1986 ("section 110 scheme"), resulting in the

voluntary liquidation of New Thai and the rollover of its assets

into the Company in exchange for the issue of new shares in the

Company to New Thai shareholders.

New shares in the Company that are issued to New Thai

shareholders will be issued on a formula asset value ("FAV")-to-FAV

basis. FAVs will be calculated using the respective net asset

values of each company, adjusted for the costs of implementing the

Proposals, any dividends and distributions declared by each party

which have a record date prior to the effective date of the

combination, an allowance for the costs of liquidation (for New

Thai), the cash exit option (for New Thai) and the tender price

pursuant to the tender offer referred to below (for the

Company).

The combination with New Thai is expected to help improve the

Company's liquidity for all shareholders as well as spreading the

fixed costs of the Company over a larger pool of assets. In

addition, it should increase the level of the Company's free float.

The Company's Board has noted the current consultation process

launched by the FCA to review elements of the listing rules for

companies, including potentially reducing the free float

requirement from 25% to 10%. There can be no certainty that this

reduction will be codified and, in any event, should the Company

wish to undertake share buyback operations in future, the Board

believes a significant headroom above the free float requirement

will be desirable. Whilst expected to be clearly favourable, the

initial impact of the Proposals on the Company's free float will

not be known until after the conclusion of New Thai's section 110

scheme including the combination with the Company and the outcome

of the Company's tender offer, as referred to below.

Tender offer

The Board expects that many shareholders will wish to continue

with their investment in the Company and would encourage them to do

so. Nevertheless, given the proposed change of investment policy,

the Board believes it is appropriate to offer those shareholders

wishing to realise part, or potentially all, of their investment in

the Company a chance to do so through a tender offer for up to 15

per cent. of the shares in issue (excluding shares held in

treasury) at a two per cent. discount to FAV per ordinary

share.

Similarly, as part of its section 110 scheme, New Thai will

offer a cash exit for up to 15% of its shares in issue at a two per

cent. discount to formula net asset value ("FAV") per ordinary

share. Those New Thai shareholders making no election will default

to the rollover option.

Board structure

Anne Gilding and Sarah MacAulay, two current New Thai directors,

have been invited to join the Board of the Company from the date of

completion of the transaction. At the annual general meeting of the

Company expected to be held in April 2022, William Collins, who has

completed nine years of service on the board, will step down. Mark

Hadsley-Chaplin, who has also completed nine years of service, has

been requested by the Board to stay on as Chairman to oversee the

transition and initial period of the Company following the

implementation of the Proposals. Accordingly, Mark will stay until

the annual general meeting in 2023, at which point he also will

step down.

Continuation vote and future performance linked tender

The Company is currently required to hold a continuation vote

every five years with the last vote held at the Company's AGM in

April 2018. If the Proposals put to shareholders are approved, it

is the intention that the requirement for this vote will be reset

with the next continuation vote put to shareholders at the

Company's AGM to be held in 2027.

In addition, the Board intends that, if the Company's NAV total

return over five years ending December 2026 does not exceed the

total return of the MSCI China All Shares Index (in Sterling

terms), the Company will undertake a tender offer for up to 25 per

cent. of the Company's issued share capital (excluding any shares

held in treasury), any such tender offer will be at a price equal

to the then prevailing FAV less two per cent.

Management arrangements

Aberdeen Standard Fund Managers Limited ("ASFML") has agreed to

make a contribution to the costs of implementing the Proposals by

means of a waiver of the management fee otherwise payable by the

Company to ASFML for the first six months following the completion

of the s.110 scheme, which will be for the benefit of all remaining

shareholders of the enlarged Company. In addition, in future the

fee for the management of the Company will be calculated with

regards to the market capitalisation of the Company, rather than

net assets. This aligns the manager with shareholder aims such that

it is better incentivised to ensure that the share price discount

to net asset value is kept close to zero. The annual management fee

will be structured on a tiered basis, with the first GBP150 million

of market capitalisation being charged at 0.80%, 0.75% on the next

GBP150 million and 0.65% thereafter.

City Code

In accordance with customary practice for section 110 schemes,

the City Code on Takeovers and Mergers is not expected to apply to

the combination of the Company and New Thai.

Approvals

Implementation of the Proposals is subject to the approval,

inter alia, of the shareholders of the Company as well as

regulatory and tax approvals and, as regards the combination with

New Thai, the shareholders of New Thai. A circular providing

further details of the Proposals and convening a general meeting to

seek the necessary shareholder approvals, together with a

prospectus in respect of the issue and admission of new shares in

connection with the Combination with New Thai, will be published by

the Company as soon as practicable. It is anticipated that the

Proposals will be implemented in Q4 2021.

The Company has consulted with a number of its major

shareholders who have indicated support for the Proposals. These

shareholders manage or control 78.7% of the Company's issued share

capital.

Mark Hadsley-Chaplin, Chairman of the Company, commented:

"The headwinds referred to above, which have strengthened over

recent years, have led the Board to this proposal which we

recommend to shareholders. After a very thorough selection process

we concluded that Aberdeen Standard Investments (ASI) is extremely

well-equipped to deliver highly competitive performance with this

exciting new mandate. As we have seen this week, China's equity

market can be volatile, but over the medium and long term, we

believe it will generate tremendous opportunities for an expert

investment team with feet on the ground. I would also note that the

closed-ended structure is well-placed to withstand short term

market volatility and to capitalise on longer term opportunities

that arise from it. We expect that the combination with Aberdeen

New Thai will enhance the liquidity of the Company's shares, with

fees set at competitive levels. This should help to attract retail

and wealth management investors, thereby diversifying the

shareholding base. I would like to pay tribute to Andy Lister and

Bernard Moody who, in spite of those headwinds, have been first

class managers of AEMC during their time at ASI (and before) and I

wish them every success in the future "

Andrew Lister, Senior Investment Manager at Aberdeen Standard

Investments, commented:

"It has been a privilege to be involved with the management of

the Company for over 20 years. The only constant in emerging

markets over this period has been change, and the emergence of

China as a global engine of growth and an attractive investment

destination has epitomised this. Bernard and I are optimistic that

the change of strategy being proposed puts the company in a strong

position to thrive in the future, as in the past, and to remain

relevant in a constantly changing investment landscape."

Enquiries

Aberdeen Emerging Mark Hadsley-Chaplin Via ASI

Markets Investment

Company Limited

Shore Capital Robert Finlay/Rose Ramsden T: 020 7408 4090

Henry Willcocks/ Fiona

Conroy

Aberdeen Standard William Hemmings T: 020 7463 6223

Investments

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZGZNGLNGMZZ

(END) Dow Jones Newswires

July 30, 2021 02:00 ET (06:00 GMT)

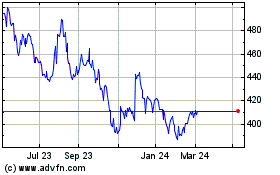

Abrdn China Investment (LSE:ACIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn China Investment (LSE:ACIC)

Historical Stock Chart

From Apr 2023 to Apr 2024