Cathay Securities Investment Trust Selects ICE FactSet Global Top 50 Brands Index for New ETF

September 26 2022 - 8:00AM

Business Wire

Intercontinental Exchange, Inc. (NYSE: ICE), a leading global

provider of data, technology and market infrastructure, today

announced that Cathay Securities Investment Trust (“Cathay SITE”)

has selected the ICE FactSet® Global Top 50 Brands Index for

a newly launched ETF.

The ICE FactSet Global Top 50 Brands Index (ICFSTBR) is a

modified, float-adjusted market capitalization-weighted equity

benchmark designed to track the performance of companies that are

characterized as having globally recognizable and strong consumer

branding, based on the metrics set forth in the index methodology.

The Cathay Global Top 50 Brands ETF (Ticker: 00916) uses ICE’s

index as its benchmark and is expected to list on the Taiwan Stock

Exchange on September 26, 2022.

“Cathay SITE has a dynamic portfolio of thematic funds, and

we’re pleased to have them list a new ETF benchmarked to an ICE

index,” said Magnus Cattan, Head of ICE Fixed Income and Data

Services in APAC. “This is the first ETF in Taiwan that focuses on

quantifying the brand value of well-known global companies by using

intangible economic value in selecting constituents, resulting in a

transparent, rules-based and innovative approach.”

Cathay SITE is the largest asset management company in Taiwan,

with assets totaling $36.71 billion. Since 2015, Cathay SITE has

expanded its product line with a broad range of ETFs, including

innovative products such as the Cathay Global Autonomous and

Electric Vehicles ETF which won The Asset’s most innovative ETF

award in 2022.

This new listing is the 43rd ETF to list in Taiwan that is

benchmarked to an ICE index, representing a total of assets under

management of approximately $15.7B.

“We are focused on extending our footprint in Asia Pacific and

offering our customers the most innovative and competitive

financial products in the market,” said Andy Chang, CEO at Cathay

SITE. “By evaluating the intangible economic value of well-known

brands, the ICE FactSet Global Top 50 Brands Index enables us to

create unique new funds for our customers to allow them to invest

in industries that match their investment profile and

strategies.”

ICE’s global family of indices serves as the performance

benchmark for more than $1.5 trillion in assets managed by

investors around the globe. For more information about ICE’s

Indices, please visit:

https://www.theice.com/market-data/indices.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks to

connect people to opportunity. We provide financial technology and

data services across major asset classes that offer our customers

access to mission-critical workflow tools that increase

transparency and operational efficiencies. We operate exchanges,

including the New York Stock Exchange, and clearing houses that

help people invest, raise capital and manage risk across multiple

asset classes. Our comprehensive fixed income data services and

execution capabilities provide information, analytics and platforms

that help our customers capitalize on opportunities and operate

more efficiently. At ICE Mortgage Technology, we are transforming

and digitizing the U.S. residential mortgage process, from consumer

engagement through loan registration. Together, we transform,

streamline and automate industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. FactSet® is a trademark of FactSet

Research Systems, Inc. Other products, services, or company names

mentioned herein are the property of, and may be the service mark

or trademark of, their respective owners. Key Information Documents

for certain products covered by the EU Packaged Retail and

Insurance-based Investment Products Regulation can be accessed on

the relevant exchange website under the heading “Key Information

Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE's business that are not historical facts are "forward-looking

statements" that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE's Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE's

Annual Report on Form 10-K for the year ended December 31, 2021, as

filed with the SEC on February 3, 2022.

Category: Fixed Income and Data Services

SOURCE: Intercontinental Exchange

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220926005249/en/

ICE Media Contact: Damon Leavell damon.leavell@ice.com

(212) 323-8587

media@ice.com

ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com (678) 981-3882 investors@ice.com

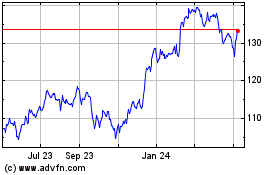

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024