By Vipal Monga

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 24, 2018).

NEW YORK -- Royal Bank of Canada has focused its U.S. ambitions

on its capital markets unit. Its first-quarter results suggest the

efforts may be starting to pay off.

The bank's unit, its second-largest by profit, reported record

net income of 748 million Canadian dollars ($591 million) during

its fiscal first quarter, up 13% from a year prior.

Those results helped propel quarterly earnings at RBC, which has

the largest market capitalization of the Canadian banks, to C$3.01

billion, or C$2.01 a share. The results compared with C$3.03

billion, or C$1.97 a share, in the year-earlier period, which

contained a C$212 million benefit from the sale of payment

processor Moneris Solutions Corp.'s U.S. operations.

The bank also recorded a C$178 million charge during the quarter

from U.S. tax reform as it wrote down the value of net deferred tax

assets. Its share price rose 0.8% in Friday trading to $81.11 on

the New York Stock Exchange.

The lender's efforts in capital markets have been costly, but

the quarter showed the investments are yielding some return. While

noninterest expense in the capital markets unit, which includes

compensation, rose 8% from a year ago to C$1.21 billion,

return-on-equity, a measure of how well the bank uses investments

to boost profits, rose to 14.7% from 13.3% a year ago.

Despite the strong quarter, RBC Capital Markets recorded a 3%

drop in its loan balances compared with a year earlier. Since the

first quarter of 2016, loan balances have dropped 9%. The declines

suggest that the bank has been pulling back on its lending, as it

isn't getting as much other business from borrowers as it would

like, said Gabriel Dechaine, analyst with National Bank of

Canada.

In a call with analysts Friday, Doug McGregor, group head of RBC

Capital Markets, said the bank would grow the balance sheet again

but "more modestly than we did several years ago."

And RBC is finding a tough competitive environment on Wall

Street. The bank slipped out of the top 10 investment banks by

revenue in the U.S. last year, according to Dealogic, with newly

emboldened rival Jefferies LLC leapfrogging the Canadian bank in

the league tables by aggressively lending money to highly indebted

companies.

To counter its decline and nudge its U.S. market share from 2.8%

to its goal of 4%, RBC has been taking fresh steps to bolster its

investment-banking arm.

Behind the moves is the head of the U.S. investment bank, Blair

Fleming, who has sought to shed the image of RBC as an overly

cautious Canadian lender since he took the helm of its New York

investment bank in 2009. On his first day in the office, he removed

an award on the wall that congratulated RBC as "mid-market

investment bank of the year."

"We weren't going to get where we wanted to be as a mid-market

bank," Mr. Fleming said in a recent interview.

He has led RBC in luring bankers from rivals that who have hit

rough patches, such as Deutsche Bank AG, and snagging advisory and

lending roles in multibillion-dollar acquisitions for clients such

as tech company Computer Sciences Corp., private-equity firm Silver

Lake Group LLC and utility Sempra Energy.

Recently, the bank has worked to create a restructuring group

and one to advise companies on defending themselves against

activist shareholders.

Last month, the bank hired Keith Murray from BNP Paribas to

finance companies that earn between $25 million and $50 million a

year, the idea being such firms will continue as clients of the

bank as they grow larger. RBC also hired Stavros Tsibiridis in

December from Wells Fargo to help boards defend themselves against

corporate activists.

Those hires aim to expand the brand, said Mr. Fleming. He refers

to the strategy as "high touch," meaning the bank ultimately will

benefit with more business if advisers have more ways of staying in

touch with board members and executives.

RBC also has tried to boost its wealth-management and commercial

banking by purchasing City National Bank, known as Hollywood's

bank, in 2015.

Dave McKay, RBC's chief executive, said the bank hopes to bring

City National's well-heeled, business-owning clients to the capital

markets unit.

"They have a respectable U.S. business," said analyst Mr.

Dechaine. "The question is, can they make it a dominant one?"

On Friday, RBC said it was raising its quarterly dividend to

C$0.94 from C$0.91, and it authorized a new program to buy back up

to 30 million shares over the next 12 months.

--Allison Prang in New York contributed to this article.

Write to Vipal Monga at vipal.monga@wsj.com

(END) Dow Jones Newswires

February 24, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

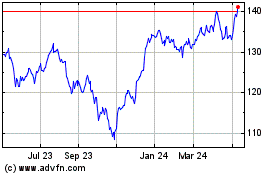

Royal Bank of Canada (TSX:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

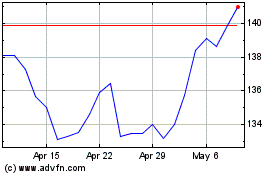

Royal Bank of Canada (TSX:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024