TIDMABDP

RNS Number : 3880G

AB Dynamics PLC

25 November 2020

25 November 2020

AB Dynamics plc

Final Results for the Year Ended 31 August 2020

"A resilient performance and continued delivery of our strategy

for sustainable growth"

AB Dynamics plc ("AB Dynamics", the "Company" or the "Group"),

the designer, manufacturer and supplier of advanced testing systems

and measurement products to the global automotive market, is

pleased to announce its final results for the year ended 31 August

2020.

Audited Audited

2020 2019

GBPm GBPm

Revenue 61.5 58.0 +6%

Adjusted operating profit(1) 11.3 12.9 (12%)

Adjusted operating margin 18.4% 22.3% (390 bps)

Adjusted profit before

tax(1) 10.9 13.1 (16%)

Statutory operating profit 5.4 10.8 (50%)

Statutory profit before

tax 5.0 11.0 (54%)

Statutory profit after

tax 4.6 8.7 (47%)

Cash flow from operations 6.9 9.9 (31%)

Cash 31.2 36.2 (14%)

------------------------------ -------- -------- ----------

Pence Pence

Adjusted diluted earnings

per share(1) 39.9 51.4 (22%)

Statutory basic earnings

per share 20.2 42.9 (53%)

Statutory diluted earnings

per share 20.1 42.1 (52%)

Total dividend per share 4.4 4.4 -

------------------------------ -------- -------- ----------

(1) Before amortisation of acquired intangibles, inventory

impairment, acquisition related charges and restructuring costs. A

reconciliation to statutory measures is given below. Prior year

comparatives have been restated to reflect the inclusion of share

based payments which were previously reported as an adjustment.

Financial highlights

-- Strong first half performance, offset by challenging trading

conditions in the second half due to the COVID-19 pandemic

-- Track testing revenue increased by 4% reflecting a

combination of strong growth in ADAS platforms and testing, offset

by a reduction in sales of driving robots and a suspension of

testing operations as a result of the pandemic

-- Laboratory testing and simulation revenues increased by 18%

as a result of significant growth in SPMM and simulation revenues,

despite experiencing deferments of orders in the second half

-- Reduction in adjusted operating margins to 18.4% driven by

continued strategic investment in capability to support long term

growth drivers

-- Significant cash balance of GBP31.2m (2019: GBP36.2m) after

investing GBP8.2m in capital expenditure in the period, which

continues to provide resources to support the Group's investment

requirements

-- Reinstatement of dividends, with a proposed final dividend of

4.4p per share, equal to the total dividend for 2019 and reflecting

the Board's confidence in the Group's financial position and

prospects

Operational and strategic highlights

-- Strong geographic growth in the USA and Japan following the

successful establishment of new sales and support offices

-- Successful launch of new products including Halo driving

robot, aNVH, Guided Soft Target 120 and Radar Cart

-- Further development of the simulation sector with new

products including Static Simulator, Data Farming, Linux OS version

and highly accurate digital twins

-- Growth in recurring revenue to 28%, up from 10% of Group

revenue through acquired businesses and increased sales of service

and support contracts

-- Continued investment in management capability, processes and

systems, including progress towards implementation of a Group-wide

ERP system

-- Construction of the new Engineering Design Centre nearing completion

-- Solid performance from companies acquired during 2019,

including significant growth of track testing services in the

USA

Current trading and outlook

-- Q1 trading to date in line with Q4 FY20 exit rate

-- Progress in laboratory testing and simulation, with a number

of the deferred 2020 orders secured either side of the financial

year end

-- Second wave impacts of the pandemic make order intake

patterns difficult to predict into 2021, particularly for

laboratory testing and simulation

-- Long-term, sustainable structural and regulatory growth drivers remain intact

-- Continued innovation and capability investment generating positive commercial momentum

-- Well placed and sufficiently invested to capitalise on

opportunities when levels of demand return

-- The Group has resumed its acquisition strategy and is

actively exploring a number of opportunities

There will be a presentation for analysts this morning at 9.30am

via conference call. Please contact abdynamics@tulchangroup.com if

you would like to attend.

Commenting on the results, Dr James Routh, Chief Executive

Officer said:

"The Group has delivered a robust and resilient performance in

2020 against a backdrop of challenging market conditions due to

COVID-19. After a very strong first half of the financial year, the

Group took rapid and effective actions to mitigate the risks of the

pandemic. Whilst the backdrop has been uncertain, the Group's

strong financial position has enabled us to remain focussed on

maintaining our strategic momentum. The Group continued to invest

in its capabilities, systems and business infrastructure which,

despite a softening in operating margins over the near term,

ensures the Group remains well placed to capitalise on the

long-term regulatory and structural growth drivers, which remain

intact.

"Demand in the first quarter of the current year has been

consistent with the Q4 FY20 exit rate. The disruption associated

with further waves of infection means that visibility is limited

and there remains short-term uncertainty as to the shape and rate

of this recovery. Looking further ahead, we remain confident that

demand will recover to pre-crisis growth patterns over the medium

term.

"Despite the uncertain backdrop, we see significant scope to

deliver on the Group's strategic priorities, such as further

product development and executing on our pipeline of potential

acquisition opportunities. We are very encouraged by the initial

progress already evident from our key strategic investment

initiatives. The market drivers are compelling, the medium-term

outlook for AB Dynamics remains positive and the Board is confident

the Group can continue to deliver on its strategic priorities"

Enquiries:

AB Dynamics plc 01225 860 200

Tony Best, Chairman

Dr James Routh, Chief Executive Officer

Sarah Matthews-DeMers, Chief Financial

Officer

Peel Hunt LLP 0207 418 8900

Mike Bell

Ed Allsopp

Tulchan Communications 0207 353 4200

James Macey White

Matt Low

Deborah Roney

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) ("MAR") prior to its release as part

of this announcement and is disclosed in accordance with the

Company's obligations under Article 17 of those Regulations.

The person responsible for arranging the release of this

information is Felicity Jackson, Company Secretary.

About AB Dynamics plc

AB Dynamics is a leading designer, manufacturer and provider of

advanced products for testing and verification of Advanced Driver

Assistance Systems ("ADAS") technology, autonomous vehicle

development and vehicle dynamics to the global automotive research

and development sector.

AB Dynamics is an international group of companies headquartered

in Bradford-on-Avon. AB Dynamics currently supplies all the top

automotive manufacturers, Tier 1 suppliers and service providers,

who routinely use the Group's products to test and verify vehicle

safety systems and dynamics.

Group overview

Against a backdrop of very challenging macroeconomic conditions

due to the COVID-19 pandemic, the Group delivered a resilient

performance in 2020, whilst continuing to invest to ensure the

Group can capitalise on the significant long-term structural and

regulatory growth drivers underlying its markets. This year's

performance demonstrates the strength of the Group's sustainable

business model and was supported by recent investments to diversify

the business and strengthen systems, processes and infrastructure.

During this challenging period, our employees around the world have

shown their skills, professionalism and commitment to continue to

deliver class-leading products to our valued customers.

During the second half of the year the Group saw a significant

slow down in customer activity as customers attempted to conserve

cash. This impacted Group order intake, particularly for larger,

capital equipment orders. There was a gradual recovery through Q4

as customer activity and order intake improved, although timing

remains uncertain going into H1 2021. Our continued investments in

the second half strengthened the Group's market position to enable

the business to emerge strongly as markets slowly recover. However,

the long term structural and regulatory growth drivers that

underpin our markets remain firmly intact.

Financial performance

The Group delivered revenue growth of 6% to GBP61.5m (2019:

GBP58.0m), reflecting the resilience of the business model and the

Group's strong market positions. The increase was driven by growth

of 19% from the acquisitions made in the previous year, offset by

an organic revenue decline of 13% as a result of COVID-19 specific

disruption to our international customers. At the half year the

Group had delivered significant revenue growth of 34%, of which 11%

was organic, however the second half was impacted by COVID-19 and

revenues declined 18% against a very strong prior year comparator.

In spite of the backdrop, the proportion of recurring revenue

increased substantially to 28% of sales (2019: 10%) due to the

impact of the businesses acquired in 2019, in addition to an

increase in longer-term service and support contracts.

Group adjusted operating profit decreased 12% to GBP11.3m (2019:

GBP12.9m) resulting in a decrease in adjusted operating margin of

390 bps to 18.4% (2019: 22.3%). The margin has been impacted by our

continued investment in our strategy for growth and building out

the senior management team, partly offset by mitigating actions to

reduce discretionary spending.

Gross margins increased by 1,020 bps to 58.4% as a result of

relative product mix between the Group's two sectors, coupled with

the relatively higher margin contributions from both rFpro and DRI

acquired towards the end of the last financial year. Our direct

sales model in key territories also contributed to the improved

gross margin as the Group utilises fewer third-party sales agents

and resellers.

Net finance costs were GBP0.4m (2019: net income GBP0.2m), with

interest income of GBP0.2m offset by lease interest of GBP0.1m and

the unwinding of the discounted value of the deferred consideration

on DRI and rFpro.

This left adjusted profit before tax of GBP10.9m (2019:

GBP13.1m).

The Group adjusted tax charge totalled GBP1.9m (2019: GBP2.5m),

an adjusted effective tax rate of 17.7% (2019: 19.3%). The

effective tax rate is lower than the current UK corporation tax

rate due to allowances for research and development and patent box.

In future years, the effective tax rate is expected to remain

stable with UK allowances offsetting higher tax rates in overseas

territories.

Adjusted diluted earnings per share were 39.9p (2019: 51.4p), a

decrease of 22%. The drop through was higher than the decrease in

adjusted operating profit due to the increased number of shares

after the prior year equity issue.

Statutory operating profit reduced by 50% to GBP5.4m and after

net finance costs of GBP0.4m (2019: interest income GBP0.2m),

statutory profit before tax was down 54% from GBP11.0m to GBP5.0m,

giving statutory basic earnings per share of 20.2p (2019: 42.9p).

The statutory tax charge was GBP0.4m (2019: GBP2.3m). A

reconciliation of statutory to underlying non-GAAP financial

measures is provided below.

The Group delivered operating cash flow of GBP6.9m with the cash

position at year end of GBP31.2m underpinning a robust balance

sheet. During 2020 we invested in the Group's new Engineering

Design Centre, R&D, payment of deferred consideration for the

acquisition of Dynamic Research Inc and working capital to support

the growth in the business.

COVID-19

The emergence of the COVID-19 pandemic in early 2020 saw

unprecedented impacts on global economies, with the automotive

sector impacted particularly significantly. As reported at the end

of the Group's first half, we took rapid steps to limit

discretionary spend and conserve cash whilst we gained clarity on

the overall short-term impact on the business.

The Group did not see any significant adverse impacts on its

supply chain or manufacturing facilities, but many larger, capital

equipment orders were initially deferred by our customers. Through

the second half of the year, the Group saw orders increase,

particularly in the fourth quarter, albeit these were still below

pre-pandemic levels at the year end. At the end of the financial

year, one of the anticipated larger capital equipment orders was

received and the pipeline for further orders is strong, although we

remain mindful of uncertainty relating to timing.

Throughout the period of lockdown, the Group was able to

maintain key manufacturing and track testing operations, whilst

approximately 70% of our global workforce worked remotely. This

balance proved to be effective and we were able to continue

delivering for our customers whilst maintaining our investment

activities, particularly in product development. The restrictions

on travel prevented certain installation, commissioning and

training activities from taking place, however our recently added

international sales and support offices were able to continue to

support customers where required.

Looking forward there remains uncertainty around the ongoing

impact of COVID-19 and the Board continues to be cautious and alert

to conditions in the wider automotive market. Timing of order

intake is likely to be variable and we expect this uncertainty to

continue through at least the first half of the new financial year,

particularly in relation to capital equipment.

However, we are confident that the long-term structural and

regulatory drivers that underpin our markets remain firmly intact

and the Group is therefore continuing to invest in new product

development as well as business infrastructure, which the Board

believes are critical to delivering its long-term growth and

strategic development objectives for the business.

Furthermore, after a brief pause in the early stages of the

pandemic, we have now resumed our acquisition strategy and the

Group is actively exploring a number of opportunities. We see good

opportunity to put our strong balance sheet to work with strategic

acquisitions that will enhance earnings, broaden our product

offering and extend our geographic footprint in key markets.

Sector review

Track testing

The track testing sector delivered overall revenue growth of 4%

to GBP51.8m (2019: GBP49.8m) through a combination of strong growth

in ADAS platforms and testing services, offset by a reduction in

sales of driving robots.

Driving robot sales reduced by 30% to GBP21.1m (2019: GBP30.1m)

as demand slowed, particularly in the second half, albeit against a

very strong prior year comparator. In the previous two financial

years, strong growth was delivered through the Chinese market as

new entrant vehicle OEMs established their testing capability. Once

established, the demand for driving robots slowed and the Group

expects sales revenues in this sector to slow in the short term,

before growing again once new regulatory requirements for new ADAS

technologies are released.

The strong growth in ADAS platforms continued despite the impact

of COVID-19 in the second half of the year, delivering 22% revenue

growth to GBP24.1m (2019: GBP19.7m). Demand for ADAS platforms,

particularly the Launchpad, continues to build as new test

protocols are released from regulatory bodies and consumer bodies

such as Euro-NCAP. The trend towards multi-object test scenarios

will further drive demand for a range of platforms that meet these

test requirements, including platforms to carry a range of objects

(e.g. pedestrian dummies, cyclists, scooters, motorcycles, etc.)

that can operate at a range of speeds and can interact with a

variety of test vehicles from passenger cars to commercial

vehicles.

Through the acquisition of Dynamic Research Inc (DRI) in August

2019, the Group is able to provide track testing services to the US

market. DRI provides testing services to evaluate the performance

of ADAS systems, autonomous vehicles and vehicle dynamics through

its extensive test facility. DRI delivered revenue of GBP6.6m

(2019: GBPNil) associated with track testing services through a

significant series of test programmes for NHTSA, the US regulatory

body, and by supporting US OEMs and technology companies.

As part of the Group objective to increase recurring revenue, AB

Dynamics launched tiered service and support packages to the

existing customer base. These multi-tiered contracts proved

successful with many high profile customers entering into long-term

support contracts which increase the Group's overall proportion of

recurring revenue.

The establishment of the Group's overseas sales and support

offices in Japan, Germany and the USA has delivered improved sales

revenue, gross margin enhancement and closer relationships with key

customers. These investments have yielded significant sales revenue

growth, particularly in Japan and the USA.

The Group continues to invest in new product development in this

sector with a number of new product launches expected in 2021

including enhancements and new variants of ADAS platforms, new

driving robot technologies and a significant new release of the

Ground Traffic Control software.

Laboratory testing and simulation

The laboratory testing and simulation sector delivered strong

overall revenue growth of 18% to GBP9.7m (2019: GBP8.2m), through

significant growth of 15% in SPMM revenue, a small contribution

from revenue recognised during the build of our first aNVH and

growth of 24% in simulation.

The growth in SPMM sales revenue of 15% to GBP4.6m (2019:

GBP4.1m) was due to construction of machines for customers in Japan

and China, however this growth was constrained in the second half

of the financial year as customers deferred their decision making

to conserve cash in the face of the COVID-19 pandemic. Order intake

activity recovered towards the end of the financial year and the

current pipeline of opportunities is promising.

During the first half of the year the Group received its first

order for the aNVH machine from a major automotive OEM. The

contract commenced during the second half of FY20 with delivery

expected during FY21, therefore only a small element of the total

contract revenue was recognised during the financial year.

The Group delivered a further simulator system to the Alfa Romeo

Formula 1 team during the year and the technical partnership is

generating significant opportunities in other areas of motorsport.

Similar to the SPMM orders, many highly probable simulator orders

were deferred due to COVID-19 and the pipeline of opportunity is

encouraging.

Overall simulation sales grew by 24% to GBP4.7m (2019: GBP3.8m)

driven predominantly by a strong performance from rFpro in the

first half of the financial year. However, a significant proportion

of rFpro revenue relates to motorsport series, particularly Formula

1, Formula E and the US motorsport series such as Nascar and

Indycar. Most motorsport was postponed due to the COVID-19 pandemic

which impacted rFpro revenues in the second half. Towards the end

of the financial year, motorsport restarted which provided some

initial recovery in revenues.

The Group has made solid progress during the year in laboratory

testing and simulation, delivering strong sales growth against

difficult market conditions. During the period impacted by the

COVID-19 pandemic, the Group invested in new technologies and

launched a number of new products during the financial year

including the aNVH test machine, the static simulator expanding the

family of simulator products and the launch of new capabilities in

rFpro such as Data Farming and Linux development.

The Group's new Engineering Design Centre will house a

simulation research and development facility to accelerate the

development of new simulator technologies. A number of significant

simulation R&D projects are currently in progress and will be

launched during 2021.

Progress on our strategy

We are pleased with the ongoing progress made against the

five-point strategy announced in April 2019. Investments in

geographic diversification, direct routes to market and our service

and support offering provide direct sales channels and improved

customer intimacy, whilst enhancing margins and recurring revenue.

These investments have been complemented by the commencement of

important initiatives to improve our systems, processes and

structure. Together with continued investment in infrastructure,

people and new product development, this will result in a

resilient, sustainable business able to effectively take advantage

of the significant structural and regulatory changes in our end

markets.

Investment in product development continued with new products

including the aNVH, Halo driving robot, GST 120, Launchpad 60,

Static Simulator and Data Farming capabilities within the rFpro

simulation software. These new products address future regulatory

requirements for testing of ADAS systems and the market need to

rapidly accelerate autonomous system verification. Significant

investment in product development continues and we expect to

announce further product launches in 2021, which supports our model

of sustainable revenue growth.

To deliver the required capability and capacity to drive our

future growth, the Group has further invested in strengthening and

developing the senior management team and the continued build of

our new Engineering Design Centre. Investment in building our

business infrastructure continues with the ERP implementation

project due to go live during 2021. This is a significant change

project that will transform the business processes across the Group

and provide strong foundations to support current and future

growth.

Acquisitions

The Group has been pleased with the integration of the two

acquisitions completed during 2019. DRI has performed beyond

expectations and was able to deliver outstanding results despite

the impact of COVID-19 in the USA. Due to this strong performance,

the Group paid the maximum of $3.5m in deferred consideration to

the previous owners of DRI. rFpro has integrated well and had a

very strong first half of the year but was adversely affected by

the COVID-19 impact on motorsport in the second half. The pipeline

for acquisitions remains promising and the Group continues to

identify value enhancing acquisition opportunities that facilitate

our stated strategic priorities.

Alternative performance measures

In the analysis of the Group's financial performance and

position, operating results and cash flows, alternative performance

measures are presented to provide readers with additional

information. The principal measures presented are adjusted measures

of earnings including adjusted operating profit, adjusted operating

margin, adjusted profit before tax, adjusted EBITDA and adjusted

earnings per share.

This financial information includes both statutory and adjusted

non-GAAP financial measures, the latter of which the Directors

believe better reflect the underlying performance of the business

and provide a more meaningful comparison of how the business is

managed and measured on a day-to-day basis. The Group's alternative

performance measures and KPIs are aligned to the Group's strategy

and together are used to measure the performance of the business

and form the basis of the performance measures for remuneration.

Adjusted results exclude certain items because if included, these

items could distort the understanding of the performance for the

year and the comparability between the periods.

We provide comparatives alongside all current year figures. The

term 'adjusted' is not defined under IFRS and may not be comparable

with similarly titled measures used by other companies. All profit

and earnings per share figures in this financial information relate

to underlying business performance (as defined above) unless

otherwise stated.

A reconciliation of statutory measures to adjusted measures is

provided below:

2020 2019

Statutory Adjustments Adjusted Statutory Adjustments * Adjusted *

Operating profit (GBPm) 5.4 5.9 11.3 10.8 2.1 12.9

Operating margin (%) 8.8 9.6 18.4 18.7 3.6 22.3

Profit before tax (GBPm) 5.0 5.9 10.9 11.0 2.1 13.1

Taxation (GBPm) (0.4) (1.5) (1.9) (2.3) (0.2) (2.5)

Profit after tax (GBPm) 4.6 4.4 9.0 8.7 1.9 10.6

Diluted earnings per share (pence) 20.1 19.8 39.9 42.1 9.3 51.4

*Comparatives have been restated to include share based payments

within underlying figures

The adjustments comprise:

2020 2019

GBPm GBPm

Amortisation of acquired intangibles 3.5 0.3

Inventory impairment 3.3 -

Acquisition related (credit) / costs (1.9) 1.3

Restructuring 1.0 0.5

-------------------------------------- ------ -----

Adjustments 5.9 2.1

-------------------------------------- ------ -----

Adjustments totalled GBP5.9m (2019: GBP2.1m), of which GBP3.5m

related to amortisation of acquired intangible assets, GBP1.9m to a

credit in relation to acquisitions and GBP1.0m to restructuring

costs. A further GBP3.3m related to a write down of inventory.

Following a detailed review of stock levels and usage, a number of

items previously included in the carrying value have been written

off and the system of accounting for inventory has been updated to

better reflect the Group's current operations. Further details of

the adjustments are provided in note 3.

The Group has previously reported the share based payment charge

as an adjustment to operating profit. However as this is expected

to be an ongoing expense for the Group, for the year ended 31

August 2020 onwards, the charge will be included within adjusted

reporting measures. Prior year comparatives have been restated to

reflect this change. Adjusted operating profit includes a charge of

GBP1.3m (2019: GBP0.6m).

Return on capital employed (ROCE)

Our capital-efficient business and high margins enable

generation of strong ROCE (defined as adjusted operating profit as

a percentage of capital employed). However, in the years in which

we acquire businesses or new properties, our capital base grows

disproportionately with profit, therefore the ratio will be

impacted. The current year has been impacted by the investment in

building the new Engineering Design Centre, accounting for the

decrease in ROCE in the year from 19.3% in 2019 to 15.2% in

2020.

Research and development

While research and development forms a significant part of the

Group's activities, a significant proportion relates to specific

customer programmes which are included in the cost of the product.

Development costs of GBP0.2m (2019: GBPNil) have been capitalised

in relation to projects for which there are a number of near-term

sales opportunities. Other research and development costs, all of

which have been written off to the profit and loss account as

incurred, total GBP0.8m (2019: GBP0.8m).

Foreign currency exposure

The Group faces currency exposure on its foreign currency

transactions and, with the acquisition of DRI and international

expansion of our sales offices, exposure to both foreign currency

translation and transaction risk has increased.

The Group maintains a natural hedge whenever possible to

transactional exposure by matching the cash inflows and outflows in

the respective currencies.

There was no material difference between the reported profit for

the year and that calculated on a constant currency basis as the

exchange rates were broadly similar to the comparative period.

Leases

IFRS 16 'Leases' has been adopted in the period. This new

standard introduces the principle that all leased assets should be

reported on the balance sheet of the lessee, recognising an asset

for the right to use the leased item and a liability for the

present value of its future lease payments. This resulted in the

recognition of a right-of-use asset of GBP1.3m and a corresponding

lease liability being recognised on 1 September 2019.

It has also resulted in an increase in depreciation and interest

costs of GBP0.6m with a similar decrease in operating lease rental

costs.

Dividends

Against a background of significant macroeconomic uncertainty,

the Board took the decision in April 2020 to suspend the interim

dividend pending the conclusion of the financial year. The Board

has reviewed the position in light of our results for the year and

is recommending a final dividend of 4.4p per share, resulting in an

unchanged total dividend for the year. It is the Board's intention

to pursue a sustainable and growing dividend policy in the future

having regard to the development of the Group.

Summary and Outlook

The Group has delivered a robust and resilient performance in

2020 against a backdrop of challenging market conditions due to

COVID-19. After a very strong first half of the financial year, the

Group took rapid and effective actions to mitigate the risks of the

pandemic. Whilst the backdrop has been uncertain, the Group's

strong financial position has enabled us to remain focussed on

maintainting our strategic momentum. The Group continued to invest

in its capabilities, systems and business infrastructure which,

despite a softening in operating margins over the near term,

ensures the Group remains well placed to capitalise on the

long-term regulatory and structural growth drivers which remain

intact.

Demand in the first quarter of the current year has been

consistent with the Q4 FY20 exit rate. The disruption associated

with further waves of infection means that visibility is limited

and there remains short-term uncertainty as to the shape and rate

of this recovery. Looking further ahead, we remain confident that

demand will recover to pre-crisis growth patterns.

Despite the uncertain backdrop, we see significant scope to

deliver on the Group's strategic priorities, such as further

product development and executing on our pipeline of potential

acquisition opportunities. We are very encouraged by the initial

progress already evident from our key strategic investment

initiatives. The market drivers are compelling, the medium-term

outlook for AB Dynamics remains positive and the Board is confident

the Group can continue to deliver on its strategic priorities.

Directors' Responsibility Statement on the Annual Report and

Accounts

The responsibility statement below has been prepared in

connection with the Group's full annual report and accounts for the

year ended 31 August 2020. Certain parts thereof are not included

within this announcement.

The Directors are responsible for preparing the Strategic

Report, Directors' Report, any other surrounding information and

the Group and Parent Company financial statements in accordance

with applicable law and regulations. Company law requires the

Directors to prepare group and parent company financial statements

for each financial year. Under that law, they have elected to

prepare the Group financial statements in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union (EU) and applicable law and have elected to

prepare the parent company financial statements in accordance with

UK Accounting Standards and applicable law (UK Generally Accepted

Accounting Practice).

Under Company law, the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Parent Company and of

their profit or loss for that year. In preparing each of the Group

and Parent Company financial statements, the Directors are required

to:

-- Select suitable accounting policies and apply them consistently;

-- Make judgments and accounting estimates that are reasonable and prudent;

-- State whether applicable accounting standards have been

followed, subject to any material departures disclosed and

explained in the financial statements; and

-- Prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and the Parent

Company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the parent

company's transactions and disclose with reasonable accuracy at any

time the financial position of the parent company and enable them

to ensure that the financial statements comply with the Companies

Act 2006. They are also responsible for safeguarding the assets of

the parent company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

They are further responsible for ensuring that the Strategic

Report and the Report of the Directors and other information

included in the Annual Report and Financial Statements is prepared

in accordance with applicable law in the United Kingdom.

The maintenance and integrity of the AB Dynamics plc web site is

the responsibility of the Directors; the work carried out by the

auditors does not involve the consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred in the accounts since they were initially

presented on the website.

Legislation in the United Kingdom governing the preparation and

dissemination of the accounts and the other information included in

annual reports may differ from legislation in other

jurisdictions.

This responsibility statement was approved by the Board of

Directors on 25 November 2020 and has been signed on its behalf by

James Routh and Anthony Best.

AB Dynamics plc

Consolidated statement of comprehensive income

For the year ended 31 August 2020

2020 2019

Note GBP'000 GBP'000

Revenue 2 61,514 57,957

Cost of sales (25,592) (30,039)

---------- ----------

Gross profit 35,922 27,918

Administrative expenses (29,229) (16,505)

Share based payment costs (1,282) (586)

Operating Profit 5,411 10,827

Finance income 218 171

Finance expense (594) -

---------- ----------

Profit before tax 5,035 10,998

Tax expense (483) (2,340)

Profit for the year 4,552 8,658

---------- ----------

Other comprehensive income:

Items that may be reclassified to consolidated

income statement:

Exchange (losses) / gains on foreign currency

net investments (1,978) 178

Total comprehensive income for the period 2,574 8,836

---------- ----------

Earnings per share - basic (pence) 6 20.2p 42.9p

Earnings per share - diluted (pence) 6 20.1p 42.1p

Alternative performance measures

2020 2019

Note GBP'000 GBP'000

Operating profit 5,411 10,827

Amortisation of acquired intangibles 3,549 279

Inventory impairment 3,267 -

Acquisition related (credit) / charge (1,865) 1,272

Restructuring 969 550

Adjusted operating profit 11,331 12,928

Net finance (expenses) / income (376) 171

Adjusted profit before tax 10,955 13,099

---------- ----------

Adjusted tax charge (1,939) (2,524)

Adjusted profit after tax 9,016 10,575

---------- ----------

Adjusted earnings per share - basic (pence) 6 40.1p 52.4p

Adjusted earnings per share - diluted

(pence) 6 39.9p 51.4p

------------------------------------------------ ------- ---------- ----------

AB Dynamics plc

Consolidated statement of financial position

As at 31 August 2020

2020 2019

GBP'000 (restated)*

GBP'000

ASSETS

NON-CURRENT ASSETS

Goodwill 16,170 17,029

Acquired intangible assets 17,623 21,803

Intangible assets 1,114 268

Investment 12 14

Property, plant and equipment 24,309 17,922

Right-of-use assets 701 -

Deferred tax assets - 1,952

--------- -------------

59,929 58,988

CURRENT ASSETS

Inventories 9,180 11,149

Trade and other receivables 12,844 12,986

Contract assets 2,926 1,885

Taxation 2,838 939

Cash and cash equivalents 31,183 36,225

--------- -------------

58,971 63,184

TOTAL ASSETS 118,900 122,172

--------- -------------

LIABILITIES

CURRENT LIABILITIES

Borrowings 505 -

Trade and other payables 12,370 16,920

Short-term lease liabilities 473 -

13,348 16,920

NON-CURRENT LIABILITIES

Deferred tax liabilities 2,549 3,206

Long-term lease liabilities 249 -

Deferred consideration - 3,239

--------- -------------

2,798 6,445

NET ASSETS 102,754 98,807

--------- -------------

EQUITY

Share capital 226 222

Share premium 61,736 60,049

Reconstruction reserve (11,284) (11,284)

Merger relief reserve 11,390 11,390

Translation reserve (1,800) 178

Retained earnings 42,486 38,252

--------- -------------

TOTAL EQUITY 102,754 98,807

--------- -------------

*Restated following finalisation of provisional fair value

adjustments on the acquisition of DRI

AB Dynamics plc

Consolidated statement of changes in equity

For the year ended 31 August 2020

Share Share Merger Reconstruction Translation Retained Total

capital premium relief reserve reserve profits equity

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 September

2018 195 10,258 11,390 (11,284) - 27,484 38,043

Share based

payment expense - - - - - 586 586

Profit after

taxation and

total comprehensive

income for the

financial year - - - - 178 8,658 8,836

Tax impact of

exercised share

options - - - - - 2,271 2,271

Dividend paid - - - - - (747) (747)

Issue of shares,

net of share

issue costs 27 49,791 - - - - 49,818

At 31 August

2019 222 60,049 11,390 (11,284) 178 38,252 98,807

--------- --------- --------- --------------- ------------ --------- --------

Share based

payment expense - - - - - 1,282 1,282

Profit after

taxation and

total comprehensive

income for the

financial year - - - - (1,978) 4,552 2,574

Tax impact of

exercised share

options - - - - - (974) (974)

Dividend paid - - - - - (626) (626)

Issue of shares,

net of share

issue costs 4 1,687 - - - - 1,691

At 31 August

2020 226 61,736 11,390 (11,284) (1,800) 42,486 102,754

--------- --------- --------- --------------- ------------ --------- --------

The share premium account is a non-distributable reserve

representing the difference between the nominal value of shares in

issue and the amounts subscribed for those shares.

The reconstruction reserve and merger relief reserve have arisen

as follows:

The acquisition by the Company of the entire issued share

capital of Anthony Best Dynamics Ltd in 2013 was accounted for as a

Group reconstruction. Consequently, the assets and liabilities of

the Group were recognised at their previous book values as if the

Company had always been the parent company of the Group.

The share capital for the period covered by these consolidated

financial statements and the comparative periods is stated at the

nominal value of the shares issued pursuant to the above share

arrangement. Any differences between the nominal value of these

shares and previously reported nominal values of shares and

applicable share premium issued by Anthony Best Dynamics Ltd were

transferred to the reconstruction reserve.

Retained profits represent the cumulative value of the profits

not distributed to shareholders but retained to finance the future

capital requirements of the Group.

AB Dynamics plc

Consolidated cash flow statement

For the year ended 31 August 2020

2020 2019

GBP'000 GBP'000

Cash flow from operating activities

Profit before tax 5,035 10,998

Adjustments for: -

Depreciation and amortisation 5,639 1,324

Interest income (188) (171)

Acquisition related (credit) / charge (2,548) 768

Share based payment 1,282 586

--------------- ---------

Operating cash flows, before working capital

changes 9,220 13,505

Decrease / (increase) in inventories 1,992 (3,447)

Increase in trade and other receivables (565) (1,667)

(Decrease) / increase in other payables (3,737) 1,554

--------------- ---------

Cash flow from operations 6,910 9,945

Interest received 218 171

Income tax paid (2,229) (1,350)

Net cash flow from operating activities 4,899 8,766

--------------- ---------

Cash flow used in investing activities

Acquisition of businesses (2,823) (32,792)

Purchase of property, plant and equipment (7,276) (4,706)

Capitalised development costs (886) (228)

Net cash flow used in investing activities (10,985) (37,726)

--------------- ---------

Cash flow from financing activities

Movement in loans 477 -

Dividends paid (626) (747)

Proceeds from issue of share capital, net of

share issue costs 1,691 49,818

Repayment of lease liabilities (592) -

Net cash flow generated from financing activities 950 49,071

--------------- ---------

Net (decrease) / increase in cash and cash

equivalents (5,136) 20,111

Cash and cash equivalents at beginning of period 36,225 15,942

Effect of exchange rates on cash and cash equivalents 94 172

Cash and cash equivalents at end of period 31,183 36,225

--------------- ---------

AB Dynamics plc

Notes to the consolidated financial statements

For the year ended 31 August 2020

1. Basis of preparation

The Company is a public limited company limited by shares and

incorporated under the UK Companies Act. The Company is domiciled

in the United Kingdom and the registered office and principal place

of business is Middleton Drive, Bradford on Avon, Wiltshire, BA15

1GB.

The principal activity is the specialised area of design and

manufacture of test equipment for vehicle suspension, steering,

noise and vibration. The company also offers a range of services

which include analysis, design, prototype manufacture, testing and

development.

The annual financial statements of the Group are prepared in

accordance with International Financial Reporting Standards as

adopted for use by the European Union. A copy of the statutory

accounts for the year ended 31 August 2019 has been delivered to

the Registrar of Companies. The auditor's report on those accounts

was unqualified and did not contain any statements under section

498(2) or (3) of the Companies Act 2006.

The same accounting policies, presentation and methods of

computation have been followed as those which were applied in the

preparation of the Group's annual statements for the year ended 31

August 2019, with the exception of updating accounting policies to

reflect changes required by the adoption of IFRS 16 and to reflect

inclusion of the share based payment charge within adjusted

operating profit. This charge was previously reported as an

adjustment.

Certain new standards, amendments to standards and

interpretations are not yet effective for the year ended 31 August

2020 and have therefore not been applied in preparing the annual

financial statements.

Going concern basis of accounting

The Directors have assessed the principal risks discussed in

note 8, including by modelling a severe but plausible downside

scenario for COVID-19, whereby the Group experiences:

-- A reduction in demand of 25% over the next two financial years

-- 10% increase in operating costs from supply chain disruption

-- Increase in cash collection cycle

With GBP31.2m of cash at 31 August 2020, in this severe downside

scenario, the Group has sufficient headroom to be able to continue

to operate for the foreseeable future. The Directors believe that

the Group is well placed to manage its financing and other business

risks satisfactorily, and have a reasonable expectation that the

Group will have adequate resources to continue in operation for at

least 12 months from the signing date of this interim financial

information. They therefore consider it appropriate to adopt the

going concern basis of accounting in preparing the financial

statements.

2. Segment information

The Group derives revenue from the sale of its advanced

measurement, simulation and testing products derived in assisting

the global automotive industry in the laboratory and on the test

track. The income streams are all derived from the utilisation of

these products which, in all aspects except details of revenue, are

reviewed and managed together within the Group and as such are

considered to be the only segment.

The operating segment is based on internal reports about

components of the Group, which are regularly reviewed and used by

the Board of Directors being the Chief Operating Decision Maker

('CODM').

Analysis of revenue by country of destination:

2020 2019

GBP'000 GBP'000

United Kingdom 2,146 2,028

Rest of Europe 14,775 15,741

North America 15,606 9,499

Asia Pacific 27,788 28,949

Rest of the World 1,199 1,740

--------- -----------

61,514 57,957

--------- -----------

No customer individually represents 10% or more of total

revenue.

Assets and liabilities by segment are not reported to the Board

of Directors on a monthly basis, therefore are not used as a key

decision making tool and are not disclosed here.

A disclosure of non-current assets by location is shown

below:

2020 2019

GBP'000 (R estated

)

GBP'000

United Kingdom 41,135 41,083

Rest of Europe 747 347

Asia Pacific 107 -

North America 17,940 17,558

--------- --------------

59,929 58,988

--------- --------------

Revenues are disaggregated as follows:

2020 2019

GBP'000 GBP'000

Revenue by sector

Track testing 51,760 49,796

Laboratory testing and simulation 9,754 8,161

--------- -----------

61,514 57,957

--------- -----------

3. Alternative Performance measures

In the analysis of the Group's financial performance and

position, operating results and cash flows, alternative performance

measures are presented to provide readers with additional

information. The principal measures presented are adjusted measures

of earnings including adjusted operating profit, adjusted operating

margin, adjusted profit before tax, adjusted EBITDA and adjusted

earnings per share.

The financial statements includes both statutory and adjusted

non-GAAP financial measures, the latter of which the Directors

believe better reflect the underlying performance of the business

and provide a more meaningful comparison of how the business is

managed and measured on a day-to-day basis. The Group's alternative

performance measures and KPIs are aligned to the Group's strategy

and together are used to measure the performance of the business

and form the basis of the performance measures for remuneration.

Adjusted results exclude certain items because if included, these

items could distort the understanding of the performance for the

year and the comparability between the periods.

We provide comparatives alongside all current year figures. The

term 'adjusted' is not defined under IFRS and may not be comparable

with similarly titled measures used by other companies. All profit

and earnings per share figures in this report relate to underlying

business performance (as defined above) unless otherwise

stated.

2020 2019

GBP'000 GBP'000

Amortisation of acquired intangibles 3,549 279

Inventory impairment 3,267 -

Acquisition related (credit)

/ charge (1,865) 1,272

Restructuring 969 550

--------- -----------

5,920 2,101

-------------------------------------- --------- -----------

Amortisation of acquired intangibles

The amortisation relates to the businesses acquired in the

previous year, DRI and rFpro.

Inventory impairment

Following a detailed review of stock levels and usage, a number

of items previously included in the carrying value have been

written off and the system of accounting for inventory has been

updated to better reflect the Group's current operations.

Acquisition related (credit) / charge

The credit relates to the release of deferred consideration on

the rFpro acquisition which, due to COVID-19 disruption is unlikely

to become payable. This is offset by costs, mainly in relation to

staff retention payments to the employees of rFpro. The cash to pay

this was contributed by the previous owners of the business prior

to acquisition, but as the employees have to remain within the

business for a period prior to receiving payment, a charge has to

be recognised in the income statement.

Restructuring

The restructuring costs relate to rebalancing the skill base of

the business and termination of agents.

Tax

The tax impact of these adjustments was as follows: amortisation

of acquired intangibles GBP0.5m, inventory GBP0.6m, acquisition

GBP0.1m and restructuring GBP0.3m.

4. Tax

The statutory effective rate of tax for the year is lower than

(2019: higher than) the standard rate of corporation tax in the UK

of 19% (2019: 19%).

The adjusted effective tax rate, adjusting both the tax charge

and the profit before taxation is 17.7% (2019: 19.3%).

5. Dividend paid

2020 2019

GBP'000 GBP'000

Final 2018 dividend paid of GBP0.022

per share - 430

Interim 2019 dividend paid of

GBP0.016 per share - 317

Final 2019 dividend paid of GBP0.028 626 -

per share

626 747

-------------------------------------- --------- -----------

In respect of the year ended 31 August 2020, the Board has

proposed a final dividend of 4.4p per share totalling GBP993,000.

No interim dividend was paid in respect of 2020. If approved, the

final dividend will be paid on 22 January 2021 to shareholders on

the register on 8 January 2021.

6. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to equity holders by the weighted average number of

ordinary shares in issue during the period.

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all potentially dilutive shares. The Company has one

category of potentially dilutive shares, namely share options.

The calculation of earnings per share is based on the following

earnings and number of shares:

2020 2019

GBP'000 GBP'000

Profit after tax attributable

to owners of the Company 4,552 8,658

Adjusted profit after tax 9,016 10,575

Weighted average number of shares

('000)

Basic 22,482 20,201

Diluted 22,622 20,585

Earnings per share

Basic 20.2 pence 42.9 pence

Diluted 20.1 pence 42.1 pence

Adjusted basic 40.1 pence 52.4 pence

Adjusted diluted 39.9 pence 51.4 pence

7. Share capital

The allotted, called up and fully paid share capital is made up

of 22,576,553 ordinary shares of GBP0.01 each.

Note Number Share Share premium

of shares capital GBP'000 Total

000 GBP'000 GBP'000

At 1 September

2018 19,537 195 10,258 10,453

6 December 2018 (i) 143 1 564 565

-------- ----------- --------- -------------- ----------

7 June 2019 (ii) 2,277 23 48,195 48,218

-------- ----------- --------- -------------- ----------

22 July 2019 (iii) 263 3 1,032 1,035

-------- ----------- --------- -------------- ----------

At 31 August 2019 22,220 222 60,049 60,271

----------- --------- -------------- ----------

27 September 2019 (iv) 200 2 770 772

-------- ----------- --------- -------------- ----------

11 December 2019 (v) 32 - 142 142

-------- ----------- --------- -------------- ----------

3 March 2020 (vi) 64 1 256 257

-------- ----------- --------- -------------- ----------

4 May 2020 (vii) 33 - 410 410

-------- ----------- --------- -------------- ----------

2 June 2020 (viii) 16 - 64 64

-------- ----------- --------- -------------- ----------

19 August 2020 (ix) 11 1 45 46

-------- ----------- --------- -------------- ----------

At 31 August 2020 22,576 226 61,736 61,962

=========== ========= ============== ==========

(i) On 6 December 2018, a total of 142,702 share options were

exercised of GBP0.01 each for GBP3.95.

(ii) On 7 June 2019, a total of 2,050,000 new ordinary shares

were placed of GBP0.01 each for GBP22.00 and a total of 227,500 new

ordinary shares of GBP0.01 were admitted to trading on AIM

following the issue of Open Offer Shares.

(iii) On 22 July 2019, a total of 263,246 share options were

exercised of GBP0.01 each for GBP3.95.

(iv) On 27 September 2019, a total of 199,526 share options were

exercised of GBP0.01 each for GBP3.95.

(v) On 11 December 2019, a total of 31,970 share options were

exercised of GBP0.01 each for GBP3.95.

(vi) On 3 March 2020, a total of 58,086 share options were

exercised of GBP0.01 each for GBP3.95 and a total of 6,173 share

options were exercised of GBP0.01 each for GBP4.45.

(vii) On 4 May 2020, a total of 33,333 share options were

exercised of GBP0.01 each for GBP12.30.

(viii) On 2 June 2020, a total of 16,162 share options were

exercised of GBP0.01 each for GBP3.95.

(ix) On 19 August 2020, a total of 11,321 share options were

exercised of GBP0.01 each for GBP3.95.

8. Principal risks

The principal risks and uncertainties impacting the Group are

described on pages 43-47 of our Annual Report 2020.

They include: COVID-19, downturn or instability in major

markets, loss of major customers and change in customer procurement

processes, failure to deliver new products, dependence on external

routes to market, acquisitions integration and performance,

cybersecurity and business interruption, competitor actions, loss

of key personnel, threat of disruptive technology, product

liability, failure to manage growth, foreign currency, credit risk

and intellectual property/patents.

9. Related party transactions

Anthony Best, Chairman of the Company, is a trustee and

beneficiary of the Best Middleton Trust. Rental payments of

GBP48,000 (2019: GBP48,000) were made to the Trust in the year. No

amounts were due to or from the trust at the end of the period

(2019: GBPnil).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPGRCGUPUGMC

(END) Dow Jones Newswires

November 25, 2020 02:00 ET (07:00 GMT)

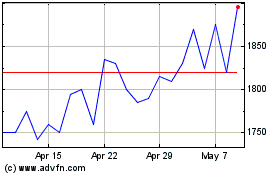

Ab Dynamics (LSE:ABDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ab Dynamics (LSE:ABDP)

Historical Stock Chart

From Apr 2023 to Apr 2024