How Gold Continues To Prove To Be A Hedge Against Inflation

August 12 2022 - 12:44PM

NEWSBTC

Across multiple economic downturns and bear markets, gold has

proven to be a haven for investors worldwide, with many traders and

investors opting to invest in it to protect their capital against

value depreciation, which occurs from inflation, causing an

increase in general prices. Because gold prices are related to the

US dollar value due to gold being dollar-denominated, a stronger

USD keeps the price of gold down and more controlled. A weaker USD

drives the gold price higher due to increasing demand. Ultimately

this means that more gold can be purchased when the dollar is more

vulnerable, protecting investors against economic events like

currency devaluation and providing a safety net during periods of

political instability. Gold gained popularity for its ability to be

an inflation hedge when governments attempted to protect their

economies, like in 1879 when the US introduced a gold standard that

began backing the US dollar with actual gold to combat inflation,

and in 1971 when President Nixon decided to end the gold standard

to gain better control over gold-to-dollar conversions and improve

inflation. While the asset has become a go-to for many investors

who wish to hedge against inflation due to its apparent low risk of

price crashes, one study from Duke University found that the asset

class was most successful at combating inflation when invested for

periods of over a century. It found that shorter-term investments

had more significant fluctuations that did not guarantee gains for

investors. Despite its utility, investors should be aware that many

gold mining companies are unsuccessful due to high overhead costs,

debt, finance, lack of control over commodity prices and

non-compliance. Investors looking to get into gold-backed

cryptocurrencies sometimes fail because they cannot create

commercial value nor maintain it. One company trying to provide a

solution for this problem is Zambesi Gold, a thriving business that

aims to lead the transition in mining assets becoming fully backed

digital assets. Self-described in its whitepaper as being “backed

by real gold, real people, and real mining operations combined with

real value,” the company believes that current issues in gold

investing exist due to companies having “a lack of a business plan

which leads to less interest and productivity.” To solve these

problems, an agreement between the Zambesi Token and its investors

ensures that no fractional lending will occur. “The number of

tokens will be fixed, preventing inflation; therefore, a token’s

value will increase irrespective of the demand for the token or of

the gold price, and the amount of gold backing for each token will

increase each month.” The company believes that each asset should

contribute to the profitability of a business and not subsidize

other assets to reduce the cost of debt. It does this by allowing

token holders to be the beneficiaries of the Gold Custodian Trust.

In this vault, physical bullion gets stored. “The Zambesi Gold

standard is a monetary system backed by the value of physical gold,

with the project’s token, just like gold, being perfectly

divisible, with historical and inherent value projected for the

future.” By implementing this structure, Zambesi token holders are

guaranteed that their investment in gold will always increase in

quantity and value. In today’s bear market, investors are

constantly looking for ways to hedge their portfolios against

inflation. While gold has been proven to be a haven for investors,

it is still not without risk, and many investments can take long

periods to provide gains. However, newcomers like Zambesi Gold are

disrupting this space, allowing investors an even safer and more

secure way to invest in gold using cryptocurrency. To learn more

about this exciting new project, head to Zambesi Gold’s website

today.

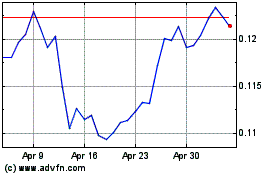

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024