TIDMCSFS

RNS Number : 4113U

Cornerstone FS PLC

06 April 2021

NOT FOR RELEASE, DISTRIBUTION, PUBLICATION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO OR FROM THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR

ANY OTHER JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION

OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION (EACH A

"RESTRICTED JURISDICTION").

6 April 2021

CORNERSTONE FS PLC

("Cornerstone" or the "Company")

ADMISSION TO AIM AND FIRst day of dealings

Cornerstone FS plc, the cloud-based provider of international

payment, currency risk management and electronic account services

to SMEs, announces that admission of its entire issued and to be

issued share capital to trading on the AIM market of the London

Stock Exchange ("Admission") will become effective and dealings

will commence at 8.00 a.m. today under the ticker "CSFS". The

Company's ISIN is GB00BNG7CD28 and its SEDOL is BNG7CD2 .

Cornerstone has successfully placed 3,664,648 new ordinary

shares ("Placing") at a price of 61 pence per ordinary share. The

Company has raised gross proceeds of GBP2.69 million comprising

GBP2.24 million via the Placing and GBP450,000 via Convertible Loan

Note Facilities. The shares sold under the Placing represent

approximately 18 per cent of the Company's issued share capital. On

Admission, the market capitalisation of the Company will be

approximately GBP12.4 million.

Cornerstone's Business

Cornerstone's strategy is to build a significant business in the

provision of payment services, foreign exchange and currency risk

management. The Company makes it easy for SMEs to handle

international payments and currency. The Company's primary customer

base is small and medium sized enterprises: generally businesses

with fewer than 250 employees. It also provides services for some

HNWIs, some of whom are owners or directors of SME customers. The

Company currently has over 740 clients.

Cornerstone has developed and built, in-house, its own

proprietary cloud-based software platform. The platform can be

fully customised to allow third parties and marketing partners to

integrate it into their own businesses and websites presenting it

as their own branded platform. This platform is currently provided,

on a white label Saas basis, to approximately 26 third-party client

aggregators.

Use of Proceeds

The funds raised will enable Cornerstone to pursue a combination

of acquisitive and organic growth, building on the capabilities of

the Company's technology platform. The ability to use the Company's

shares as acquisition currency is a significant part of its growth

strategy. Additionally, funds will also be used to pay the costs of

the IPO and develop a broader range of products and services.

Julian Wheatland, Chief Executive Officer of Cornerstone, said:

"We are pleased to announce our successful placing and admission to

AIM. It is an important milestone and a key element of our

strategy. We already have more than 700 customers who give us a

strong financial foundation and we plan to build on that to fuel

value creation.

"The 'non-financial institutions' segment of the market is

highly fragmented with many smaller players struggling to cope with

the ever-increasing regulatory demands and the costs of acquiring

up-to-date technology. At the same time, SME customers are seeking

better quality and more bespoke services than are provided by the

major financial institutions that dominate the FX market. This

provides us with a clear opportunity for our offering, which, with

our strong board, excellent management team and highly scalable

platform, we are well-placed to deliver.

"We'd really like to thank our current investors and welcome new

ones as we embark on the next phase of our development."

SPARK Advisory Partners Limited is acting as Nominated Adviser

and Peterhouse Capital Limited and Pello Capital Limited are acting

as Joint Brokers in relation to the Admission.

Cornerstone's Admission Document, giving full details about the

business, is available to download from the Company's website -

www.cornerstonefs.com.

Enquiries

For further information please contact:

Cornerstone FS plc Tel: +44 (0) 203 971 4865

Julian Wheatland, Chief Executive

Judy Happe, Chief Financial

Officer

SPARK Advisory Partners Limited Tel: +44 (0) 203 368 3550

(Nomad)

Mark Brady

Neil Baldwin

Peterhouse Capital Limited (Joint Tel: +44 (0) 207 469 0930

Broker)

Heena Karani

Lucy Williams

Pello Capital Limited (Joint Tel: +44 (0) 203 700 2500

Broker)

Dan Gee

Mark Treharne

Luther Pendragon (Financial Tel: +44 (0) 207 618 9100

PR)

Harry Chathli

Claire Norbury

Joe Quinlan

Notes to Editor

Board of Directors

Elliott Michael Mannis, CPA, CA, Non-Executive Chairman

Elliott is the Chairman and shareholder of London Bridge

Capital, an FCA authorised corporate finance firm. Previous roles

have included Chief Executive at D1 Oils, an AIM-listed biofuels

business, and Group Finance Director at AWG, the FTSE 250 holding

company for Anglian Water.

Julian David Wheatland, CEng, Chief Executive

Julian has an extensive track record of scaling technology

businesses and has held numerous directorships in private and

public companies. This includes Chief Executive of a GBP400m

international technology investment portfolio at Consensus Business

Group; CEO of Hatton International, a finance and technology

advisory firm that he established; and CFO and COO, and

subsequently CEO, of the SCL/Cambridge Analytica companies.

Judy Amanda Happe, ACA, Chief Financial Officer

Judy is an experienced corporate executive and CFO with a

background in fundraising, mergers and acquisitions and post-deal

integration. Most recently, she was CFO of XenZone (now AIM-listed

Kooth plc). Judy commenced her career as a chartered accountant

with Saffrey Champness.

Glyn Anthony Barker, FCA, Independent Non-Executive Director

Glyn's current roles include Chairman of Berkeley Group plc

(residential property development) and of Irwin Mitchell (law firm)

and Senior Advisor to Novalpina Capital (private equity). Glyn was

previously Managing Partner of PwC UK and Senior Independent

Director of Aviva plc (insurance).

Daniel Song Mackinnon, Independent Non-Executive Director

Daniel is a corporate financier who began his career with

Rothschild before joining Emerald Investment Partners as Investment

Director. He has worked on a variety of transactions across

multiple sectors, jurisdictions and public as well as private

markets, including the IPO of Cairn Homes plc, raising EUR440m on

the LSE Main Market.

Gareth Maitland Edwards, Non-Executive Director

Gareth was a partner at law firm Pinsent Masons LLP, where he

was Global Head of Corporate and International Development Partner.

He brings significant public markets experience, including having

acted on the AIM Disciplinary and Appeals Committee. Gareth is

currently a strategic consultant and an Executive Director of

London Bridge Capital and holds several directorships at LSE-quoted

companies, including Chairman of Honye Financial Services Limited

and of Nightcap plc.

Philip Barry, Non-Executive Director

Philip co-founded FXPress in 2010. Previously, he helped manage

the foreign exchange exposure of a company portfolio and worked in

both the financial and property sectors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCIAMTTMTTMBRB

(END) Dow Jones Newswires

April 06, 2021 02:00 ET (06:00 GMT)

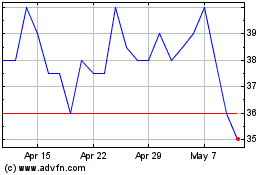

Cornerstone Fs (LSE:CSFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

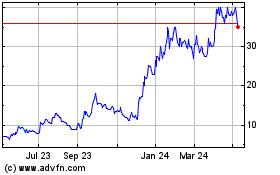

Cornerstone Fs (LSE:CSFS)

Historical Stock Chart

From Apr 2023 to Apr 2024