Ackroo Announces 2021 Unaudited Results

January 18 2022 - 7:00AM

Ackroo Inc. (TSX-V: AKR; OTC: AKRFF) (the “Company”), a loyalty

marketing, payments and point-of-sale technology and services

provider, is pleased to report unaudited quarterly revenues of

$1,657,915 for the period ended December 31st, 2021 and unaudited

annual revenues of $5,978,683 for the year ended 2021. This

represents similar results from the previous year and a 9-year

cumulative average growth rate of 30% per year since the Company’s

founding in 2012. The Company delivered $4,979,357 of annual

recurring revenue, completed their 11th acquisition, and their

fourth consecutive positive EBITDA year.

The complete financial results for Ackroo are

available at www.sedar.com. Highlights include:

2021 announced quarterly results:

|

|

Q1 - March 31, 2021 |

Q2 - June 30, 2021 |

Q3 - September 30, 2021 |

Q4 – December 31, 2021 |

Avg QoQgrowth |

|

Total Revenue |

$1,284,289 |

$1,469,357 |

$1,567,121 |

$1,657,915 |

+ 7% |

|

Subscription Rev |

$1,054,468 |

$1,250,299 |

$1,323,794 |

$1,369,596 |

+ 7% |

|

Gross Margins |

$1,123,694 (88%) |

$1,295,369 (88%) |

$1,381,224 (88%) |

$1,473,223 (89%) |

+ 8% (0%) |

|

Adjusted EBITDA |

$8,408 |

$45,026 |

$179,936 |

TBD |

TBD |

|

EBITDA % of Rev |

< 1% |

3% |

11% |

TBD |

TBD |

“After a very challenging start to 2021 we are

very happy with how we adapted and managed to improve quarter over

quarter,” said Steve Levely, CEO of Ackroo. “We started the year

with a large pull back in revenues from larger attrition than

normal, COVID related customer write offs, plus less one time and

new sales then we had anticipated. At the same time, we were

further investing in our organic business so not only were revenues

affected so were earnings to start the year. This forced the

Company to adapt quickly to maintain our EBITDA positive business

with an even tighter focus on operational and financial decisions.

We made changes during Q2 and Q3 that allowed us to better manage

our operations and return to a solid earnings growth business. We

then finished the year with a very strong quarter and a record

number of new customer wins - growing 6% over the previous quarter

and a 29% increase over Q1. We managed to complete the bulk of the

normalization of our most recent acquisition of Interactive DMS,

completed several migrations of legacy platform clients, and have

done lots of internal restructuring to position us for much greater

success in years to come.”

The Company cautions that figures for revenue

have not been audited and are based upon calculations prepared by

management. Actual results may differ from those reported in this

release once these figures have been audited. The Company expects

to complete its 2021 audit in April to confirm revenue figures,

along with other financial results.

Ackroo also announces that its board of

directors has approved the appointment of MNP LLP as the new

auditor of the Company effective January 11, 2022. MNP LLP has

been engaged to complete an audit of the 2021 financial year for

the Company.

Ackroo has also granted incentive stock options

to purchase 900,000 common shares to certain directors and

employees of the Company exercisable at a price of $0.125, for a

period of 3 years. The option grant remains subject to the approval

of the TSX Venture Exchange.

About Ackroo

Through vendor and industry consolidation,

Ackroo provides marketing, payment and point-of-sale solutions for

merchants of all sizes. Ackroo’s self-serve, data driven,

cloud-based marketing platform helps merchants in-store and online

process and manage loyalty, gift card and promotional transactions

at the point of sale. Ackroo’s payment services provide merchants

with low-cost payment processing options through some of the

world’s largest payment technology and service providers. Ackroo’s

hybrid management and point-of-sale solutions help manage and

optimize the general operations for niche industry’s including golf

clubs, automotive dealers and more. All solutions are focused on

helping to consolidate, simplify and improve the merchant

marketing, payments and point-of sale ecosystem for their clients.

Ackroo is headquartered in Hamilton, Ontario, Canada. For more

information, visit: www.ackroo.com.

For further information, please contact:

Steve LevelyChief Executive

Officer | AckrooTel: 416-360-5619 x730Email: slevely@ackroo.com

The TSX Venture Exchange has neither approved

nor disapproved the contents of this press release. Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward Looking StatementsThis

release contains forecasts and forward-looking statements that are

not guarantees of future performance and activities and are subject

to risks and uncertainties. The Company has based these

forward-looking statements on assumptions and assessments made by

its management in light of their experience and their perception of

historical trends, current conditions, expected future developments

and other factors they believe to be appropriate. Important factors

that could cause actual results, developments and business

decisions to differ materially from those anticipated in these

forward-looking statements include, but are not limited to: the

Company’s ability to raise enough capital to support the Company’s

go forward plans; the overall global economic environment; the

impact of competition and new technologies; general market,

political and economic conditions in the countries in which the

Company operates; projected capital expenditures and liquidity;

changes in the Company’s strategy; government regulations and

approvals; changes in customers’ budgeting priorities; plus other

factors that may arise. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

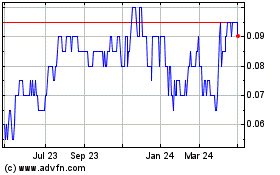

Ackroo (TSXV:AKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

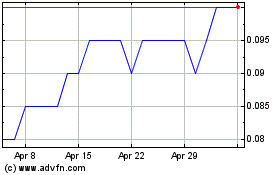

Ackroo (TSXV:AKR)

Historical Stock Chart

From Apr 2023 to Apr 2024