TIDMWJG

RNS Number : 9154Y

Watkin Jones plc

18 May 2021

For immediate release 18 May 2021

Watkin Jones plc

('Watkin Jones' or the 'Group')

Half year results for the six months to 31 March 2021

'Maintaining momentum as confidence returns'

Watkin Jones plc (AIM:WJG), the UK's leading developer and

manager of residential for rent, with a focus on the build to rent

('BtR') and purpose built student accommodation ('PBSA') sectors,

announces its results for the six months ended 31 March 2021

('H1-2021' or the 'period').

Financial Highlights

H1-2021 H1-2020 Movement

(Restated(1)

)

Revenue GBP178.4 million GBP185.7 million -3.9%

Gross profit GBP41.3 million GBP42.3 million -2.3%

Operating profit GBP29.1 million GBP29.6 million -1.8%

Profit before tax GBP25.8 million GBP26.7 million -3.3%

EBITDA GBP33.4 million GBP34.2 million -2.5%

Basic earnings per

share 8.11 pence 8.46 pence -4.1%

Dividend per share 2.6 pence Nil pence -

Cash GBP88.7 million GBP72.4 million -

Net cash(2) GBP31.7 million GBP37.5 million -

Commenting on the interim results, Richard Simpson, Chief

Executive Officer of Watkin Jones, said: "As we begin to emerge

from the pandemic, we are seeing increasing investor confidence in

our market sectors. We've maintained the momentum from the second

half of last year and made further good progress in securing new

forward sales, adding to our development pipeline and keeping all

our construction activities on track.

"All parts of the business have continued to perform well, and

whilst our profit for the first half of the year was slightly below

last year, this was because the first half last year was largely

before the onset of the disruption caused by the pandemic.

"The fundamentals supporting the markets for high quality build

to rent and student accommodation assets remain strong, driving

growing institutional demand, and combined with the continued

progress we have made in the first half of the year, gives us

confidence in our future trading."

Financial headlines

-- GBP29.1 million operating profit, slightly below last year's pre-pandemic level

-- 33% of revenue was from BtR, showing its increasing importance to the Group (H1-2020: 22%)

-- 23.2% gross margin, up 0.4% points (H1-2020: 22.8%), with a

robust performance across all our businesses

-- GBP146.3 million total liquidity available, being cash and

available debt facilities (H1-2020: GBP153.4 million)

-- 2.6 pence per share interim dividend (H1-2020: nil pence)

Notes

1. The comparative results for H1-2020 have been restated for an

adjustment to opening IFRS 16 lease assets and liabilities. Further

details are provided in note 3 to the interim financial

statements.

2. Net cash is stated after deducting site specific bank loans

and other interest-bearing loans, but before deducting IFRS 16

lease liabilities.

Business Highlights

Operational resilience demonstrated across all parts of the

Group

-- Work is on track on all 15 BtR and PBSA developments currently being built

-- 3,424 new student bed property management mandates for Fresh since the start of the year

-- Residential sales momentum maintained

Continued progress in forward sales market

-- 909 beds across three PBSA developments contracted in the period

-- 462-bed PBSA development in Leicester contracted after the half year

-- 722 BtR apartments in advanced legals for sale, these being

Hove (216 apartments), Leicester (184 apartments) and Lewisham (322

apartments)

-- 295-bed PBSA development in Edinburgh for delivery in FY23, sale terms agreed

Development pipeline further enhanced

-- GBP1.6 billion future revenue value now in our secured

development pipeline (up from GBP1.0 billion last year):

Current H1-2020 January 2021

Update

BtR (apartments) 5,008 2,660 4,466

------------------ ------------------ -----------------

PBSA (beds) 8,509 7,200 7,910

------------------ ------------------ -----------------

Future revenue c.GBP1.6 billion* c.GBP1.0 billion* c.GBP1.5 billion

value

------------------ ------------------ -----------------

* Excluding the revenue delivered in the period.

-- 542 BtR apartments and 599 PBSA beds added to our pipeline

since our last update in January 2021:

BtR PBSA

(apartments) (beds)

January 2021 update 4,466 7,910

-------------- --------

New sites secured:

Edinburgh 524 286

Swansea - 350

-------------- --------

524 636

Design changes 18 (37)

-------------- --------

Current 5,008 8,509

-------------- --------

-- Planning secured for our first co-living scheme, for 133 beds

in Exeter, in which tenants have a private studio with shared

communal facilities

Market dynamics supportive

-- Significant increase in institutional demand for PBSA;

confidence returning in occupancy levels for 2021-2022 academic

year

-- Growing institutional demand for BtR

Affordable homes opportunity

-- Pilot on track

Analyst meeting

A conference call for analysts and investors will be held at

09.30am today, 18 May 2021. A copy of the Half Year Results

presentation will be available on the Group's website:

http://www.watkinjonesplc.com

An audio webcast of the conference call with analysts will be

available after 12pm today:

https://webcasting.buchanan.uk.com/broadcast/607d6a2c0386285386cc951a

For further information:

Watkin Jones plc

Richard Simpson, Chief Executive Tel: +44 (0) 20 3617 4453

Officer

Philip Byrom, Chief Financial www.watkinjonesplc.com

Officer

Peel Hunt LLP (Nominated Adviser Tel: +44 (0) 20 7418 8900

& Joint Corporate Broker)

Mike Bell / Ed Allsopp www.peelhunt.com

Jefferies Hoare Govett (Joint Corporate Tel: +44 (0) 20 7029 8000

Broker)

Max Jones / Will Soutar www.jefferies.com

Media enquiries:

Buchanan

Henry Harrison-Topham / Richard Oldworth

Jamie Hooper / Steph Watson Tel: +44 (0) 20 7466 5000

watkinjones@buchanan.uk.com www.buchanan.uk.com

Notes to Editors

Watkin Jones is the UK's leading developer and manager of

residential for rent, with a focus on the build to rent and student

accommodation sectors. The Group has strong relationships with

institutional investors, and a reputation for successful,

on-time-delivery of high quality developments. Since 1999, Watkin

Jones has delivered 43,000 student beds across 130 sites, making it

a key player and leader in the UK purpose-built student

accommodation market. In addition, Fresh, the Group's specialist

accommodation management business, manages over 20,000 student beds

and build to rent apartments on behalf of its institutional

clients. Watkin Jones has also been responsible for over 80

residential developments, ranging from starter homes to executive

housing and apartments. The Group is increasingly expanding its

operations into the build to rent sector and is piloting an

opportunity to re-focus its residential house building operation as

a developer of affordable homes.

The Group's competitive advantage lies in its experienced

management team and business model, which enables it to offer an

end-to-end solution for investors, delivered entirely in-house with

minimal reliance on third parties, across the entire life cycle of

an asset.

Watkin Jones was admitted to trading on AIM in March 2016 with

the ticker WJG.L. For additional information please visit

www.watkinjonesplc.com

Review of Performance

Results for the six months to 31 March 2021

Revenues for the period were GBP178.4 million, compared to the

pre-pandemic GBP185.7 million for H1-2020. Our developments in

build are all progressing in line with expectations.

Gross profit was GBP41.3 million (H1-2020: GBP42.3 million),

with an improvement in the gross margin to 23.2% from 22.8% last

year. Margin performance was as expected, with the developments in

build contributing strongly.

Operating profit for the period was GBP29.1 million (H1-2020:

GBP29.6 million).

Net finance costs for the period amounted to GBP3.2 million

(H1-2020: GBP2.9 million), reflecting the additional cost

associated with the GBP40.0 million increase in our RCF limit in

May last year. Finance costs include GBP2.4 million (H1-2020:

GBP2.6 million) in respect of the finance cost of capitalised

operating leases under IFRS16.

Profit before tax for the period was GBP25.8 million (H1-2020:

GBP26.7 million). Basic earnings per share for the period were 8.11

pence, compared to 8.46 pence for H1-2020.

Segmental review

Build to Rent ('BtR')

The contribution from BtR increased further in the period, with

revenues of GBP59.1 million, up GBP17.9 million (43.3%) on H1-2020.

Revenues derived from the build of our forward sold developments in

Reading, Sutton, Stratford and Wembley, which are progressing on

track for completion in H2-2021.

BtR gross profit for the period was GBP12.4 million (H1-2020:

GBP6.6 million), an increase of 87.8%. The margin for the period

was 21.0% (H1-2020: 16.1%), reflecting a robust performance across

all of the developments in build for FY21 as they near

completion.

We are in advanced legals for the forward sale of our

developments in Hove (216 apartments), Leicester (184 apartments)

and Lewisham (322 apartments plus 43 affordable).

In the period we secured a site in Belfast (780 apartments) and

subsequent to the period end a site in Edinburgh (524 apartments),

both subject to planning. We are actively progressing with several

other site acquisitions.

The current BtR development pipeline is as shown in the table

below:

BtR apartments

-----------------------------------------------------

Total pipeline FY21 FY22 FY23 FY24 FY25

----------------------------------- --------------- ------ ----- ----- ------ ------

Forward sold 928 857 71 - - -

Forward sales in legals 765 184 - 581 - -

Sites secured with planning - - - - - -

Sites secured subject to planning 3,315 - - - 1,324 1,991

----------------------------------- --------------- ------ ----- ----- ------ ------

Total secured 5,008 1,041 71 581 1,324 1,991

----------------------------------- --------------- ------ ----- ----- ------ ------

Change* +542 +184 -184 +43 +207 +292

----------------------------------- --------------- ------ ----- ----- ------ ------

Site acquisitions in legals - - - - - -

----------------------------------- --------------- ------ ----- ----- ------ ------

Total BtR pipeline 5,008 1,041 71 581 1,324 1,991

----------------------------------- --------------- ------ ----- ----- ------ ------

Change* +295 +184 -184 +43 -40 +292

----------------------------------- --------------- ------ ----- ----- ------ ------

*The change in the pipeline is compared to the previous update

in January 2021.

The appraised future revenue value to the Group of the secured

development pipeline, excluding the revenue delivered in H1-2021,

is c.GBP950.0 million (H1-2020: GBP550.0 million).

Student accommodation ('PBSA')

Revenues from PBSA were 13.3% lower than last year at GBP104.8

million (H1-2020: GBP120.8 million), with the prior year revenues

benefitting by GBP23.5 million from the recognition of the full

sales value of a development completed in Chester, which had been

sold on a turnkey basis. Forward sold development revenues were

therefore a little ahead of last year, reflecting the continued

good progress on site of all developments in build.

PBSA revenues include the letting income on our six historic

leased PBSA assets and this has been reduced by approximately

GBP4.3 million compared to H1-2020 as a result of the lower level

of student occupancy this year. We have seen a number of students

returning to their accommodation as lockdown restrictions have

eased and we expect the full year reduction in revenues to be

within the previously guided maximum of GBP10.0 million.

The gross margin for PBSA was 24.1%, a small decrease on the

24.5% gross margin for H1-2020.

In the period we forward sold three PBSA developments in Bristol

(291 beds), Leicester (250 beds) and York (368 beds) for delivery

in FY22. For each of these developments, the clients concerned

acquired the land site directly. Subsequent to the period end we

exchanged contracts for the sale on a turnkey basis of our 462-bed

scheme in Leicester, for delivery this financial year. The combined

revenue value to the Group of these four contracted sales is

GBP101.1 million.

We have also agreed terms for the forward sale of a 295-bed

development in Edinburgh, subject to the receipt of a planning

amendment, which is targeted for delivery in FY23.

We secured two sites subject to planning since the start of the

year, these being in Edinburgh (286 beds) and Swansea (350

beds).

The current PBSA development pipeline is as shown in the table

below:

PBSA beds

-------------------------------------------------------

Total pipeline FY21 FY22 FY23 FY24 FY25

----------------------------------- --------------- ------ ------ ------ ------ ------

Forward sold 4,360 3,192 1,168 - - -

Forward sales in legals 547 - - 547 - -

Sites secured with planning 778 - 778 - - -

Sites secured subject to planning 2,824 - - 1,816 673 335

----------------------------------- --------------- ------ ------ ------ ------ ------

Total secured 8,509 3,192 1,946 2,363 673 335

----------------------------------- --------------- ------ ------ ------ ------ ------

Change* +599 - +1 -75 +338 +335

----------------------------------- --------------- ------ ------ ------ ------ ------

Site acquisitions in legals 1,517 - - 357 394 766

----------------------------------- --------------- ------ ------ ------ ------ ------

Total PBSA pipeline 10,026 3,192 1,946 2,720 1,067 1,101

----------------------------------- --------------- ------ ------ ------ ------ ------

Change* +118 - +1 -380 +162 +335

----------------------------------- --------------- ------ ------ ------ ------ ------

*The change in the pipeline is compared to the previous update

in January 2021.

The appraised future revenue value to the Group of the secured

development pipeline, excluding the revenue delivered in H1-2021,

is c.GBP625.0 million (H1-2020: c.GBP500.0 million).

Accommodation management (Fresh)

Fresh achieved revenues of GBP3.8 million (H1-2020: GBP4.1

million), reflecting the largely fixed nature of its management fee

income. The reduction of 8% reflects the loss of some income that

varies with student occupancy levels, partly offset by the higher

number of student beds and BtR apartments under management at the

start of the year (20,179), compared to the start of FY20

(17,721).

Operationally, Fresh has continued to support both its student

customers and clients through the pandemic. Since the start of the

year it has won new mandates for 3,424 student beds.

The reduction in Fresh's revenue for the period led to a modest

decrease in gross profit to GBP2.2 million (H1-2020: GBP2.6

million), at a margin of 58.4% (H1-2020: 61.9%).

By FY 2023, Fresh is currently appointed to manage 22,981

student beds and BtR apartments across 71 schemes, including

expected renewals, an increase of 1,191 beds since our update in

January 2021.

Residential

The residential development business achieved 33 sales

completions in the period, in line with its targets (H1-2020: 73

sales). H1-2020 sales included the completion of the 35-apartment

scheme at Trafford Street, Chester, which had been sold on a

turnkey basis. Excluding this sale, house completions for H1-2021

were at a similar level to last year. The momentum we reported in

new sales being reserved during the summer months of 2020 has

continued, with a further 55 reservations since the start of the

year, adding to the 25 reservations with which we started the

year.

Revenues for the division were GBP8.9 million lower than last

year at GBP10.7 million. H1-2020 revenues included the revenue from

the completion of the apartment scheme in Chester, as well as the

remaining higher value sales of apartments at our Duncan House,

Stratford development.

The gross profit achieved by the division was GBP1.5 million

(H1-2020: GBP3.7 million), at a margin of 14.0% (H1-2020: 19.0%).

The reduction in margin reflects the mix of sales, with last year's

margin benefiting in particular from the apartment sales at Duncan

House.

Affordable homes pilot

We made good progress with the launch of the North West

affordable homes pilot in the period.

Pipeline

We completed the acquisition of the site in Crewe for 245 units

and exchanged contracts on a site for 51 units in Llay, Wrexham. We

are also in advanced legal negotiations to secure a further site in

the North West for 189 units, which will bring the current

affordable homes pipeline to 485 units for delivery over the period

FY22 - FY25. All of these sites have planning. Given the

encouraging initial progress, a number of further site

opportunities are also under review.

Forward sales

Subsequent to the period end we exchanged forward sale contracts

with Adra for 23 units at the site in Llay and we expect to

exchange contracts imminently for the forward sale of 159 units at

the site in Crewe. We are also progressing heads of terms for the

forward sale of 133 units at the further new site that we are in

the process of acquiring. All forward sale values are in line with

our financial appraisals.

Balance sheet and liquidity

Our financial position and liquidity remains strong. We had a

cash balance at 31 March 2021 of GBP88.7 million (31 March 2020:

GBP72.4 million), whilst net cash stood at GBP31.7 million (31

March 2020: GBP37.5 million), before deducting IFRS 16 lease

liabilities.

The Group had undrawn headroom of GBP47.6 million on its

revolving credit facility ('RCF') with HSBC at 31 March 2021 and an

unutilised overdraft facility of GBP10.0 million, giving total cash

and available facilities of GBP146.3 million (31 March 2020:

GBP153.4 million).

We have continued to secure opportunities in the land market

during the pandemic. We have also been able to progress the

development of our BtR and PBSA schemes in Leicester for completion

in FY21. This investment, combined with our normal annual cash

profile, which sees a utilisation of cash in the first half of the

year, resulted in a reduction in our net cash balance of GBP63.1

million since the start of the year. Our inventory and work in

progress balance has similarly increased by GBP63.3 million in the

period to GBP189.0 million. Of this balance, GBP42.3 million

relates to the work in progress cost of the two developments in

Leicester.

Contract assets and receivables at 31 March 2021 stood at

GBP38.7 million and GBP23.5 million respectively and were broadly

unchanged from the position at 30 September 2020. The contract

assets relate primarily to the final payments to be received on

completion of the forward sold developments in build. Contract and

trade liabilities amounted to GBP98.1 million at 31 March 2021 and

were also at a similar level to the FY20 year-end position.

Environmental, Social and Governance ('ESG')

We continue to evolve our ESG framework. Our work in the period

has centred on identifying the key initiatives for the business,

determining the targets against which we will measure and report

our performance and how the initiatives will be integrated as part

of our day to day operations. As part of this work we are engaging

with our key stakeholders to identify what is important to them and

to help inform our approach.

The health and safety of our employees, supply chain partners

and tenants of the properties we manage is our number one priority.

We continue to deploy strict Covid-19 working practices on our

sites and through Fresh to ensure that the wellbeing of students

and our BtR consumers is catered for. Whilst we have continued to

operate highly effectively, this is against the backdrop of the

pandemic and our employees have continued to work tirelessly in

exceptionally difficult circumstances. Their efforts and commitment

have been exemplary and I would again like to thank them all

personally.

Cladding update

In our FY20 results we made a provision of GBP15.0 million to

cover the cost of cladding remedial works on previous high-rise

residential buildings we had developed, working with the property

owners concerned to ensure the safety of tenants, even though we

are not legally liable. These works are progressing in line with

our previous guidance.

GBP5.1 million of the cost of the works was incurred in FY20,

with a further GBP0.9 million incurred in H1-2021. The remaining

provision of GBP9.0 million is expected to be incurred over the

remainder of FY21 and FY22.

The Government has recently announced that it intends to levy a

tax on the profits of residential developers, combined with a

planning gain levy on future developments, in order to recoup the

cost of its high-rise cladding replacement support scheme. The

precise scope and detail of the residential developer tax have not

yet been concluded and will be the subject of a consultation

process over the coming months. We are currently preparing our

response and will actively participate in the consultation

process.

Dividend

The Board has declared an interim dividend for the period of 2.6

pence per share, which will be paid on 30 June 2021 to shareholders

on the register at close of business on 9 June 2021. The shares

will go ex-dividend on 8 June 2021.

Outlook

The underlying market fundamentals supporting residential for

rent remain strong, as evidenced by increasing investor appetite

for both BtR and PBSA as we emerge from the pandemic. This,

combined with the growth in our development pipeline, operational

capabilities and financial strength, underpins our confidence in

the future prospects for the Group.

Richard Simpson

Chief Executive Officer

18 May 2021

Consolidated Statement of Comprehensive Income

for the six month period ended 31 March 2021 (unaudited)

6 months to 6 months to 12 months to

31 March 31 March 30 September

2021 2020 2020

(Restated

- note 3)

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 178,420 185,672 354,121

Cost of sales (137,089) (143,373) (278,205)

------------ ------------ --------------

Gross profit 41,331 42,299 75,916

Administrative expenses (12,255) (12,682) (24,249)

Operating profit before exceptional costs 29,076 29,617 51,667

Exceptional costs 6 - - (20,437)

------------ ------------ --------------

Operating profit 29,076 29,617 31,230

Share of profit in joint ventures - - 199

Finance income 1 200 251

Finance costs (3,239) (3,084) (6,366)

------------ ------------ --------------

Profit before tax from continuing operations 25,838 26,733 25,314

Income tax expense 7 (5,056) (5,104) (4,222)

------------ ------------ --------------

Profit for the period attributable to ordinary equity holders of

the parent 20,782 21,629 21,092

============ ============ ==============

Other comprehensive income

Net gain on equity instruments designated at fair value through

other comprehensive income - - (6)

------------ ------------ --------------

Total comprehensive income for the period attributable to

ordinary equity holders of the parent 20,782 21,629 21,086

============ ============ ==============

Earnings per share for the period attributable to ordinary equity Pence Pence Pence

holders of the parent

Basic earnings per share 8 8.113 8.458 8.246

============ ============ ==============

Diluted earnings per share 8 8.108 8.425 8.234

============ ============ ==============

Adjusted basic earnings per share (excluding exceptional costs) 8 8.113 8.458 14.717

============ ============ ==============

Adjusted diluted earnings per share (excluding exceptional costs) 8 8.108 8.425 14.696

============ ============ ==============

Consolidated Statement of Financial Position

as at 31 March 2021 (unaudited)

31 March 31 March 30 September

2021 2020 2020

(Restated

- note 3)

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 13,004 13,564 13,284

Investment property (leased) 10 101,475 110,125 104,623

Right of use assets 10 4,923 5,402 4,763

Property, plant and equipment 4,068 4,965 4,376

Investment in joint ventures 3,243 2,794 3,243

Deferred tax asset 3,313 3,758 3,313

Other financial assets 1,133 1,139 1,133

---------- ------------ -------------

131,159 141,747 134,735

---------- ------------ -------------

Current assets

Inventory and work in progress 189,005 108,640 125,660

Contract assets 38,682 79,211 41,522

Trade and other receivables 23,457 20,419 23,518

Cash and cash equivalents 12 88,727 72,394 134,513

---------- ------------ -------------

339,871 280,664 325,213

---------- ------------ -------------

Total assets 471,030 422,411 459,948

========== ============ =============

Current liabilities

Trade and other payables (91,602) (69,153) (97,300)

Contract liabilities (6,537) (4,462) (8,967)

Lease liabilities (6,139) (6,209) (6,310)

Provisions (5,384) - (6,277)

Interest-bearing loans and borrowings (870) (1,021) (711)

Current tax liabilities (4,087) (6,869) (819)

---------- ------------ -------------

(114,619) (87,714) (120,384)

---------- ------------ -------------

Non-current liabilities

Interest-bearing loans and borrowings (56,132) (33,861) (38,956)

Lease liabilities (125,544) (131,437) (128,143)

Deferred tax liabilities (1,187) (1,042) (1,040)

Provisions (3,587) - (3,587)

---------- ------------ -------------

(186,450) (166,340) (171,726)

---------- ------------ -------------

Total Liabilities (301,069) (254,054) (292,110)

========== ============ =============

Net assets 169,961 168,357 167,838

========== ============ =============

Equity

Share capital 2,562 2,553 2,562

Share premium 84,612 84,612 84,612

Merger reserve (75,383) (75,383) (75,383)

Fair value reserve of financial assets at FVOCI 428 434 428

Share-based payment reserve 2,515 2,263 2,348

Retained earnings 155,227 153,878 153,271

---------- ------------ -------------

Total Equity 169,961 168,357 167,838

========== ============ =============

Consolidated Statement of Changes in Equity

for the six month period ended 31 March 2021 (unaudited)

Fair value

of financial Share-based

Share Share Merger assets payment Retained

Capital Premium Reserve at FVOCI reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP000 GBP'000 GBP'000

Balance at 30 September

2019 2,553 84,612 (75,383) 434 2,311 146,568 161,095

Profit for the period - - - - - 21,629 21,629

Share-based payments - - - - (48) - (48)

Dividend paid (note

9) - - - - - (14,319) (14,319)

Balance at

31 March 2020 (restated) 2,553 84,612 (75,383) 434 2,263 153,878 168,357

========= ======== ========== ============= =========== ========== ========

(Loss) for the period - - - - - (537) (537)

Share-based payments - - - - 85 - 85

Other comprehensive

income - - - (6) - - (6)

Deferred tax debited

directly to equity - - - - - (70) (70)

Issue of shares 9 - - - - - 9

Balance at 30 September

2020 2,562 84,612 (75,383) 428 2,348 153,271 167,838

========= ======== ========== ============= =========== ========== ========

Profit for the period - - - - - 20,782 20,782

Share-based payments - - - - 167 - 167

Dividend paid (note

9) - - - - - (18,826) (18,826)

--------- -------- ---------- ------------- ----------- ---------- --------

Balance at

31 March 2021 2,562 84,612 (75,383) 428 2,515 155,227 169,961

========= ======== ========== ============= =========== ========== ========

Consolidated Statement of Cash Flows

for the six month period ended 31 March 2021 (unaudited)

6 months 6 months 12 months

to to to

31 March 31 March 30 September

2021 2020 2020

(Restated

- note 3)

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash (outflow)/inflow from

operations 11 (35,467) (12,975) 54,868

Interest received 1 200 245

Interest paid (3,658) (3,300) (6,792)

Tax paid (1,641) (5,211) (10,035)

--------- ---------- -------------

Net cash (outflow)/inflow from

operating activities (40,765) (21,286) 38,286

========= ========== =============

Cash flows from investing activities

Acquisition of property, plant

and equipment (763) (672) (317)

Proceeds on disposal of property,

plant and equipment - 19 69

Cash flow from joint venture

interest - - 812

Net cash outflow from investing

activities (763) (653) 564

========= ========== =============

Cash flows from financing activities

Dividend paid 9 (18,826) (14,319) (14,319)

Proceeds from exercise of share

options - - 9

Payment of principal portion

of lease liabilities (2,768) (2,998) (6,089)

New other interest- bearing

loan 261 - -

Payment of capital element

of other interest-bearing loans (164) (526) (1,034)

Drawdown of RCF 19,808 1,302 20,843

Repayment of bank loans (2,569) (4,778) (18,499)

Bank loan arrangement fees - - (900)

Net cash outflow from financing

activities (4,258) (21,319) (19,989)

========= ========== =============

Net (decrease)/increase in

cash (45,786) (43,258) 18,861

Cash and cash equivalents at

beginning of the period 134,513 115,652 115,652

--------- ---------- -------------

Cash and cash equivalents at

end of the period 12 88,727 72,394 134,513

========= ========== =============

Notes to the consolidated financial information

1. General information

Watkin Jones plc (the 'Company') is a limited company

incorporated in the United Kingdom under the Companies Act 2006

(Registration number 09791105). The Company is domiciled in the

United Kingdom and its registered address is 7-9 Swallow Street,

London, W1B 4DE.

The principal activities of the Company and its subsidiaries

(collectively the 'Group') are the development and management of

multi-occupancy residential rental properties.

The consolidated interim financial statements of the Group for

the six month period ended 31 March 2021 comprises the Company and

its subsidiaries. The basis of preparation of the consolidated

interim financial statements is set out in note 2 below.

The financial information for the six months ended 31 March 2021

is unaudited. It does not constitute statutory financial statements

within the meaning of Section 434 of the Companies Act 2006. The

consolidated interim financial statements should be read in

conjunction with the financial information for the year ended 30

September 20 which has been prepared in accordance with

international accounting standard in conformity with the

requirements of the Companies Act 2006. The report of the auditors

on those financial statements was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498(2) of the Companies Act 2006.

This report was approved by the directors on 17 May 2021.

2. Basis of preparation

The interim financial statements have been prepared based on

IFRS that are expected to exist at the date on which the Group

prepares its financial statements for the year ended 30 September

2021. To the extent that IFRS at 30 September 2021 does not reflect

the assumptions made in preparing the interim financial statements,

those financial statements may be subject to change.

The interim financial statements have been prepared on a going

concern basis and under the historical cost convention.

The interim financial statements have been presented in pounds

sterling and all values are rounded to the nearest thousand

(GBP'000), except when otherwise indicated.

The preparation of financial information in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events may ultimately differ from those

estimates.

The interim financial statements do not include all financial

risk information and disclosures required in the annual financial

statements and they should be read in conjunction with the

financial information that is presented in the Company's audited

financial statements for the year ended 30 September 2020. There

has been no significant change in any risk management policies

since the date of the last audited financial statements.

3. Accounting policies

The accounting policies used in preparing these interim

financial statements are the same as those set out and used in

preparing the Company's audited financial statements for the year

ended 30 September 2020.

Restatement of results for six months to 31 March 2020

After the release of the half year results to 31 March 2020,

several changes were made in relation to the initial application of

the new accounting standard, IFRS 16, and incorporated into the

audited full year results for the year ending 30 September 2020.

The comparative figures to 31 March 2020 have now been restated to

reflect these amendments, which relate to the Group's six historic

student accommodation sale and leaseback properties. These assets

had been reported in the H1-2020 consolidated statement of

financial position as 'right of use' assets, but have been

reclassified as 'investment property (leased) assets' at 30

September 2020. This better reflects the asset classification

requirements of IAS 40 'Investment Property' when applied in

conjunction with IFRS 16. In addition, a change was made to the

Incremental Borrowing Rates ("IBRs") used to calculate the initial

values for the investment property (leased) assets and associated

lease liabilities, which had the effect of reducing their opening

values. The IBRs were increased to better reflect the likely

borrowing rate which would be paid over a similar term to the

underlying long leases. Presentational changes have also been made

to the consolidated statement of financial position at 31 March

2020 in relation to provisions for onerous leases, which are now

reported within investment property (leased) assets as impairment

provisions; and to prepayment and accrual balances relating to the

leases which are now included in the lease asset and liability

values.

The restatements for these changes are immaterial on total

comprehensive income, reduce net equity by GBP0.5 million and have

no impact on cash. The detailed changes to each affected financial

statement line items are as follows:

Impact on consolidated statement of comprehensive income due to

increase in IBR:

6 months to

31 March

2020

Increase/(decrease)

GBP'000

Cost of sales (420)

Finance costs 324

Income tax expense 43

Net impact on total comprehensive income for the period 53

---------------------

Impact on basic and diluted earnings per share (EPS) due to the

correction relating to the IBR:

6 months to

31 March

2020

Increase

Pence

Basic earnings per share 0.021

Diluted earnings per share 0.021

Impact on consolidated statement of financial position as at 31

March 2020:

Reclassification of Increase in IBR Reclassification of Total

student sale and leaseback onerous lease provision,

properties prepayments and accruals.

Increase/

(decrease)

GBP'000 GBP'000 GBP'000 GBP'000

Investment property

(leased) 121,775 (8,256) (3,457) 110,062

Right of use assets (121,775) - - (121,775)

Deferred tax asset - 28 91 119

Trade and other receivables - - (593) (593)

--------------------------- ---------------- --------------------------- ------------

Total assets - (8,228) (3,959) (12,187)

Trade and other payables - - (141) (141)

Lease liabilities - (8,110) - (8,110)

Current tax liabilities - 30 - 30

Provisions - - (3,457) (3,457)

--------------------------- ---------------- --------------------------- ------------

Total liabilities - (8,080) (3,598) (11,678)

Net impact on equity - (148) (361) (509)

--------------------------- ---------------- --------------------------- ------------

Impact on consolidated statement of cash flows due to the

correction relating to the increase in IBR:

6 months to

31 March

2020

Increase/(decrease)

GBP'000

Cash outflow from operations (83)

Interest paid 324

Payment of principal portion of lease liabilities (241)

Net impact on cash flows for the period -

---------------------

4. Segmental reporting

The Group has identified four segments for which it reports

under IFRS 8 'Operating segments', as follows:

A Student accommodation - the development of purpose-built student accommodation;

B Build to rent - the development of build to rent accommodation;

C Residential - the development of residential property for sale; and

D Accommodation management - the management of student

accommodation and build to rent property.

Corporate - revenue from the development of commercial property

forming part of mixed use schemes and other revenue and costs not

solely attributable to any one operating segment.

Performance is measured by the Board based on gross profit as

reported in the management accounts. Apart from inventory and work

in progress, no other assets or liabilities are analysed into the

operating segments.

Build

6 months to 31 Student to Accommodation

March 2021 (unaudited) accommodation rent Residential management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental revenue 104,759 59,112 10,670 3,816 63 178,420

--------------- -------- ------------ -------------- ---------- ---------

Segmental gross

profit 25,215 12,397 1,490 2,228 1 41,331

Administration

expenses - - - (1,708) (10,547) (12,255)

Finance income - - - - 1 1

Finance costs - - - - (3,239) (3,239)

Profit/(loss)

before tax 25,215 12,397 1,490 520 (13,784) 25,838

Taxation - - - - (5,056) (5,056)

--------------- -------- ------------ -------------- ---------- ---------

Profit/(loss)

for the period 25,215 12,397 1,490 520 (18,840) 20,782

=============== ======== ============ ============== ========== =========

Inventory and

WIP 56,700 90,656 31,316 - 10,333 189,005

--------------- -------- ------------ -------------- ---------- ---------

6 months to 31

March 2020 (unaudited) Build

(Restated - note Student to Accommodation

3) accommodation rent Residential management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental revenue 120,766 41,241 19,613 4,147 (95) 185,672

--------------- -------- ------------ -------------- ---------- ---------

Segmental gross

profit 29,570 6,648 3,743 2,565 (227) 42,299

Administration

expenses - - - (1,804) (10,878) (12,682)

Finance income - - - - 200 200

Finance costs - - - - (3,084) (3,084)

Profit/(loss)

before tax 29,570 6,648 3,743 761 (13,989) 26,733

Taxation - - - - (5,104) (5,104)

--------------- -------- ------------ -------------- ---------- ---------

Profit/(loss)

for the period 29,570 6,648 3,743 761 (19,093) 21,629

=============== ======== ============ ============== ========== =========

Inventory and

WIP 22,067 42,807 33,599 - 10,167 108,640

--------------- -------- ------------ -------------- ---------- ---------

The comparative information for the 6 months to 31 March 2020

has been re-presented in a way which is consistent with the

internal reporting provided to the chief operating decision-maker.

Revenue of GBP4,698,000 and gross profit of GBP689,000 has been

transferred from the residential to the build to rent segment.

Year ended Build

30 September Student to Accommodation

2020 accommodation rent Residential management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental revenue 226,026 93,991 26,268 7,586 250 354,121

--------------- -------- ------------ -------------- ---------- ---------

Segmental gross

profit 54,285 14,884 4,042 4,540 (1,835) 75,916

Administration

expenses - - - (3,432) (20,817) (24,249)

Exceptional costs - - - - (20,437) (20,437)

Share of operating

profit in joint

ventures 199 - - - - 199

Finance income - - - - 251 251

Finance costs - - - - (6,366) (6,366)

Profit/(loss)

before tax 54,484 14,884 4,042 1,108 (49,204) 25,314

Taxation - - - - (4,222) (4,222)

--------------- -------- ------------ -------------- ---------- ---------

Profit/(loss)

for the period 54,484 14,884 4,042 1,108 (53,426) 21,092

=============== ======== ============ ============== ========== =========

Inventory and

WIP 30,706 53,964 30,656 - 10,334 125,660

--------------- -------- ------------ -------------- ---------- ---------

5. Disaggregated revenue information

Student Build to Accommodation

6 months to 31 March 2021 (unaudited) accommodation rent Residential management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Type of goods or service

Construction contracts or development

agreements 99,283 58,405 - - 63 157,751

Sale of land - - - - - -

Sale of completed property - - 10,670 - - 10,670

Rental income 5,476 707 - - - 6,183

Accommodation management - - - 3,816 - 3,816

-------------------------------------------- -------------- -------- ----------- ------------- --------- -------

Total revenue from contracts with customers 104,759 59,112 10,670 3,816 63 178,420

============================================ ============== ======== =========== ============= ========= =======

Timing of revenue recognition

Goods transferred at a point in time - - 10,670 - - 10,670

Services transferred over time 104,759 59,112 - 3,816 63 167,750

-------------------------------------------- -------------- -------- ----------- ------------- --------- -------

Total revenue from contracts with customers 104,759 59,112 10,670 3,816 63 178,420

============================================ ============== ======== =========== ============= ========= =======

Student Build to Accommodation

6 months to 31 March 2020 (unaudited) accommodation rent Residential management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Type of goods or service

Construction contracts or development

agreements 87,460 40,554 - - (95) 214,367

Sale of land - - - - - 93,557

Sale of completed property 23,502 - 19,613 - - 40,528

Rental income 9,804 687 - - - 18,873

Accommodation management - - - 4,147 - 7,460

-------------------------------------------- -------------- -------- ----------- ------------- --------- -------

Total revenue from contracts with customers 120,766 41,241 19,613 4,147 (95) 185,672

============================================ ============== ======== =========== ============= ========= =======

Timing of revenue recognition

Goods transferred at a point in time 23,502 - 19,613 - - 43,115

Services transferred over time 97,264 41,241 - 4,147 (95) 142,557

-------------------------------------------- -------------- -------- ----------- ------------- --------- -------

Total revenue from contracts with customers 120,766 41,241 19,613 4,147 (95) 185,672

============================================ ============== ======== =========== ============= ========= =======

Year ended Student Build to Accommodation

30 September 2020 accommodation rent Residential management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Type of goods or service

Construction contracts or development

agreements 181,248 92,618 - - 250 274,116

Sale of land 5,558 - - - - 5,558

Sale of completed property 23,502 - 26,268 - - 49,770

Rental income 15,718 1,373 - - - 17,091

Accommodation management - - - 7,586 - 7,586

-------------------------------------------- -------------- -------- ----------- ------------- --------- -------

Total revenue from contracts with customers 226,026 93,991 26,268 7,586 250 354,121

============================================ ============== ======== =========== ============= ========= =======

Timing of revenue recognition

Goods transferred at a point in time 29,060 - 20,961 - - 50,021

Services transferred over time 196,966 93,991 5,307 7,586 250 304,100

-------------------------------------------- -------------- -------- ----------- ------------- --------- -------

Total revenue from contracts with customers 226,026 93,991 26,268 7,586 250 354,121

============================================ ============== ======== =========== ============= ========= =======

6. Exceptional costs

6 months to 6 months to 12 months to

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

COVID-19 costs

COVID-19 additional costs of on-site working and in completing

developments - - (2,659)

Waiver of academic year 2019/20 final term rents due on leased student

accommodation assets

due to lockdown measures - - (1,086)

Impairment of the right-of-use carrying value of leased student

accommodation assets due to

reduced 2020/21 student occupancy - - (1,892)

Total COVID-19 costs - - (5,637)

------------- ------------- --------------

Fire safety recladding works - - (14,800)

------------- ------------- --------------

Total exceptional costs - - (20,437)

============= ============= ==============

7. Income taxes

The tax expense for the period has been calculated by applying

the estimated effective tax rate for the financial year ending 30

September 2021 of 19.6 % to the profit for the period.

8. Earnings per share

Basic earnings per share ("EPS") amounts are calculated by

dividing the net profit or loss for the year attributable to

ordinary equity holders of the parent by the weighted average

number of ordinary shares in issue during the year.

The following table reflects the income and share data used in

the basic EPS computations:

6 months to 6 months to 12 months to

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

Profit for the period attributable to ordinary equity

holders of the parent 20,782 21,629 21,092

Adjusted profit for the period attributable to

ordinary equity holders of the parent (excluding

exceptional (costs)/income after tax) 20,782 21,629 37,646

Number of shares Number of shares Number of shares

Number of ordinary shares for basic earnings per share 256,163,459 255,722,099 255,795,659

Adjustments for the effects of dilutive potential

ordinary shares 151,310 1,016,400 367,800

Weighted average number for diluted earnings per share 256,314,769 256,738,499 256,163,459

Pence Pence Pence

Basic earnings per share

Basic profit for the period attributable to ordinary

equity holders of the parent 8.113 8.458 8.246

Adjusted basic earnings per share (excluding

exceptional (costs)/income after tax)

Adjusted profit for the period attributable to

ordinary equity holders of the parent 8.113 8.458 14.717

Diluted earnings per share

Basic profit for the period attributable to diluted

equity holders of the parent 8.108 8.425 8.234

Adjusted diluted earnings per share (excluding

exceptional (costs)/income after tax)

Adjusted profit for the period attributable to diluted

equity holders of the parent 8.108 8.425 14.696

9. Dividends

6 months to 6 months to 12 months to

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

Final dividend paid in February 2020 of 5.6 pence - 14,319 14,319

Final dividend paid in February 2021 of 7.35 pence 18,826 - -

18,826 14,319 14,319

============ ============ ==============

An interim dividend of 2.6 pence per ordinary share will be paid

on 30 June 2021. This dividend was declared after 31 March 2021 and

as such the liability of GBP6,660,000 has not been recognised at

that date. At 31 March 2021 the Company had distributable reserves

available of GBP81,990,000.

10. Leases

Investment property (leased) Office Leases Motor Vehicle Leases Total

GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 30 September 2019 158,231 9,411 1,597 169,239

Additions/adjustment 3,162 - 283 3,445

Disposals - - (248) (248)

----------------------------- -------------- --------------------- --------

At 31 March 2020 (restated) 161,393 9,411 1,632 172,436

Additions - - 30 30

Disposals - - (230) (230)

----------------------------- -------------- --------------------- --------

At 30 September 2020 161,393 9,411 1,432 172,236

Additions - 720 13 733

Disposals - - (321) (321)

----------------------------- -------------- --------------------- --------

At 31 March 2021 161,393 10,131 1,124 172,648

----------------------------- -------------- --------------------- --------

Depreciation

At 30 September 2019 44,550 4,203 875 49,628

Charge for the period 3,261 396 305 3,962

Disposals - - (138) (138)

------- ------ ------ -------

At 31 March 2020 (restated) 47,811 4,599 1,042 53,452

Charge for the period 3,261 395 247 3,903

Disposals - - (203) (203)

------- ------ ------ -------

At 30 September 2020 51,072 4,994 1,086 57,152

Charge for the period 3,148 424 123 3,695

Disposals - - (295) (295)

------- ------ ------ -------

At 31 March 2021 54,220 5,418 914 60,552

------- ------ ------ -------

Impairment

At 30 September 2019 3,457 - - 3,457

Charge for the period - - - -

------- ------ ------ -------

At 31 March 2020 (restated) 3,457 - - 3,457

Charge for the period 2,241 - - 2,241

------- ------ ------ -------

At 30 September 2020 5,698 - - 5,698

Charge for the period - - - -

------- ------ ------ -------

At 31 March 2021 5,698 - - 5,698

------- ------ ------ -------

Net Book Value

At 31 March 2021 101,475 4,713 210 106,398

-------- ------ ---- --------

At 30 September 2020 104,623 4,417 346 109,386

-------- ------ ---- --------

At 31 March 2020 (restated) 110,125 4,812 590 115,527

-------- ------ ---- --------

At 30 September 2019 110,224 5,208 722 116,154

-------- ------ ---- --------

11. Reconciliation of profit before tax to net cash flows from operating activities

12 months

6 months to 6 months to to

31 March 31 March 30 September

2021 2020 2020

(Restated

- note 3)

GBP'000 GBP'000 GBP'000

Profit before tax 25,838 26,733 25,314

Depreciation of leased investment

properties and right-of-use

assets 3,695 3,903 7,865

Depreciation of plant and equipment 338 436 998

Impairment of leased investment

properties - - 2,241

Amortisation of intangible

assets 280 280 560

(Profit) on sale of plant and

equipment - (3) (24)

Finance income (1) (200) (245)

Finance costs 3,239 3,084 6,366

Share of profit in joint ventures - - (199)

(Increase)/decrease/(increase)

in inventory and work in progress (63,345) 25,586 8,566

Interest capitalised in development

land, inventory and work in

progress 419 216 465

(Increase)/decrease in contract

assets 2,840 (53,633) (15,944)

(Increase)/decrease in trade

and other receivables 61 (7,093) (10,786)

Increase/(decrease) in contract

liabilities (2,430) (702) 3,803

Increase/(decrease) in trade

and other payables (5,675) (11,534) 15,987

Increase/(decrease) in provision

for fire safety cladding works (893) - 9,864

Increase/(decrease) in share-based

payment reserve 167 (48) 37

----------- ---------------------- -------------

Net cash (outflow)/inflow from

operating activities (35,467) (12,975) 54,868

----------- ---------------------- -------------

12. Analysis of net cash/(debt)

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

Cash at bank and in hand 88,727 72,394 134,513

Other interest-bearing loans (728) (866) (631)

Bank loans (56,275) (34,016) (39,036)

-------------- -------------- ----------------

Net cash before deducting lease liabilities 31,724 37,512 94,846

Lease liabilities (131,683) (137,647) (134,453)

-------------- -------------- ----------------

Net debt (99,959) (100,135) (39,607)

============== ============== ================

13. Employee Benefits - long-term incentive plans

In January 2021, 1,230,560 share awards were made under the

Watkin Jones plc Long-Term Incentive Plan (the Plan). The awards

have an exercise price of one penny per share and become

exercisable after three years from the date of grant subject to

continued employment and the Company's Earning per Share (EPS) and

Total Shareholder Return (TSR) performance as follows:

TSR (50% of award) % of TSR award vesting(1)

---------------------- --------------------------

250 pence or less 0%

---------------------- --------------------------

325 pence or greater 100%

---------------------- --------------------------

EPS growth (50% of award) % of EPS award vesting(1)

--------------------------- --------------------------

10% p.a. or less 0%

--------------------------- --------------------------

20% p.a. or more 100%

--------------------------- --------------------------

(1) Vesting on a straight-line basis between target levels

The fair value of share awards granted subject to EPS conditions

is 194.8 pence and has been estimated as the market price of an

ordinary share of the Company at the date the award was granted

less the one penny exercise price for the award. The fair value of

the share awards subject to TSR performance conditions has been

estimated at the grant date using a Monte Carlo valuation model

using the following assumptions:

Share price 195.8 pence

Exercise price 1 penny

Expected term 3 years

Risk-free interest rate (0.07)%

Are dividend equivalents receivable for the award holder? Yes

Expected volatility 31.3%

This resulted in an estimated fair value for an award with TSR

performance conditions of 63.78 pence. For the six months ended 31

March 2021, the amount charged to the statement of comprehensive

income and credited to share based payment reserve was GBP167,575

(31 March 2020: (GBP47,765)).

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFLIEEIDLIL

(END) Dow Jones Newswires

May 18, 2021 02:00 ET (06:00 GMT)

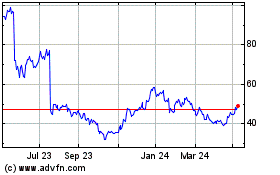

Watkin Jones (LSE:WJG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Watkin Jones (LSE:WJG)

Historical Stock Chart

From Apr 2023 to Apr 2024