TIDMEVG

RNS Number : 1297I

Evgen Pharma PLC

10 December 2020

Evgen Pharma plc

("Evgen" or "the Company" or "the Group")

Half year Report

Evgen Pharma plc (AIM: EVG), the clinical stage drug development

company developing sulforaphane based medicines for the treatment

of multiple diseases, announces its unaudited interim results for

the six months ended 30 September 2020.

Operational highlights

-- Dr Huw Jones appointed as Chief Executive Officer

-- Completion of first out-licensing deal with Juvenescence for

use of Sulforadex(R) technology in non-pharmaceutical markets. Up

to $10.5m receivable in milestones with royalties on sales

-- Phase IIb/III trial using SFX-01 for acute respiratory

distress syndrome (" ARDS") including COVID-19 patients sponsored

by Dundee University, with grant funding from LifeArc; the "STAR"

trial ( SFX-01 treatment for acute respiratory infections)

-- Patient recruitment commenced in STAR trial post the period

end with data potentially available in Q4 2021.

-- Strong pre-clinical data generated in a new solid tumour

indication; requirements for and design of a Phase Ib/IIa trial

being assessed

-- Pre-clinical work commenced in a blood cancer indication

based on new evidence that SFX-01 inhibits the SHP2 pathway

-- Pre-clinical work proceeding to support SFX-01 use in

metastatic breast cancer patients who have become resistant to

CDK4/6 drugs

-- Good progress in process development to scale up manufacturing and formulation of SFX-01

Financial highlights

-- Financial performance in-line with expectations:

o Loss post tax of GBP1.8m (2019: loss of GBP1.6m)

o Cash outflow from operations of GBP1.9m (2019: outflow of

GBP1.7m)

o Cash balance at 30 September 2020 of GBP2.3m (30 September

2019: GBP5.1m)

Dr Huw Jones, Chief Executive Officer of Evgen Pharma, said: "I

am delighted to have joined Evgen Pharma during a period of such

positive news for the Company. Substantial progress was made in the

half year in business development and in particular in our STAR

trial where patients with community acquired pneumonia from any

infection including COVID-19 can be recruited. I look forward to

updating the market and our shareholders on our next cancer

indication in due course, where preliminary pre-clinical data look

compelling. We continue to demonstrate the huge potential of our

pipeline and are excited for the future progression of this."

Enquiries:

Evgen Pharma plc www.evgen.com via Walbrook

Dr Huw Jones, CEO

Richard Moulson, CFO

finnCap www.finncap.com +44 (0) 20 7220 0500

Geoff Nash / Teddy Whiley (Corporate

Finance)

Alice Lane Sunila de Silva

(ECM)

Walbrook PR +44 (0)20 7933 87870 or evgen@walbrookpr.com

Paul McManus / Anna Dunphy +44 (0)7980 541 893 / +44 (0)7876 741 001

About Evgen Pharma plc

Evgen Pharma is a clinical stage company developing sulforaphane

based medicines with a focus on cancer and respiratory diseases.

The Company's core technology is Sulforadex(R), a method for

synthesising and stabilising the naturally occurring compound

sulforaphane and novel proprietary analogues based on sulforaphane.

The lead product, SFX-01, is a patented composition of synthetic

sulforaphane and alpha-cyclodextrin.

The Company has its headquarters at The Colony, Wilmslow,

Cheshire, and its registered office is at the Liverpool Science

Park, Liverpool. Our lead product, SFX-01, has demonstrated

efficacy in a Phase II trial for advanced metastatic breast cancer.

It has been used to treat over 150 patients in clinical trials and

is well-tolerated with predominately mild side-effects.

Evgen shares are traded on the AIM market of the London Stock

under the ticker symbol EVG.

For further information, please visit: www.evgen.com

CHAIRMAN'S AND CHIEF EXECUTIVE'S STATEMENT

We are pleased to present the financial results of Evgen for the

six months ended 30 September 2020 and to provide an update on the

significant progress made by the Group during the period.

INTRODUCTION

Evgen is a clinical stage drug development company focused on

the development of sulforaphane-based compounds, a new class of

pharmaceuticals which are synthesised in a proprietary,

well-tolerated, stable formulation. We have a comprehensive

intellectual property package over this technology. Our pipeline

exploits sulforaphane's activity in two oncology and inflammatory

diseases, based on inhibition of the pSTAT3 and SHP2 pathways, of

importance in controlling cancers, and up-regulation of Nrf2, a

therapeutic target associated with a broad range of diseases

characterised by excessive oxidative stress and inflammation.

Our lead product, SFX-01, has demonstrated efficacy in a Phase

II trial for advanced metastatic breast cancer. It has been used to

treat over 150 patients in clinical trials and is well-tolerated

with predominantly mild side-effects.

Dr Huw Jones joined Evgen recently as CEO. He has over 30 years'

experience of leadership roles in public and private R&D-based

companies within the biotechnology and pharmaceutical sector, with

a particular focus on pre-clinical and clinical drug development,

dilutive and non-dilutive financing and business development.

STRATEGY

Following the appointment of Dr Jones, Evgen's strategy has been

refined as follows:

-- To ensure our selected development programmes meet stringent

scientific and commercial criteria

-- Our core R&D efforts to be focused on our oncology and ARDS pipeline

-- SFX-01 to continue to be provided to academic groups for

preclinical evaluation in selected disease models

-- Consideration will be given to supporting clinical evaluation

of SFX-01 in non-core indications where there is compelling

preclinical data and an attractive commercial opportunity

-- To leverage the Sulforadex(R) platform by supporting

Juvenescence in bringing products to market outside the

pharmaceutical sector

-- The business model is to establish proof of concept and then conclude partnerships.

PIPELINE

Metastatic breast cancer ("mBC")

Since 2012, Evgen has worked with University of Manchester

scientists at the Cancer Research UK Manchester Institute

("Manchester") and together we have generated promising data

showing SFX-01 reduces the number of cancer stem cells in

patient-derived breast cancer tissue in xenograft models. The

xenograft studies used a combination of hormone therapy and SFX-01,

with the role of SFX-01 being to target the cancer stem cell

population. Crucially, the data also showed that SFX-01 is unique,

compared with existing marketed therapies, in deactivating

phosphorylated STAT3, a key agent in driving cancer metastases and

resistance to current standards of care. This data was recently

published in the prestigious journal, Oncogene.

In the open-label Phase II trial of SFX-01 in 46 mBC patients we

demonstrated:

-- Conclusive evidence of anti-cancer activity via objective responses (tumour shrinkage)

-- 24% of patients showed a durable clinical benefit for at

least six months, despite the late stage of disease and patients'

established resistance to hormone therapy. Of these, five patients

were still receiving SFX-01 at 12 months and one patient still

remains on treatment after 18 months

-- A mild and favourable side effect profile for an anti-cancer drug.

Since we commenced the trial CDK4/6 inhibitors have grown in

acceptance and are becoming standard of care in first line mBC

treatment. These drugs provide an extended period of progression

free survival, but invariably patients become resistant to them.

Accordingly, we are conducting further preclinical work with

Manchester to assess the impact of SFX-01 in CDK4/6 resistance

models. Positive data from this study would therefore support a

trial in second line mBC treatment of patients who have failed on

CDK4/6 inhibitors, which would be designed as a Phase II

placebo-controlled study. Such a trial could commence in Q1

2022.

ARDS in COVID-19 and other patients

In June, we won a highly competitive grant process to secure

funding from LifeArc to evaluate SFX-01 in patients with suspected

COVID-19, in conjunction with the University of Dundee ("Dundee").

The trial, sponsored by Dundee, will investigate whether SFX-01 can

reduce the severity, or prevent the onset of, acute respiratory

distress syndrome ("ARDS") associated with COVID-19 and pneumonia

resulting from other infectious agents, thus reducing the need for

invasive patient ventilation and potentially improving recovery

times.

SFX-01 upregulates the Nrf2 pathway which is part of the natural

human defence against inflammatory and oxidative stress, such as

the inflammation that occurs during a severe viral infection.

Preclinical studies have shown that up-regulating the Nrf2 pathway

reduces the severity of ARDS, the progressive lung damage observed

in COVID-19 and other pneumonia patients which can result in the

need for invasive ventilation in an intensive care unit.

The Phase IIb/III study will recruit up to 300 patients with

confirmed or suspected COVID-19. Patients will be drawn from both

hospital and community settings and may present with COVID-19 or

other respiratory diseases such as viral pneumonia. Half the group

will receive SFX-01 in addition to standard hospital care while the

other half will receive a placebo and standard hospital care.

Evgen will supply clinical centres with SFX-01 and a placebo as

its contribution to the trial. No additional financing is required

as the costs of providing SFX-01 for the trial are not

material.

Up to the 7(th) of December nine patients had been recruited and

depending on availability of COVID-19 patients and other patients

with ARDS, data could be available in the final quarter of 2021. In

addition, a Data Safety and Monitoring Board will review unblinded

data after 100 patients have been treated with SFX-01 or

placebo.

Solid tumour oncology target

In a collaboration which will be disclosed when patent filings

and a scientific paper have been prepared, strong preclinical data

has been generated when SFX-01 was evaluated in a model of a cancer

with very poor life expectancy, and for which current treatments

are limited.

In particular, in vitro studies with patient-derived cell lines

showed dose-dependent reduction in proliferation and migration.

Further, in vivo orthotopic xenograft models, treatment with SFX-01

increased disease-free survival and lengthened tumour progression

times, an effect that is synergistic with radiotherapy.

Further preclinical work will be initiated shortly to complete

the data set required for a clinical trial application and/or

partnering discussions. The preclinical work should be completed by

the middle of 2021 and a phase Ib/II could commence in Q1 of

2022.

Blood cancer target

Professor Philip Eaton at Queen Mary University of London has

shown that SFX-01 inhibits activity of the non-receptor

phosphotyrosine phosphatase, SHP2 (coded by the ptpn11 gene). SHP2

is thought to be a significant factor in some cancers and we have

recently agreed to support work in well-renowned university to

investigate whether SFX-01 has potential in a specific blood cancer

disease.

JUVENESCENCE PARTNERSHIP

In September we announced the licensing of our Sulforadex(R)

sulforaphane stabilisation technology in a number of

non-pharmaceutical applications to Juvenescence Ltd

("Juvenescence"). In particular, Juvenescence intends to market and

sell a high-end nutritional health product containing a defined

dose of sulforaphane extracted from natural sources. Under the

terms of the license agreement the ("Agreement"), we will receive

milestone and option payments of up to $10.5m together with

royalties on future product sales.

This agreement monetises one element of Evgen's sulforaphane

technology platform within a timescale considerably shorter than

that typical of pharmaceutical development. Our focus will remain

on progressing the therapeutic programmes, and the Agreement

contains provisions which ensure a clear differentiation between

potential nutritional health products and pharmaceutical products,

including limitations on daily dose.

The natural source of sulforaphane to be used by Juvenescence

contrasts with the synthetic sulforaphane which is used in SFX-01,

the Company's lead therapeutic product. It is envisaged that

product launch by Juvenescence will occur in around two years'

time.

NON-CLINICAL PROGRAMMES

Our long-term toxicology and manufacturing process development

work has continued. Initial data suggest that we will be able to

demonstrate an acceptable toxicology profile for conducting

clinical trials in chronic diseases where longer term dosing is

required. These data are consistent with our observations of

patients who received SFX-01 for extended periods in the mBC

trial.

Scale-up of our formulation and manufacturing processes has

progressed. In particular, a commercial scale process for producing

a key intermediate in drug substance manufacture has been developed

by a well-regarded contract manufacturing organisation. Also, the

stabilised sulforaphane conjugate has demonstrated good flow

properties in prototype solid dose formulations, enabling larger

scale production.

FINANCIAL REVIEW

The financial performance for the six-month period to 30

September 2020 was in line with expectations. Our first licensing

revenues ($250k) were received following signature of the

Juvenescence license. Operating losses increased on the previous

period by GBP0.3m from GBP1.6m to GBP1.9m; this was due to the

increase in activity and costs of the toxicology programmes and

manufacturing process development. Consequently the total

comprehensive loss for the period was GBP1.8m (30 September 2019:

GBP1.6m).

The net cash outflow for the period was GBP1.8m (30 September

2019: inflow of GBP3.0m as a result of an equity fundraise).

The cash position at 30 September 2020 stood at GBP2.3m (30

September 2019: GBP5.1m), reflecting the operating loss before

share-based payment charges. Since the year end HMRC has remitted

R&D tax credits of GBP0.47m.

The Directors estimate that the cash held by the Group together

with known receivables will be sufficient to support the current

level of activities into at least late 2021. They have therefore

prepared the financial statements on a going concern basis.

OUTLOOK

We have achieved a great deal since our last year end including

commencing the Phase IIb/III ARDS trial and our first partnership.

Furthermore, we now have two interesting preclinical programmes in

oncology of great potential, one of which targets a new pathway for

SFX-01. We are excited about our prospects going into 2021.

We would like to thank all our shareholders for their support

and look forward to progressing with our strategy which remains

clearly focused on commercialising the undoubted potential of

SFX-01.

Barry Clare Huw Jones

Chairman CEO

10(th) December 2020

Consolidated Statement of Comprehensive Income

for the six months ended 30 September 2020 - unaudited

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

Notes Unaudited Unaudited Audited

--------------------------------------------- ------ -------------- -------------- ----------

Revenue 3 194 - -

Operating expenses

Operating expenses (1,965) (1,526) (2,998)

Share based compensation 5 (82) (84) (168)

--------------------------------------------- ------ -------------- -------------- ----------

Total operating expenses (2,047) (1,610) (3,166)

Operating loss (1,853) (1,610) (3,166)

Other income 10 - -

--------------------------------------------- ------ -------------- -------------- ----------

Loss on ordinary activities before

taxation (1,843) (1,610) (3,166)

Taxation - 5 451

--------------------------------------------- ------ -------------- -------------- ----------

Loss and total comprehensive expense attributable

to equity holders of the parent for the

period (1,843) (1,605) (2,715)

----------------------------------------------------- -------------- -------------- ----------

Loss per share attributable to equity

holders of the parent (pence)

--------------------------------------------- ------ -------------- -------------- ----------

Basic loss per share 4 (1.38) (1.43) (2.10)

Diluted loss per share 4 (1.38) (1.43) (2.10)

--------------------------------------------- ------ -------------- -------------- ----------

Consolidated Statement of Financial Position

as at 30 September 2020 - unaudited

As at As at As at

30 September 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

Notes Unaudited Unaudited Audited

------------------------------------- ------ ------------- ------------- ---------

ASSETS

Non-current assets

Property, plant and equipment 1 3 2

Intangible assets 74 89 82

------------------------------------- ------ ------------- ------------- ---------

Total non-current assets 75 92 84

Current assets

Trade and other receivables 161 113 196

Current tax receivable 446 328 446

Cash and cash equivalents 2,306 5,050 4,131

------------------------------------- ------ ------------- ------------- ---------

Total current assets 2,913 5,491 4,773

Total assets 2,988 5,583 4,857

------------------------------------- ------ ------------- ------------- ---------

LIABILITIES AND EQUITY

Current liabilities

Trade and other payables 434 353 653

------------------------------------- ------ ------------- ------------- ---------

Total current liabilities 434 353 653

Equity

Ordinary shares 6 343 331 331

Share premium 17,932 17,831 17,831

Merger reserve 2,067 2,067 2,067

Share based compensation 1,970 1,806 1,890

Retained deficit (19,758) (16,805) (17,915)

------------------------------------- ------ ------------- ------------- ---------

Total equity attributable to equity

holders of the parent 2,554 5,230 4,204

Total liabilities and equity 2,988 5,583 4,857

------------------------------------- ------ ------------- ------------- ---------

Consolidated Statement of Changes in Equity

for the six months ended 30 September 2020 - unaudited

Ordinary Share Merger Share based Retained

shares premium reserve compensation deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------- -------- -------- ------------- --------- --------

Balance at 1 April 2020 331 17,831 2,067 1,890 (17,915) 4,204

Total comprehensive expense

for the period - - - - (1,843) (1,843)

Transactions with owners

Share issue - options exercised 12 101 - - - 113

Share based compensation

- share options - - - 80 - 80

---------------------------------

Total transactions with owners 12 101 - 80 - 193

--------------------------------- --------- -------- -------- ------------- --------- --------

Balance at 30 September 2020 343 17,932 2,067 1,970 (19,758) 2,554

--------------------------------- --------- -------- -------- ------------- --------- --------

Ordinary Share Merger Share based Retained

shares premium reserve compensation deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------- -------- -------- ------------- --------- --------

Balance at 1 April 2019 247 13,240 2,067 1,722 (15,200) 2,076

Total comprehensive expense

for the period - - - - (1,605) (1,605)

Transactions with owners

Share issue 84 4,919 - - - 5,003

Share issue - costs - (328) - - - (328)

Share based compensation

- share options - - - 84 - 84

---------------------------------

Total transactions with owners 84 4,591 - 84 - 4,759

--------------------------------- --------- -------- -------- ------------- --------- --------

Balance at 30 September 2019 331 17,831 2,067 1,806 (16,805) 5,230

--------------------------------- --------- -------- -------- ------------- --------- --------

Ordinary Share Merger Share based Retained

shares premium reserve compensation deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------- -------- -------- ------------- --------- --------

Balance at 1 April 2019 247 13,240 2,067 1,722 (15,200) 2,076

Total comprehensive expense

for the period - - - - (2,715) (2,715)

Transactions with owners

Share issue 83 4,589 - - - 4,672

Share issue - options exercised 1 2 - - - 3

Share based compensation

- share options - - - 168 - 168

--------------------------------- --------

Total transactions with owners 84 4,591 - 168 - 4,843

--------------------------------- --------- -------- -------- ------------- --------- --------

Balance at 31 March 2020 331 17,831 2,067 1,890 (17,915) 4,204

--------------------------------- --------- -------- -------- ------------- --------- --------

The registered number of Evgen Pharma plc is 09246681.

Consolidated Statement of Cash Flows

for the six months ended 30 September 2020 - unaudited

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

---------------------------------------------- -------------- -------------- ----------

Cash flows from operating activities

Loss before taxation for the period (1,843) (1,610) (3,166)

Depreciation and amortisation 9 12 21

Share based compensation 82 84 168

---------------------------------------------- -------------- -------------- ----------

(1,752) (1,514) (2,977)

Changes in working capital

(Increase)/decrease in trade and other

receivables 35 22 (61)

(Decrease)/increase in trade and other

payables (219) (335) (35)

---------------------------------------------- -------------- -------------- ----------

Cash used in operations (184) (313) (96)

Taxation received - 169 497

---------------------------------------------- -------------- -------------- ----------

Net cash used in operating activities (1,936) (1,658) (2,576)

Cash flows (used in)/generated from investing activities

Acquisition of tangible fixed assets - - (1)

---------------------------------------------- -------------- -------------- ----------

Net cash (used in)/generated from investing

activities - - (1)

Cash flows from financing activities

Net proceeds from issue of shares 111 4,675 4,675

Net cash generated from financing activities 111 4,675 4,675

---------------------------------------------- -------------- -------------- ----------

Movements in cash and cash equivalents

in the period (1,825) 3,017 2,098

---------------------------------------------- -------------- -------------- ----------

Cash and cash equivalents at start of

period 4,131 2,033 2,033

---------------------------------------------- -------------- -------------- ----------

Cash and cash equivalents at end of period 2,306 5,050 4,131

---------------------------------------------- -------------- -------------- ----------

1. GENERAL INFORMATION

EVGEN PHARMA PLC ("Evgen", "the Group" or "the Company") is a

public limited company incorporated in England & Wales and is

admitted to trading on the AIM market of the London Stock Exchange

under the symbol EVG.

The address of its registered office is Liverpool Science Park

Innovation Centre 2, 146 Brownlow Hill, Liverpool, Merseyside, L3

5RF. The principal activity of the Group is clinical stage drug

development.

2. BASIS OF PREPARATION AND SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The Group's half-yearly financial information, which is

unaudited, consolidates the results of Evgen Pharma plc and its

subsidiary undertaking up to 30 September 2020. The Group's

accounting reference date is 31 March. Evgen Pharma plc's shares

are quoted on the AIM Market of the London Stock Exchange

(AIM).

The Company is a public limited liability company incorporated

and domiciled in the UK. The consolidated financial information is

presented in round thousands of Pounds Sterling (GBP'000).

The financial information contained in this half-yearly

financial report does not constitute statutory accounts as defined

in section 434 of the Companies Act 2006. It does not therefore

include all of the information and disclosures required in the

annual financial statements. The financial information for the six

months ended 30 September 2019 and 30 September 2020 is

unaudited.

Full audited financial statements of the Group in respect of the

period ended 31 March 2020, which received an unqualified audit

opinion and did not contain a statement under section 498(2) or (3)

of the Companies Act 2006, have been delivered to the Registrar of

Companies.

The accounting policies used in the preparation of the financial

information for the six months ended 30 September 2020 are in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards as adopted by the

European Union ('IFRS') and are consistent with those which will be

adopted in the annual financial statements for the year ending 31

March 2020.

Whilst the financial information included has been prepared in

accordance with the recognition and measurement criteria of IFRS,

the financial information does not contain sufficient information

to comply with IFRS.

The Group has not applied IAS 34, Interim Financial Reporting,

which is not mandatory for UK AIM listed Groups, in the preparation

of this interim financial report.

Going concern

At 30 September 2020, the Group had cash and cash equivalents,

including short-term investments and cash on deposit, of GBP2.3

million.

The Directors have prepared detailed financial forecasts and

cash flows looking beyond 12 months from the date of the approval

of these financial statements. In developing these forecasts, the

Directors have made assumptions based upon their view of the

current and future economic conditions that will prevail over the

forecast period.

The Directors estimate that the cash held by the Group together

with known receivables will be sufficient to support the current

level of activities at least the end of the fourth quarter of

calendar year 2021. They have therefore prepared the financial

statements on a going concern basis.

Significant management judgement in applying accounting policies

and estimation uncertainty

When preparing the condensed consolidated interim financial

information, the Directors make a number of judgements, estimates

and assumptions about the recognition and measurement of assets,

liabilities, income and expenses.

The following are significant management judgements and

estimates in applying the accounting policies of the Group that

have the most significant effect on the condensed consolidated

interim financial information. Actual results may be substantially

different.

Share-based payments

The Group measures the cost of equity-settled transactions with

employees by reference to the fair value of the equity instruments

at the date at which they are granted. The fair value of the

options granted is determined using the Black-Scholes model, taking

into consideration the best estimate of the expected life of the

option and the estimated number of shares that will eventually

vest.

Research and development expenditure

All research and development costs, whether funded by third

parties under license and development agreements or not, are

included within operating expenses and classified as such. Research

and development costs relating to clinical trials are recognised

over the period of the clinical trial based on information provided

by clinical research organisations. All other expenditure on

research and development is recognised as the work is

completed.

All ongoing development expenditure is currently expensed in the

period in which it is incurred. Due to the regulatory and other

uncertainties inherent in the development of the Group's

programmes, the criteria for development costs to be recognised as

an asset, as prescribed by IAS 38, 'Intangible assets', are not met

until the product has been submitted for regulatory approval, such

approval has been received and it is probable that future economic

benefits will flow to the Group. The Group does not currently have

any such internal development costs that qualify for capitalisation

as intangible assets.

3. REVENUE

This is the up-front fee on signature of the Juvenescence

licensing deal, being $250,000.

4. LOSS PER SHARE

Basic loss per share is calculated by dividing the loss for the

period attributable to equity holders by the weighted average

number of ordinary shares outstanding during the period.

For diluted loss per share, the loss for the period attributable

to equity holders and the weighted average number of ordinary

shares outstanding during the period is adjusted to assume

conversion of all dilutive potential ordinary shares. As the effect

of the share options would be to reduce the loss per share, the

diluted loss per share is the same as the basic loss per share.

The calculation of the Group's basic and diluted loss per share

is based on the following data:

Six months Six months Year

ended ended ended

30 September 30 September 31 March

2020 2019 2020

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Loss for the year attributable to equity

holders (1,843) (1,605) (2,715)

--------------------------------------------- -------------- -------------- ------------

As at As at As at

30 September 30 September 31 March

2020 2019 2020

Number Number Number

Unaudited Unaudited Audited

Weighted average number of ordinary shares 133,726,538 112,307,585 129,315,418

--------------------------------------------- -------------- -------------- ------------

Effects of dilution:

Share options - - -

Weighted average number of ordinary shares

adjusted for the effects of dilution 133,726,538 112,307,585 129,315,418

--------------------------------------------- -------------- -------------- ------------

Pence Pence Pence

Loss per share - basic and diluted (1.38) (1.43) (2.10)

--------------------------------------------- -------------- -------------- ------------

5. SHARE-BASED PAYMENTS

As at the end of the current period, the reconciliation of share

option scheme movements is as follows:

As at

30 September 2020

Number WAEP

Outstanding at 1 April 2020 9,531,368 GBP0.02

Granted during the period - -

Exercised during the period (4,751,178) GBP0.02

Lapsed/cancelled during the period (1,521,869) -

Outstanding at 30 September 2020 3,258,321 GBP0.02

----------------------------------- ------------ --------

During the six month period ended 30 September 2020, a

share-based payment charge of GBP81,504 (six months to 30 September

2019: GBP84,052) was expensed to the consolidated Statement of

Comprehensive Income.

The fair values of the options granted have been calculated

using a Black-Scholes model.

Assumptions used were an option life of 5 years, a risk-free

rate of 2 per cent., a volatility of 60 per cent. and no dividend

yield.

6. ISSUED CAPITAL AND RESERVES

Ordinary shares

Company Share Capital

Number GBP'000

As at 31 March 2020 132,646,263 331

---------------------------------- -------------- --------

Issued on exercise of options 4,751,178 12

Issued under placing agreement - -

At 30 September 2020 137,397,441 343

---------------------------------- -------------- --------

On 6 July 2020 2,957,600 new ordinary shares 0.25p each were

issued in connection with the exercise of share options.

On 7 July 2020 778,378 new ordinary shares 0.25p each were

issued in connection with the exercise of share options.

On 24 July 2020 1,015,200 new ordinary shares 0.25p each were

issued in connection with the exercise of share options.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KKCBNABDDCBK

(END) Dow Jones Newswires

December 10, 2020 02:00 ET (07:00 GMT)

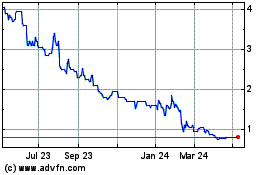

Evgen Pharma (LSE:EVG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Evgen Pharma (LSE:EVG)

Historical Stock Chart

From Apr 2023 to Apr 2024