TIDMKRS

RNS Number : 6645U

Keras Resources PLC

30 July 2020

Keras Resources plc / Index: AIM / Epic: KRS / Sector:

Mining

30 July 2020

Keras Resources plc ('Keras' or the 'Company')

Acquisition of 51% Interest in Producing, High Margin, Organic

Phosphate Project and a total cash fundraising of GBP1.73

million

Keras Resources plc, the AIM listed mineral resource company, is

pleased to announce that it has agreed to acquire a 51% interest in

Falcon Isle Holdings LLC ('Falcon Isle') for nominal consideration,

on the basis that Keras provides a US$2.5m loan facility to Falcon

Isle payable in tranches as set out below ('the Acquisition').

Falcon Isle is the 100% owner of the Diamond Creek phosphate mine

('Diamond Creek' or the 'Project') located in in Utah (USA) which

is a fully permitted, high grade direct shipping ore ('DSO'), low

capex organic phosphate operating mine.

The Company has agreed to raise GBP1,728,013.99 (before

expenses) through the placing of 1,440,011,666 new ordinary shares

of 0.01p each ('Ordinary Shares') for cash at a price of 0.12p per

Ordinary Share (the 'Placing Shares').

Overview of the Acquisition

-- Acquisition of a controlling interest in a niche market,

operating organic phosphate mine, supporting Keras' strategy of

building cashflow positive mining projects, growing its asset base

and diversifying its revenue streams

-- Diamond Creek benefits from:

o full permitting and location in the mining friendly

jurisdiction of Utah, USA

o current production - 5,000 tons of DSO planned for the North

American market in Year 1 ramping up to 48,000 tons in Year 5

o excellent economics with internally estimated operating costs

of US$229/ton in Year 1 reducing to US$92/ton at peak production in

Year 5

o estimated low capex requirement of US$468,000 including

contingencies

o long resource life*: at a peak production rate of 48ktpa, the

opencast resources alone represent in excess of 60 years of

production

o operationally de-risked - bulk sample completed in November

2019 proving up mining, processing and logistics for the

project

o Diamond Creek is one of the highest grade phosphate projects

in the US and is marketing a 28% Phosphorus pentoxide ('P (2) 0 (5)

') premium product with minimum 14% available phosphorous ('P'),

the available P is significantly higher than the 3% which the

majority of its competitors market

-- Complements existing asset base - together with its interest

in Nayega, Keras holds two quality projects, both with bulk samples

completed, low capex and near-term production with robust cashflow

projected

-- Appointment of Jean du Plessis, who together with Russell

Lamming and Graham Stacey was part of the successful Chromex Plc

executive management team, to advance Diamond Creek and build the

platform required to build a cashflow generative, dividend paying

company

*Mineral resources have not been classified according to any

International Reporting Standard / any Standard defined in the AIM

Rules for Companies.

Russell Lamming, CEO of Keras Resources, commented, "Diamond

Creek meets all our investment criteria as a high grade, low Capex

and cash generative investment and sits well with our existing

project - the Nayega Manganese Project in Togo - in that both

projects are low volume, high margin assets with the initial

investments based on known resources leaving significant upside to

develop long-life assets. This is a significant milestone for Keras

with the Company transforming from developer to producer overnight

with the first commercial production of high grade organic

phosphate taking place at Diamond Creek yesterday.

"Importantly, Diamond Creek has a direct route to market as a

shallow open pit mining operation with a simple crushing and

screening plant minimising the technical risks. The technical

attributes are further underscored, when read in parallel with its

location in the mining friendly jurisdiction of Utah, and the

compelling long-term demand fundamentals for organic

fertilisers.

"We have followed the same route to production at Diamond Creek

as we did in Togo with a bulk sample and the procurement of a local

turn-key contractor to reduce the operational risk. The bulk sample

which included the construction of access roads, the extraction and

processing of 300 tons of DSO, metallurgical testwork for an owner

operated processing plant and the supply of saleable product to key

potential customers.

"The lease area has a long history of small scale mining but the

receipt of organic certification by all three official

certification agencies; Organic Materials Review Institute

('OMRI'), California Department of Food and Agriculture ('CDFA')

and Washington State Department of Agriculture ('WSDA') in June

2016 was the major breakthrough in the Project's advancement and

has played a pivotal role in paving the way for us to develop an

economically viable and operationally robust asset through which to

diversify revenue streams and create tangible value for

shareholders.

"Diamond Creek boasts strong economics which promise to build

value; an internally estimated EBITDA margin in excess of 50%, low

operational gearing, and a significant resource to underpin a long

life-of-mine. Importantly the marketing strategy and ability to

carve out a market share is underpinned by the ability to sell a

premium, higher grade product to our competitors at a competitive

price. This strategy has already been validated by the first order

of 770 tons, representing approximately 15% of projected sales for

the year ahead.

"I would like to welcome Jean du Plessis to the Keras group.

Jean, together with Graham Stacey and I, was part of the successful

Chromex Mining Plc team which built the Stellite chrome mine in

South Africa. He has significant experience in operating mining and

processing operations around the world and has been based in the

United States since October 2011. Jean will be employed by Falcon

Isle and will be highly instrumental in both the operation of

Diamond Creek and identifying other projects in the US as we

continue to diversify our portfolio of assets both operationally

and geographically.

"I look forward to providing updates on both assets as we move

towards commercial production in the coming months."

Transaction Details

Keras will subscribe, at a nominal consideration, for up to a

51% equity interest in Falcon Isle, and will provide a US$2.5m loan

facility ("Loan"), which will be re-paid from the cash flow

generated from the operation of the Project. The Loan will be paid

in a series of tranches as below:

Loans Amount Keras total equity

in Falcon Isle Holdings

LLC %

Tranche 1 $700,000 20%

--------- -------------------------

Tranche 2a $600,000 30%

--------- -------------------------

Tranche 2b $600,000 40%

--------- -------------------------

Tranche 2c $600,000 51%

--------- -------------------------

1. Tranche one of US$700,000 has already been paid (by Dave

Reeves and Russell Lamming personally) to fund the construction of

access roads, the bulk sample and metallurgical testwork. This loan

will be transferred to Keras for consideration payable in new

Ordinary Shares, further details of which are set out below.

2. Tranche two will comprise US$1.8m, which will be paid over

the next seven month period by Keras and will be used to upgrade

the quality of access roads, undertake the phase one mining

campaign of 5,000 tons, commission the Spanish Fork processing

facility and delineate five years of JORC compliant ore

reserves.

3. A finder's fee of 112,491,001 new Ordinary Shares and

US$35,000 cash will be paid to a third party consultant, with 50%

of these shares locked-in until 29 July 2021 and 50% locked-in

until 29 July 2022 ("Finder's Fee").

4. The founder of Falcon Isle will hold an initial equity

interest of 80% in Falcon Isle Holdings LLC, reducing to 49% once

all of the above Loan tranches have been paid by Keras.

5. The board of directors of Falcon Isle Holdings LLC will

comprise two Keras Directors and one from the founder. Voting will

be based on total shareholding with Keras having a controlling

interest post the payment of Tranche 2c.

The Loan will be repaid in two phases:

1. Phase 1 Repayment: 70% of distributable cashflow from the

Project will be repaid to Keras for the first $1.1m of the

Loan.

2. Phase 2 Repayment: 51% of distributable cashflow from the

Project will be repaid to Keras for the remaining $1.4m of the

Loan.

3. During Phase 1 and 2, Falcon Isle Resources will be repaid a

total of $1.82m from the Project, being a repayment of loans

attributable to the shareholders of Falcon Isle Resources.

Post Phase 2 Repayment, distributable cashflow will be paid out

pro rata to shareholders, so that Keras will be entitled to

51%.

Funding

1. The Company has agreed to raise GBP1,728,013.99 (before

expenses) through the placing of 1,440,011,666 Placing Shares at a

price of 0.12 pence per share. A Warrant will be issued for each

two Placing Shares.

2. Directors Russell Lamming (CEO) and Dave Reeves

(Non-Executive Director) have each agreed to convert their loans of

US$350,000 (GBP272,374) each previously advanced to Falcon Isle

into 224,982,001 new ordinary shares of 0.01 pence each in the

Company, at a price of 0.12p per Ordinary Share, (the 'Loan

Conversion Shares'). These loans comprise Tranche 1 of the loan to

Falcon Isle as described above. A Warrant will be issued for each

two Loan Conversion Shares.

3. The Company is currently authorised to issue 1 billion new

Ordinary Shares for cash consideration on a non pre-emptive basis

and the proposed issue of Placing Shares set out above and other

proposed issues of new Ordinary Shares as further set out in this

announcement exceeds the share issuing authorities of the Company.

As such the Company intends to convene a General Meeting to obtain

additional share issuing authorities on or about 24 August 2020.

The new Ordinary Shares to be issued prior to the General Meeting

are being issued pro rata with the balance to be issued under the

new authorities to be obtained at the General Meeting.

4. 78,739,000 new Ordinary Shares are being issued in lieu of

cash to existing creditors of the Company at a price of 0.12p

("Creditors Shares")

5. 112,491,001 new Ordinary Shares for the Finder's Fee.

6. A total of 984,357,334 Warrants will be issued on the basis

of one warrant for every two Placing Shares, Loan Conversion Shares

and Creditors Shares as per 1, 2 and 4 above and each warrant will

entitle that subscriber to acquire one new Ordinary Share at a

price of 0.24 pence per Ordinary Share ("Warrants"). Warrants will

have a subscription period of one year from the 31 August 2020.

Application will be made for admission of the 1,191,230,001 new

Ordinary Shares to trading on the AIM market of the London Stock

Exchange ("AIM") on 13 August 2020 ("First Admission"), with a

further application to be made for admission of 889,975,668 new

Ordinary Shares to trading on AIM on 25 August 2020 ("Second

Admission"). The new Ordinary Shares to be issued pursuant to the

First Admission and Second Admission will rank pari passu with the

existing Ordinary Shares, which are currently traded on AIM.

Following the First Admission, there will be 3,976,032,183

Ordinary Shares in issue with each share carrying the right to one

vote. There are no shares currently held in treasury. The total

number of voting rights in the Company will therefore be

3,976,032,183 and this figure may be used by shareholders as the

denominator for the calculations by which they determine if they

are required to notify their interest in, or a change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure Rules and Transparency Rules.

Following the Second Admission, there will be 4,866,007,851

Ordinary Shares in issue with each share carrying the right to one

vote. There are no shares currently held in treasury. The total

number of voting rights in the Company will therefore be

4,866,007,851 and this figure may be used by shareholders as the

denominator for the calculations by which they determine if they

are required to notify their interest in, or a change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure Rules and Transparency Rules

Related Party

The issue of the Loan Conversion Shares and Warrants to Russell

Lamming and Dave Reeves together with the acquisition of 62,500,000

Placing Shares by Dave Reeves constitutes a related party

transaction pursuant to AIM Rule 13 of the AIM Rules for Companies.

Brian Moritz, being the director independent of the transactions

considers, having consulted with the Company's Nominated Adviser,

that the issue of the Loan Conversion Shares to Russell Lamming and

Dave Reeves and the acquisition of 62,500,000 Placing Shares by

Dave Reeves is fair and reasonable insofar as the shareholders of

the Company are concerned. Following these transactions, the

beneficial interests of the Directors in the issued Ordinary Shares

is as follows:

Director Interest in Ordinary % interest in Warrants held following

Shares following Ordinary Shares Second Admission

Second Admission following Second

Admission

Dave Reeves 780,706,252 16.04 143,741,001

--------------------- ------------------ -----------------------

Russell Lamming 370,916,552 7.62 112,491,001

--------------------- ------------------ -----------------------

Brian Moritz 106,627,178 2.19 Nil

--------------------- ------------------ -----------------------

Total 1,258,249,982 25.85 256,232,002

--------------------- ------------------ -----------------------

Investment Rationale

The acquisition of an interest in Diamond Creek meets all

Keras's investment criteria and finalises the Company's transition

from explorer to producer.

Keras is focused on building a diverse portfolio of near term or

producing, permitted, low capex, high margin, cash generative

assets to maximise shareholder value, utilising the robust track

record of its experienced management team and board of directors in

identifying and developing resource assets. The Company's balance

sheet is now aligned with this strategy and past losses have been

eliminated clearing the path for the potential for profits to be

distributed to shareholders by way of dividends.

The acquisition of a controlling interest in Diamond Creek

complements the Nayega Manganese Project in Togo, West Africa,

which Keras has been developing to commercial production. Keras now

holds two quality projects, both with bulk samples completed, with

low capex and near-term production with robust cashflow

projected.

Nayega hosts a current JORC Compliant Mineral Resource of 13.5Mt

@ 11.1% Mn and an Ore Reserve of 8.44Mt @ 14.0% Mn with additional

upside identified through exploration work. Its current installed

processing capacity is 6,500 saleable tpm, which the Company aims

to increase to 25,000tpm with annual production planned for 300,000

tonnes. On 18 October 2019, the Council of Ministers of the

Republic of Togo adopted a decree to grant a licence for

large-scale exploitation of the manganese deposit at Nayega to SGM.

The Company is still awaiting the formal award of the exploitation

licence to allow production to begin.

Background on Diamond Creek

Approximately 70km SSE of Salt Lake City, Utah and 30km from the

Spanish Fork processing facility, the Project is ideally located to

take advantage of Salt Lake City's rich history in mining and

Utah's mining friendly jurisdiction.

The Project has a significant historical mineral resource

(mineral resources have not been classified according to any

International Reporting Standard) with the first 2.5 years of

production already pre-stripped. The phosphate mineralisation

comprises shale beds in the Meade Peak Member of the Phosphoria

Formation. The mineralised zone is c.3m thick and averages 28% P(2)

O(5) with average available phosphorous of 16%. Historic reports

vary with "surface mineable resources" ranging from 3.10Mt to

4.60Mt. At a peak production rate of 48ktpa, the opencast resources

alone represent in excess of 60 years of production. The

construction of access roads for the 2019 bulk sample has provided

key infrastructure thus reducing time to production. A turn-key

contractor was secured post bulk sample to provide all mining,

logistical and crushing services.

Diamond Creek's most recent mineral resource estimate in 1980

quotes 3.89Mt and 1.17Mt of surface mineable phosphate ore in the

southern and northern sections of the Project area respectively.

Approximately 22Kt of premium ore (28%P(2) O(5) & 16.2%

available P) and 15Kt of medium grade ore (18%P(2) O(5) & 10.1%

available P) has already been pre stripped, representing the first

2.5 years of production. Furthermore, an infill drilling campaign

planned for Q2 2021 is expected to delineate an additional 100Kt

representing five years of JORC compliant ore reserves.

The Project's production profile increases to 48Ktpa by Year 5

and is based on a combination of increased market share with a

well-priced premium product and the sustained growth expected in

the organic market over the next decade.

A key milestone in the Project's history came in June 2016 when

it received Organic Certification by all three key certification

agencies in the USA: Organic Materials Review Institute (OMRI),

California Department of Food & Agriculture (CDFA) and

Washington State Department of Agriculture (WSDA). With organic

certifications, and as a direct shipping ore (DSO) requiring no

chemical upgrade process, with in-situ grade of 28% P2O5, low heavy

metal impurities and significantly higher available phosphate than

any other organic rock phosphate in North America, the Project's

premium product can be priced at a competitive level to gain market

share. Falcon Isle has a modest target of gaining a market share of

c.14% of the North American organic rock phosphate market in five

years.

Diamond Creek Economics

Production of 5,000 tons of DSO in Year 1 ramping up to 48,000

tons in Year 5 is underpinned by excellent economics with

internally estimated operating costs of US$229/ton in Year 1

reducing to US$92/ton at peak production in Year 5. The expected

capex requirement of US$468,000 including contingencies is aligned

with the Company's strategy of targeting near-term, low capex

projects and the long resource life*, which at a peak production

rate of 48ktpa represent in excess of 60 years of production

provides significant upside to the project.

* Mineral resources have not been classified according to any

International Reporting Standard

The Organic Phosphate Market**

The 2019 organic fertiliser industry in North America is

currently a 3Mt industry worth $1.17bn, which over the next decade

is forecast to grow to a 6.3Mt and US$2.5bn industry - with volumes

expected to grow at CAGR of 7%. Phosphate fertilisers make up 22%

of the total organic fertiliser market and 20% of phosphate

fertilisers are sourced form rock phosphate. Phosphate fertilisers

are expected to grow at CAGR of 6.8%.

Diamond Creek is one of the highest grade phosphate projects in

the US and is marketing a 28% P (2) 0 (5) product with minimum 14%

available phosphorous ('P'), the available P is significantly

higher than the 3% which the majority of its competitors market.

The resulting competitive US$/P cost to end-users underpins the

Company's marketing plan to gain a dominant position in the organic

phosphate market.

The Diamond Creek production profile has been designed to build

market share from 2% to 14% over a five year period; this targeted

growth is modest to take into account the barriers to entry but is

underpinned by the superior quality and the very competitive price

per phosphorous unit.

** "Organic Fertilizers Market, North America Industry Analysis,

Size, Share, Growth, Trends, and Forecast, 2019-2030", Transparency

Market Research 2020.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED TO

CONSTITUTE INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE

MARKET ABUSE REGULATION (EU) NO. 596/2014. UPON THE PUBLICATION OF

THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE

IN THE PUBLIC DOMAIN.

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Dave Reeves

-------------------------------- -------------------------------------

2. Reason for the notification

-----------------------------------------------------------------------

a) Position/status: Non Executive Director

-------------------------------- -------------------------------------

b) Initial notification/amendment: Initial notification

-------------------------------- -------------------------------------

3. Details of the issuer emission allowance market

participant, auction platform, auctioneer or auction

monitor

-----------------------------------------------------------------------

a) Name: Keras Resources plc

-------------------------------- -------------------------------------

b) LEI: 213800OZFKFM2N4R4F47

-------------------------------- -------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place

where transactions have been conducted

-----------------------------------------------------------------------

a) Description of the Ordinary shares of 0.01

financial instrument, pence each

type of instrument:

ISIN: GB00B649J414

Identification code:

-------------------------------- -------------------------------------

b) Nature of the transaction: 1. Issue of Loan Conversion

Shares

2. Grant of Warrants (in

respect of the Loan Conversion

Shares and Placing Shares)

3. Subscription for Placing

Shares

-------------------------------- -------------------------------------

c) Price(s) and volume(s): Prices(s) Volume(s)

1. 0.12p 1. 224,982,001

2. 0.24p 2. 143,741,001

3. 0.12p 3. 62,500,000

----------------

-------------------------------- -------------------------------------

d) Aggregated information: Multiple transactions as

in 4 c) above

Aggregated volume: Prices(s) Volume(s)

1. 0.12p 1. 224,982,001

Price: 2. 0.24p 2. 143,741,001

3. 0.12p 3. 62,500,000

----------------

-------------------------------- -------------------------------------

e) Date of transaction: 30 July 2020

-------------------------------- -------------------------------------

f) Place of transaction outside of a trading venue

-------------------------------- -------------------------------------

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Russell Lamming

----------------------------------- ----------------------------------

2. Reason for the notification

-----------------------------------------------------------------------

a) Position/status: Chief Executive Officer

----------------------------------- ----------------------------------

b) Initial notification/amendment: Initial notification

----------------------------------- ----------------------------------

3. Details of the issuer emission allowance market

participant, auction platform, auctioneer or auction

monitor

-----------------------------------------------------------------------

a) Name: Keras Resources plc

----------------------------------- ----------------------------------

b) LEI: 213800OZFKFM2N4R4F47

----------------------------------- ----------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of

transaction; (iii) each date; and (iv) each place

where transactions have been conducted

-----------------------------------------------------------------------

a) Description of the Ordinary shares of 0.01

financial instrument, pence each

type of instrument:

ISIN: GB00B649J414

Identification code:

----------------------------------- ----------------------------------

b) Nature of the transaction: 1. Issue of Loan Conversion

Shares

2. Grant of Warrants (in

respect of the Loan Conversion

Shares)

----------------------------------- ----------------------------------

c) Price(s) and volume(s): Prices(s) Volume(s)

1. 0.12p 1. 224,982,001

2. 0.24p 2. 112,491,001

----------------

----------------------------------- ----------------------------------

d) Aggregated information: Multiple transactions as

in 4 c) above

Aggregated volume: Prices(s) Volume(s)

1. 0.12p 1. 224,982,001

Price: 2. 0.24p 2. 112,491,001

----------------

----------------------------------- ----------------------------------

e) Date of transaction: 30 July 2020

----------------------------------- ----------------------------------

f) Place of transaction outside of a trading venue

----------------------------------- ----------------------------------

**ENDS**

For further information please visit www.kerasplc.com , follow

us on Twitter @kerasplc or contact the following:

Russell Lamming Keras Resources plc info@kerasplc.com

Nominated Adviser & Joint

Broker

Ewan Leggat / Charlie SP Angel Corporate Finance +44 (0) 20 3470

Bouverat LLP 0470

Joint Broker Shard Capital Partners +44 (0) 207 186

Damon Heath / Erik Woolgar LLP 9900

Financial PR

Susie Geliher / Cosima +44 (0) 20 7236

Akerman St Brides Partners Ltd 1177

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQKKKBDPBKDDON

(END) Dow Jones Newswires

July 30, 2020 11:15 ET (15:15 GMT)

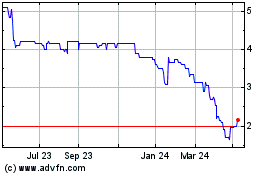

Keras Resources (LSE:KRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

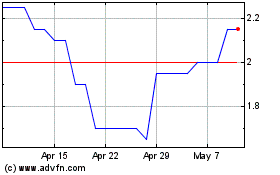

Keras Resources (LSE:KRS)

Historical Stock Chart

From Apr 2023 to Apr 2024