TIDMTWD

RNS Number : 7976Z

Trackwise Designs PLC

23 September 2020

23 September 2020

TRACKWISE DESIGNS PLC

("Trackwise", the "Company" or the "Group")

Interim Results for the six months ended 30 June 2020

Trackwise Designs (AIM: TWD), a leading provider of specialist

products using printed circuit technology, is pleased to announce

its interim results for the six months ended 30 June 2020.

Financial highlights

-- Revenues GBP2.39m (H1 2019: GBP1.547m)

-- Improved Harness Technology(TM) ("IHT") revenues of GBP252k (H1 2019: GBP547k)

-- Gross margin 17.8% (H1 2019: 38%)

-- Adjusted E BITDA of GBP102k (H1 2019: GBP237k)

-- Adjusted o perating loss of GBP365k (profit H1 2019: GBP61k)

-- Reported profit after taxation of GBP921k (loss H1 2019: GBP(64k))

-- Net cash* of GBP1.612m (31 December 2019: net debt GBP0.302m)

-- Basic EPS of 4.98 pence per share

* Excludes IFRS 16 lease liabilities

Operational highlights

-- Trading performance impacted by COVID-19

-- Gross margin reflects increased capacity investment prior to

anticipated increased business and the impacts of COVID-19

-- Acquisition of Stevenage Circuits Ltd ("SCL"), for an adjusted total consideration of GBP1.8m

o strengthening manufacturing capabilities and customer base

o SCL has traded cash positively since acquisition

-- Deepened relationships with key customers in our target IHT

markets: electric vehicles ("EV"), medical and aerospace, including

first production order for IHT in EV

o increased IHT total customers and opportunities to 82 (H1

2019: 57)

o 10 NDAs signed in period to commence design phase of potential

new customer orders; (14 including post-period NDAs); building a

pipeline of future revenue opportunities

Post period highlights

-- Significant manufacturing agreement signed with UK EV OEM worth up to GBP38m

-- Commissioning of Direct Imaging machine to facilitate

increased IHT production efficiency and capacity at Tewkesbury

site

-- Continued investment in capabilities to support series production

Outlook

Looking ahead, while the Company's full year performance will

reflect the difficult economic trading conditions, the EV

manufacturing contract win and progress in our two other core

target markets, medical and aerospace, support our convictions of

IHT's merit and its potential to be a catalyst for transformation

in these markets, with our innovation enabling the global

technology of the future. We are excited about the near and

long-term prospects for Trackwise with growing visibility of an

increasing number of opportunities.

Philip Johnston, CEO of Trackwise, commented : "While the

business remained open and safely operational throughout the

period, like many businesses we were not immune from the impacts of

COVID-19. Nevertheless we have made excellent progress

strategically with the acquisition of Stevenage Circuits, which has

extended our product range, our expertise and customer base and

increased our production capabilities, enabling us to move towards

the facility in Tewkesbury becoming dedicated to IHT

production.

Since the period end, we completed the commissioning of the

critical roll to roll direct imaging machine, which represents the

final investment of our IPO proceeds and we secured the highly

significant three-year contract to manufacture IHT for electric

vehicles.

Looking ahead, while the Company's full year performance will

reflect the difficult economic trading conditions, the EV

manufacturing contract win and progress in our two other core

target markets, medical and aerospace, support our convictions of

IHT's merit and its potential to be a catalyst for transformation

in these markets, with our innovation enabling the global

technology of the future.

With a growing customer base and pipeline, and a net cash

position, we are confident in our ability to deliver on these

growth opportunities as trading conditions normalise."

Enquiries

Trackwise Designs plc +44 (0)1684 299 930

Philip Johnston, CEO www.trackwise.co.uk

Mark Hodgkins, CFO

finnCap Ltd +44 (0)20 7220 0500

NOMAD and Broker

Ed Frisby/Matthew Radley - Corporate

Finance

Andrew Burdis/Manasa Patil - ECM

Alma PR +44 (0)20 3405 0205

Financial PR and IR

Caroline Forde/Josh Royston/David

Ison/Kieran Breheny

Notes to editors

Trackwise is a UK-based manufacturer of specialist products

using printed circuit technology.

The full suite includes: Improved Harness Technology(TM) ("IHT")

and Advanced PCBs - Microwave and Radio Frequency ("RF"), Short

Flex, Flex Rigid and Rigid Multilayer products.

IHT uses a proprietary, patented process that Trackwise has

developed to manufacture multilayer flexible printed circuits of

unlimited length. While the technology has many applications, the

directors expect that one of its primary uses will be to replace

traditional wire harness in a variety of industries.

The Company manufactures on two sites, located in Tewkesbury and

Stevenage (following the acquisition of Stevenage Circuits Ltd in

April 2020). It serves customers in Europe, North America, Asia and

Australia.

Trackwise Designs plc was admitted to trading on AIM in 2018

with the ticker TWD. For additional information please visit

www.trackwise.co.uk .

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014.

Chairman's Statement

While we acknowledge the impact of COVID-19 on the short-term

trading environment, which impeded our ability to complete our

investment into new equipment and has prolonged sales cycles, we

remain excited about the near and long-term prospects for Trackwise

and have visibility of a growing number of opportunities.

The wellbeing of our staff has remained our top priority

throughout. We have maintained our strict adherence to all UK

Government safety guidelines and focused on working from home where

possible, while implementing strict social distancing and

additional hygiene measures in our facilities. Our teams responded

well to the challenges and I would like to thank them for their

efforts.

CEO's Statement

Despite COVID-related headwinds affecting our trading

performance, we are pleased to report on excellent strategic

progress for the Company during the period. Major achievements have

been made in both our production capabilities and our reach into

target markets.

The key highlight in the period was the acquisition of SCL in

April 2020. This acquisition represents a transformational step

forward for Trackwise, extending our manufacturing capabilities and

providing capacity at Tewkesbury to deliver IHT series production,

while diversifying our revenue streams and customer base.

Post period, the announcement of our first series production

order from a UK based manufacturer of electric vehicles signified

the next stage of progress for our IHT flexible printed circuit

technology and was a key step into one of our strategic

markets.

Impact of COVID-19

COVID-19 has impacted much of the manufacturing industry and,

despite good progress against our strategic objectives, trading

remains challenging across our business. Much of our typical run

rate business has continued, but we have seen a slow-down in new

orders. A number of new opportunities across our product range

remain in discussion with associated revenues now predominantly

expected in the following financial year.

Revenues from the medical sector were impacted by the delayed

commissioning of new machinery due to lockdown restrictions and

this impacted deliveries to a customer. This has now been rectified

and the product has been supplied to our customer. We were not

alone in experiencing delays in the arrival of manufacturing

machinery, with anticipated follow-on orders from customers

impacted by delays due to the lockdowns in Europe. We will continue

to monitor the situation across our end markets and track our

expectations against the sector-wide performance of these

industries .

Upgrades to Flexible Printed Circuit ("FPC") manufacturing

operations

We continued to strengthen our production capability and

capacity by investing in new equipment, installing and

commissioning an advanced roll-to-roll direct imaging system and a

roll-to-roll flexible circuit laser drilling system. This

investment, alongside the acquisition of SCL, will enable Trackwise

to significantly boost its operational throughput and address

growing customer interest in FPCs based on proprietary IHT

technology. We are now much better positioned to serve future

market opportunities as they arise, supporting greater volume

demands, as well as providing enhanced levels of quality.

IHT

Our IHT technology remains the growth driver for Trackwise and

we are confident in the applicability of this proprietary

technology to our chosen markets and the significant revenues this

has the potential to generate.

We have set out the three markets where we expect to see the

greatest levels of growth for IHT. These are:

1. Electric vehicles

2. Medical

3. Aerospace

We have seen positive developments across these markets during

this period. IHT customers and opportunities grew to 82 by the end

of the period (31 December 2019: 72).

Most significantly, in February we announced an order for the

supply of flex PCBs to a UK EV OEM, with a follow-on manufacturing

agreement signed earlier this month that could be worth up to

GBP38m over three years subject to annual pricing reviews. This

deal is Trackwise's first order for full series production of IHT

and is a strong validation of the application of our technology to

this market and delivery capability.

We remain active in looking for further opportunities within EVs

and expect to benefit from the growing emphasis on the

sustainability agenda and an increasing legislative pressure to

force the automotive sector towards non-fossil fuel motive

power.

There continues to be encouraging levels of interest in IHT from

the medical industry and we continue to work closely with

prospective customers on trials of our technology with a view to

securing a meaningful uptick in revenues in FY21.

In aerospace, our developments with GKN of next generation

systems continue despite the well-documented industry-wide

slowdown.

In the near-term, revenue opportunities will likely continue to

be hindered by COVID-19 disruption, but we remain confident in the

applicability of IHT to all our chosen market sectors.

SCL Acquisition and integration

We completed the transformational acquisition of Stevenage

Circuits Ltd in April 2020, funded through the support of existing

and new investors in a GBP5.87m placing, significantly increasing

our production capabilities. Our focus since completion of the

acquisition has been to ensure the integration of SCL is as

seamless as possible. SCL has been cash generative since the

acquisition, providing a valuable base of largely recurring

revenue. SCL has continued to win new contracts with key accounts,

though these new projects and associated revenues are expected to

be delivered in H2, principally because of COVID-19 related

disruption.

RF

The forthcoming roll out of 5G technology is a re-equipment

opportunity which the Board believe will create demand for the

Company's RF products, now part of the Advanced PCB division.

However, RF continues to be impacted by factors such as Brexit and

the US-China trade war, and continues to be compounded by the

uncertainty caused by COVID-19. We have adjusted our budget for RF

for the year to reflect these factors. RF continues to be

profitable, adding value to the Group as a whole.

Financial Review

Revenue for the period increased to GBP2.389m (H1 2019:

GBP1.547m), benefitting from the inclusion of SCL for Q2. These

numbers were disappointing and were the result of the impacts of

COVID-19. The issue of new equity at the time of the SCL

acquisition strengthened the balance sheet, with net cash of GBP

1.564m at the end of June 2020.

We have continued to invest in our know-how and technical

capability which will support the increasing amount of IHT business

that we will have throughout the coming years.

Our acquisition of SCL was attractively priced and we acquired

the business at a discount to stated net assets, and this gave rise

to a credit to the Group P&L account of GBP1.54m which has

bolstered distributable reserves and net assets accordingly. We

were able to enforce our rights under the acquisition agreement to

have restitution of funds to make good premises and equipment

deficiencies that were agreed post acquisition.

The outcome of the period is that earnings per share are 4.98p (H1 2019: (0.43) p) .

Summary & Outlook

While COVID-19 impacted revenues in the first half of the year,

delaying both the receipt of new orders and the ability to complete

our investment in our production facilities, it was nonetheless a

period of excellent strategic progress, underpinned by a base of

recurring revenues and profit generation in the Advanced PCB

business, incorporating RF. The acquisition of SCL has transformed

our production capabilities, paving the way for IHT production at

scale, while bringing additional expertise and customer base. We

have been pleased with the integration and performance of the

business to date.

Looking ahead, we are confident the recent IHT manufacturing

agreement with a UK manufacturer of EVs will be the catalyst for a

step change in Trackwise's revenue and a solid platform on which to

build. This, alongside the progress we are making elsewhere in the

sector and with partners and prospective customers in medical and

aerospace, clearly illustrates the merits of IHT and its

potential.

While the Company's full year performance will reflect the

difficult economic trading conditions, we expect some improvement

in elements of our Advanced PCB business and the growing pipeline

for IHT gives us confidence in our ability to deliver meaningful

IHT revenue growth in FY21.

The macro-economic backdrop will remain uncertain due to both

Brexit and as the pandemic continues to play out, but Trackwise's

long-term value proposition remains unchanged. We will continue to

carefully monitor and respond to the situation, and supported by

net cash on our balance sheet, a stable customer base and growing

pipeline, we are confident in our ability to deliver on these

growth opportunities as trading conditions normalise.

Interim Condensed Consolidated Statement of Comprehensive

Income

Notes Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

GBP'000 GBP'000 GBP'000

Revenue 3 2,389 1,547 2 2,906

Cost of sales (1,964) (961) (1,805)

Gross profit 425 586 1,101

Administrative expenses

excluding (790) (518) (900)

exceptional costs and share

based payment - - (28)

(112) (127) (224)

Exceptional severance costs

Share based payment charges

Total administrative expenses (902) (645) (1,152)

Operating loss (477) (59) (51)

Negative goodwill arising

on acquisition 9 1,545 - -

Acquisition expenses 9 (214) - -

Finance income - 4 5

Finance costs (66) (32) (83)

Profit/(loss) before taxation 788 (87) (129)

Taxation 4 133 23 81

Profit/(loss) and total

comprehensive income/(expense)

for the period 921 (64) (48)

------------ ------------- -------------

Earnings per share (pence)

Basic 6 4.98 (0.43) (0.32)

------------ ------------- -------------

Diluted 6 4.82 (0.43) (0.32)

------------ ------------- -------------

Interim Condensed Consolidated Statement of Financial

Position

Notes Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 7 5,200 3,389 4,268

Property, plant and

equipment 9 8,363 3,004 2,547

13,563 6,393 6,815

---------- ---------- -------------

Current assets

Inventories 1,740 468 555

Trade and other receivables 1,585 879 1,657

Current tax receivable 448 156 338

Cash and cash equivalents 3,209 1,565 567

---------- ---------- -------------

6,982 3,068 3,117

---------- ---------- -------------

Total assets 20,545 9,461 9,932

---------- ---------- -------------

LIABILITIES

Current liabilities

Trade and other payables (2,210) (1,262) (1,046)

Borrowings (575) (237) (339)

(2,785) (1,499) (1,385)

---------- ---------- -------------

Non-current liabilities

Deferred income - grants (914) (763) (856)

Borrowings 9 (3,640) (999) (1,253)

Provisions (310) - -

Deferred tax liabilities (401) (285) (401)

---------- ---------- -------------

(5,265) (2,047) (2,510)

---------- ---------- -------------

Total liabilities (8,050) (3,546) (3,895)

---------- ---------- -------------

Net assets 12,495 5,915 6,037

---------- ---------- -------------

EQUITY

Share capital 8 885 591 591

Share premium account 8 9,374 4,234 4,234

Retained earnings 2,088 903 1,045

Revaluation reserve 148 187 167

Total equity 12,495 5,915 6,037

---------- ---------- -------------

Interim Condensed Consolidated Statement of Changes in

Equity

Share Share premium Retained Revaluation Total equity

capital account earnings reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2019 591 4,234 840 206 5,871

Loss and total comprehensive

income for the period - - (64) - (64)

Share based payment - - 108 - 108

Revaluation realised in

period - - 19 (19) -

--------- -------------- ---------- ------------ -------------

At 30 June 2019 and 1 July

2019 591 4,234 903 187 5,915

--------- -------------- ---------- ------------ -------------

Profit and total comprehensive

income for the period - - 16 - 16

Share based payment - - 106 - 106

Revaluation realised in

period - - 20 (20) -

At 31 December 2019 and

1 January 2020 591 4,234 1,045 167 6,037

--------- -------------- ---------- ------------ -------------

Profit and total comprehensive

income for the period - - 921 - 921

Issue of shares (net of

GBP439,000 of issue expenses) 294 5,140 - - 5,434

Share based payment - - 103 - 103

Revaluation realised in

period - - 19 (19) -

-------------- ------------

At 30 June 2020 885 9,374 2,088 148 12,495

--------- -------------- ---------- ------------ -------------

Interim Condensed Consolidated Statement of Cash Flows

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

GBP'000 GBP'000 GBP'000

Cash flow from operating

activities

Profit/(loss) for the period

before taxation 788 (87) (129)

Adjustment for:

Employee share based payment

charges 112 127 224

Depreciation of property,

plant and equipment 349 127 225

Amortisation of intangible

assets 118 84 183

Negative goodwill credited (1,545) - -

Finance costs 66 28 78

Changes in working capital:

Increase in inventories (314) (88) (175)

Decrease/(increase) in trade

and other receivables 459 (287) (268)

Increase/(decrease) in trade

and other payables 21 257 (496)

--------------- ------------ -------------

Cash generated from operations 54 161 634

Income tax received 420 - 21

--------------- ------------ -------------

Net cash from operating activities 474 161 655

--------------- ------------ -------------

Cash flow from investing

activities

Purchase of property, plant

and equipment (net of new

leases) (359) (47) (951)

Purchase of intangible assets (1,036) (854) (1,736)

Purchase of subsidiary (net (1,629) - -

of cash acquired)

Grant funding - purchase

of intangible assets - 159 175

Interest received - - 5

Net cash used in investing

activities (3,024) (1,238) (2,507)

--------------- ------------ -------------

Cash flow from financing activities

Share capital issued 5,873 - -

Expenses relating to share (439) - -

capital issue

Interest paid (66) (32) (83)

Lease payments (81) - (89)

Repayment of capital element

of lease contracts (95) (112) (195)

------- --------- ---------

Net cash from/(used in) financing

activities 5,192 (144) (367)

------- --------- ---------

Increase/(decrease) in cash

and cash equivalents 2,642 (1,221) (2,219)

------- --------- ---------

Net cash and cash equivalents

at beginning of the period 567 2,786 2,786

Net cash and cash equivalents

at end of period (all cash

balances) 3,209 1,565 567

------- --------- ---------

1. Corporate information

Trackwise Designs plc is a Company incorporated in the United

Kingdom. The registered address of the Company is 1 Ashvale,

Alexandra Way, Ashchurch, Tewkesbury, Gloucestershire, GL20 8NB.

The principal activity of the Company and the Group is the

development, manufacture and sale of printed circuit boards.

2. Accounting policies

Basis of preparation

This unaudited consolidated interim financial information has

been prepared in accordance with IFRS as adopted by the European

Union including IAS 34 'Interim Financial Reporting'. The principal

accounting policies used in preparing the interim results are those

it expects to apply in its financial statements for the year ending

31 December 2020. These are unchanged from those applied in the 31

December 2019 Company financial statements except for the addition

of the application of Group policies which are now relevant

following the acquisition of a material subsidiary from April 2020

and the consolidation of its results and financial position with

those of the Company. In particular, IFRS 3 Business Combinations

and IFRS 10 Consolidated Financial Statements have been

applied.

The financial information does not contain all of the

information that is required to be disclosed in a full set of IFRS

financial statements. The financial information for the six months

ended 30 June 2020 and 30 June 2019 is unreviewed and unaudited and

does not constitute the Group or Company's statutory financial

statements for those periods.

The comparative financial information for the full year ended 31

December 2019 has, however, been derived from the audited statutory

financial statements for that period. A copy of those statutory

financial statements has been delivered to the Registrar of

Companies. The auditor's report on those accounts was unqualified,

did not include references to any matters to which the auditor drew

attention by way of emphasis without qualifying its report and did

not contain a statement under section 498(2)-(3) of the Companies

Act 2006.

The financial information in the Interim Report is presented in

Sterling.

3. Segmental reporting

IFRS 8, Operating Segments, requires operating segments to be

identified on the basis of internal reports that are regularly

reviewed by the Company's chief operating decision maker. The chief

operating decision maker is considered to be the Board of

Directors.

The operating segments are monitored by the chief operating

decision maker and strategic decisions are made on the basis of

adjusted segment operating results. From January 2018 the RF (now

part of Advanced PCB) and IHT activities began to be separately

reviewed and monitored, initially in respect of revenue.

All assets, liabilities and revenues are located in, or derived

in, the United Kingdom. The material assets and liabilities relate

to overall activity with the exception of the intangible

development costs and deferred grants which are solely in respect

of IHT.

In the six months ended 30 June 2020 the Group had two major

customers who each represented 12% of revenue (30 June 2019: two

major customers who represented 11% and 10% of total revenue, and

full year ended 31 December 2019: no major customer representing in

excess of 10% of revenue).

Revenue by product and geographical destination was as

follows:

Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

GBP'000 GBP'000 GBP'000

IHT 251 547 938

Advanced PCB 2,138 1,000 1,968

--------------- ------------ -------------

2,389 1,547 2,906

--------------- ------------ -------------

UK 1,495 485 1,046

Europe 751 758 1,332

Other 143 304 528

2,389 1,547 2 2,906

--------------- ------------ -------------

4. Income tax

Taxation is provided at the estimated rate of tax for the

period, applying 19% (2019:17%) to deferred tax balances, and

including the benefit of enhanced allowances for research and

development costs.

5. Dividends paid and proposed

No dividends have been paid or proposed in the period ended 30

June 2020 or year ended 31 December 2019.

6. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Earnings Unaudited Unaudited Audited

Six months Six months Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

GBP'000 GBP'000 GBP'000

Earnings/(loss) for the purpose

of basic and diluted earnings

per share being net profit/(loss)

attributable to the shareholders 921 (64) (48)

--------------- ------------ -------------

Number Number Number

Weighted average number of

ordinary shares for the purposes

of basic earnings per share 18,503,836 14,772,372 14,772,372

Weighted average number of

ordinary shares for the purposes

of diluted earnings per share 19,116,462 14,772,372 14,772,372

Options over 901,909 shares were granted to employees on 15 June

2018 which are still exercisable and potentially dilutive shares

included in the weighted average for the period to 30 June 2020.

The 1,009,000 of additional options issued on 24 June 2020 are not

considered to be dilutive on the period to 30 June 2020.

7. Intangible fixed assets

Development

costs

GBP'000

Cost

At 1 January 2019 2,552

Additions 850

As at 30 June 2019 3,402

Additions 966

As at 31 December 2018 4,368

Additions 1,024

As at 30 June 2020 5,392

------------

Amortisation or impairment

At 1 January 2019 92

Charge 82

As at 30 June 2019 174

Charge 94

As at 31 December 2019 268

Charge 113

As at 30 June 2020 381

------------

Carrying amount

As at 30 June 2019 3,228

------------

As at 31 December 2019 4,100

------------

As at 30 June 2020 5,011

------------

The capitalised development project costs relate to the

significant continuing investment in respect of the Company's

Improved Harness Technology ('IHT') process for unlimited length

printed circuit boards and know-how which is being developed by the

Company with amortisation on the initial development projects

commencing in 2018. The remainder of intangible assets is

represented by software assets and an unchanged amount of goodwill

in respect of the initial technology.

8. Share capital

7,341,250 GBP0.04 ordinary shares were issued on 31 March 2020

at GBP0.80 each for cash in order to provided funds for the

acquisition made in the period and continuing investment in the

business. This increased nominal share capital by GBP294,000 and

share premium by GBP5,579,000. Share issue costs of GBP439,000 were

charged against the share premium account resulting in a net

increase of GBP5,140,000.

9. Acquisition of Stevenage Circuits Ltd

The Company acquired all of the share capital of Stevenage

Circuits Ltd ("SCL"), a UK-based designer and manufacturer of short

flex and rigid printed circuit boards, on 1 April 2020. The

acquisition primarily adds further manufacturing capacity to enable

the demand-led ramp up of Trackwise Design's Improved Harness

Technology production, as well as customers and technical, sales

and operational expertise.

The assets were acquired at a discount to their provisional fair

value resulting in negative goodwill of GBP1,545,000 which has been

credited to the income statement in accordance with IFRS 3 and

represents an exceptional item in the period. This relates to the

ability of the combined Group to fully utilise the manufacturing

capacity of SCL and enhance earnings from the specialist plant and

equipment. The consolidated negative goodwill credit is not

expected to be taxable.

The provisional fair values of the assets and liabilities

acquired are as follows:

Fair value

GBP'000

Property, plant and equipment 2,969

Right of use property assets 1,915

Intangible assets 14

Inventories 872

Trade receivables and prepayments 1,136

Tax 396

Cash 543

Trade and other payables (1,370)

Lease liabilities (1,915)

Hire purchase liabilities (533)

Provisions (310)

3,717

Negative goodwill arising (1,545)

-----------

Consideration was paid in cash and there is no deferred or

contingent consideration payable. Gross trade receivables acquired

were GBP903,000 all of which were expected to be recovered. Right

of use property assets are included in property, plant and

equipment and lease liabilities within borrowings in the

consolidated statement of financial position.

Acquisition related expenses of GBP214,000 have been charged as

an exceptional item in the consolidated income statement. The

negative goodwill and acquisition expenses are both considered

highly material and significant non-recurring items. They are

therefore presented below operating loss in the consolidated income

statement.

SCL has contributed GBP1,224,000 of revenue and incurred a loss

of GBP47,000 included in the consolidated income statement from 1

April 2020 to 30 June 2020 (excluding acquisition expenses and

negative goodwill). Had SCL been consolidated from 1 January 2020

it would have contributed another GBP1,284,000 of revenue and a

loss of GBP23,000 to the six-month period.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KKBBNDBKBCCB

(END) Dow Jones Newswires

September 23, 2020 02:00 ET (06:00 GMT)

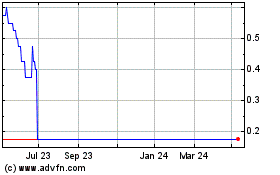

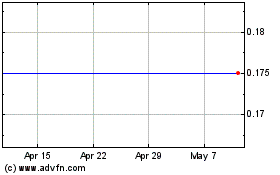

Trackwise Designs (LSE:TWD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trackwise Designs (LSE:TWD)

Historical Stock Chart

From Apr 2023 to Apr 2024