Compuware Shareholders Approve Definitive Agreement to Be Acquired by Thoma Bravo

December 08 2014 - 3:15PM

Business Wire

Transaction Valued at Approximately $2.4

Billion

Compuware Corporation (NASDAQ: CPWR) announced that at the

special meeting of Compuware shareholders held earlier today,

shareholders voted to approve the proposed definitive merger

agreement with Thoma Bravo, LLC.

The transaction follows a thorough review by the Compuware Board

of Directors of strategic options for Compuware. More than 99% of

the shares voting at the special meeting voted in favor of the

adoption of the merger agreement. The CEO of Compuware, Bob Paul,

stated, “The acquisition by Thoma Bravo provides a great value

proposition for Compuware’s shareholders and we are very pleased

with the level of support this transaction has received from our

shareholders.”

Upon completion of the merger, valued at approximately $2.4

billion, Compuware shareholders will have received an aggregate

value of $10.75 per share for each share of Compuware common stock

they own as of the effective time of the merger, which includes a

net cash payment of $10.389188 per share of common stock (after

deducting the corporate level taxes associated with the Covisint

spin-off to Compuware shareholders) as well as the per-share value

of the Covisint shares distributed to holders of Compuware equity

as of October 20, 2014, the record date for the Covisint spin-off.

The companies currently expect the merger to be completed later

this month, following the satisfaction or waiver of all conditions

to the merger.

About Compuware Corporation

Compuware Corporation is the technology performance company, and

we exist solely to help our customers optimize the performance of

their most important and innovative technologies—those that drive

their businesses forward. Today, more than 7,100 companies,

including many of the world’s largest organizations, depend on

Compuware and our new generation approach to performance management

to do just that. Learn more at www.compuware.com.

About Thoma Bravo, LLC

Thoma Bravo is a leading private equity investment firm building

on a 30+ year history of providing equity and strategic support to

experienced management teams and growing companies. The firm seeks

to create value by collaborating with company management to improve

business operations and provide capital to support growth

initiatives. Thoma Bravo invests with a particular focus on

application and infrastructure software and technology enabled

services. The firm currently manages a series of private equity

funds representing more than $7.5 billion of equity commitments.

For more information, visit www.thomabravo.com.

Forward-looking statements

All of the statements in this release, other than historical

facts, are forward-looking statements made in reliance upon the

safe harbor of the Private Securities Litigation Reform Act of

1995, including, without limitation, the statements made concerning

the Company’s intent to consummate a merger with an affiliate of

Thoma Bravo. As a general matter, forward-looking statements are

those focused upon anticipated events or trends, expectations, and

beliefs relating to matters that are not historical in nature. Such

forward-looking statements are subject to uncertainties and factors

relating to the Company’s operations and business environment, all

of which are difficult to predict and many of which are beyond the

control of the Company. Among others, the following uncertainties

and other factors could cause actual results to differ from those

set forth in the forward-looking statements: (i) the risk that the

merger may not be consummated in a timely manner, if at all; (ii)

the risk that the definitive merger agreement may be terminated in

circumstances that require the Company to pay Thoma Bravo a

termination fee of $83.4 million and/or reimbursement of their

expenses of up to $4.0 million; (iii) risks related to the

diversion of management’s attention from the Company’s ongoing

business operations; (iv) risks regarding the failure of the

relevant Thoma Bravo affiliate to obtain the necessary financing to

complete the merger; (v) the effect of the announcement of the

merger on the Company’s business relationships (including, without

limitation, customers and suppliers), operating results and

business generally; and (vi) risks related to obtaining the

requisite consents to the merger, including, without limitation,

the timing (including possible delays) and receipt of regulatory

approvals from various domestic and foreign governmental entities

(including any conditions, limitations or restrictions placed on

these approvals) and the risk that one or more governmental

entities may deny approval. Further risks that could cause actual

results to differ materially from those matters expressed in or

implied by such forward-looking statements are described in

Compuware’s SEC reports, including but not limited to the risks

described in Compuware’s Annual Report on Forms 10-K and 10-K/A for

its fiscal year ended March 31, 2014 and Quarterly Reports on Form

10-Q for the fiscal quarters ended June 30, 2014 and September 30,

2014. Compuware assumes no obligation and does not intend to update

these forward-looking statements.

Source:Compuware

Compuware CorporationLisa

Elkin313-227-7345Lisa.Elkin@compuware.comorThoma BravoJeff

SegvichLANE (for Thoma Bravo, LLC)503-546-7870jeff@lanepr.com

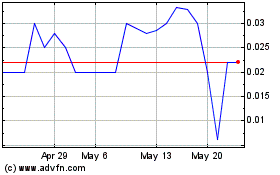

Ocean Thermal Energy (CE) (USOTC:CPWR)

Historical Stock Chart

From Nov 2024 to Dec 2024

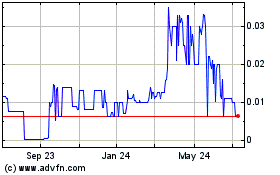

Ocean Thermal Energy (CE) (USOTC:CPWR)

Historical Stock Chart

From Dec 2023 to Dec 2024