TIDMASY

RNS Number : 5410X

Andrews Sykes Group PLC

05 May 2021

Andrews Sykes Group plc

Summary of results

For the 12 months ended 31 December 2020

12 months 12 months

ended ended 31

31 December December

2020 2019

GBP'000 GBP'000

Revenue from continuing operations 67,259 77,246

EBITDA* from continuing operations 26,089 28,519

Operating profit 16,386 19,298

Profit after tax for the financial period 13,020 15,019

Basic earnings per share from total operations

(pence) 30.87p 35.61p

Interim and final dividends paid per equity

share (pence) 46.10p 23.80p

Proposed final dividend per equity share

(pence) 11.50p 10.50p

Net cash inflow from operating activities 22,255 18,522

Total interim and final dividends paid 19,442 10,038

Net funds 7,672 12,136

* Earnings Before Interest, Taxation, Depreciation, profit on

sale of property, plant and equipment, Amortisation and non-

recurring items as reconciled on the consolidated income

statement.

For further information please contact:

Andrews Sykes Group plc

Carl Webb, Group Managing Director 0190 232 8700

------------------------------------- --------------

GCA Altium Limited (NOMAD)

Tim Richardson 0207 484 4040

------------------------------------- --------------

Arden Partners plc (Broker)

Steve Douglas 0207 614 5900

------------------------------------- --------------

Andrews Sykes Group plc

Chairman's Statement

Overview and outlook

Andrews Sykes' trading continues to be resilient despite the

unprecedented challenge posed by the coronavirus pandemic. We are

thankful and proud of our team members responding as essential

service providers. The wellbeing of our employees and business

partners is of paramount importance as we adhere to the local

government guidelines. In the UK, Europe, and Middle East, we have

introduced social distancing measures, furloughed employees where

appropriate and embraced home working for as many employees as

possible. Our priority is to keep our operations safe for

customers, employees, and business partners.

Despite unprecedented circumstances, we are encouraged how the

business has constantly adapted to overcome operational issues. We

modified various aspects of our service to suit both clients and

staff. These measures include cleaning and sanitising all equipment

prior to despatch, non-contact deliveries wherever possible, and

the mandatory use of PPE when on customer sites.

While lockdowns and 'stay at home' guidance have affected

traditional opportunities in the facilities management and events

sectors, we have instead capitalised on demand from other

industries to generate profitable revenue. The company's extensive

involvement with many Covid-related projects ensured consistent

boiler and chiller revenue throughout the year. This was supported

by an exceptional year for our UK pump hire business, which

finished the year 3% up on the previous year's revenue.

Profit for 2020 was GBP13.0 million compared with GBP15.0

million for 2019, it reflects a fall in the level of trading across

all our businesses as our markets continued to be affected by the

pandemic. The Board is confident that once conditions ease and

external market conditions improve, customer demand and trading

will return to normal levels. Conditions are improving in the UK

with positive signs for the months ahead.

We have modelled with caution the effects of sales decline along

with other factors to ensure the group remains within its bank

facilities including cash flow forecasts for a period more than 12

months. The group has sufficient funds beyond May 2022 without

renegotiating its bank facilities. The Board therefore considers

the group is well positioned to continue to manage through the

impact of the pandemic considering its strong balance sheet and

significant net cash position.

The Board has paid three dividends during 2020, the final

dividend from 2019 of 10.5 pence per share and two interim

dividends for 2020 of a total of 35.6 pence per share. The Board

has decided to propose a final dividend for 2020 of 11.5 pence per

share that, subject to shareholder approval, will be paid in June

2021.

2020 trading summary

The group's revenue for the year ended 31 December 2020 was

GBP67.3 million, a decrease of GBP10.0 million, or 12.9%, compared

with the same period last year. This decrease had a more than

proportionate impact on operating profit which decreased by 15.1%,

or GBP2.9 million, from GBP19.3 million last year to GBP16.4

million in the year under review. This decrease reflects a much

lower level of trading across all our businesses mainly due to the

effects of the coronavirus pandemic. The fourth quarter of 2020 was

particularly challenging due to the combination of severe Covid-19

restrictions being imposed by the governments in the UK and Europe

and a relatively mild winter in the UK.

Net finance costs were GBP0.6 million this year compared with

GBP0.7 million last year. Profit before taxation was GBP15.8

million (2019: GBP18.6 million) and profit after taxation was

GBP13.0 million (2019: GBP15.0 million).

The group has reported a decrease in the basic earnings per

share of 4.74p, or 13.3%, from 35.61p in 2019 to 30.87p in the

current year. This is mainly attributable to the above decrease in

the group's operating profit.

The group continues to generate strong cash flows. Net cash

inflow from operating activities was GBP22.3 million compared with

GBP18.5 million last year reflecting strong cash management.

Despite shareholder related cash outflows of GBP19.4 million on

ordinary dividends, net funds only decreased by GBP4.4 million from

GBP12.1 million at 31 December 2019 to GBP7.7 million at 31

December 2020.

Cost control, cash and working capital management continue to be

priorities for the group. Capital expenditure is concentrated on

assets with strong returns, in total GBP4.9 million was invested in

the hire fleet this year; lower than the normal level due to the

decline in customer demand. In addition, the group invested a

further GBP0.3 million in property, plant and equipment. These

actions will ensure that the group's infrastructure and revenue

generating assets are sufficient to support future growth and

profitability. Hire fleet utilisation, condition and availability

continue to be the subjects of management focus.

Operating performance

The following table splits the results between the first and

second half years:

Turnover Operating profit

GBP'000 GBP'000

--------- ------------------

1st half 2020 33,480 7,000

--------- ------------------

1st half 2019 34,974 6,918

--------- ------------------

2nd half 2020 33,779 9,386

--------- ------------------

2nd half 2019 42,272 12,380

--------- ------------------

Total 2020 67,259 16,386

--------- ------------------

Total 2019 77,246 19,298

--------- ------------------

The above table reflects the length and severity of the

coronavirus pandemic which extended longer than most people

anticipated. The majority of the decline in both turnover and

operating profit occurred in the second half of the year as all

this period was affected by the pandemic.

The turnover of our main business segment in the UK and Northern

Europe decreased from GBP60.4 million last year to GBP55.2 million

and operating profit fell from GBP16.9 million to GBP15.1 million

in the year under review. This reflects a decrease in both air

conditioning and heater hire revenues due to a combination of the

coronavirus pandemic and a relatively mild summer and winter in the

UK and most of Europe. Pump and boiler hire proved to be more

resilient, the latter being assisted by some key contracts in the

UK.

The turnover of our hire and sales business in the Middle East

decreased from GBP13.2 million last year to GBP10.3 million and

operating profit decreased from GBP3.2 million to GBP2.0 million in

the year under review. Whilst last year's result was exceptionally

good, the second half of the current year was badly affected by the

pandemic, the postponement of Expo 2020 and a slump in the oil

price which all had a very negative impact on the local economy.

Nevertheless, there were some early signs of an improvement in our

pump hire business towards the end of the year.

Our fixed installation business sector in the UK returned an

operating profit of GBP0.2 million this year, the same as that

achieved in 2019. The market continues to be fragmented with high

levels of price competition.

Central overheads were GBP0.8 million in the current year

compared with GBP1.0 million in 2019.

Profit for the financial year

Profit before tax was GBP15.8 million this year compared with

GBP18.6 million last year, a decrease of GBP2.8 million. This is

attributable to the above GBP2.9 million decrease in operating

profit and the reduction of GBP0.1 million in net interest

costs.

Tax charges decreased from GBP3.5 million in 2019 to GBP2.8

million this year. The overall effective tax

rate decreased slightly from 19.1% in 2019 to 17.8% this year.

Profit for the financial year was GBP13.0 million compared with

GBP15.0 million last year.

Defined benefit pension scheme

A formal funding valuation as of 31 December 2019, together with

a revised schedule of contributions and recovery plan, was agreed

by the Board with the pension scheme trustees in March 2021. In

accordance with this agreement, the group will be paying GBP1.3

million per annum into the pension scheme in both 2021 and 2022.

Prior to the signing of this agreement, and prior to the payment of

the special interim dividend noted below, the group made a one-off

voluntary contribution of GBP600,000 to the pension scheme during

2020.

Equity dividends

The company paid three dividends during the year. On 19 June

2020, a final dividend for the year ended 31 December 2019 of 10.5

pence per ordinary share was paid and this was followed by two

interim dividends for 2020. The first, a special interim dividend

of 23.7 pence per ordinary share was paid on 28 August 2020. This

dividend was paid out of the group's substantial brought forward

cash reserves accumulated from previous years trading, a proportion

of which were surplus to the group's requirements and were

therefore returned to shareholders. On 6 November 2020, the company

paid a second interim dividend of 11.9 pence per share. Therefore,

during 2020, a total of GBP19.4 million in cash dividends has been

returned to our ordinary shareholders.

The Board has decided to propose a final dividend of 11.5 pence

per share. If approved at the forthcoming Annual General Meeting

this dividend, which in total amounts to GBP4.85 million, will be

paid on 18 June 2021 to shareholders on the register as of 28 May

2021.

Share buybacks

The company did not purchase any of its own ordinary shares for

cancellation during the period under review. In previous years,

purchases were made which enhanced earnings per share and were for

the benefit of all shareholders. As of 4 May 2021, there remained

an outstanding general authority for the directors to purchase

5,271,794 ordinary shares which was granted at last year's Annual

General Meeting.

The Board believes that it is in the best interests of

shareholders to have this authority in order that market purchases

may be made in the right circumstances if the necessary funds are

available. Accordingly, at the next Annual General Meeting,

shareholders will be asked to vote in favour of a resolution to

renew the general authority to make market purchases of up to 12.5%

of the ordinary share capital in issue.

Net funds

Despite shareholder related cash outflows of GBP19.4 million on

ordinary dividends, net funds only decreased by GBP4.4 million from

GBP12.1 million at 31 December 2019 to GBP7.7 million at 31

December 2020

Bank loan facilities

The group continues to operate within its bank covenants. In

April 2017, a bank loan of GBP5 million was taken out with the

group's bankers, Royal Bank of Scotland. The first four loan

repayments of GBP0.5 million were made in accordance with the bank

agreement on 30 April 2018, 2019, 2020 and 2021.The remaining

balance of GBP3.0 million is due to be repaid by a final balloon

repayment on 30 April 2022.

JG Murray

Chairman

4 May 2021

Andrews Sykes Group plc

Consolidated Income Statement

For the 12 months ended 31 December 2020

12 months 12 months

ended ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Continuing operations

Turnover 67,259 77,246

Cost of sales (28,184) (32,244)

------------- -------------

Gross profit 39,075 45,002

Distribution costs (12,136) (11,996)

Administrative expenses (12,183) (13,708)

Other operating income 1,630 -

------------- -------------

Operating profit 16,386 19,298

EBITDA* 26,089 28,519

Depreciation and impairment losses (7,183) (7,203)

Depreciation of right-of-use assets (3,014) (2,538)

Profit on the sale of plant and equipment 450 520

Profit on the sale of right-of-use assets 44 -

------------- -------------

Operating profit 16,386 19,298

------------- -------------

Finance income 116 146

Finance costs (669) (884)

Profit before taxation 15,833 18,560

Taxation (2,813) (3,541)

Profit for the financial period attributable

to equity holders of the parent 13,020 15,019

============= =============

There were no discontinued operations

in either of the above periods

Earnings per share

Basic (pence) 30.87p 35.61p

Diluted (pence) 30.87p 35.61p

Interim and final dividends paid per

equity share (pence) 46.10p 23.80p

Proposed final dividend per equity share

(pence) 11.50p 10.50p

* Earnings Before Interest, Taxation, Depreciation, profit on

the sale of property, plant and equipment, Amortisation and

non-

recurring items.

Andrews Sykes Group plc

Consolidated Statement of Comprehensive Total Income

For the 12 months ended 31 December 2020

12 months 12 months

ended ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Profit for the financial period 13,020 15,019

-------------- -------------------------

Other comprehensive income and (charges)

Items that may be reclassified to

profit and loss:

Currency translation differences

on foreign operations 529 (906)

Foreign exchange difference on IFRS

16 adjustments (3) 1

Related deferred tax 1 -

Items that will never be reclassified

to profit and loss:

Remeasurement of defined benefit

assets and liabilities (1,980) 559

Related deferred tax 376 (106)

Other comprehensive charges for the

period net of tax (1,077) (452)

-------------- -------------------------

Total comprehensive income for the

period 11,943 14,567

============== =========================

Andrews Sykes Group plc

Consolidated Balance Sheet

As at 31 December 2020

31 December 2020 31 December 2019

------------------------------- ---------------------------------

GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 22,774 24,561

Right-of-use assets 12,463 11,515

Prepayments 42 44

Deferred tax asset 704 254

Retirement benefit pension

surplus 498 1,963

---------------- ----------------

36,481 38,337

Current assets

Stocks 8,048 6,333

Trade and other receivables 17,274 21,333

Cash and cash equivalents 24,012 27,880

------------- ---------------

49,334 55,546

------------- ---------------

Current liabilities

Trade and other payables (12,290) (12,942)

Current tax liabilities (1,161) (1,674)

Bank loans (493) (493)

Right-of-use lease obligations (2,656) (2,279)

(16,600) (17,388)

------------- ---------------

Net current assets 32,734 38,158

Total assets less current

liabilities 69,215 76,495

Non-current liabilities

Bank loans (2,998) (3,490)

Right-of use lease obligations (10,193) (9,482)

(13,191) (12,972)

---------------- ----------------

Net assets 56,024 63,523

================ ================

Equity

Called-up share capital 422 422

Share premium 13 13

Retained earnings 51,421 59,447

Translation reserve 3,922 3,395

Other reserves 246 246

Surplus attributable to

equity holders of the parent

being total equity 56,024 63,523

================ ================

Andrews Sykes Group plc

Consolidated Cash Flow Statement

For the 12 months ended 31 December 2020

12 months 12 months

ended ended

31 December 31 December

2020 2019

GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 26,266 22,917

Interest paid (592) (609)

Net UK corporation tax paid (2,288) (2,227)

Overseas tax paid (1,131) (1,559)

Net cash flow from operating activities 22,255 18,522

--------------------- ----------------------

Investing activities

Sale of property, plant and equipment 619 685

Purchase of property, plant and

equipment (4,157) (6,207)

Interest received 79 100

----------------------

Net cash flow from investing activities (3,459) (5,422)

--------------------- ----------------------

Financing activities

Loan repayments (500) (500)

Capital repayments for right-of-use

lease obligations (2,832) (2,296)

Equity dividends paid (19,442) (10,038)

Net cash flow from financing activities (22,774) (12,834)

===================== ======================

Net (decrease) / increase in cash

and cash equivalents (3,978) 266

Cash and cash equivalents at the

beginning of the period 27,880 27,862

Effect of foreign exchange rate

changes 110 (248)

Cash and cash equivalents at the

end of the period 24,012 27,880

===================== ======================

Reconciliation of net cash flow

to movement in net funds in the

period

Net (decrease) / increase in cash

and cash equivalents (3,978) 266

Cash outflow from the repayment

of loans and right-of-use lease

obligations 3,332 2,796

Non-cash movement in respect of

raising loan finance (8) (7)

Non-cash movement in respect of

termination of right-of-use lease 249 -

obligations

Non-cash movements re new right-of-use

lease obligations (3,943) (2,593)

----------------------

Net (decrease) / increase in net

funds during the period (4,348) 462

Opening net funds at the beginning

of the period 12,136 23,381

Transitional adjustment for right-of-use

leases at the start of the period - (11,699)

Effect of foreign exchange rate

changes on right-of-use lease obligations (226) 240

Effect of foreign exchange rate

changes 110 (248)

--------------------- ----------------------

Closing net funds at the end of

the period 7,672 12,136

===================== ======================

Andrews Sykes Group plc

Consolidated Statement of Changes in Equity

For the 12 months ended 31 December 2020

Attributable to equity holders of the parent company Non-controlling Total

interest equity

---------------------------------------------------------------------

Share Share Retained Translation Other

capital Premium earnings reserve reserves Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 December

2018 422 13 54,013 4,300 246 58,994 10 59,004

Profit for the

financial

period - - 15,019 - - 15,019 - 15,019

Other

comprehensive

income and

(charges):

Items that may

be reclassified

to profit and

loss:

Currency

translation

differences on

foreign

operations - - - (906) - (906) - (906)

IFRS 16

adjustments - - - 1 - 1 - 1

Related deferred - - - - - - - -

tax

Items that will

never be

reclassified to

profit and loss:

Remeasurement of

defined benefit

assets and

liabilities - - 559 - - 559 - 559

Related deferred

tax - - (106) - - (106) - (106)

-------- -------- ----------- ------------ --------- ----------- ---------------- -----------

Total other

comprehensive

income and

(charges) - - 453 (905) - (452) - (452)

-------- -------- ----------- ------------ --------- ----------- ---------------- -----------

Transactions

with owners

recorded

directly in

equity:

Dividends paid - - (10,038) - - (10,038) - (10,038)

Write-off of

non-controlling

interest - - - - - - (10) (10)

-------- -------- ----------- ------------ --------- ----------- ---------------- -----------

Total

transactions

with owners - - (10,038) - - (10,038) (10) (10,048)

-------- -------- ----------- ------------ --------- ----------- ---------------- -----------

At 31 December

2019 422 13 59,447 3,395 246 63,523 - 63,523

Profit for the financial period - - 13,020 - - 13,020 - 13,020

Other comprehensive income and

(charges):

Items that may be reclassified to

profit and loss:

Currency translation differences on

foreign operations - - - 529 - 529 - 529

Foreign exchange difference on IFRS

16 adjustments - - - (3) - (3) - (3)

Related deferred tax - - - 1 - 1 - 1

Items that will never be

reclassified to profit and loss:

Remeasurement of defined benefit

assets and liabilities - - (1,980) - - (1,980) - (1,980)

Related deferred tax - - 376 - - 376 - 376

Total other comprehensive income

and (charges) - - (1,604) 527 - (1,077) - (1,077)

------ ----- ----------- -------- ------ ----------- ---- -----------

Transactions with owners recorded

directly in equity:

Dividends paid - - (19,442) - - (19,442) - (19,442)

Total transactions with owners - - (19,442) - - (19,442) - (19,442)

------ ----- ----------- -------- ------ ----------- ---- -----------

At 31 December 2020 422 13 51,421 3,922 246 56,024 - 56,024

------ ----- ----------- -------- ------ ----------- ---- -----------

Andrews Sykes Group plc

Notes

For the 12 months ended 31 December 2020

1. Basis of preparation

Whilst the information included in this preliminary announcement

has been prepared in accordance with the recognition and

measurement criteria of International Financial Reporting Standards

(IFRSs), this announcement does not itself contain sufficient

information to comply with IFRSs. Therefore the financial

information set out above does not constitute the company's

financial statements for the 12 months ended 31 December 2020 or 31

December 2019 but it is derived from those financial

statements.

2. Going Concern

The Board remains satisfied with the group's funding and

liquidity position. The group has operated throughout the 2020

financial year within its financial covenants as contained in the

bank agreement. We continue to make payments to our suppliers in

accordance with our agreed terms and, with the exception of the May

2020 UK VAT payment that was deferred and paid in early 2021, all

fiscal payments to the UK and overseas government bodies have been

and will continue to be made on time. Bank loan repayments are also

forecast to be made in accordance with the bank agreement. The

group's UK trading entities continue to make use of the Coronavirus

Job Retention Scheme but on a vastly reduced level as compared to

April 2020 and the level of monthly receipts are not

significant.

The directors are required to consider the application of the

going concern concept when approving financial statements. The

principal element required to meet the test is sufficient liquidity

for a period from the end of the year until at least twelve months

subsequent to the date of approving the accounts. Management has

prepared a detailed "bottom-up" budget including profit and loss

and cash flow for the financial year ending 31 December 2021 and

has extrapolated this forward into 2022 in order to form a view of

an expected trading and cash position for the required period. This

base level forecast fully incorporates management's expectations

around the continued impact of coronavirus on the group and was

prepared on a cautiously realistic basis. This forecast takes into

account specific factors relevant in each of our businesses. It has

been assumed that the impact of the coronavirus pandemic continues

to affect trading for the remainder of 2021 but with trade

returning to a more normal level in the latter part of the year.

These 2021 forecasts have been reviewed and approved by the

Board.

Whilst profitability and cash flow performance to the end of

February 2021 has been close to expectation, in order to further

assess the company's ability to continue to trade as a going

concern, management have performed an exercise to assess a

reasonable worst case trading scenario and the impact of this on

profit and cash. For the purposes of the cash forecast only the

below assumptions have been incorporated into this forecast:

-- Normal level of dividends will be maintained during the

twelve months subsequent to the date of approving the accounts;

-- Bank loan of GBP3.5m will be paid to terms, repaid in full

and no new external funding sought;

-- Hire turnover and product sales reduced based on year-to-date

trends and 2020 trading levels. In total turnover is reduced by

over GBP15m between the forecast period of March 2021 and May

2022;

-- All overheads continue at the base forecast level apart from

overtime and commission and repairs and marketing which are reduced

by 5% and travel costs reduced by 2.5%;

-- Coronavirus Job Retention Scheme participation ceases immediately;

-- All current vacancies are filled immediately;

-- Capital expenditure is reduced by 5%.

The above factors have all been reflected in the forecast for

the period ending twelve months subsequent to the date of approving

the accounts; The headline numbers at a group level are as

follows:

-- Group turnover for the 12 months ending 31 December 2021 is

forecast to be comparable but above the 31 December 2020 figures.

Operating profit is comparable to the profit for 2020.

-- Closing net funds as at the end of May 2022 are forecast to

be below the level reported at 31 December 2020.

Under this reasonable worst case scenario the group has

sufficient net funds throughout 2021 and up to the end of May 2022

to continue to operate as a going concern.

A final sensitivity analysis was performed in order to assess by

how much group turnover could fall before further external

financing would need to be sought. Under this scenario it was

assumed that:

-- The existing bank loan would be repaid to terms in full;

-- Capital expenditure falls proportionately to turnover;

-- Temporary staff are removed from the group;

-- Various overheads decrease proportionately with turnover.

Given these assumptions, and for modelling purposes only,

assuming dividends are maintained at normal levels, group turnover

could fall to below GBP55m on an annualised basis without any

liquidity concerns. For modelling purposes only, if the group were

to cease dividends under these assumptions group turnover could

fall to below GBP40m on an annualised basis before any liquidity

concerns arose. Due to the level of confidence the Board has in the

future trading performance of the group this scenario is considered

highly unlikely to occur.

The group has considerable financial resources and a wide

operational base. Based on the detailed forecast prepared by

management taking into account the anticipated impact of the

coronavirus pandemic, the Board has a reasonable expectation that

the group has adequate resources to continue to trade for the

foreseeable future even in the reasonable worst case scenario

identified by the group. Accordingly, the Board continues to adopt

the going concern basis when preparing this preliminary

announcement.

3 . International Financial Reporting Standards (IFRS) adopted

for the first time in 2020

There were no new standards or amendments to standards adopted

for the first time this year that had a material impact on the

results of the group. The prior year comparatives have not been

restated for any changes in accounting policies that were required

due to the adoption of new standards this year.

4. Other operating income

Other operating income relates to furlough employment support

receipts. Income related government grants, for example those

related to the furlough scheme, are recognised in the income

statement on an accruals basis. They are disclosed separately on

the face of the income statement and / or in the notes to the

accounts where that degree of prominence is deemed necessary.

5. Distribution of Annual Report and Financial Statements

The group expects to distribute copies of the full Annual Report

and Financial Statements that comply with IFRSs by 18 May 2021

following which copies will be available either from the registered

office of the company; St David's Court, Union Street,

Wolverhampton, WV1 3JE; or from the company's website;

www.andrews-sykes.com . The Annual Report and Financial Statements

for the 12 months ended 31 December 2019 have been delivered to the

Registrar of Companies and those for the 12 months ended 31

December 2020 will be filed at Companies House following the

company's Annual General Meeting. The auditor has reported on those

financial statements; the report was unqualified, did not draw

attention to any matters by way of emphasis without qualifying

their report and did not contain details of any matters on which

they are required to report by exception.

6. Date of Annual General Meeting

The group's Annual General Meeting will be held at 3.30 p.m. on

Tuesday, 15 June 2021 at Unit 5, Peninsular Park Road, London, SE7

7TZ. However in the light of the COVID-19 situation and the

measures implemented by the UK Government which currently impose

restrictions on public gatherings, limits the number of people that

can meet indoors and require social distancing measures to be in

place, shareholders will not be permitted to attend this Annual

General Meeting in person but can be represented by the Chairman of

the meeting acting as their proxy. Please see the Notice of Annual

General Meeting that will be distributed with the Annual Report and

Financial Statements for more information and current

developments.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SSIESLEFSESI

(END) Dow Jones Newswires

May 05, 2021 02:00 ET (06:00 GMT)

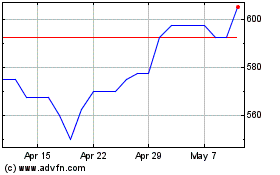

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Apr 2023 to Apr 2024