TIDMEAI

RNS Number : 4567R

Entertainment AI PLC

30 June 2020

Entertainment AI plc

(the "Group" or the "Company")

Audited results for the six months ended 31 December 2019

Outlook for 2020

Entertainment AI plc, a global social media and technology

platform for sharing video moments to enable discovery, sharing and

e-commerce through the targeting and connecting of creators,

audiences and brands is pleased to present its full, audited

results for the six months ended 31 December 2019 and Outlook for

2020. The Group is also today separately announcing its technology

launch and a name change to SEEEN plc with the ticker symbol (AIM:

SEEN) better reflecting the Group's technology and social media

platform.

During 2H 2019, the Company signed a letter of intent and closed

the acquisition of three operating entities creating the Group and

completed a strong fundraising. The results reflected in the

audited results therefore reflect three months of the Company as a

cash shell (3Q) and three months of the Group (4Q).

Coincident with the formation of the Group, the Company changed

its reporting period to calendar year to reflect full-year

operations of the Group starting in 2020.

As a result of the timing of the transactions, comparisons

between the results for the twelve months to 30 June 2019

(Blockchain's fiscal year reporting as a cash shell) and the six

months to 31 December 2019 (formation of Entertainment AI plc) are

not meaningful.

Copies of the Annual Report are today being posted to

shareholders and will be made available to view on the Company's

websites at www.entertainmentai.co.uk and seeen.com.

Key Highlights 2019

Transaction

-- Formation of a technology and media platform with

acquisitions of Tagasauris, Inc, GTChannel Inc, and Entertainment

AI, Inc. together with GBP8.6 million fundraising from leading

institutional investors and strategic partners and admission to

AIM

-- Core operating assets: (i) YouTube multichannel network with

global audience, content creators and digital ad revenue ("MCN");

and (ii) intellectual property (patent, trade secrets, product

designs) enabling artificial intelligence and machine learning

applications to video

2019 Results For Operating Assets Acquired During Year

-- Calendar year 2019 views of 12.6 billion on the Group's M CN, up 47.7% (2018: 8.5 billion)

-- Average RPM (Revenue per Thousand Videos) up 11% to $1.49 (2018: $1.35)

-- Gross YouTube advertising revenue on MCN of $18.7 million, up 64% (2018: $11.4 million)

-- Net revenue (minus YouTube commission) of $10.5 million, up 58% (2018: $6.5 million)

-- Net cash of $9.5 million at 31 December 2019

1H 2020 Subsequent Events / Outlook

-- Continued significant growth in MCN views and creator channel partners despite C OVID-19

-- COVID-19 creates reduction in global digital advertising

spend among brands leading to keeping Forecasts Under Review until

general market conditions stabilise

-- Market decline in digital advertising spend creates

opportunity for the Group's technology to drive greater yield on

spend for brands

-- Pilot with Group's first external B2B customer

-- Pipeline of B2B sales opportunities

-- 30 June 2020 brand launch with name change to SEEEN plc and

new website reflecting the Group's social media and technology

platform to enable greater monetization of video, especially on

mobile devices

Dr. Patrick DeSouza, Chairman of SEEEN, commented: "With our

2019 Entertainment AI plc Accounts, we close the formative chapter

of our technology and social media platform, today re-branded as

SEEEN. During 2019 we assembled a strong set of proprietary

operating assets, strong board, execution-oriented management,

global strategic partners such as Sumitomo Corporation, and

first-tier institutional capital. 2020 execution is on track and we

are coming to market at the right time. Market demand is

accelerating for short-form video on mobile devices that can be

discovered, shared and monetized through brand ads and

e-commerce."

Todd Carter, CEO of SEEEN, commented: "I am proud of our team

and execution during 1H in navigating the COVID-19 environment in

productive ways. These are unprecedented times for SEEEN and the

world, and we are incredibly grateful for our team, and their focus

and resilience. With the support of our institutional investors, we

have turned the operating assets we acquired in 2019 into

"go-to-market" products that create new, robust and diversified

revenue channels and that leverage our MCN starting point.

Our mission - to deliver new types of adaptable video content

designed for action at the point of inspiration - has never been

more relevant. SEEEN's users can create, enrich, share and enjoy

video moments at different granularities, interlinked with each

other and other kinds of information, searchable, and accessible

everywhere and at every time on their internet-connected screens.

And because SEEEN-enriched video content is more discoverable,

connected and engaging it leads to richer opportunities for

creators, brands and fans.

We have a tight focus on delivery as we transition from our

launch on AIM during 4Q 2019 to our execution during 2020. Our

ability to leverage data analytic and behavioral insights from our

MCN continue to give us confidence that the road ahead for SEEEN

will be exciting for our audience, creator and brand ecosystem and

profitable for our shareholders."

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Enquiries:

Water Intelligence plc

Patrick DeSouza, Executive Chairman Tel: +1 203 654 5426

Todd Carter, CEO

Adrian Hargrave, CFO Tel: +44 (0)7775 701

838

WH Ireland Limited - NOMAD and Broker Tel: +44 (0)20 7220 1666

Adrian Hadden

James Sinclair-Ford

Matthew Chan

Dowgate Capital Limited - Joint Broker Tel: +44 (0)7920 599

Stephen Norcross 793

Chairman's Statement

The fourth quarter of 2019 marked the exciting launch of

Entertainment AI and its mission to attack a global market

opportunity that is rapidly unfolding and triggering the

convergence of the media, technology and telecommunications

sectors. More precisely, short-form video displayed over mobile

devices is becoming a dominant mode of expression and social

networking, as evidenced most recently by the global phenomenon of

TikTok. As discussed in these pages, with today's launch of our

brand - SEEEN - we aspire to deliver to our shareholders another

extraordinary video platform company.

As typical when markets are disrupted, opportunities emerge.

Currently, there is a scramble among various constituencies to

unlock value. Consumers demand more video content to discover,

share and act upon often as part of their online path to purchase.

Creators seek to meet growing consumer demand by producing more

content that they hope to monetize. Media companies seek to harness

creators and fresh content to drive audience engagement and

revenue. COVID-19 has only accelerated video consumption trends as

individuals shelter-in-place. Brands, meanwhile, seek to better

target and then connect with consumers by using technology and data

to offer more relevant authentic content and create higher yield

from their advertising spend, especially in a COVID-era of reduced

operating budgets.

Entertainment AI, now SEEEN, came into being during 2H 2019

because we believe that we have a proprietary technology that

enables us to organize the various constituencies - consumers,

creators, brands - into a marketplace by deconstructing or

"momentizing" video into relevant interest events. Video need not

be consumed as a simple unitary object. Rather, by breaking apart

any video into moments of interest, viewers can focus on exactly

what they desire; moreover, by linking videos the way Google links

text, our technology can stream more relevant packages of video to

consumers as an offering. Such functionality enables our platform

to drive the economics of internet-based video. Brands would pay

for such targeting and creators could extract more value for their

content. Meanwhile, consumers could search and find the parts of

videos that they want to see and act to buy products in a

frictionless way. Today, after nine months of refining our

technology products and "Go to Market" strategy, we are initiating

our brand as "SEEEN" to better communicate our ability to target

and organize video content. Our corporate mantra is that only video

that is truly "seen" may be acted upon.

We began our journey in 4Q 2019 with the following strong set of

assets: (i) a world-class technology portfolio from which to create

products; (ii) a large multichannel network with over 1,200

monetizable creators of content, an audience of over 12.6 billion

video views generating over $10 million in annual revenue and

growing; (iii) over $10 million in cash from strong, institutional

funds; (iv) brand partners including Sumitomo Corporation; (v) an

experienced, all-star board and execution-oriented management team;

and (vi) an AIM listing. During 4Q and 1H, together with our

partners, we have deployed EIS/VCT monies to put together the

technology components of today's platform launch. Our CEO and team

have navigated COVID-19 and a worldwide decline in digital ad spend

despite the increase in our MCN viewership. Ironically, this latter

reality makes the launch of our "targeting" technology during 3Q

2020 a compelling value proposition for brands as they look to

produce more yield from their ad spend.

As discussed by our CEO, despite COVID-19 we have made sure to

keep our eyes on the prize. We have focused on defining our first

set of video platform products and developing a sales pipeline for

these products. As previously announced, during 1H we have launched

CreatorSuite geared for video creators and during 3Q we will be

launching a product - BrandSuite - for brands. While executing this

technology priority, we have continued to develop our

revenue-generating multichannel network, adding viewers and also

extracting important insights about audience behavior that are

useful for our technology products. In pilot tests with brands

during 1H 2020, we have defined the highest value functionality for

prospective business customers.

In summarizing our excitement as we close the formative chapter

of 2H 2019 with these Accounts, we have assembled the right

components both organically and through acquisition and a capital

raise. We are ready to attack the market on a mission to create a

global platform. We have technology and social media market leaders

like Pinterest and Adobe to look to in calibrating our business

model. Through CreatorSuite and BrandSuite, we can extend

revenue-generating tools to everyone in the marketplace: The

"B-to-E" market - creators, consumers, brands. In this way, we can

"unleash video".

Let us underscore that while we are excited by the market

opportunity, we are launching SEEEN focused on execution and

delivery.

Dr. Patrick DeSouza

Chairman

29 June 2020

Chief Executive Officer's Statement

Today we introduce SEEEN, an open platform for experiencing,

launching & monetizing video moments. Changing a company name

is an emotional topic because it is about identity. To the outside

world, a corporate name change may appear as an abrupt, "out of the

blue" change catching customers, partners and stakeholders

off-guard. The reality of our rebrand is about aligning and

integrating, from the inside out, the why, how and what of "video

unleashed". We are excited about the road ahead.

Our mission - to deliver new types of adaptable video content

designed for action at the point of inspiration - has never been

more relevant. The COVID-19 pandemic is reshaping lives and

businesses around the world and our audiences, creatives and brand

partners are no exception. More people than ever are creating and

watching video online and brands are increasingly turning to video,

whether product tutorials or shoppable social media posts, in

search of innovative ways to boost brand identity and sales.

We are acutely aware that we are fortunate to have a service

that is even more meaningful to people confined at home. SEEEN's

users can create, enrich, share and enjoy video moments at

different granularities, interlinked with each other and other

kinds of information, searchable and accessible everywhere and at

any time on their internet-connected screens. And because

SEEEN-enriched video content is more discoverable, connected and

engaging, it leads to richer opportunities for creators, brands and

fans.

The baseline from which we are launching SEEEN is that our MCN

continues to attract both creators and audience. During 2019 the

Group's MCN achieved growth across all key metrics. Our affiliated

channels grew in number to more than 10,000, approximately 1,200 of

which are now monetized on YouTube. These 1,200 monetized channels

delivered record view counts of 12.6 billion, up 48% on 2018 (8.5

billion). These views, in turn, yielded greater revenues (2019:

$10.5m; 2018: $6.6m). Moreover, RPM (Revenue per Thousand)

increased 11% to $1.49 in 2019 (2018: $1.35). These results

underscore that our MCN's content is both more engaging and

increasingly suited to brand advertising.

These results also provide a foundation from which to launch our

technology products. These new products will allow us to diversify

revenue as we leverage our affiliated network of creators, content

and audience base. We are increasing channel partners and views,

both within our core audiences, as well as a new Spanish language

service. Like many businesses reliant on advertising income, we

have not been immune from the effects of Covid-19. Unlike other

MCNs, our technology portfolio will allow us to capture advertising

budgets through new revenue-generating products that create yield

for brands through targeting of consumers.

Operating Priorities

In designing our technology products, we have a built-in

advantage because of our MCN. Online video is a rich source of

content from which machine learning can extract people, objects,

actions, locations and narrations "in the wild". We are able to tap

into and upcycle video moments from the wealth of authentic,

high-quality, relatable video content generated by our creators

saving our brand partners time and helping them scale their

campaigns across digital touchpoints.

We have four operating priorities for 2020: (i) generating

inspiring content to expand our audience base and viewer attraction

to our platform; (ii) enabling shopping to realize monetizable

actions by consumers using our technology; (iii) diversifying our

advertising base especially through targeting relevant content and

increasing digital ad revenue yield; and (iv) expanding use cases

through audience data enabling us to have a robust product

roadmap.

Inspiring Content

Our first priority is to help information seekers by making it

easy to find or skip to precisely where they want to go to in a

video, like in a book. Google referred to this feature as "Key

Moments", in taking the user to an important part of a video clip.

In 2019 we began publishing "I-want-to-know", "I want-to-go",

"I-want-to-watch", "I-want-to-do", "I-want-to-buy" video clips to

the Google search and social media ecosystems. In 1H 2020 we

introduced an exciting new "how-to" moment type. How-to moments are

presented to the user as a series of easy to navigate process

steps.

During 1H 2020, we accelerated our work on projects that help

our creators, brands and fans publish and enjoy inspiring video

moments as they adjust to new norms. We have increased our use of

machine learning and automation to accelerate our video

momentization process and launched CreatorSuite to make it easier

for our creative and brand partners to upcycle content, publish

video moments and provide relevant feedback to our machine learning

operations. During 2Q, we built on our foundation by launching an

embedded widget that lets our creators curate and syndicate video

moments and playlists to third party websites and channels.

We will continue to enhance our SEEEN platform's on-demand user

experience. We are now launching a redesigned owned and operated

(O&O) website to help our audience better connect to interests

on our platform. Over the course of 2H, we will experiment with

options to give our audience the ability to curate video moments

from our O&O, similar to Pinterest. By enabling curation, we

expect to enrich the organization and presentation of our content

and make it more adaptable and relevant as we scale beyond our

traditional automotive focus in our existing and new audience

geographies.

Shopping

We have arrived at a critical moment for e-commerce innovation

in the marketplace. We can align our vision with the needs of

consumers to easily discover and buy products from merchants they

trust. There are two aspects to that strategy: (i) catalog-side

inventory development; and (ii) offer-side user experience

experimentation. We will make significant additional strides

platforming these capabilities over the course of 2H.

The first aspect of our strategy is to build catalog-side

inventory by launching a platform to enable merchants to upload

catalog feeds to get distribution on high-intent shopping moments

as well as access to a new analytics insight tool that lets them

measure the sales impact of both paid and organic moments on the

SEEEN platform. Evasive Motorsport is an example of an early

adopter to the program but we expect to begin signing up more

merchants to the program in 2H. While we believe that the program

will gain significant traction over the long term (particularly as

the pace of digital transformation accelerates the shift to

shopping online), it is still early days.

At the same time, on the offer-side, we are making it easier for

our audience to pivot from curiosity to commerce. During 1H we made

significant strides towards designing better shopping experiences

both on and off our platform starting with user journeys through

discovery. Today's shoppers are in control of their path to

purchase and Google Search is often the entry point for that unique

user journey. Empirically, the next step is video viewed on mobile

devices. We provide explicit information about our videos and the

video moments that we publish to help our content appear and rank

in Google Search results.

SEEEN video moments include markup that relates to the specific

concepts depicted or associated with a video moment. In this way,

SEEEN video moments are discoverable directly from user queries in

search engine results. We have also updated the design of our media

player and the presentation of video moments on our O&O. All

video moments related to a particular concept are connected within

SEEEN and across the Web presenting our users with even more

related content. A high degree of confidence in content

understanding allows users to purchase products associated with

different parts of a video directly from within the SEEEN

application.

Supporting and Diversifying our Advertiser Base

In the current environment, marketers are looking for

transparent returns on their ad spend, and we have the opportunity

now through our technology to demonstrate our value for advertisers

seeking conversion events. Our vision is to deliver measurable

value by making it easier for marketers to use our services and

scale on our platform. In doing so, we can diversify our advertiser

base and aggregate more relevant commercial offerings

Expansion of User Cases

Video streaming is a novel application area. We are discovering

new use cases, as well as deepening existing ones, and we are

testing new foundational features to support both of these

outcomes. First, we have launched playlisting capabilities during

2Q. Second, we are introducing a curation feature that lets our

audience group video moments on similar topics into auto-organized

channels. Finally, we are exploring ways to make a video more

adaptable to the user's goals, preferences and knowledge. For

example, using computer vision and machine learning, we plan to

launch a feature that lets our audience make a "SEEEN," which can

be about any topic whether it is baking delicious bread at home,

cross country ski racing or researching collector cars. SEEEN then

lets you curate the content you love, share your channel with

others and find new content based on what you have saved.

Advertisers pay for additional promoted moments to appear in their

desired audiences channels or in search results.

Additionally, we will partner with e-commerce platform providers

to help get smaller merchants onto SEEEN. Partner merchants should

be able to upload their product catalogs to SEEEN and create SEEEN

ad campaigns with just a few clicks. We are excited to welcome more

merchants to SEEEN.

Outlook for 2020

During 1H 2020, we made progress on our two most significant

revenue product priorities. Our first priority is our CreatorSuite

product, which we delivered to seeded creators during 2Q.

CreatorSuite is an important bridge for our strategy to build upon

our MCN base and diversify our revenue. We expect CreatorSuite's

cloud-based, microservice architecture will result in new revenue

opportunities, more efficient operations, faster innovation, and

better ability to experiment. We are pleased that some of our

creator and brand partners are already running live video

moment-based campaigns from CreatorSuite.

Our second revenue priority is promoted video moments, beginning

with our owned and operated website and our next-generation video

moment advertising format. We recently began pilots, testing

portions of our improved offering with a few digital marketers. We

plan to expand testing over several phases. We see a path to

driving more direct response advertising on our owned and operated

platform in 2020 and beyond through this work on video moments and

creating a more personalized experience. Our improved video

moments, together with our SEEEN-powered syndication widgets,

should increase our market capture enabling us to be more resilient

than most as businesses cope with the effects of COVID-19. Current

consumer behavior illustrates the increasingly unique ways people

shop even within the same categories of products. Today's shoppers

are in control of their path to purchase and can explore thousands

of categories, brands, and products at any moment. SEEEN supports

these unique user journeys with discoverable, relevant, inspiring

and connected video content.

These personalised paths to purchase have three broad

implications for brands around which SEEEN's video moments deliver

value. Marketers need to be there, wherever users are, be useful,

with relevant and timely information, and be quick to deliver

experiences that are fast and frictionless. SEEEN can help brands

understand and respond to intent "in the moment" in ways that

simply were not possible before.

The market backdrop makes this a very exciting time for the

Group and we are fully committed to exploiting this window of

opportunity and executing quickly and aggressively. Our suite of

innovative technology products is now ready for the market and we

continue to develop against our product roadmap. Our patented

machine learning technology and deep knowledge in this space will

enable us to continue to create leading-edge products for viewers,

consumers and brands.

During 3Q, we have an exciting set of product launches and

feature releases, starting with CreatorSuite and our Syndication

Widgets. These products will complement our MCN. We have a strong

balance sheet, but we remain mindful of investing prudently to

capture the market opportunity.

In closing, we believe video moments are the currency of

tomorrow. But to achieve this outcome, video content needs to be

both intelligent and connected. Through our vision of "video

unleashed", we will unlock a new generation of visual-first

discovery, learning and exploration and open completely new

application areas for audio-visual information on the Web.

Todd Carter

Chief Executive Officer

29 June 2020

Strategic Report

Business Review and Key Performance Indicators

Entertainment AI plc and its subsidiaries ("Group") is a global

social media and technology platform for sharing video moments to

enable discovery, sharing and e-commerce through the targeting and

connecting of creators, audiences and brands.

The Chairman's Statement and CEO's Statement provide two core

dimensions to the Group's presentation of its progress during the

year as a technology and media business, together with the outlook

for the Group's future developments. The Chairman's Statement

presents the Group's strategy to create significant shareholder

value driven by the Group's technology roadmap. The CEO's Statement

provides an evaluation of our execution highlights and challenges

that transform vision into reality and create a competitive

advantage in the marketplace.

For the 2019 Accounts, Blockchain Worldwide plc (the "Company")

is closing one chapter of its corporate history and beginning

another. During 1H the Company was a cash shell. During 2H 2019 the

Company was substantially transformed through a series of

acquisitions and an accompanying capital raise at the end of

September 2019. Post-closing of the transactions, the Group is

fully funded for its business plan, owning a set of fast-growing

operating assets and cutting-edge artificial intelligence

technologies. During 4Q the Company began its new journey and

established a calendar year reporting period to underscore the

launch of its new business plan with accompanying key performance

indicators (KPIs). The 2019 Strategic Report prepares the way with

an overview of the Group's business plan and an initial set of KPIs

around which the business will be shaped in 2020 and beyond. This

Strategic Report will evolve as the Group executes its business

plan fully in 2020.

Results for the six months ended 31 December 2019 reflect three

months of the standalone Company as a cash shell and three months

of figures for the enlarged Group as required under IFRS accounting

standards. As a result, comparisons between the results for the

twelve months to 30 June 2019 (Blockchain's fiscal year reporting)

and the six months to 31 December 2019 (combined as Entertainment

AI plc) are not meaningful.

Corporate History

Prior to 30 June, Blockchain Worldwide plc had the status of a

cash shell with certain liabilities. On 23 May 2019, the Company

announced that it was in discussions to acquire certain operating

businesses. On 11 September 2019 the Company announced that it had

entered into agreements to acquire Tagasauris, Inc., ("Tag"), GT

Channel Inc.("GTC") and Entertainment AI, Inc. ("EAI Inc."). On 30

September 2019, these acquisitions were completed. The operating

assets and business plan of these three companies allow the Company

to compete in a fast-growing global market for short-form video

content and e-commerce. In this emerging market, consumers seek to

discover, share and create short-form video content either through

YouTube or proprietary websites. Moreover, using mobile devices,

consumers seek to take actions in a frictionless way upon seeing

videos and being inspired by them. The principal action sought by

consumers is to be able to purchase goods and services seen in the

video. Moreover, brands seek to tap into such consumer demand

creating new marketplaces connecting consumers to brands. As a

result of this multi-billion dollar opportunity, there is rapid

convergence of the media (content), technology (e-commerce) and

telecommunications (mobile) sectors taking place. Such convergence

provides opportunities for the Group and its products. On 30

September 2019, related to the acquisition of the operating assets,

the Company announced the completion of a successful capital raise.

To fund its business plan, the Company raised GBP8.6 million from

institutions and private investors. The Group was admitted to AIM

on 30 September 2019 following these transactions.

Company's Business Upon Admission to AIM

Coincident with the transactions that formed the new business of

the Group, the Company changed its name to Entertainment AI plc

(EAI). EAI is organized into two principal businesses - technology

and media - that work together synergistically to create EAI's

product roadmap and value proposition to the market. The

synergistic nature of these business lines means that the Board and

management consider the Group and its progress as one business as

opposed to separate reporting entities.

Technology Business

Tag and EAI Inc. own various intangible assets - patents, trade

secrets, licenses and product designs - that underlie a proprietary

product roadmap focused on the production of video "micromoments"

that enable consumers to access the most relevant features of

videos for themselves. During 4Q the Company began to deploy

capital to transform the Company's proprietary assets via a

"Go-to-Market" plan that would capture market demand during 2H

2020. Because the Company is a technology company exploiting

various media assets, one KPI used by the Board to monitor the

advancement of its business plan is the pace of product releases to

the market and robustness of its product roadmap.

Media Business

GTC is a multichannel network ("MCN") that aggregates creators

of short form video content and publishes such content on YouTube.

The Company also produces proprietary content and publishes that

content to its owned and operated web site. Published content

attracts viewers and digital ad revenue on YouTube producing gross

revenues. After YouTube deducts its commission, the Company

receives net revenue from YouTube. The economics of the

multichannel network creates various KPIs which help the Board to

monitor the business plan of its media business. These KPIs measure

critical attributes: (i) number of creator channel producing

monetizable content; (ii) number of views/audience attracted to

such content; (iii) digital ad yield from such content and

accompanying audience expressed as Revenue Per Thousand. From these

KPIs, the Company can create its forecasts on net revenues and

profit before taxes.

Synergies from the Technology and Media Businesses

Shareholder value is extracted from the synergies that the

technology business and the media business unlock by working

together, requiring the Group to operate as one unified business

rather than as separate subsidiaries. In addition to digital ad

revenue, the MCN provides an audience and content creators upon

which the Company's micro-moments technology may be tested and

productized in through various offerings. Business-to-business

customers, such as brands and advertising agencies, seek to

purchase insight and data with respect to audiences and content.

Moreover, they seek to license technologies that enable them to

target and match content to audience, including content generated

through the Group's MCN. The Company's micro-moment technology

provides business-to-business customers both data analytics and

targeted reach. One KPI that provides the Board an understanding of

the traction from synergies between its technology and media

businesses is the number of business-to-business transactions.

Non-Core Costs

As noted during 2H, the Company engaged in a series of

transactions ranging from acquisitions to capital raising in order

form its go-forward business. Such transactions costs, especially

legal and financial advisory, were significant. While organic

growth will be the focus of execution, because of the marketplace

convergence of media, technology and telecommunications sectors,

acquisitions may be part of the Company. Understanding non-core

costs, as distinct from continuing operating costs, enables the

Board to evaluate capital allocation choices.

Capital

The Board is mindful that it raised GBP8.6 million in its IPO

(GBP6.8 million net of costs) and that such financial resources

need to be applied prudently. Of the total capital raise,

approximately, GBP5 million was categorized as EIS/VCT approved.

Such funding, by regulation, is targeted for the Group's technology

development. The regulations require that the Company use such

investment by 30 September 2021. Cash net of borrowings is a KPI

that enables the Board to manage to its budget. As part of its Net

Cash KPI, the Board plans to track its deployment of EIS/VCT

investment.

KPIs

Given the timing of the launch of the Company's business plan in

the fourth quarter of 2019, after its admission to AIM, there are

no relevant comparators. However, as a baseline for evaluation of

2020 performance, the Board will consider the following KPIs for

the Group:

(i) Technology Products. The Board notes that the Group has a

strong product roadmap based on its "micromoments" insight. The

Group plans to file additional intellectual property in 2020. The

Group spent $227,000 in 4Q on technology development of which

$94,000 was capitalized.

(ii) MCN Creator Channels. At year-end 2019, the MCN had

approximately 10,000 creator channels, of which 1,200 were

monetized.

(iii) MCN Audience. At year-end 2019, the MCN had approximately 12.6 billion views.

(iv) MCN Average RPM. At year-end 2019, the MCN had an average RPM of $1.49.

(v) Business-to-Business Traction. At 31 December 2019, the

Group initiated a pilot with Sumitomo Corporation to deploy its

technology in extending e-commerce during the Rugby World Cup in

Tokyo.

(vi) Non-Core Costs. During the six months to 31 December 2019,

non-core costs amounted to $601,595, reflecting acquisition and

listing costs. An additional $1.6 million was capitalized into the

Group's Share Premium and Retained Earnings account reflecting

transaction costs.

(vii) Net Cash. At the end of 2019, the Group, after transaction

costs, had $9.5 million in cash. The Company invested $227,000 of

EIS/VCT money in technology development.

Principal Risks and Uncertainties

The Group's objectives, policies and processes for measuring and

managing risk are described in note 18. The principal risks and

uncertainties to which the Group is exposed include:

Technological advances within the industry

The technology industry as a whole evolves rapidly with new

entrants and ideas continuously changing the market. There is a

risk that competitors react to opportunities faster, rendering the

Group's technology uncompetitive which could have a material

adverse impact on the prospects of the Group.

Data Protection and General Data Protection Regulation

("GDPR")

Data protection, driven in Europe by GDPR, is becoming

increasingly relevant in the handling of consumer data. Any

failures to follow relevant data protection rules could result in

significant monetary penalties.

Foreign exchange risk

The Group has employees and contractors based overseas paid in

foreign currencies and may enter into contracts priced in foreign

currencies. It is therefore exposed to adverse exchange rate

movements which could cause its costs to increase (relative to its

reporting currency) resulting in reduced profitability for the

Group.

Credit Risk

The Group's credit risk is primarily attributable to its cash

and cash equivalents and trade receivables. The credit risk on

other classes of financial assets is considered insignificant.

Liquidity Risk

The Group manages its liquidity risk primarily through the

monitoring of forecasts and actual cash flows.

Organisational Risk

As a small Group, there is a reliance on a high proportion of

key staff; the loss of any of these staff would be detrimental to

the Group.

New Product Risk

The Group is creating products based on its proprietary

technology, but until the products are released there is no

guarantee that there will be significant uptake from customers.

Advertising Revenue Risk

The Group has historically been dependent on revenue from its

YouTube MCN to generate profitability and changes to the either

market conditions or regulations and the terms of advertising on

YouTube could affect the Group's ability to generate revenues and

profits.

Covid-19 Risk

COVID-19 could impact on the Group's ability to generate

advertising income due to lower customer spending as well as reduce

customers' desire to spend money on the new technologies produced

by the Group given increased budgetary constraints.

Corporate Governance Statement s172 of the Companies Act

Each director must act in a way that, in good faith, would most

likely promote the success of the Group for the benefit of its

stakeholders. A discussion of s172 is presented in the Statement on

Corporate Governance. The Strategic Report incorporates actions

taken by the Group to ensure compliance with s172.

By order of the Board

Patrick DeSouza

Non-Executive Chairman

29 June 2020

Directors' Report

The Directors present their report on the affairs of

Entertainment AI plc (the "Company") and its subsidiaries, referred

to as the Group, together with the audited Financial Statements and

Independent Auditors' report for the year ended 31 December

2019.

Principal Activities

The Group is a global social media and technology platform for

sharing video micro-moments to enable discovery, sharing and

e-commerce through the targeting and connecting of creators,

audiences and brands.

Results

The financial performance in this report relates to the six

months ended 31 December 2019 following the Board's decision to

amend the Company's year end from 30 June to 31 December to reflect

the formation of the Entertainment AI plc group during 4Q 2019. The

Group's Statement of Comprehensive Income and the Group's financial

position at the end of the year, is shown in the Financial

Statements.

During this six month period, the Company was transformed by the

acquisition of its three US subsidiaries; Tagasauris, GTChannel and

EAI Inc. Alongside these acquisitions, the Company: (i)

successfully raised GBP8.6 million through a placing and

subscription; (ii) admitted its shares to AIM; (iii) renamed the

Group from Blockchain Worldwide plc to Entertainment AI plc to

reflect the transformation of the business from a cash shell to an

operating business; and (iv) changed its Board to reflect the new

ownership structure. As a result of these acquisitions, these

results reflect the results for only the Company to 29 September

2019 and the results for the enlarged Group from the period to 30

September 2019 to 31 December 2019, rendering comparisons between

this reporting period and prior financial reporting periods less

relevant.

Future Developments

The Company has chosen in accordance with section 414C(11) of

the Companies Act 2006 to include the disclosure of likely future

developments in the Strategic Report.

Going Concern

At the time of approving the financial statements, the Directors

have a reasonable expectation that the Company and the Group have

adequate resources to continue in operational existence for the

foreseeable future. In reaching this conclusion the Directors have

considered the financial position of the Group, taking into

consideration the recent fundraising, together with its forecasts

and projections for two years from the reporting date that take

into account reasonably possible changes in trading performance

including those that the Coronavirus may cause. The going concern

basis of accounting has therefore been adopted in preparing the

financial statements.

Dividends

The Directors do not recommend the payment of a dividend (30

June 2019: nil).

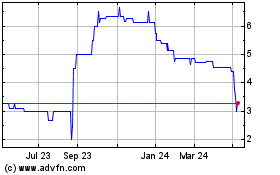

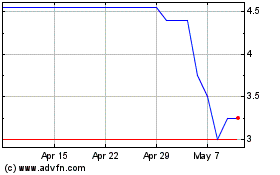

Share Price

On 31 December 2019, the closing market price of Entertainment

AI plc ordinary shares was 42.5 pence. The highest and lowest

prices of these shares during the year to 31 December 2019 were

52.5 pence and 38.5 pence respectively.

Capital Structure

Details of the authorised and issued share capital are shown in

Note 18. No person has any special rights of control over the

Company's share capital and all issued shares are fully paid.

Treasury Operations & Financial Instruments

The Group operates a centralised treasury function which is

responsible for managing liquidity, interest and foreign currency

risks associated with the Group's activities.

The Group's principal financial instrument is cash, the main

purpose of which is to fund the Group's operations.

The Group has various other financial assets and liabilities

such as trade receivables and trade payables naturally arising

through from its operations.

The Group's exposure and approach to capital and financial risk,

and approach to managing these is set out in note 18 to the

consolidated financial statements.

Subsequent Events

On 29 June 2020, the Board approved that the Company change its

name from Entertainment AI plc to SEEEN plc to better communicate

to the marketplace the Company's suite of products and target

markets. This name change will become effective as soon as it is

registered by Companies House in the UK. Upon such registration,

the Company's website shall be seeen.com. All documents of the

Company shall be located at the new website in accordance with AIM

regulations.

In April 2020, the US subsidiaries of the Group received loan

(Loan) proceeds in the amount of approximately $198,000 under the

Paycheck Protection Program ("PPP"). The PPP, established as part

of the Coronavirus Aid, Relief and Economic Security Act ("CARES

Act"), provides for loans to qualifying businesses to maintain

workforce stability. Under the terms of the PPP, certain amounts of

the Loan may be forgiven if they are used for qualifying expenses

as described in the CARES Act. Any unforgiven portion of the PPP

loan is payable over two years at an interest rate of 1%, with a

deferral of payments for the first six months.

Directors

The Directors who served the Company during the year and up to

the date of this report were as follows:

Executive Directors

Todd Carter (Appointed 30 September 2019)

Scott Schlichter (Appointed 30 September 2019)

Non-Executive Directors

Patrick DeSouza (Appointed 30 September 2019)

Akiko Mikumo (Appointed 30 September 2019)

Mike Kelly (Appointed 30 September 2019)

David Anton (Appointed 30 September 2019)

Rodger Sargent (Resigned 30 September 2019)

Jon Hale (Resigned 30 September 2019)

The biographical details of the Directors of the Company are set

out on the Company's website www.entertainmentai.co.uk . Upon

registration of the Company's new name of SEEEN, the website shall

be seen.com .

Directors' Indemnity

The Company's Articles of Association provide, subject to the

provisions of UK legislation, an indemnity for Directors and

officers of the Company in respect of liabilities they may incur in

the discharge of their duties or in the exercise of their powers,

including any liabilities relating to the defence of any

proceedings brought against them which relate to anything done or

omitted, or alleged to have been done or omitted, by them as

officers or employees of the Company. Appropriate directors' and

officers' liability insurance cover is in place in respect of all

the Directors.

Directors' Conflicts of Interest

In the event that a Director becomes aware that they, or their

connected parties, have an interest in an existing or proposed

transaction involving the Group, they will notify the Board in

writing or at the next Board meeting.

Political Donations

The Group did not make any political donations during the six

months to 31 December 2019 (12 months to 30 June 2019: GBPNil).

Directors' emoluments

6 months to 31 December 2019 Salary, Fees

& Bonus Benefits Total

------------------------------

$ $ $

------------------------------ ------------- --------- -------

Executive Directors

T Carter 50,000 - 50,000

S Schlichter 50,000 - 50,000

Non-Executive Directors

P DeSouza 12,500 - 12,500

A Mikumo 12,500 - 12,500

M Kelly 12,500 - 12,500

D Anton 12,500 - 12,500

R Sargent - - -

J Hale - - -

- - -

------------------------------ ------------- --------- -------

12 months to 30 June 2019 Salary, Fees

& Bonus Benefits Total

------------------------------

$ $ $

------------------------------ ------------- --------- -------

Non-Executive Directors

R Sargent - - -

J Hale - - -

------------------------------ ------------- --------- -------

- - -

------------------------------ ------------- --------- -------

Directors' interests

The Directors who held office at 31 December 2019 and subsequent

to year end had the following direct interest in the ordinary

shares of the Company at 31 December 2019 and at the date of this

report:

Number of shares % held at

at 31 December 31 December Number of shares % held at

2019 2019 at 29 June 2020 26 Jun 2020

S Schlichter 5,870,406 11.8% 5,870,406 11.8%

P DeSouza 5,426,165 10.9% 5,426,165 10.9%

T Carter 2,813,309 5.6% 2,813,309 5.6%

--------------- ---------- ------------- ----------------- -------------

In addition to the above, the following directors were granted

options with no vesting period over Ordinary Shares on 30 September

2019 as part of the completion of the Group's Admission to AIM.

These options were issued as part of the transactions, including

the Company's admission to AIM and are not designed as options for

Employee Incentivization. The Group expects to issue options for

Employee Incentivization during 2020.

Name Number of options Exercise Price First exercise

date

-------------- ------------------ --------------- ------------------

Todd Carter 1,977,083 45p 30 September 2020

Akiko Mikumo 152,083 45p 30 September 2020

Mike Kelly 152,083 45p 30 September 2020

David Anton 152,083 45p 30 September 2020

Substantial Shareholders

As well as the Directors' interests reported above, the

following interests of 3.0% and above as at the date of this report

were as follows:

Number of shares % held

------------------------------- ---------------- ------

Gresham House Asset Management

Limited 6,666,666 13.3%

Canaccord Genuity Group Inc. 4,444,444 8.9%

Water Intelligence plc 3,855,032 7.7%

Taro Koki 3,601,436 7.2%

Sumitomo Corporation 2,314,815 4.6%

Rathbone Investment Management

Limited 1,732,540 3.5%

------------------------------- ---------------- ------

Employees

The Group has established employment policies which are

compliant with current legislation and codes of practice. The Group

is an equal opportunities employer.

Independent Auditors

Crowe U.K. LLP has expressed their willingness to continue in

office. In accordance with section 489 of the Companies Act 2006,

resolutions for their re-appointment and to authorise the Directors

to determine the Independent Auditors' remuneration will be

proposed at the forthcoming Annual General Meeting.

Statement of disclosure to the Independent Auditor

Each of the persons who are directors at the time when this

Directors' report is approved has confirmed that:

-- so far as that director is aware, there is no relevant audit

information of which the Company and the Group's auditor is

unaware; and

-- that director has taken all the steps that ought to have been

taken as a director in order to be aware of any relevant audit

information and to establish that the Company and the Group's

auditor is aware of that information.

By order of the Board

Patrick DeSouza

Non-Executive Chairman

29 June 2020

Corporate Governance Statement

As a Board, we believe that practising good Corporate Governance

is essential for building a successful and sustainable business in

the long-term interests of all stakeholders. Entertainment AI's

shares are listed on AIM, a market operated by the London Stock

Exchange.

Upon Admission to AIM on 30 September 2019, Entertainment AI has

adopted the QCA Corporate Governance Code. The Company has adopted

a share dealing code for the Board and employees of the Company

which is in conformity with the requirements of Rule 21 of the AIM

Rules for Companies. The Company takes steps to ensure compliance

by the Board and applicable employees with the terms of such

code.

The following sections outline the structures, processes and

procedures by which the Board ensures that high standards of

corporate governance are maintained throughout the Group.

Further details can be found on our website at

www.entertainmentai.co.uk/corporate-governance.

Takeovers and Mergers

The Company is subject to The City Code on Takeovers and

Mergers.

Board

The Board, chaired by Dr. Patrick DeSouza, comprises two

executive and three non-executive directors. The Board oversees and

implements the Company's corporate governance programme. As

Chairman, Dr. DeSouza is responsible for the Company's approach to

corporate governance and the application of the principles of the

QCA Code. Akiko Mikumo, Mike Kelly and David Anton are the

Company's independent directors, with Akiko Mikumo being the Senior

Independent Director. The Board is supported by four committees:

Audit, Remuneration, Personnel and Strategy. The Audit and

Remuneration Committees are the principal committees for Corporate

Governance.

Each Board member commits sufficient time to fulfill their

duties and obligations to the Board and the Company. They are

required to attend at least 4 Board meetings annually and join

Board calls that take place between formal meetings and offer

availability for consultation when needed.

Board papers are sent out to all directors in advance of each

Board meeting including management accounts and accompanying

reports from those responsible.

Meetings held during the period between 1 July 2019 and 31

December 2019 and the attendance of directors is summarised below.

Given the timing of the transactions and admission to AIM during

4Q, certain committees did not meet between completion of the

transactions on 30 September 2019 and the period end.

Board meetings Audit committee Remuneration committee

Possible (attended) Possible (attended) Possible (attended)

------------------ -------------------- -------------------- -----------------------

Todd Carter 2/2

Scott Schlichter 2/2

Patrick DeSouza 2/2

Akiko Mikumo 2/2

Mike Kelly 2/2

David Anton 2/2

Rodger Sargent 2/2 1/1

Jon Hale 2/2 1/1

------------------ -------------------- -------------------- -----------------------

Board Committees

The Board has established an Audit Committee, Remuneration

Committee, Nominations Committee and Strategy Committee with

delegated duties and responsibilities.

(a) Audit Committee

The Audit Committee has the primary responsibility for

monitoring the quality of internal control, ensuring that the

financial performance of the Company is properly measured and

reported on and for reviewing reports from the Company's auditors.

The Audit Committee will meet at least twice a year at appropriate

times in the reporting and audit cycle and otherwise when required.

The Audit Committee will also meet with the Company's auditors at

least once a year.

The Audit Committee comprises Mike Kelly, David Anton and Akiko

Mikumo and is chaired by Patrick DeSouza.

(b) Remuneration Committee

The Remuneration Committee is responsible for the review and

recommendation of the scale and structure of remuneration for

executive directors and other designated senior management, taking

into account all factors which it deems necessary. The Remuneration

Committee considers all aspects of the executive directors'

remuneration including pensions, benefits and share option awards.

No director will be involved in any decision as to his or her own

remuneration. The Remuneration Committee will meet at least twice a

year and otherwise when required. In exercising this role, the

Directors shall have regard to the recommendations put forward in

the QCA Corporate Governance Code and, where appropriate, the QCA

Remuneration Committee Guide and associated guidance.

The Remuneration Committee comprises Mike Kelly and David Anton

and is chaired by Akiko Mikumo. As the Remuneration Committee will

comprise all of the Independent Non-Executive Directors, this

committee also considers related party matters as they arise.

(c) Nominations Committee

The Nominations Committee is responsible for consideration of

future succession plans for Board members as well as to whether the

New Board has the skills required effectively to manage the

Enlarged Group. The Nominations Committee will also be responsible

for, amongst other things, identifying and nominating members of

the Board, recommending Directors to be appointed to each committee

of the Board and the chair of each such committee. The Nominations

Committee also arrange for evaluation of the Board.

The Nominations Committee meets on an ad-hoc basis and comprises

Patrick DeSouza, Akiko Mikumo and is chaired by Mike Kelly.

(d) Strategy Committee

The strategy committee is responsible for reviewing and

considering the following matters: (i) control over the strategy

development and its implementation; (ii) acquisitions and business

sale transactions; (iii) major investment projects, investment

budget allocation and key financial targets.

The Strategy Committee comprises Patrick DeSouza, Akiko Mikumo

and Mike Kelly and is chaired by David Anton.

(e) Advisory Panel

The Company has an Advisory Panel, comprised of Charlie Collier,

Thomas Glocer and Chris Welty. The purpose of the Advisory Panel is

to enable the Directors to draw upon the skills of these industry

experts as well as supporting Entertainment AI in accessing growth

opportunities via the network of contacts of each member of the

Advisory Panel. The Advisory Panel meets on an ad-hoc basis and is

available for consultations with Directors as required.

Board Experience

All members of the board bring complementary skill sets to the

Board. One director is female and five are male. The board believes

that its blend of relevant experience, skills and personal

qualities and capabilities is sufficient to enable it to

successfully execute its strategy. In addition, the Board receives

regular updates from, amongst others, its nominated adviser, legal

counsel and company secretary in relation to key rule changes and

corporate governance requirements, as well as regular liaison with

audit firms both in the UK and the US in respect of key disclosure

and accounting requirements for the Group, especially as accounting

standards evolve. In addition, each new director appointment is

required to receive AIM rule training from the Company's nominated

adviser at the time of their appointment.

Patrick J. DeSouza, Chairman

Term of office: Appointed 30 September 2019.

Since 2010 Dr. DeSouza has been the Executive Chairman of Water

Intelligence plc, a rapidly growing AIM quoted business focusing on

technology transformation of the water industry. He has 25 years of

operating and financial advisory leadership experience with both

public and private companies in media and technology and asset

management industries. Over the last 15 years, Dr. DeSouza has also

invested in and incubated technology companies centered at Yale

University. Dr. DeSouza has served at the White House on the

National Security Council. He is a graduate of Columbia College,

Yale Law School and Stanford Graduate School. He is a member of the

Council on Foreign Relations.

Todd Carter, Chief Executive Officer

Term of office: Appointed 30 September 2019.

Todd is the Co-Founder & CEO of Tagasauris, which was

acquired by Entertainment AI on 30 September 2019. Prior to

Tagasauris, he was Co-founder/President of OWL Multimedia, Inc. a

music search technology company centered at Yale University and

Co-Founder/CTO of Busy Box, a publicly traded technology company.

He co-authored the AXS File Concatenation Protocol, an early

standard for image metadata representation that found broad

adoption in the printing and publishing industries including by

Reuters, Agence France Presse, and PressLink. Todd was also a

member of ISO/IEC JTC1/SC29/WG11, more commonly known as the Moving

Pictures Experts Group, a working group that develops international

standards for audio-visual information representation.

Scott Schlichter, Executive Director

Term of office: Appointed 30 September 2019.

Scott is the Co-Founder & CEO of GTChannel, which was

acquired by Entertainment AI on 30 September 2019. Prior to

GTChannel, Scott launched and managed Hysteria, Inc., Dogma

Studios, and advised several start-ups including JusCollege. He has

25 years of experience in entertainment and digital video and has

launched several media focused start-ups with clients including

major Hollywood studios, network television companies, and cable

channels.

Akiko Mikumo, Senior Independent Non-executive Director

Term of office: Appointed 30 September 2019.

Akiko is a retired partner at Weil Gotshal and Manges LLP, one

of the world's leading law firms. She has over 35 years of mergers

and acquisitions, securities and governance experience. Her clients

have included some of the leading media and technology companies

and investment firms. Akiko founded the Hong Kong office of Weil

and led the growth of its London office. She served as a member of

the firm's Management Committee. Ms. Mikumo is a director of

Cambridge Science Corporation, a biotech investment company in

Cambridge Massachusetts. Recently, she served as a fellow at

Harvard's Advanced Leadership Initiative. She is a graduate of

University of California, Berkeley and New York University School

of Law.

Mike Kelly, Independent Non-executive Director

Term of office: Appointed 30 September 2019.

Mike is the Co-Founder of Kelly Newman Ventures, LLC, an

advisory and investment firm. He was formerly Chief Executive

Officer of The Weather Channel Companies, a leading weather-focused

media and technology company owned by a consortium made up of The

Blackstone Group, Bain Capital, and NBCU. Prior to that, he served

as the President of AOL Media Networks, a division of Time Warner

where he pioneered the media network strategy through a number of

successful acquisitions such as Advertising.com and Tacoda. He

currently serves on the Board of Directors of Cars.com (NYSE:Cars),

is the non-exec Chairman of BGF backed Dianomi LTD, a UK based

marketing platform and is a member of the Board of Quantcast

Corporation, a US based technology company that specializes

real-time advertising, He is a graduate of the University of

Illinois, Champaign-Urbana.

David Anton, Independent Non-executive Director

Term of office: Appointed 30 September 2019.

David is Chief Executive Officer of Anton & Partners, a

leading advertising, branding, and marketing communication company

with a 20-year track record of creating impact for some of the

worlds most notable brands in fashion, lifestyle, financial and

automotive sectors. David is a serial entrepreneur and has founded

various successful companies. He is an investor in and advisor to

Village Roadshow Productions, leading movie production company.

David has advised, co-founded and invested in multiple companies

such as Tori Burch, Roqu Media International, Village Roadshow and

Spotify among others. He is a graduate of Columbia University.

The Group has a non-Board Chief Financial Officer, Adrian

Hargrave, who reports regularly to the Chief Executive Officer and

Non-Executive Chairman and assist in the preparation of Board

materials and in reviewing the budget and ongoing performance.

The Company Secretary is responsible for ensuring that Board

procedures are followed and that all applicable rules and

regulations are complied with. Adrian Hargrave currently performs

the role of Company Secretary, providing an advisory role to the

Board. The Company Secretary is supported and guided in this role

by the Company's legal advisors.

The Directors have access to the Company's CFO/Company

Secretary, NOMAD, lawyers and auditors as and when required and are

able to obtain advice from other external bodies when

necessary.

Board Performance and Effectiveness

The performance and effectiveness of the Board, its committees

and individual Directors is reviewed by the Chairman and the Board

an ongoing basis. Training is available should a Director request

it, or if the Chairman feels it is necessary. The performance of

the Board is measured by the Chairman and Akiko Mikumo, the Senior

Independent Non-Executive Directors, with reference to the

Company's achievement of its strategic goals.

Risk Management

The Directors recognise their responsibility for the Group's

system of internal control and have established systems to ensure

that an appropriate and reasonable level of oversight and control

is provided. The Group's systems of internal control are designed

to help the Group meet its business objectives by appropriately

managing, rather than eliminating, the risks to those objectives.

The controls can only provide reasonable, not absolute, assurance

against material misstatement or loss.

The Chief Executive Officer with the assistance of the Company

Secretary and the Chief Financial Officer manages a risk register

for the Group that identifies key risks in the areas of corporate

strategy, financial, clients, staff, environmental and the

investment community. The Governance Committee of the Board are

provided with a copy of the register. The register is reviewed

periodically and is updated as and when necessary.

Within the scope of the annual audit, specific financial risks

are also evaluated in detail, including in relation to foreign

currency, interest rates, debt covenants, taxation and

liquidity.

The annual budget is reviewed and approved by the Board.

Financial results, with comparisons to budget and latest forecasts

are reported on a monthly basis to the Board together with a report

on operational achievements, objectives and issues encountered.

Significant variances from plan are discussed at Board meetings and

actions set in place to address them.

Approval levels for authorisation of expenditure are at set

levels throughout the management structure with any expenditure in

excess of pre-defined levels requiring approval from the

Non-Executive Chairman and the Chief Financial Officer.

Measures continue to be taken to review and embed internal

controls and risk management procedures into the business processes

of the organisation and to deal with areas of improvement which

come to the management's and the Board's attention. We expect the

internal controls for the business to change as the business

expands both geographically and in terms of product

development.

The Company's auditors are encouraged to raise comments on

internal control in their management letter following their audit,

and the points raised and actions arising are monitored through to

completion by the Audit Committee.

Corporate Culture

The Group aims to operate ethically and be socially responsible

in its actions. Importantly, the Board recognises that the Group's

employees are its most important asset.

The Group is committed to achieving equal opportunities and to

complying with relevant anti-discrimination legislation. It is

established Group policy to offer employees and job applicants the

opportunity to benefit from fair employment, without regard to

their sex, sexual orientation, marital status, race, religion or

belief, age or disability. Employees are encouraged to train and

develop their careers.

The Group has continued its policy of informing all employees of

matters of concern to them as employees, both in their immediate

work situation and in the wider context of the Group's

well-being.

In addition, all directors and senior employees are required to

abide by the Group's share dealing code, which was updated at the

time of admission to AIM.

Audit Committee Annual Review

The role of the Audit Committee is to monitor the quality of

internal controls and check that the financial performance of the

Group is properly assessed and reported on. It receives and reviews

reports from the Chief Financial Officer, other members of

management and external auditors relating to the interim and annual

accounts and the accounting and internal control systems in use

throughout the Group. The members of the Audit Committee are

Patrick DeSouza (Chairman), Akiko Mikumo, Mike Kelly and David

Anton.

The Chief Executive Officer and Chief Financial Officer are

invited to attend parts of meetings. The external auditors attend

meetings to discuss the conclusions of their work and meet with the

members of the Committee. The Committee is able to call for

information from management and consults with the external auditors

directly as required.

The objectivity and independence of the external auditors is

safeguarded by reviewing the auditors' formal declarations,

monitoring relationships between key audit staff and the Company

and tracking the level of non-audit fees payable to the

auditors.

The currently constituted Audit Committee was established on 30

September 2019 after Admisson to AIM and had not met prior to 31

December 2019. Pre-Admission, the Company's Audit Committee as

previously constituted met. The Audit Committee t is expected to

meet twice during each financial year, to review the annual

accounts and the interim accounts. The Committee will review with

the independent auditor its judgements as to the acceptability of

the Company's accounting principles. The currently constituted

Audit Committee has met with the Group's external auditors since

the period end in preparation for the Board to approve the 2019

accounts.

In addition, the Committee monitors the auditor firm's

independence from Company management and the Company.

Remuneration Committee Annual Review

The Remuneration Committee was established on 30 September 2019

and prior to 31 December 2019 had not convened. The Committee

comprises Akiko Mikumo, Mike Kelly and David Anton, with Akiko

Mikumo as Chairman. The Remuneration Committee is responsible for

reviewing the performance of Executive Directors and determining

the remuneration and basis of service agreement. The Remuneration

Committee also determines the payment of any bonuses to Executive

Directors and the grant of options. Where appropriate the Committee

consults the Non-Executive Chairman regarding its proposals. No

Director plays a part in any discussion regarding his or her own

remuneration.

Relations with Shareholders

The Company is available to hold meetings with its shareholders

to discuss objectives and to keep them updated on the Company's

strategy, Board membership and management.

The board also welcome shareholders' enquiries, which may be

sent via the Company's website www.entertainmentai.co.uk . Upon

registration of the Company's new name of SEEEN, the website shall

be seeen, com.

Corporate Governance Statement s172 of the Companies Act

Each director must act in a way that, in good faith, would most

likely promote the success of the Group for the benefit of its

stakeholders. The board of directors consider, both individually

and together, that they have acted in the way they consider, in

good faith, would be most likely to promote the success of the

company for the benefit of its members as a whole (having regard to

the stakeholders and matters indicated in S172) in the decisions

taken during the year ended 31 December 2019. Following is an

overview of how the Board performed its duties during 2019.

Shareholders

The Chairman, Chief Executive Officer and Chief Financial

Officer, members of the Board and senior executives on the

management team have regular contact with major shareholders. The

Board receives regular updates on the views of shareholders which

are taken into account when the Board makes its decisions. On 30

September 2019, the Company raised capital largely from

institutional investors to fund its business plan. The Company

received feedback during that process, as well as subsequent

meetings and calls alongside trading updates issued by the

Group.

Employees

The Group encourages an environment of openness and debate and

welcomes all feedback from within.

The Board communicates with senior management and employees. The

Group also operates internal platforms, which staff can access as

required and is a source of both discussion and sharing information

relevant to employees. Details of the Group's performance are

shared with all employees at appropriate times using these

methods.

The Group expects a high standard from its staff and provides

training to achieve this. Where possible, as new roles in the

organisation arise, the Group aims to promote from within.

Customers

The Group currently has one primary revenue generating customer,

which is YouTube. Through the Group's MCN, the Group provides video

inventory to YouTube. In turn YouTube sells digital adverts against

this video inventory. The Group aims to maintain strong relations

with YouTube, including the provision of suitable videos and

assisting with any queries in relation to videos provided by the

MCN.

Going forwards, the Group expects to broaden its customer base

and the Board will pay significant levels of attention to the

quality of our delivery to all customers.

Content Creators

The Group's MCN business sources a large proportion of the

content it provides from third party content creators. The Group

maintains regular contact with the creators through the MCN

management team. The Group is committed to conducting business with

content creators fairly and in an ethical fashion.

Community

The Group is aware that the dissemination of video carries with

it social responsibility to the broader community. Board and

management are committed to the highest levels of professionalism

in the aggregation and dissemination of video content and to ensure

compliance with relevant data compliance regulations.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and the Financial Statements in accordance with the Companies Act

2006 and for being satisfied that the Financial Statements give a

true and fair view. The Directors are also responsible for

preparing the Financial Statements in accordance with International

Financial Reporting Standards ("IFRSs") as adopted by the European

Union.

Company law requires the Directors to prepare Financial

Statements for each financial period which give a true and fair

view of the state of affairs of the Company and the Group and of

the profit or loss of the Company and the Group for that period. In

preparing those Financial Statements, the Directors are required

to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable and prudent;

-- state whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the Financial Statements; and

-- prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Company and the

Group will continue in business.

The Directors confirm that they have complied with the above

requirements in preparing the Financial Statements. The Directors

are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions, disclose

with reasonable accuracy at any time the financial position of the

Company and the Group, and to enable them to ensure that the

Financial Statements comply with the Companies Act 2006.

They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

Website publication

The Directors are responsible for ensuring the Annual Report and

Financial Statements are made available on a website.

As of this publication date, Financial Statements are published

on the Group's website ( www.entertainmentai.co.uk ) in accordance

with legislation in the United Kingdom governing the preparation

and dissemination of Financial Statements, which may vary from