TIDMALU

RNS Number : 9307N

Alumasc Group PLC

04 February 2021

Thursday 4 February 2021

The Alumasc Group plc

Interim results

Outstanding H1 performance

Alumasc (ALU.L) the sustainable building products, systems and

solutions Group today announces results for the six months ended 31

December 2020.

Commenting on the interim results, Paul Hooper, Chief Executive

of Alumasc said:

"The Group's substantially strong performance of an 11% increase

in revenues, 23% increase in export sales and more than 100%

increase in underlying pre-tax profit during the period, reflects

the successful execution of our repositioning strategy launched in

2019. This has been achieved by the hard work of the employees, for

which I would like to thank them.

Alongside an increasingly strong financial performance, the

Group has undertaken a significant number of internal initiatives

to act in an environmentally sustainable manner, including sourcing

50% of the Group's electricity from sustainable sources. We are

also in the process of setting internal metrics to monitor

performance and aligning our ESG programme to TCFD and the UN

Sustainability Goals. Many of our products contribute to carbon and

water efficiency in the built environment and our internal

initiatives contribute further to helping our customers mitigate

their environmental impact.

Reflecting the Board's confidence in the year ahead, the

underlying strength of the business and the strategic growth

opportunities available to us, we have today proposed an interim

dividend of 3.25 pence per share.

Our long-term strategy remains to continue to deliver profitable

growth through our strategic positions in sustainable building

products, while growing our export market. In spite of some

potential industry headwinds, we will focus on delivering this to

generate sustainable returns for all our stakeholders."

Financial Highlights:

Against a background of the continuing presence of COVID-19 and

uncertainty surrounding the likelihood of a Trade Agreement being

secured with the UK's exit from the EU, Alumasc's performance in H1

was outstanding.

- Group revenues were up by 11% to GBP45.6 million (2019:

GBP41.1 million), with UK revenues 9% ahead and exports

(representing 13% of Group revenues) 23% ahead

- Underlying operating margins were ahead by 7.5 percentage

points to 13.6% (2019: 6.1%) reflecting increased sales, improved

margins and the benefit of the prior year cost reduction programme

in lower overheads

- Underlying profit before tax was GBP6.0 million (2019: GBP2.3 million)

- EBITDA was GBP7.4 million (2019: GBP3.5 million)

- Statutory profit before tax was GBP5.5 million (2019: GBP2.1 million)

- Underlying earnings per share were 13.4 pence (2019: 5.1

pence) and basic earnings per share 12.2 pence (2019: 5.0

pence)

- Net bank debt at 31 December was GBP0.2 million (30 June 2020:

GBP4.3 million), benefitting from strong focus on working capital

management

- Pension deficit at 31 December was GBP12.8 million (30 June

2020: GBP19.3 million), benefitting from a strong investment

performance

- An interim dividend of 3.25 pence per share is planned for

payment in April 2021, reflecting the Board's confidence in the

underlying strength of the business and strategic growth

opportunities available to it. This would be an increase from the

2.95 pence per share interim dividend that was planned for April

2020 but which was cancelled in light of the Pandemic's onset.

Operational Highlights:

The Water Management Division, representing 42% of Group

revenues, made a profit of GBP3.5 million (18% operating margin),

GBP1.1 million (44%) ahead of the prior year first half, driven by

GBP1.6 million (9%) volume increases, gross margin improvements and

cost savings.

The Building Envelope Division, representing 46% of Group

revenues, delivered a record performance, returning to profit of

GBP2.5 million (12% operating margin), GBP2.8 million ahead of the

prior year. This benefitted both from market share gains at Roofing

and from a much improved performance at Levolux, where more

disciplined opportunity qualification, project management and

reduced overheads led to a profit in every month of H1.

Housebuilding Products Division, representing 12% of Group

revenues, grew profit by 29% to GBP1.2 million (22% operating

margin), testament to the success of new product introductions,

outstanding service and stringent cost controls. The achievement of

100% On Time In Full delivery performance in H1 was clearly

appreciated by its customers.

The Levolux restructuring and turnaround performance created a

much improved performance in which it achieved a profit in each

month of H1. As anticipated, revenues have fallen in line with our

decision to strategically position it as a specialist provider of

solar shading, architectural screening and modular balconies, with

an increasing bias towards design and supply work. Its performance

was largely driven by the growth of export sales to the US in this

design and supply category. Improved opportunity qualification, and

project management along with higher than budgeted cost reductions

also contributed to the turnaround as the business continues to

operate with a more professional approach to tender opportunity

selection. The new approach is beginning to show a healthy pipeline

of targeted projects for the future.

In addition, following a search using consultants we have

identified a new Group Finance Director, who will join us on 1

March 2021, and have issued a separate RNS on this today.

Outlook

Underlying profit before tax at 13% of sales demonstrates what

Alumasc can achieve in its chosen marketplace. The Group has a

strong balance sheet, with a healthy cash position, and a well

defined growth path. One mark of our confidence in the future is

the resumption of the interim dividend today.

While it is encouraging that an EU Free Trade Agreement has been

agreed, we wait to see how frictionless this is in practice and

what the impact of the proposed cessation of the Help to Buy and

Stamp Duty government initiatives in our Q3 might be. In spite of

COVID-19 and its mutations which have put the UK into a third

lockdown construction, at least at this stage, is being allowed to

continue to operate. It is hoped that the roll-out of vaccines

should result in a more stable situation in our Q4. Nevertheless,

despite the above risks and uncertainties, the Group is now in a

very strong position to move further forward.

Enquiries:

The Alumasc Group plc Paul Hooper, CEO + 44 (0) 1536 383844

Peel Hunt (Broker)

Mike Bell + 44 (0)207 418 8831

finnCap (NOMAD)

Julian Blunt + 44 (0)207 220 0500

Camarco:

Ginny Pulbrook + 44 (0)203 757 4992

Tom Huddart + 44 (0)203 757 4991

Email: alumasc@camarco.co.uk

Notes to Editors:

Alumasc is a UK-based supplier of premium building products,

systems and solutions. Almost 80% of group sales are driven by

building regulations and specifications (architects and structural

engineers) because of the performance characteristics offered.

The Group has three business segments with strong positions and

brands in their individual markets. The three segments are: Water

Management; Building Envelope; and Housebuilding Products.

REVIEW OF INTERIM RESULTS

Overview

Financial Overview

-- Against a background of the continuing presence of COVID-19

and uncertainty surrounding the likelihood of a Trade Agreement

being secured with the UK's exit from the EU Alumasc's performance

in H1 was outstanding.

- Group revenues were up by 11% to GBP45.6 million (2019:

GBP41.1 million), with UK revenues 9% ahead and exports

(representing 13% of Group revenues) 23% ahead

- Gross margins were 36.7% (2019: 29.8%)

- Underlying operating margins were ahead by 7.5 percentage

points to 13.6% (2019: 6.1%) reflecting increased sales, improved

margins and the benefit of the prior year cost reduction programme

in lower overheads

- Underlying profit before tax was GBP6.0 million (2019: GBP2.3 million)

- EBITDA was GBP7.4m (2019: GBP3.5m)

- Statutory profit before tax was GBP5.5 million (2019: GBP2.1 million)

- Underlying earnings per share were 13.4 pence (2019: 5.1

pence) and basic earnings per share 12.2 pence (2019: 5.0

pence)

- Net bank debt at 31 December was GBP0.2 million (30 June 2020:

GBP4.3 million), benefitting from strong focus on working capital

management.

-- An interim dividend of 3.25 pence per share is planned for

payment in April 2021, reflecting the Board's confidence in the

underlying strength of the business and strategic growth

opportunities available to it. This would be an increase from the

2.95 pence per share interim dividend that was planned for April

2020 but which was cancelled in light of the COVID-19 Pandemic's

onset.

-- Government grant income of GBP0.1 million was repaid during

the period in relation to Coronavirus Job Retention Scheme income

that had been claimed in the previous financial period for

employees that have, unfortunately, subsequently been made

redundant.

Operational Overview

-- The 11% uplift in our revenues to GBP45.6 million reflects an

increase in our market share won particularly in our Roofing

business and Water Management Division. Following a refocus of the

customer profile our Housebuilding Products Division's revenue grew

slightly, bolstered by the success of several new products across

the last twelve months.

-- Export sales grew by 23% to GBP6.2 million, 13.5% of the

total (2019: 12.1%), driven by sales to North America by

Levolux.

-- The Water Management Division, representing 42% of Group

revenues, made a profit of GBP3.5 million (18% operating margin),

GBP1.1 million (44%) ahead of the prior year first half, driven by

GBP1.6 million (9%) volume increases, gross margin improvements and

cost savings. The division continued to deliver Rain to Drain

solutions, enabling customers to benefit from rainwater and

drainage products that capture, retain and control the flow of

rainwater inside and outside buildings from origination source to

water course, sewer or ground.

-- The Building Envelope Division, representing 46% of Group

revenues, delivered a record performance, returning to profit of

GBP2.5 million (12% operating margin), GBP2.8 million ahead of the

prior year. This benefitted both from market share gains at Roofing

and from the successful execution of the Levolux strategy, where

more disciplined project management and reduced overheads led to a

profit in every month of H1. The Roofing business has increased

focus on a high end specification offer supported by the highest

standards on a customer focused service level which meets the

client's requirements on providing carbon reducing systems combined

with safety in installation; all backed by bona fide long term

warranties which combine to increase market share growth across all

sectors.

-- Housebuilding Products Division, representing 12% of Group

revenues, grew profit by 29% to GBP1.2 million (22% operating

margin), testament to the success of new product introductions,

outstanding service and stringent cost controls. The achievement of

100% On Time In Full delivery performance in H1 was clearly

appreciated by its customers.

-- The Levolux restructuring and turnaround performance created

a much improved performance in which it achieved a profit in each

month of H1. As anticipated, revenues have fallen in line with our

decision to strategically position it as a specialist provider of

solar shading, architectural screening and modular balconies, with

an increasing bias towards design and supply work. Its performance

was largely driven by the growth of export sales to the US in this

design and supply category. Improved opportunity qualification, and

project management along with higher than budgeted cost reductions

also contributed to the turnaround as the business continues to

operate with a more professional approach to tender opportunity

selection. The new approach is beginning to show a healthy pipeline

of targeted projects for the future.

Outlook

-- Underlying profit before tax at 13% of sales demonstrates

what Alumasc can achieve in its chosen marketplace. The Group has a

strong balance sheet, with a healthy cash position, and a well

defined growth path. One mark of our confidence in the future is

the resumption of the interim dividend today.

-- While it is encouraging that an EU Free Trade Agreement has

been agreed, we wait to see how frictionless this is in practice

and what the impact of the proposed cessation of the Help to Buy

and Stamp Duty government initiatives in our Q3 might be. In spite

of COVID-19 and its mutations which have put the UK into a third

lockdown construction, at least at this stage, is being allowed to

continue to operate. It is hoped that the roll-out of vaccines

should result in a more stable situation in our Q4. Nevertheless,

despite the above risks and uncertainties, the Group is now in a

very strong position to move further forward.

Strategy Update

-- The significant improvement in the Group's fortunes emanates

from the execution of the strategy which includes the stated

objectives of:

-- Recovery of Levolux's financial performance back into a run rate profit

-- Continuing to simplify, streamline and reduce fixed costs across the Group.

-- Over GBP1.8 million of costs (versus a target GBP1.5 million)

were taken out of Levolux in the prior year and, when combined with

its embryonic focus on supply only, improved project management and

developing North America further, this has been successful with the

aforementioned profit achieved in every month of H1 and a

significant increase of sales into North America.

-- Alongside these short-term areas of focus the Group has

continued to progress its long-term strategy to deliver profitable

growth through leveraging its strong strategic positions in

sustainable building products and to outperform the UK construction

market while continuing development of export markets. The Group's

11% revenue increase, including the 23% growth in export revenue,

is testament to that.

-- Alumasc is also in a very strong position to benefit from the

environment/green/sustainability agenda both in terms of its own

actions and through the development of further products to manage

energy in buildings, to produce a greener built environment, to

take CO(2) out of the atmosphere and to manage the scarce resource

of water following changes in rainwater patterns in the UK. Many

internal initiatives have also been taken to act in an

environmentally sustainable manner, including the sourcing of

electricity from renewable sources for over 50% of the Group's

electricity.

Operational Review

Water Management

Revenue: GBP19.2 million (2019/20: GBP17.6 million)

Operating profit: GBP3.5 million (2019/20: GBP2.4 million)

Operating margin: 18.3% (2019/20: 13.8%)

Alumasc Water Management Division delivered another strong

performance in the first half year, significantly increasing profit

and operating margin. The drivers of the 44% improvement in

operating profit to GBP3.5 million (18.3% operating margin) were

the continued control of operating costs including the benefit of

the Slotdrain manufacturing move from Dover to the Halstead

facility along with improved productivity at the Burton Latimer

facility. This was accompanied by a GBP1.6 million (9%) revenue

increase which will have taken market share with all parts of the

Division ahead. Within this the E-commerce business, Rainclear,

delivered a significant, 30%, revenue growth following increased

marketing activity and, as has been seen in many parts of the UK

economy, greater activity has taken place online. Gatic and Wade

performed very strongly in H1. Although not registered as revenue

yet the first shipment to Chek Lap Kok's Airport Runway 3 will be

recognised at the start of Q3.

Alumasc Water Management Solutions performed well with

encouraging Alumasc Rainwater, Harmer Drainage and Skyline sales

along with a strong Wade and Gatic Slotdrain performance. This

followed successful marketing and sales initiatives in this

Division.

Building Envelope

Revenue: GBP21.1 million (2019/20: GBP18.2 million)

Underlying operating profit/(loss): GBP2.5 million (2019/20:

GBP(0.3) million)

Underlying operating margin: 12.0% (2019/20: (1.5)%)

Operating profit/(loss): GBP2.4 million (2019/20: GBP(0.4)

million)

The Building Envelope Division had a significant turnaround in

H1 from a small loss in the prior year to a GBP2.5 million (12%

operating margin) operating profit.

Alumasc Roofing had an outstanding first half year and, in

particular, benefitted from the further investment in its sales

team particularly in areas that had been historically weak for it.

It also had increased activity focussed into the refurbishment

market. The COVID-19 impact meant that there was more demand for

external work, for instance, on schools rather than on internal

refurbishment. Alumasc benefitted from this while taking market

share. New Build work also held up well during H1.

It was very pleasing to see the result of much hard work at

Levolux turning into profit for every month including December. The

strategy, to focus on good value added projects in the UK,

preferably supply only, and better project management while

developing the strong opportunity further in North America is

showing encouraging early signs. This is very much the case despite

the UK new commercial market being a little challenging.

Specification sales opportunities are growing from the new

integrated Building Envelope sales approach with some combined

project wins already achieved.

Housebuilding Products

Revenue: GBP5.3 million (2019/20: GBP5.3 million)

Underlying operating profit: GBP1.2 million (2019/20: GBP0.9

million)

Operating margin: 22.2% (2019/20: 17.3%)

Operating profit: GBP1.1 million (2019/20: GBP0.9 million)

Timloc, our Housebuilding Products business, continues to

perform well. It really benefitted from the introduction of several

new products across the last year and also from its acclaimed 100%

OTIF delivery performance.

Its new products, such as Adapt-Air, InvisiWeep, Meter boxes,

Fire-rated Cavity Closer and Rad-Seal, have been very successful.

There has been an increased focus on operational efficiency

improvements which has led to cost reductions in H1. Continued

investment in new equipment with much improved energy consumption,

delivering excellent paybacks, has been a significant contribution

to assisting the reduction in the Group's greenhouse gas emissions.

In addition, Timloc has now sourced all its energy requirements

from renewable sources.

Financial Review

The Group's net cash inflow was GBP4.1 million in the period,

with net bank debt decreasing to GBP0.2 million at 31 December 2020

compared with GBP4.3 million at 30 June 2020. Capital expenditure

was GBP1.0 million in the period, in line with depreciation and

non-brand amortisation. The Group continues to invest in new plant

and machinery to support new product development and to improve

operational efficiency and environmental performance, and the

expectation is that capital investment will exceed depreciation in

the shorter term to continue with these improvements.

The Group's net assets and shareholders' funds increased from

GBP19.8 million at the beginning of the financial year to GBP27.6

million at 31 December 2020, reflecting the impact of pension

scheme actuarial gains and the retained profit after tax in the

first half year, offset by the payment of the prior year's final

dividend in October. The Group's IAS 19 pension liability was

GBP12.8 million at 31 December 2020, GBP6.4 million lower than at

30 June 2020, with an increase in the valuation of gross pension

liabilities due to reduced gilt yields more than offset by a good

investment performance and company deficit reduction contributions.

Post tax return on investment was 13.9% (2019: 10.6%) reflecting

the higher year on year operating profit.

Board

A new Group Finance Director, Simon Dray, will join the Board on

1 March 2021. After qualifying as a Chartered Accountant Simon

moved into industry where he served 6 years at Halma plc becoming

Group Financial Controller before joining Low and Bonar plc where

he moved from Group Financial Controller to Interim CFO before

becoming Director of Group Strategy and M&A. Simon brings with

him much experience in running the finance side of a PLC along with

significant M&A experience which will assist Alumasc in its

next phase of strategy growth.

Paul Hooper, Chief Executive

4 February 2021

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

for the half year to 31 December 2020

Year to

Half year to 31 December Half year to 31 December 30 June

2020 2019 2020

Non-underlying Non-underlying

Underlying Total Underlying Total Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited)

Continuing Notes GBP'000 GBP'000 GBP'000 GBP'000

operations: GBP'000 GBP'000 GBP'000

Revenue 5 45,551 - 45,551 41,099 - 41,099 75,992

Cost of sales (28,851) - (28,851) (28,854) - (28,854) (53,413)

----------- -------------- ----------- ----------- -------------- ----------- ----------

Gross profit 16,700 - 16,700 12,245 - 12,245 22,579

Net operating

expenses

Net operating

expenses

before

non-underlying

items (10,497) - (10,497) (9,718) - (9,718) (19,386)

Other operating

income - - - - - - 968

IAS 19 past

service

pension cost 4 - (150) (150) - - - -

Other

non-underlying

items 4 - (178) (178) - (313) (313) (1,045)

Net operating

expenses (10,497) (328) (10,825) (9,718) (313) (10,031) (19,463)

4,

Operating profit 5 6,203 (328) 5,875 2,527 (313) 2,214 3,116

Finance expenses 6 (251) (134) (385) (247) (160) (407) (757)

----------- -------------- ----------- ----------- -------------- ----------- ----------

Profit before

taxation 5,952 (462) 5,490 2,280 (473) 1,807 2,359

Tax expense 7 (1,167) 33 (1,134) (447) 81 (366) (442)

----------- -------------- ----------- ----------- -------------- ----------- ----------

Profit for the

period

from continuing

operations 4,785 (429) 4,356 1,833 (392) 1,441 1,917

Discontinued

operations:

Profit after

taxation

for the period

from

discontinued

operations - - - - 339 339 339

Profit for the

period 4,785 (429) 4,356 1,833 (53) 1,780 2,256

=========== ============== =========== =========== ============== =========== ==========

Other

comprehensive

income:

Items that will

not

be recycled to

profit

or loss:

Actuarial

gain/(loss)

on defined

benefit

pensions, net

of tax 4,373 (1,271) (6,473)

----------- ----------- ----------

Items that are or

may be recycled

subsequently

to profit or

loss:

Effective

portion

of changes in

fair

value of cash

flow

hedges, net of

tax (300) (167) 176

Exchange

differences

on

retranslation

of

foreign

operations (41) (8) 11

(341) (175) 187

----------- ----------- ----------

Other

comprehensive

gain/(loss) for

the

period, net of

tax 4,032 (1,446) (6,286)

----------- ----------- ----------

Total

comprehensive

profit /(loss)

for

the period, net

of

tax 8,388 334 (4,030)

=========== =========== ==========

Earnings per Pence Pence Pence

share

Basic earnings

per

share

- Continuing

operations 12.2 4.0 5.4

- Discontinued

operations - 1.0 0.9

10 12.2 5.0 6.3

=========== =========== ==========

Diluted earnings

per

share

- Continuing

operations 12.1 4.0 5.4

- Discontinued

operations - 1.0 0.9

10 12.1 5.0 6.3

=========== =========== ==========

Alternative

Performance

Measures:

Underlying

earnings

per share

(pence) 10 13.4 5.1 8.2

=========== =========== ==========

Full reconciliations of underlying to statutory profits and

earnings per share are provided in notes 4 and 10 respectively.

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL

POSITION

at 31 December 2020

31 December 31 December 30 June

2020 2019 2020

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment

- owned assets 11,210 11,652 11,089

Property, plant and equipment

- right of use assets 5,474 4,820 5,856

Goodwill 18,705 18,705 18,705

Other intangible assets 3,389 3,335 3,352

Deferred tax assets 2,441 2,217 3,661

------------- ------------- -----------

41,219 40,729 42,663

Current assets

Inventories 9,779 10,732 8,596

Trade and other receivables 14,987 12,712 13,868

Contract assets 2,416 2,758 2,402

Derivative financial assets - - 207

Cash at bank 11 19,759 9,773 16,143

Corporation tax receivable - 31 325

46,941 36,006 41,541

Total assets 88,160 76,735 84,204

------------- ------------- -----------

Liabilities

Non-current liabilities

Interest bearing loans and

borrowings 11 (19,935) (10,883) (19,909)

Lease liability (4,914) (4,506) (5,244)

Employee benefits payable (12,847) (13,043) (19,269)

Provisions (1,028) (1,120) (1,182)

Deferred tax liabilities (1,203) (753) (1,007)

------------- ------------- -----------

(39,927) (30,305) (46,611)

Current liabilities

Trade and other payables (17,194) (13,719) (14,413)

Contract liabilities (662) (900) (898)

Lease liability (670) (348) (680)

Provisions (1,172) (1,512) (1,194)

Corporation tax payable (758) - -

Derivative financial liabilities (163) (211) -

Bank overdraft - (5,535) (567)

(20,619) (22,225) (17,752)

Total liabilities (60,546) (52,530) (64,363)

------------- ------------- -----------

Net assets 27,614 24,205 19,841

============= ============= ===========

Equity

Called up share capital 4,517 4,517 4,517

Share premium 445 445 445

Capital reserve - own shares (416) (416) (416)

Hedging reserve (132) (175) 168

Foreign currency reserve 60 82 101

Profit and loss account reserve 23,140 19,752 15,026

Total equity 27,614 24,205 19,841

============= ============= ===========

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS

for the half year to 31 December 2020

Half year Half year

to to Year to

31 December 31 December 30 June

2020 2019 2020

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

Operating activities

Operating profit 5,875 2,214 3,116

Adjustments for:

Depreciation 1,056 750 1,851

Amortisation 157 334 313

Impairment of assets - - 300

Loss on disposal of property, plant

and equipment 3 58 4

IAS 19 past service pension cost 150 - -

(Increase)/decrease in inventories (1,183) (244) 1,892

(Increase)/decrease in receivables (1,133) 5,914 5,114

Increase/(decrease) in trade and

other payables 2,516 (5,452) (4,564)

Movement in provisions (176) (973) (1,229)

Cash contributions to retirement

benefit schemes (1,307) (1,601) (2,254)

Share based payments 100 - -

------------- ------------- -----------

Cash generated by operating activities

of continuing operations 6,058 1,000 4,543

Tax received/(paid) 409 (34) (93)

Net cash inflow from operating activities 6,467 966 4,450

------------- ------------- -----------

Investing activities

Purchase of property, plant and

equipment (804) (645) (1,342)

Payments to acquire intangible fixed

assets (194) (253) (417)

Proceeds from sales of property,

plant and equipment 41 50 143

Net proceeds from sale of business

activity - 339 339

Net cash outflow from investing

activities (957) (509) (1,277)

------------- ------------- -----------

Financing activities

Bank interest paid (141) (150) (297)

Equity dividends paid (715) (1,574) (1,574)

Draw down of amounts borrowed - 3,000 12,000

Principal paid on lease liabilities (340) (173) (346)

Interest paid on lease liabilities (90) (76) (153)

Net cash (outflow)/inflow from financing

activities (1,286) 1,027 9,630

------------- ------------- -----------

Net increase in cash at bank and

bank overdrafts 4,224 1,484 12,803

Net cash at bank and bank overdraft

brought forward 15,576 2,762 2,762

Net increase in cash at bank and

bank overdraft 4,224 1,484 12,803

Effect of foreign exchange rate

changes (41) (8) 11

Net cash at bank and bank overdraft

carried forward 11 19,759 4,238 15,576

============= ============= ===========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the half year to 31 December 2020

Hedging Foreign Profit

Capital reserve currency and loss

Share Share - account

capital premium own shares reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2020 4,517 445 (416) 168 101 15,026 19,841

Profit for the period - - - - - 4,356 4,356

Exchange differences on retranslation

of foreign operations - - - - (41) - (41)

Net loss on cash flow hedges - - - (370) - - (370)

Tax on derivative financial liability - - - 70 - - 70

Share based payments - - - - - 100 100

Actuarial gain on defined benefit

pension schemes, net of tax - - - - - 4,373 4,373

Dividends - - - - - (715) (715)

At 31 December 2020 4,517 445 (416) (132) 60 23,140 27,614

======= ======= =============== ======== ========== ========== =======

Hedging Foreign Profit

Capital reserve currency and loss

Share Share - account

capital premium own shares reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2019 4,517 445 (416) (8) 90 20,817 25,445

Profit for the period - - - - - 1,780 1,780

Exchange differences on retranslation

of foreign operations - - - - (8) - (8)

Net loss on cash flow hedges - - - (201) - - (201)

Tax on derivative financial liability - - - 34 - - 34

Actuarial loss on defined benefit

pension schemes, net of tax - - - - - (1,271) (1,271)

Dividends - - - - - (1,574) (1,574)

At 31 December 2019 4,517 445 (416) (175) 82 19,752 24,205

======= ======= =============== ======== ========== ========== =======

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

for the half year to 31 December 2020

1. Basis of preparation

The condensed consolidated interim financial statements of The

Alumasc Group plc and its subsidiaries have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 that are effective

at 31 December 2020.

The condensed consolidated interim financial statements have

been prepared using the accounting policies set out in the

statutory accounts for the financial year to 30 June 2020 and in

accordance with AIM Rule 18, and the same accounting policies will

be adopted in the 2021 annual financial statements.

The consolidated financial statements of the Group as at and for

the year ended 30 June 2020 are available on request from the

Company's registered office at Burton Latimer, Kettering,

Northants, NN15 5JP or on the website www.alumasc.co.uk.

The comparative figures for the financial year ended 30 June

2020 are not the Company's statutory accounts for that financial

year but have been extracted from those accounts. Those accounts

have been reported on by the Company's auditors and delivered to

the registrar of companies. The report of the auditors was (i)

unqualified, (ii) did not include a reference to any matters to

which the auditors drew attention by way of emphasis without

qualifying their report, and (iii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

The condensed consolidated interim financial statements for the

half year ended 31 December 2020 are not statutory accounts and

have been neither audited nor reviewed by the Group's auditors.

They do not contain all of the information required for full

financial statements, and should be read in conjunction with the

consolidated financial statements of the Group as at and for the

year ended 30 June 2020.

These condensed consolidated interim financial statements were

approved by the Board of Directors on

4 February 2021.

The Group has out-performed ahead of the Base Case trading

scenario modelled as part of the 30 June 2020 year end Going

Concern review, and also compared to the stress testing performed

in relation to additional National lockdowns. On the basis of the

Group's financing facilities and current financial plans and

sensitivity analyses, the Board is satisfied that the Group has

adequate resources to continue in operational existence for twelve

months from the date of signing this report and accordingly

continues to adopt the going concern basis in preparing these

condensed consolidated interim financial statements.

2. Estimates

The preparation of condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amount of assets and liabilities, income and expense.

Actual results may differ from these estimates.

Except as described below, in preparing these condensed

consolidated interim financial statements, the significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the consolidated financial statements

as at and for the year ended 30 June 2020, namely the valuation of

defined benefit pension obligations, the valuation of the Group's

acquired goodwill, the recognition of revenue and profit on

contracts with customers where revenue is recognised over time and

the valuation of lease liabilities following the adoption of IFRS

16 on 1 July 2019.

During the six months ended 31 December 2020, management

reassessed and updated its estimates in respect of retirement

benefit obligations based on market data available at 31 December

2020. The resulting impact was a GBP5.4 million pre-tax actuarial

gain, calculated using IAS 19 conventions, recognised in the six

month period to 31 December 2020.

3. Risks and uncertainties

A summary of the Group's principal risks and uncertainties was

provided on pages 20 and 21 of Alumasc's Report and Accounts for

the year ended 30 June 2020. The Board considers these risks and

uncertainties remain relevant to the current financial year.

Specific risks and uncertainties relating to the Group's

performance in the second half year are:

- Continued economic uncertainty on a global basis surrounding the COVID-19 pandemic;

- The impact of the cessation of government incentives on the

construction industry, such as the Stamp Duty Land Tax holiday;

- Potential cost increases following Brexit;

- Prolonged period of bad weather impacting the Group's construction markets.

4. Underlying to statutory profit reconciliation

Half year Half year Year to

to 31 December to 31 December 30 June

Profit before tax 2020 2019 2020

GBP'000 GBP'000 GBP'000

Underlying profit before tax 5,952 2,280 3,665

Brand amortisation (119) (119) (238)

IAS 19 net pension scheme finance costs (134) (160) (261)

IAS 19 past service cost in respect

of GMP equalisation (150) - -

Restructuring & relocation costs (59) (194) (807)

Continuing operations 5,490 1,807 2,359

Profits/gains relating to discontinued

operations - 339 339

Statutory profit before tax 5,490 2,146 2,698

=============== =============== ========

Half year Half year Year to

to 31 December to 31 December 30 June

Operating profit 2020 2019 2020

GBP'000 GBP'000 GBP'000

Underlying operating profit 6,203 2,527 4,161

Brand amortisation (119) (119) (238)

IAS 19 past service cost in respect

of GMP equalisation (150) - -

Restructuring & relocation costs (59) (194) (807)

Statutory operating profit 5,875 2,214 3,116

=============== =============== ========

In the presentation of underlying profits, management treats the

amortisation of acquired brands and IAS 19 pension costs

consistently as non-underlying items because they are material

non-cash and non-trading items that typically would be excluded in

assessing the value of the business.

In addition, management has presented the following items as

non-underlying as they are non-recurring items that are judged to

be significant enough to affect the understanding of the underlying

trading performance of the business:

- One-off costs of material restructuring and relocation of

separate businesses within the Group in both 2019/20 and

2020/21;

- One-off IAS 19 past service pension cost relating to

Guaranteed Minimum Pension ("GMP") equalisation between men and

women, following a High Court decision on 20 November 2020; and

- One-off profit relating to the sales proceeds recognised in

relation to the contingent consideration earned and received in

cash following the divestment of the Alumasc Facades business.

5. Segmental analysis

In accordance with IFRS 8 Operating Segments, the segmental

analysis below follows the Group's internal management reporting

structure.

Segmental

operating

Revenue result

Half Year to 31 December 2020 GBP'000 GBP'000

Water Management 19,160 3,501

Building Envelope 21,064 2,519

Housebuilding Products 5,327 1,184

------- ----------

Trading 45,551 7,204

Unallocated costs (1,001)

Total 45,551 6,203

======= ==========

GBP'000

Segmental operating result 6,203

Brand amortisation (119)

Past service cost in respect of GMP

equalisation (150)

Restructuring & relocation costs (59)

Total operating profit 5,875

=======

Segmental

operating

Revenue result

Half Year to 31 December 2019 GBP'000 GBP'000

Water Management 17,619 2,436

Building Envelope 18,178 (269)

Housebuilding Products 5,302 919

------- ----------

Trading 41,099 3,086

Unallocated costs (559)

Total 41,099 2,527

======= ==========

GBP'000

Segmental operating result 2,527

Brand amortisation (119)

Restructuring & relocation costs (194)

Total operating profit 2,214

==========

Segmental

operating

Revenue result

GBP'000 GBP'000

Full Year to 30 June 2020

Water Management 33,715 4,824

Building Envelope 33,209 (939)

Housebuilding Products 9,068 1,243

------- ----------

Trading 75,992 5,128

Unallocated costs (967)

Total 75,992 4,161

======= ==========

GBP'000

Segmental operating result 4,161

Brand amortisation (238)

Restructuring & relocation costs (807)

Total operating profit 3,116

=======

6. Finance expenses

Half year Half year

to to Year to

31 December 31 December 30 June

2020 2019 2020

GBP'000 GBP'000 GBP'000

Finance costs - Bank overdrafts 8 17 40

- Revolving credit facility 153 154 303

- Interest on lease liabilities 90 76 153

------------ ------------ --------

251 247 496

- IAS 19 net pension scheme finance

costs 134 160 261

385 407 757

============ ============ ========

7. Tax expense

Half year Half year Year to

to 31 December to 31 December 30 June

2020 2019 2020

GBP'000 GBP'000 GBP'000

Current tax:

UK corporation tax 652 300 22

Overseas tax 29 - 48

Amounts over provided in previous years - (10) (19)

Total current tax 681 290 51

Deferred tax:

Origination and reversal of temporary

differences 450 99 450

Amounts under/(over) provided in previous

years 3 (23) (157)

Rate change adjustment - - 98

Total deferred tax 453 76 391

Total tax expense 1,134 366 442

---------------- ---------------- ---------

Deferred tax recognised in other comprehensive

income:

Actuarial gains/(losses) on pension

schemes 1,026 (262) (1,838)

Cash flow hedges (70) (34) 41

Tax charged/(credited) to other comprehensive

income 956 (296) (1,797)

Total tax charge/(credit) in the statement

of comprehensive income 2,090 70 (1,355)

================ ================ =========

8. Dividends

The Directors have approved an interim dividend per share of

3.25 pence (2019/20: GBPnil) which will be paid on 6 April 2021 to

shareholders on the register at the close of business on 26

February 2021. The cash cost of the dividend is expected to be

GBP1,162,000. In accordance with accounting requirements, as the

dividend was approved after the statement of financial position

date, it has not been accrued in the interim consolidated financial

statements. A final dividend per share of 2.0 pence in respect of

the 2019/20 financial year was paid at a cash cost of GBP715,000

during the six months to 31 December 2020.

9. Share Based Payments

During the period the Group awarded 170,000 options (2019/20:

160,000) under the Executive Share Option Scheme ("ESOS"). These

options have an exercise price of 79.0 pence and require certain

criteria to be fulfilled before vesting. No existing options

(2019/20: none) were exercised during the period and 120,000

existing options lapsed (2019/20: 130,000).

Total awards granted under the Group's Long Term Incentive Plans

("LTIP") amounted to 265,760 (2019/20: 219,078). LTIP awards have

no exercise price but are dependent on certain vesting criteria

being met. No existing LTIP awards were exercised during the period

(2019/20: none) and 257,688 existing LTIP awards lapsed (2019/20:

253,208).

10. Earnings per share

Basic earnings per share is calculated by dividing the net

profit for the period attributable to ordinary equity shareholders

of the parent by the weighted average number of ordinary shares in

issue during the period. Diluted earnings per share is calculated

by dividing the net profit attributable to ordinary equity

shareholders of the parent by the weighted average number of

ordinary shares in issue during the period, after allowing for the

exercise of outstanding share options. The following sets out the

income and share data used in the basic and diluted earnings per

share calculations:

Half year Half year Year to

to 31 December to 31 December 30 June

2020 2019 2020

GBP'000 GBP'000 GBP'000

Net profit attributable to equity

holders of the parent - continuing

operations 4,356 1,441 1,917

Net profit attributable to equity

holders of the parent - discontinued

operations - 339 339

---------------- ---------------- -------------

4,356 1,780 2,256

---------------- ---------------- -------------

000s 000s 000s

Basic weighted average number of

shares 35,764 35,764 35,764

Dilutive potential ordinary shares

- employee share options 169 16 55

Diluted weighted average number of

shares 35,933 35,780 35,819

================ ================ =============

Half year Half year Year to

to 31 December to 31 December 30 June

2020 2019 2020

Pence Pence Pence

Basic earnings per share:

Continuing operations 12.2 4.0 5.4

Discontinued operations - 1.0 0.9

12.2 5.0 6.3

================ ================ =============

Diluted earnings per share:

Continuing operations 12.1 4.0 5.4

Discontinued operations - 1.0 0.9

12.1 5.0 6.3

================ ================ =============

Calculation of underlying earnings per share from continuing

operations:

Half year Half year Year to

to 31 December to 31 December 30 June

2020 2019 2020

GBP'000 GBP'000 GBP'000

Reported profit before taxation from

continuing operations 5,490 1,807 2,359

Brand amortisation 119 119 238

IAS 19 net pension scheme finance

costs 134 160 261

Pension GMP equalisation 150 - -

Restructuring & relocation costs 59 194 807

Underlying profit before taxation

from continuing operations 5,952 2,280 3,665

Tax at underlying Group tax rate

of 19.6%

(2019/20 first half year: 19.6%;

full year: 20.3%) (1,167) (447) (744)

Underlying earnings from continuing

operations 4,785 1,833 2,921

---------------- ---------------- -------------

Weighted average number of shares 35,764 35,764 35,764

---------------- ---------------- -------------

Underlying earnings per share from

continuing operations 13.4p 5.1p 8.2p

================ ================ =============

11. Movement in borrowings

Cash at Bank loans Net bank Lease liabilities Total borrowings

bank /bank cash/(debt)

overdrafts

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2019 2,762 (7,857) (5,095) - (5,095)

Impact of adoption of IFRS

16 - - - (5,027) (5,027)

Cash flow movements 1,484 (3,000) (1,516) 173 (1,343)

Non-cash movements - (26) (26) - (26)

Effect of foreign exchange

rates (8) - (8) - (8)

At 31 December 2019 4,238 (10,883) (6,645) (4,854) (11,499)

=========== =========== ============= ================== =================

Cash at Bank loans Net bank Lease Total borrowings

bank /bank cash/(debt) liabilities

overdrafts

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2020 15,576 (19,909) (4,333) (5,924) (10,257)

Cash flow movements 4,224 - 4,224 340 4,564

Non-cash movements - (26) (26) - (26)

Effect of foreign exchange

rates (41) - (41) - (41)

At 31 December 2020 19,759 (19,935) (176) (5,584) (5,760)

============ =========== ============= ============= =================

12. Related party disclosure

The Group has a related party relationship with its Directors

and with its UK pension schemes. There has been no material change

in the nature of the related party transactions described in the

Report and Accounts 2020. Related party information is disclosed in

note 29 of that document.

Responsibility Statement

The Directors confirm that, to the best of their knowledge the

condensed consolidated interim financial statements have been

prepared in accordance with Alternative Investment Market ("AIM")

Rule 18.

On behalf of the Board

G P Hooper

Chief Executive

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKNBKFBKDNBK

(END) Dow Jones Newswires

February 04, 2021 02:00 ET (07:00 GMT)

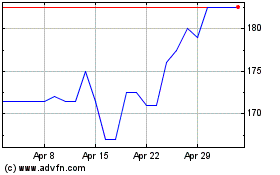

Alumasc (LSE:ALU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alumasc (LSE:ALU)

Historical Stock Chart

From Apr 2023 to Apr 2024