TIDMI3E

RNS Number : 3614E

i3 Energy PLC

29 June 2023

29 June 2023

i3 Energy plc

("i3", "i3 Energy", or the "Company")

Q1 2023 Operational and Financial Update, Revised 2023 Capital

and Dividend Programme

Investor Webinar via Investor Meet Company

i3 Energy plc (AIM:I3E) (TSX:ITE), an independent oil and gas

company with assets and operations in the UK and Canada, announces

the following Q1 2023 operational and financial update, along with

its revised 2023 capital and dividend programme.

The Company will hold an investor webinar on Wednesday 5 July

2023 at 3:00 pm BST including a Q&A session (details of which

can be found below).

Q1 Highlights:

-- Av erage Q1 2023 production of approximately 22,773 barrels

of oil equivalent per day ("boepd"), representing a 24% increase

from Q1 2022.

-- Capitalizing on the availability of services, i3 commenced

its Q1 2023 capital programme in late Q4 2022 with a total of 8

gross wells (5.5 net) successfully drilled by the end of Q1 2023 in

its core Central Alberta, Wapiti and Clearwater assets.

-- CO2e emission reduction initiatives continued with

electrification of 12 well sites in Carmangay and Retlaw.

-- As part of i3's commitment to its total shareholder return

model, dividends of GBP6.12 million (USD 7.71 million) were paid in

Q1 2023.

-- Post quarter-end strengthened the Company's balance sheet

with the refinancing of its outstanding loan notes of circa CAD 50

million with a new CAD 100 million facility.

Outlook:

-- Given prevailing and forecast commodity pricing for 2023, i3

has adjusted its full-year 2023 capital and dividend programme.

o Approved capital programme of USD 25 million plus USD 6

million, subject to board approval, for a revised drilling

programme targeting the Company's Clearwater acreage. The approved

and contingent drilling programme in Canada is currently forecast

to deliver 14 gross (8.5 net) oil focussed wells, down from the

previously expected 23 (net 15.2) wells.

o i3 approved capital programme to deliver average annual

production of 20,000 to 21,000 boepd, representing an increase of

up to 3% over 2022 production.

o The Company's adjusted dividend programme is forecast to

return GBP15.4 million in dividends during the first nine months of

2023.

Majid Shafiq, CEO of i3 Energy plc, commented :

"Q1 2023 was another busy quarter for i3 as we commenced our

planned 2023 drilling programme in Canada, drilling production

wells in Central Alberta, Wapiti and key Clearwater wells in our

Dawson and Marten Creek acreage. Average production in Q1 resulted

in another consecutive quarter of growth, dating back to Q2 2021,

which is a testament to the quality of our asset base and

operations staff. Since commencement of our Canadian operations, i3

has invested circa USD 80 million in drilling operations; grown

production from zero to over 24,000 boepd and has returned GBP31.0

million in dividend payments to shareholders.

Given prevailing commodity prices and in line with our

disciplined approach to capital allocation and prudent amortisation

and management of the Company's debt, we have revised down our 2023

capital and dividend programme, protecting the value of the assets

and providing us with the flexibility to ramp up operations should

commodity prices improve. We remain confident that our asset base,

with a 2PDP NPV10 per share of GBP0.36 and P+P NPV10 per share of

GBP0.81 as at 1 January 2023, i3's total shareholder return model

and business strategy which, subject to market conditions,

optimises growth through drilling or alternatively M&A if

commodity prices remain low, will allow us to continue to deliver

strong returns to shareholders."

Production Update

Production in Q1 2023 averaged 22,773 boepd, comprised of 69.6

million standard cubic feet of natural gas per day ("mmcf/d"),

5,569 barrels per day ("bbl/d") of natural gas liquids ("NGLs"),

5,238 bbl/d of oil & condensate and 373 boepd of royalty

interest production. The strong quarterly production represents an

increase of approximately 24% over Q1 2022. Production growth in Q1

2023 was achieved despite the impact of gathering system pressure

constraints and curtailments relating to the ongoing capacity

restrictions in the Pembina Peace Pipeline liquid line in the

Company's Wapiti area, which necessitated selling a higher

proportion of hot gas rather than NGLs, and a reduction in over 500

boepd of production over the quarter. i3 expects these restrictions

will be minimized or resolved by mid Q3 2023 with the commissioning

of Keyera's Key Access Pipeline System ("KAPS"). Despite these

recent constraints, solid performance in Q1 has resulted in i3

realising consecutive quarter-on-quarter increases in production

since Q2 2021, which reflects both the predictable low-decline

nature of the Company's base assets and the quality of its

inventory of development drilling locations.

Period Average Production Comparison: Last

Five Quarters

-------------------- ---------------------------------------------------

Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022

Production (boepd) 22,773 22,757 20,571 19,502 18,391

Oil & Condensate

(bbl/d) 5,238 5,119 4,396 3,886 3,945

NGLs (bbl/d) 5,569 5,106 5,038 5,099 4,942

Gas (mcf/d) 69,555 72,442 64,180 60,785 54,689

Royalty Interest

(boepd) 373 458 440 385 389

Corporate field production estimates averaged 20,729 boepd, for

the seven-day period ending 31 May 2023, comprised of approximately

63.6 mmcf/d of natural gas, 4,990 bbl/d of NGLs, 4,741 bbl/d of oil

and condensate and an estimated 400 boepd of gross overriding

royalty interest production. Throughout May and into June,

production has been affected by planned facility turnarounds, at

operated and third-party area gas plants. Production over this

period has been further impacted by the ongoing Alberta wildfires,

which have curtailed production in the Company's Lodgepole, Wapiti

and Simonette areas. No more than 15% of corporate production has

been temporarily shut-in at any one time throughout these

events.

Hedging Programme

i3's risk management strategy currently protects USD 45.6

million(1) (CAD 60.7 million) of net operating income for 2023 with

current hedges in place to cover 38.9%, 22.6%, 18.4% and 16.9% of

the Company's projected Q1, Q2, Q3 and Q4 2023 production volumes,

respectively. i3's hedges are as follows:

Swaps Costless Collars Basis Swaps

GAS Volume Price Volume Avg Avg Ceiling Volume Price ($US/mmbtu)

(GJ) (C$/GJ) (GJ) Floor Price (mmbtu)

Price (C$/GJ)

(C$/GJ)

Q1

2023 2,397,500 4.41 1,125,000 5.80 10.09

Q2

2023 960,101 (1.46)

Q3

2023 610,000 2.76 970,652 (1.46)

Q4

2023 920,000 2.76 327,067 (1.46)

Participation Swaps(2)

OIL Volume Price Volume Avg Avg Ceiling Volume Avg Floor

(bbl) (C$/bbl) (bbl) Floor Price (bbl) Price (C$/bbl)

Price (C$/bbl)

(C$/bbl)

Q1

2023 58,500 106.85 162,000 100.00 124.22

Q2

2023 36,400 112.83 113,650 100.00 127.35 91,000 90.00

Q3

2023 138,000 101.10

Q4

2023 138,000 101.10

PROPANE Volume Price Volume Avg Avg Ceiling

(bbl) (C$/bbl) (bbl) Floor Price

Price (C$/bbl)

(C$/bbl)

Q1

2023 45,000 42.00 51.61

Q1 2023 Operational Results

With the success of i3's 2022 drilling programme, the Company

capitalized on the availability of services and accelerated a

portion of its Q1 2023 programme in late Q4 2022. The drilling

programme focussed on operated oil and liquids rich gas wells in

Central Alberta (Cardium), Wapiti (Cardium, Dunvegan), and

Clearwater (operated and non-operated) assets. As part of the 2023

programme, the Company participated in 8 gross (5.5 net) wells

across its drilling portfolio, including 7 gross (5.0 net) operated

wells and 1 gross (0.5 net) non-operated well.

Wapiti

In Q1, i3 and its working interest partner completed the

drilling of 4 gross (2.0 net) horizontal wells in the Wapiti area.

The wells included 3 gross (1.8 net) operated 1.5-mile Cardium

wells and 1 gross (0.2 net) operated 2-mile Dunvegan well. The

Cardium wells were efficiently drilled off a common pad and tied-in

to existing production facilities, in which i3 holds a working

interest, while the Dunvegan well was drilled off an existing pad

and tied-in to the same production facilities.

Production associated with the Q1 programme at Wapiti was

impacted due to high gathering system pressures, which restricted

the Company's ability to optimize the productive capacity of the

new wells. The relevant third-party area operator is scheduled to

debottleneck the gathering system in late Q2 through an upgrade of

existing infrastructure, which is expected to alleviate line

pressure constraints, thereby eliminating restrictions on well

performance, and allowing the Company to optimize production from

its new Wapiti wells.

Additionally, the Wapiti area has experienced unanticipated

apportionment issues associated with the Pembina Peace Pipeline

liquids line, which has resulted in reduced liquids yields realized

by area operators. i3 expects the apportionment issues to be

resolved with the upcoming commissioning of KAPS.

Central Alberta

i3's Q1 capital programme in Central Alberta was focussed

primarily in the greater Lodgepole area, where the Company expanded

its extensive infrastructure network and drilled 1 gross (1.0 net)

well. The Company's infrastructure improvements include a 2.3 km

pipeline to reroute production away from third-party

infrastructure, reducing the fee structure and improving run-time

efficiencies. The rerouting project was executed on-time and below

budget.

i3 drilled 1 gross (1.0 net) horizontal Cardium oil well in the

Lodgepole area of Central Alberta. The well was drilled off an

existing pad-site and tied into its new pipeline system. The well

was drilled on-budget and placed on stream in late Q1. The

performance of the new well has been impacted by disruptions

associated with wildfires in the area. As proximal wildfires

continue, or are brought under control, the Company will remain

focussed on optimizing its production output while maintaining

personnel safety as its highest priority.

Clearwater

In Q1, i3 drilled 3 gross (2.5 net) multilateral horizontal

Clearwater wells at Dawson and Marten Creek as part of its ongoing

exploration and development portfolio of 144 gross sections (109

net sections, equivalent to 280 km2) of prospective Clearwater

lands.

At Dawson, i3 and its 50% partner, drilled the 05-16-081-16W5

six-leg (7,500 m of total lateral length) multilateral horizontal

Clearwater well. The well was drilled with oil-based mud ("OBM")

and placed on production in late January. After recovering the OBM

drilling fluid, the well had an initial 30 days' production

averaging 81 barrels of oil per day ("bopd") before being shut-in

late March due to road bans associated with spring breakup. Scaling

the well performance for an industry standard eight-leg

multilateral horizontal well configuration (10,000 m) translates,

encouragingly, to an estimated 110 bopd rate. With the success of

this initial earning well, i3 and its 50% partner have elected to

drill the second and final earning well at Dawson, which the

Company anticipates will be drilled and on production prior to

year-end.

At Marten Creek, i3 followed up on its 2022 recompletion

activity with 2 gross (2.0 net) exploratory three-leg multilateral

horizontal wells (retrieving a vertical core from one well). The

two exploratory wells were drilled in January, targeting two

separate Clearwater sequences. The core indicated two thick, oil

saturated sands with encouraging porosity and permeability levels

and free oil was detected in the rig process system during drilling

operations. The wells were equipped with temporary production

facilities and placed on production in late January and early

February, respectively. Due to unseasonably warm weather in the

area and early breakup of ice-roads, production equipment had to be

removed from the well-sites before all the associated OBM was

recovered. i3 intends to return this coming winter to complete

testing of the wells to determine deliverability.

Additionally, the Company is pleased to disclose the location of

its 15 section Clearwater land acquisitions, previously announced

on 2 November 2022. These 15 gross (15 net) sections are situated

in the Cadotte and Walrus areas, offsetting i3's existing land

positions, and are proximal to active development and delineation

by industry peers. With these acquisitions, the Company has

increased its position at Cadotte to 18 gross (15 net) sections and

10 gross (10 net) sections at Walrus.

Serenity

i3 continues to work with its partner Europa Oil and Gas to

advance a field development plan for a one-well development for the

Serenity field.

Environmental, Social and Governance ("ESG")

i3 is committed to conducting its operations responsibly and in

accordance with industry best practices. The Company's commitment

to high ESG standards is central to maintaining our social licence

to operate, creating value for all stakeholders, and ensuring

long-term commercial success.

In Q1 2023, i3 invested USD 1.20 million net, before any

government grants, to complete 20 well abandonments and further

advance site reclamations across its portfolio. Incorporating the

results of the Q1 2023 programme, i3 has successfully reduced its

inactive well count by 20% since the beginning of 2022. In 2023, i3

will continue its abandonment and reclamation programme, with

approximately USD 3.91 million being directed to pipeline and

wellbore abandonments, pipeline and facility decommissioning, along

with well site reclamation.

Additionally, i3 continues to reduce its emissions footprint

through its ongoing electrification projects. In Q1 2023, the

Company c ompleted the electrification of 12 gross (10.5 net) well

sites in Carmangay and Retlaw to eliminate the use of propane and

natural gas for power generation.

Return of Capital & Change of 2023 Guidance

The Company is revising its capital and dividend programme for

the remainder of 2023.

The 2023 budget announced in December 2022 was based on

consensus estimates for 2023 oil and gas prices of USD 80/bbl for

WTI and CAD 4.50/GJ for AECO gas. Due to slower than expected

global demand growth and resilient supply dynamics, commodity

prices have subsequently fallen significantly. In particular, the

AECO gas strip forecast for 2023 has fallen to approximately CAD

2.60/GJ while the WTI strip forecast for 2023 has fallen to

approximately USD 72.00/bbl. This reduction in commodity pricing

has impacted the Company's forecasted cash flows for 2023 in line

with the sensitivity guidance i3 released in December 2022,

alongside its original 2023 capital budget.

At the end of May the Company refinanced its outstanding debt of

circa CAD 50 million with a new CAD 100 million facility; of which,

CAD 75 million was drawn to settle the Company's outstanding loan

notes and an additional CAD 25 million provided for general working

capital purposes. To align with the Company's conservative approach

to debt management, the new facility amortises on a straight-line

monthly basis (unlike the debt it replaced, which was

non-amortising). This amortisation schedule will repay the loan

over its three-year term, beginning with USD 16.1 million in

amortisation, interest commitments and associated set-up costs to

be paid throughout the remainder of 2023.

The Company remains committed to its total shareholder return

model, consisting of production growth through drilling and

accretive M&A activity, and shareholder cash returns via

dividends, whilst prudently maintaining capital discipline. i3 is

therefore revising its capital budget for the year to an approved

USD 25 million, and an additional amount of circa USD 6 million,

subject to board approval, for a revised drilling programme

targeting locations in the Company's Clearwater acreage, which in

aggregate is expected to result in the drilling of 14 gross (8.5

net) wells (previously 23 gross (15.2 net) wells). Due to a steady

decline in 2023 gas prices, i3's capital focus will shift from its

large inventory of high-rate liquids rich gas Glauconite and

Cardium locations, to the efficient development and delineation of

its oil focussed Clearwater opportunities at Dawson and its

expanded position in Cadotte, as surface locations are secured and

prepared for operations in mid-to-late Q4. Should the outlook for

commodity prices strengthen in the second half of 2023, the Company

will refresh its capital plans to accelerate its drill ready

low-risk high-impact Glauconite / Falher, Cardium and Dunvegan /

Wilrich inventory in Central Alberta, Wapiti, and Simonette

respectively. By year-end, the Company's revised capital programme

will deliver 4 gross (2 net) wells in Wapiti, 1 gross (1 net) well

in Central Alberta and, subject to board approval of the revised

drilling programme, 9 gross (5.5 net) wells in the Clearwater, with

production for the year forecast to average 20,000 to 21,000 boepd,

pre-drilling of the Clearwater wells. This forecast accounts for

the downtime associated with i3's, and third-party operators,

planned summer turnaround maintenance programmes, which are

currently underway, and some lesser downtime related to

precautionary shutdowns to mitigate risks associated with wildfires

in Alberta. Despite the downtime, the Company's approved capital

programme is forecast to deliver production growth of up to 3% on a

year over year basis (adjusting for planned turnarounds,

curtailments and downtime associated with the wildfires, i3's 2023

revised production forecast would have been expected to deliver

approximately 7% year-over-year growth).

Due to the overarching commodity price outlook, the financial

ratios and restrictions on distributions contained within the Loan

Documentation and to align with forecast 2023 cashflows, the

Company is also revising downward its 2023 expected go forward

dividend by 50% from 0.171 pence/share per month to the equivalent

of 0.0855 pence/share per month. Additionally, the Company will now

commence paying dividends on a quarterly basis and will pay the Q3

dividend in October 2023, subject to being in compliance with (or

obtaining a waiver from) the financial ratios contained within the

Loan Documentation, following the financial ratio test at each

quarter end. Including dividends declared for the first 6 months in

2023 of GBP12.3 million, the forecast aggregate dividend payment to

shareholders for the first nine months of 2023, of 1.28 pence per

share, represents a yield of approximately 7.9% and a forward

running yield of 6.3% based on the closing price of i3's ordinary

shares of 16.26 pence on 28 June 2023. The Company will continue to

review its capital and dividend programmes on a quarterly basis,

with the purpose of balancing its total return model whilst

maintaining balance sheet strength.

The Company's asset base and operating model provides a large

degree of flexibility to modify and to scale up or down its

operations and capital programme. Should commodity prices improve

i3 will have the option to rapidly deploy capital to expand its

revised 2023 drilling programme. Alternatively, during periods of

low commodity pricing and low asset valuations the Company's

business model directs us to focus on growth via acquisitions to

maximise return on capital. It was through such similar initiatives

in 2020 and 2021 that the Company acquired its Canadian asset

portfolio at very low cash flow and reserve-based multiples. i3

aggressively monitors the transaction market in efforts to identify

acquisition opportunities which can be appropriately financed to

provide superior returns to those achieved by organic growth.

i3's revised guidance for 2023, which is now based on strip

pricing for the remainder of the year, is shown below. Sensitivity

to movement in commodity prices is also provided.

2023 Updated Guidance

2023 guidance and assumptions

(3)

Annual Average Production 20,000 - 21,000 boepd

(4)

------------------------------

Average Expenses ($/boe)

Royalty 15.3%

Operation & Transport USD 13.40 - 13.60 / boe

------------------------------

Net Operating Income (5) USD 75 million - 80 million

------------------------------

EBITDA (6) USD 67 million - 72 million

------------------------------

Capital Expenditures USD 25 million

------------------------------

Dividends (7) ( Forecast for USD 19 million

Jan - Sept. 2023)

------------------------------

2023 Updated Commodity Assumptions (8)

WTI (USD/bbl) $72.00/bbl

MSW Oil Differential (USD/bbl) $3.10/bbl

-----------

AECO Natural Gas (CAD/GJ) $2.60/GJ

-----------

USD / CAD Foreign Exchange 1.33

-----------

GBP / CAD Foreign Exchange 1.68

-----------

Next Twelve-Month Net Operating Income Sensitivity (9)

Next twelve months' sensitivity Estimated change to net operating

income

Change in WTI USD 1.00/bbl USD 1.30 million

----------------------------------

Change in AECO CAD 0.10/GJ USD 1.40 million

----------------------------------

Change in CAD/USD exchange USD 1.27 million

rate CAD 0.01

----------------------------------

Notice of Investor Presentation via Investor Meet Company

Management will be hosting a live presentation via Investor Meet

Company on 5 July 2023 at 3:00 pm BST.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and to

meet I3 ENERGY PLC via:

https://www.investormeetcompany.com/i3-energy-plc/register-investor

Investors who already follow I3 ENERGY PLC on the Investor Meet

Company platform will automatically be invited.

(1) Unless otherwise denoted, all figures are referenced in USD

($) and assume a foreign exchange rate of 1.33 CAD:USD and 1.26

GBP:USD, which is the average forecast for 2023

(2) i3 receives the average floor price plus 50% of difference

between the average floor price and the realised price if

higher.

(3) i3's 2023 guidance for its Net Operating Income and EBITDA

is based on an annual average production range of 20,000 - 21,000

boepd.

(4) Total annual average production (boepd) is comprised of

approximately 48% Oil, Condensate & NGLs, 51% Natural Gas and

1% Gross Overriding Royalty Production

(5) Net Operating Income is a non-GAAP financial measure and is

defined as gross profit before depreciation and depletion and gains

or losses on risk management contracts, which equals revenue net of

royalty expenses, less production costs

(6) EBITDA is a non-GAAP financial measure and is defined as

earnings before depreciation depletion, financial costs, and

tax

(7) Based on i3's forecast nine-month 2023 ordinary share

dividend of GBP15.2 million (US$19.0 million assuming 1.26 GBP:USD)

to be declared and paid during the first nine months in 2023. The

declaration of dividends is subject to terms of loan facility and

the approval of i3's board of directors, compliance with (or waiver

from) the financial ratios contained within the Company's

refinanced debt documentation and is subject to change. Forecast of

Q4 2023 dividends are not included in current guidance numbers but

will be revisited when the Company reviews its Q4 capital and

dividend programmes this fall.

(8) Commodity prices and foreign exchange reflect full year

average realized prices or rates

(9) Illustrates the expected impact of changes in commodity

prices and the CAD:USD exchange rate on i3's estimate of Net

Operating Income for 2023 of USD 75 million to USD 80 million,

holding all other variables constant. The sensitivity is based on

the commodity price and exchange rate assumptions set forth in the

table above. Calculations are performed independently and may not

be indicative of actual results. Actual results may vary materially

when multiple variables change at the same time and/or when the

magnitude of the change increases.

Qualified Person's Statement

In accordance with the AIM Note for Mining and Oil and Gas

Companies, i3 discloses that Majid Shafiq is the qualified person

who has reviewed the technical information contained in this

document. He has a Master's Degree in Petroleum Engineering from

Heriot-Watt University and is a member of the Society of Petroleum

Engineers. Majid Shafiq consents to the inclusion of the

information in the form and context in which it appears.

Enquiries:

i3 Energy plc c/o Camarco

Majid Shafiq (CEO) Tel: +44 (0) 203 781 8331

WH Ireland Limited (Nomad and

Joint Broker) Tel: +44 (0) 207 220 1666

James Joyce, Darshan Patel

Tennyson Securities (Joint Broker)

Peter Krens Tel: +44 (0) 207 186 9030

Stifel Nicolaus Europe Limited

(Joint Broker) Tel: +44 (0) 20 7710 7600

Ashton Clanfield, Callum Stewart

Camarco

Georgia Edmonds, Violet Wilson, Tel: +44 (0) 203 757 4980

Sam Morris

Notes to Editors:

i3 Energy is an oil and gas Company with a low cost,

diversified, growing production base in Canada's most prolific

hydrocarbon region, the Western Canadian Sedimentary Basin and

appraisal assets in the North Sea with significant upside.

The Company is well positioned to deliver future growth through

the optimisation of its existing 100% owned asset base and the

acquisition of long life, low decline conventional production

assets.

i3 is dedicated to responsible corporate practices and the

environment, and places high value on adhering to strong

Environmental, Social and Governance (" ESG ") practices. i3 is

proud of its performance to date as a responsible steward of the

environment, people , and capital management. The Company is

committed to maintaining an ESG strategy, which has broader

implications to long-term value creation, as these benefits extend

beyond regulatory requirements.

i3 Energy is listed on the AIM market of the London Stock

Exchange under the symbol I3E and on the Toronto Stock Exchange

under the symbol ITE. For further information on i3 Energy please

visit https://i3.energy

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSEDSLUEDSEIM

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

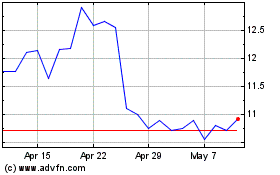

I3 Energy (LSE:I3E)

Historical Stock Chart

From Apr 2024 to May 2024

I3 Energy (LSE:I3E)

Historical Stock Chart

From May 2023 to May 2024