Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

May 17 2024 - 4:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

| (Check One): |

☐ Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR |

| |

|

| |

For Period Ended: March 31, 2024

☐ Transition Report on Form 10-K

☐ Transition Report on Form 20-F

☐ Transition Report on Form 11-K

☐ Transition Report on Form 10-Q

For the Transition Period Ended: _______________________ |

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I - REGISTRANT INFORMATION

OpGen, Inc.

Full Name of Registrant

Former Name if Applicable

9717 Key West Avenue, Suite 100

Address of Principal Executive Office (Street and Number)

Rockville, MD 20850

City, State and Zip Code

PART II - RULES 12B-25(B) AND (C)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-(b), the following should be completed. (Check box, if appropriate)

| |

(a) |

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| |

|

|

| |

(b) |

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K or Form N- SAR, or portion thereof will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or portion thereof will be filed on or before the fifth calendar day following the prescribed due date; and |

| |

|

|

| |

(c) |

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III - NARRATIVE

State below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

OpGen, Inc. (the “Company”) is filing this Notification of Late Filing on Form 12b-25 with respect to its Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 (the “Form 10-Q”), as its focus is on the preparation, finalization and audit or review, as applicable, of the Company’s financial statements to be included in its Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”). The Company has determined that it is unable to file its Form 10-Q within the prescribed time period without unreasonable effort or expense. The Company experienced delays in compiling and finalizing accounting and financial documentation necessary for the Form 10-K as a result of the Company’s limited financial resources, which required that the Company consummate a financing transaction. In addition as previously reported, the Company’s independent public accounting firm notified the Company that it would resign as the Company’s auditor effective as of April 22, 2024. The Company selected a new independent public accounting firm on April 23, 2024. While the Company is working with its independent auditors to file the Form 10-K and to file the Form 10-Q as soon as practicable following the completion of the Form 10-K, the Company does not expect to file the Form 10-Q on or before the expiration of the 5 calendar day extension period provided in Rule 12b-25(b).

PART IV - OTHER INFORMATION

|

(1) |

Name and telephone number of person to contact in regard to this notification. |

| David Lazar |

|

(646) |

|

768-8417 |

| (Name) |

|

(Area Code) |

|

(Telephone Number) |

|

(2) |

Have all other periodic reports required under section 13 or 15(d) of the Securities Exchange Act of 1934 or section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s). ☐ Yes ☒ No |

Annual Report on Form 10-K for the year ended December 31, 2023

|

(3) |

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? ☒ Yes ☐ No |

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

For the three months ended March 31, 2023, the Company’s Form 10-Q indicated approximately $913 thousand in revenues and a net loss of approximately $5.7 million. Due to the insolvency filings of the Company’s foreign subsidiaries in November 2023, the Company’s Form 10-Q for the three months ended March 31, 2024 will not include the operating activity for these entities, which was included in the 2023 filing for the same period. In addition, the Company shifted its focus at the end of 2023 and into 2024 toward pursuing a strategic transaction, so domestic operations, and as a result, revenues and expenditures, declined. Furthermore, during the three months ended March 31, 2024, the Company assigned its lease to another tenant, which will allow the Company to record a gain on assignment of lease in its Q1 2024 Form 10-Q. Given these factors, the Company’s preliminary statement of operations for the three months ended March 31, 2024 shows revenues of approximately $168 thousand and net income of approximately $425 thousand, and such income is primarily due to the gain on assignment of lease of approximately $2.1 million. These preliminary figures for the three months ended March 31, 2024 are subject to change and will be reviewed by the Company’s independent auditor, but these are our estimated figures at this time.

OpGen, Inc.

| |

|

PRELIMINARY |

|

|

ACTUAL |

|

| |

|

Three months ended

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

|

|

| Product sales |

|

$ |

141,373 |

|

|

$ |

410,897 |

|

| Laboratory services |

|

|

26,776 |

|

|

|

21,673 |

|

| Collaboration revenue |

|

|

- |

|

|

|

480,874 |

|

| Total revenue |

|

|

168,149 |

|

|

|

913,444 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

| Cost of products sold |

|

|

73,236 |

|

|

|

592,378 |

|

| Cost of services |

|

|

1,575 |

|

|

|

128,306 |

|

| Research and development, net |

|

|

25,856 |

|

|

|

1,812,831 |

|

| General and administrative |

|

|

1,595,801 |

|

|

|

2,423,953 |

|

| Sales and marketing |

|

|

128,575 |

|

|

|

1,026,087 |

|

| Gain on assignment of lease |

|

|

(2,128,027 |

) |

|

|

- |

|

| Total operating (income) expenses |

|

|

(302,985 |

) |

|

|

5,983,555 |

|

| Operating income (loss) |

|

|

471,134 |

|

|

|

(5,070,111 |

) |

| Other expense |

|

|

|

|

|

|

|

|

| Other income |

|

|

11 |

|

|

|

30,106 |

|

| Interest expense |

|

|

- |

|

|

|

(617,298 |

) |

| Foreign currency transaction gains (losses) |

|

|

281 |

|

|

|

(91,994 |

) |

| Change in fair value of EIB loan guaranty |

|

|

(46,584 |

) |

|

|

- |

|

| Change in fair value of derivative financial instruments |

|

|

- |

|

|

|

12,694 |

|

| Total other expense |

|

|

(46,292 |

) |

|

|

(666,492 |

) |

| Income (loss) before income taxes |

|

|

424,841 |

|

|

|

(5,736,603 |

) |

| Provision for income taxes |

|

|

- |

|

|

|

- |

|

| Net income (loss) |

|

$ |

424,841 |

|

|

$ |

(5,736,603 |

) |

OpGen, Inc.

(Name of Registrant as specified in charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 17, 2024 |

By: |

/s/ David Lazar |

| |

|

David Lazar, Chairman and CEO |

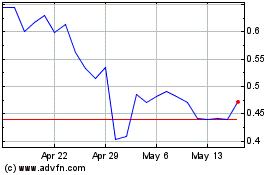

OpGen (NASDAQ:OPGN)

Historical Stock Chart

From Nov 2024 to Dec 2024

OpGen (NASDAQ:OPGN)

Historical Stock Chart

From Dec 2023 to Dec 2024