TIDMAFN

RNS Number : 2429K

ADVFN PLC

20 December 2022

THIS ANNOUNCEMENT, INCLUDING THE APPIX TO THIS ANNOUNCEMENT, AND

THE INFORMATION CONTAINED IN IT, IS RESTRICTED AND IS NOT FOR

PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA,

JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN

WHICH IT WOULD BE UNLAWFUL TO DO SO.

20 December 2022

ADVFN plc

("ADVFN" or the "Company")

Open Offer timetable and AGM

On 6 December 2022, ADVFN announced a proposed equity fundraise

of up to approximately GBP6.82 million, before expenses, through an

Open Offer pursuant to which Qualifying Shareholders are able to

subscribe at an Issue Price of 33 pence per Open Offer Share on the

basis of 11 Open Offer Shares for every 14 Existing Ordinary Shares

for an aggregate of up to 20,676,322 Open Offer Shares. Qualifying

Shareholders are also able to apply for Excess Shares through an

Excess Application Facility.

The Board of ADVFN is aware that due to postal disruption and

other industrial action, a number of shareholders who have

expressed an interest in participating in the Open Offer are

concerned that due to delays in receiving the necessary

documentation either directly or from nominees, they may be unable

to submit their applications by the current closing date of 11.00am

on 21 December 2022. The Board has therefore decided to extend the

closing date of the Open Offer (as permitted by the terms of the

Open Offer) to 11.00am on Thursday, 5 January 2023. The Board

believes that this should provide sufficient additional time for

affected Qualifying Shareholders. The Open Offer timetable as

extended is set out in the Appendix to this announcement.

Similarly, the Board has also decided to adjourn the Annual

General Meeting (which had otherwise been convened for 10.00am on

29 December 2022) to 10.00am on 13 January 2023. An updated Annual

General Meeting notice with details of the adjourned meeting is

being sent to shareholders. Proxies appointed and Forms of Proxy

returned will remain valid for the adjourned Annual General

Meeting. Shareholders who would like to attend the Annual General

Meeting in person are requested to only attend the reconvened

meeting on 13 January 2023 as no business will be conducted on 29

December 2022.

This announcement should be read in conjunction with the full

text of the circular issued on 6 December 2022 ("Circular"). All

capitalised/defined terms used in this announcement and not

otherwise defined shall have the meanings given to them in the

Circular.

A copy of this announcement is available on the Company's

website, www.advfnplc.com.

For further information please contact:

ADVFN plc

Amit Tauman (CEO) +44 (0) 203 8794 460

Beaumont Cornish Limited

(Nominated Adviser)

Michael Cornish

Roland Cornish +44 (0) 207 628 3396

Peterhouse Capital Limited

(Broker)

Eran Zucker +44 (0) 207 469 0930

IMPORTANT NOTICES

Beaumont Cornish Limited ("Beaumont Cornish"), which is

authorised and regulated in the United Kingdom by the FCA and is a

member of the London Stock Exchange, is the Company's nominated

adviser for the purposes of the AIM Rules. Beaumont Cornish is

acting exclusively for the Company and will not regard any other

person (whether or not a recipient of this announcement) as a

client and will not be responsible to anyone other than the Company

for providing the protections afforded to its clients nor for

providing advice in relation to the contents of this document or

any other matter referred to herein. Beaumont Cornish's

responsibilities as the Company's nominated adviser under the AIM

Rules for Nominated Advisers are owed to the London Stock Exchange

and not to any other person and in particular, but without

limitation, in respect of their decision to acquire Open Offer

Shares or Open Offer Warrants in reliance on any part of this

announcement. Beaumont Cornish has not authorised the contents of

this announcement for any purpose and no liability whatsoever is

accepted by Beaumont Cornish nor does it make any representation or

warranty, express or implied, as to the accuracy of any information

or opinion contained in this announcement or for the omission of

any information. Beaumont Cornish expressly disclaims all and any

responsibility or liability whether arising in tort, contract or

otherwise which it might otherwise have in respect of this

announcement.

Peterhouse House Capital Limited ("Peterhouse"), which is

authorised and regulated in the United Kingdom by the FCA and is a

member of the London Stock Exchange, is the Company's broker for

the purposes of the AIM Rules. Peterhouse is acting exclusively for

the Company and will not regard any other person (whether or not a

recipient of this announcement) as a client and will not be

responsible to anyone other than the Company for providing the

protections afforded to its clients nor for providing advice in

relation to the contents of this announcement or any other matter

referred to herein. Peterhouse has not authorised the contents of

this announcement for any purpose and no liability whatsoever is

accepted by Peterhouse nor does it make any representation or

warranty, express or implied, as to the accuracy of any information

or opinion contained in this announcement or for the omission of

any information. Peterhouse expressly disclaims all and any

responsibility or liability whether arising in tort, contract or

otherwise which it might otherwise have in respect of this

announcement.

No representation, responsibility or warranty, expressed or

implied, is made by ADVFN plc, Beaumont Cornish, Peterhouse or any

of their respective directors, officers, employees or agents as to

any of the contents of this announcement in connection with the

Open Offer or any other matter referred to in this

announcement.

Notice to overseas persons

The distribution of this announcement, the Open Offer Document

and/or the Application Form in jurisdictions other than the United

Kingdom may be restricted by applicable laws or regulations. This

announcement does not constitute an offer to sell or an invitation

to subscribe for, or solicitation of an offer to subscribe for or

buy Open Offer Shares to any person in any jurisdiction to whom it

is unlawful to make such offer or solicitation.

Neither the Open Offer Shares nor the Open Offer Warrants have

been, and will not be, registered under the Securities Act or

qualified for sale under the laws of any state of the United States

or under the applicable laws of any of Canada, Australia, Japan or

the Republic of South Africa and, subject to certain exceptions,

may not be offered or sold in the United States or to, or for the

account or benefit of, US persons (as such term is defined in

Regulation S under the Securities Act) or to any national, resident

or citizen of Canada, Australia, Japan or Republic of South

Africa.

In respect of the offering in Israel of the securities offered

hereunder, this Open Offer Document has not been approved by the

Israeli Securities Authority, and that any offer in Israel is

limited exclusively to special types of investors enumerated in the

first schedule of the Israeli Securities Law, 5728-1968 (known as

"Qualified Investors") and to certain non-qualified investors, as

permitted under such Law. Further, the Company may require, as a

condition to the purchase of the offered securities by an Israeli

offeree, that such offeree executes additional agreements and

certifications, and provides such additional information, as may be

required to comply with Israeli law. This announcement may not be

reproduced or used for any other purpose, nor be furnished to any

person in Israel other than those to whom copies have been

specifically provided by the Company. By purchasing securities

offered hereunder, any such offeree confirms that it is purchasing

the same for its own benefit and account, and not with the aim or

intention of distributing or offering such securities to other

parties. All offerees are encouraged to seek competent investment

advice from a locally licensed investment advisor prior to making

any investment.

Neither the Open Offer Shares nor the Open Offer Warrants have

been and will not be registered under the United States Securities

Act of 1933, as amended, or under the applicable securities laws of

any state or other jurisdiction of the United States or qualified

for distribution under any applicable securities laws in any other

Restricted Jurisdiction. The Open Offer Shares may not be offered,

sold, taken up, resold, transferred or delivered, directly or

indirectly, within, into or in the United States except pursuant to

an applicable exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and in

compliance with the securities laws of any state or other

jurisdiction of the United States. The Open Offer Shares and Open

Offer Warrants are being offered and sold either: (i) outside the

United States in offshore transactions within the meaning of, and

in accordance with, the safe harbour from the registration

requirements in Regulation S under the Securities Act; or (ii) in

the United States in private placement transactions not involving

any public offering in reliance on the exemption from the

registration requirements of Section 5 of the Securities Act

provided by Section 4(2) under the Securities Act or another

applicable exemption therefrom. There will be no public offer of

the Open Offer Shares in the United States.

None of the Open Offer Shares or Open Offer Warrants, the

Application Form, this announcement nor any other document

connected with the Open Offer has been nor will be approved or

disapproved by the United States Securities and Exchange Commission

nor by the securities commissions of any state or other

jurisdiction of the United States or any other regulatory

authority, nor have any of the foregoing authorities or any

securities commission passed upon or endorsed the merits of the

offering of the Open Offer Shares nor Open Offer Warrants, the

Application Form or the accuracy nor adequacy of this announcement

nor any other document connected with the Open Offer. Any

representation to the contrary is a criminal offence.

The ability of Qualifying Shareholders to participate in the

Open Offer may be restricted in certain jurisdictions. The

attention of Overseas Shareholders is drawn to paragraph 6 of Part

III "Terms and conditions of the Open Offer" of the Open Offer

Document.

Appendix

EXPECTED EXTENDED TIMETABLE OF PRINCIPAL EVENTS

2022

Recommended latest time and date for requesting 29 December

withdrawal of Open Offer Entitlements and

Excess CREST Open Offer Entitlements from

CREST

Latest time and date for depositing Open 30 December

Offer Entitlements and Excess CREST Open

Offer Entitlements into CREST

2023

Latest time and date for splitting Application 3 January

Forms (to satisfy bona fide market claims

in relation to Open Offer Entitlements only)

Latest time and date for receipt of completed 11 a.m. on 5 January

Application Forms and payment in full under

the Open Offer or settlement of the relevant

CREST instructions (as appropriate)

Announcement of results of Open Offer 6 January

Expected date when Admission is effective 9 January

and dealings in the Open Offer Shares on

AIM

Open Offer Shares credited to CREST stock 9 January

accounts

Despatch of definitive share certificates Within 10 business

in respect of Open Offer Shares and warrant days of Admission

certificates in respect of Open Offer Warrants

to be issued in certificated form

Expected date for crediting of the Open 9 January

Offer Warrants in uncertificated form to

CREST

Notes:

(i) References to times in this document are to London time (unless otherwise stated).

(ii) If any of the above times or dates should change, the

revised times and/or dates will be notified by an announcement to

an RIS.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFZMMZZLMGZZZ

(END) Dow Jones Newswires

December 20, 2022 02:00 ET (07:00 GMT)

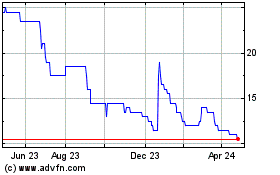

Advfn (LSE:AFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

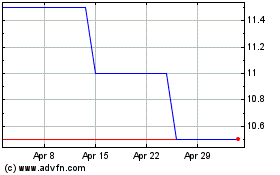

Advfn (LSE:AFN)

Historical Stock Chart

From Apr 2023 to Apr 2024