TIDMAYM

11th January 2021 LSE:AYM

Parys Mountain - Preliminary Economic Assessment

Major Increase in Mineable Tonnages

PEA Projects Strong Financial Results

Anglesey Mining plc ("Anglesey") is pleased to report the positive results of

the Preliminary Economic Assessment (PEA) on its Parys Mountain

copper-zinc-lead-gold-silver project on the island of Anglesey in North Wales

prepared by Micon International Limited ("Micon") an independent consulting

firm.

Highlights

* Updated Resource Estimate of 5.2 million tonnes of Indicated together with

11.7 million tonnes of Inferred

* Financial model for Expanded Case shows pre-tax NPV10 of $US120 million, (GBP

96 million), 26% IRR and 12 year mine life

Bill Hooley, Chief Executive stated: "This Preliminary Economic Assessment

demonstrates that a major mining operation can be established at Parys

Mountain, with robust economics at a reasonable capital cost, and can produce

copper, zinc, lead and gold concentrates at competitive operating costs able to

withstand the cycles that occur within our industry, over a meaningful mine

life of 10 to 12 years."

Summary

This PEA includes an updated mineral resource statement showing 5.2 million

tonnes of Indicated Resources at a combined base metal grade of 4.3%, together

with 11.7 million tonnes of Inferred Resources at a combined base metals grade

of 2.8%, based on the revised estimated cut-off cost of $US48 per tonne.

Three separate development alternatives were evaluated, utilising planned mine

tonnages ranging from 5.5 million tonnes at 1,500 tonnes per day in Case A to

11.4 million tonnes at 3,000 tonnes per day in Case C. Highlights are shown in

the table below.

Parameter Case A Case B Case C

(US$ 000) (US$ 000) (US$ 000)

Life of Mine (Years) 12 11 12

Tonnes Mined (Mt) 5.9 5.5 11.4

Total Net Smelter Returns 478,078 445,973 1,014,970

Total Operating Costs 252,176 227,134 503,454

Operating Cash Flow (EBITDA) 225,903 218,839 511,516

Pre-production Capital Expenditure 70,438 57,519 99,015

Net Present Value Before Tax (Disc. 36,123 41,843 120,321

10%)

Net Present Value After Tax (Disc. 25,991 30,370 92,144

10%)

Internal Rate of Return (Before Tax) 19.6% 26.4% 26.0%

Internal Rate of Return (After Tax) 17.5% 22.7% 23.6%

Each case has a detailed financial analysis utilising three-year trailing

average metal prices of $US1.20 per pound for zinc, $US2.81 per pound for

copper, $US0.95 per pound for lead, $US16.67 per ounce for silver and $US1,459

per ounce for gold, an exchange rate of GBP1.00=$US1.25.

In summary, the most attractive option is the expanded Case C, which, with some

$99 million of pre-production capital expenditure, generates a total cumulative

cash operating surplus over a 12 year mine life of more than $510 million (GBP408

million), which translates to a pre-tax Net Present Value discounted at 10% pa

of over $120 million (GBP96 million), with an attractive IRR of 26%.

Using the higher current January 2021 metal prices and exchange rate would

double this Case C NPV10 to $238 million (GBP176 million) and applying a more

conservative 12% discount rate to this would result in an NPV12 of $195 million

(GBP144 million).

"We are very encouraged with these financial results, particularly for the

expanded scenario. The PEA clearly demonstrates that Parys Mountain has the

potential to be developed as a serious mining project producing an average

7,300 tonnes of copper, 8,000 tonnes of zinc, 7,600 tonnes of lead, 6,000 kg of

silver and 160 kg of gold, in concentrates, per year in Case C and become a

major contributor to the UK economy." added Bill Hooley.

Background

In 2017 Micon produced a Scoping Study on Parys Mountain. This followed

previous work by Micon in 2006 and particularly a JORC resource estimate in

2012. The 2017 Scoping Study included major input by Fairport Engineering

Limited ("FEL") on the process plant design and costing. The 2017 study was

based on only the Indicated Resources in the Engine and White Rock zones.

These amounted to 2.45 million tonnes and at a planned production rate of 1,000

tonnes per day gave a mine life of approximately 8 years.

Anglesey concluded that utilising the Indicated Resources only did not properly

reflect the potential of the Parys Mountain property. In 2018 Anglesey entered

into an agreement with Quarry and Mining Equipment Limited ("QME") to carry out

an Optimisation Study to review expected mining capital and operating costs and

potential mining tonnages and to include the additional Inferred Resources

previously identified by Micon in 2012. The QME Optimisation Study was

completed in 2020.

Micon utilised the results of the QME Optimisation Study, as it felt

appropriate, into the Preliminary Economic Assessment. This PEA therefore

builds on Micon's previous work, including its 2012 resource estimate, the 2017

Scoping Study, including FEL's processing and infrastructure capital and

operating costs, and QME's 2020 Optimisation Study on current mining capital

and operating costs and mineable tonnages.

This PEA includes Inferred Resources and therefore the tonnages indicated as

available for mining cannot be extrapolated to Reserve status, and consequently

the financial results cannot be considered as reaching Feasibility Study basis.

QME Optimisation Study

QME is an Irish based contracting and consulting company and has been supplying

complete solutions to the mining industry since 1985. It is currently

intimately involved in a number of developing and operating mines in Ireland

and elsewhere and employs a team of qualified and highly experienced

engineering and support staff. QME utilised these skills and project and

mining experience to develop the enhanced mining plans for Parys Mountain and

to provide current and relevant knowledge to the development of capital and

operating cost estimates for these revised plans.

An important initial aspect of the QME work was an estimate of overall costs

based on its own experience and it derived mining capital and operating costs

from the ground up. Given QME's current hands-on operating experience, these

cost estimates can be regarded as the best estimates currently available. QME

then utilised the cost estimates for the non-mining, ie processing and

infrastructure, aspects of the project from the 2017 study which had been

largely produced by FEL with additional input from Micon. QME estimated that

at a 1,000tpd operating level, total operating costs would be approximately

$US48 per tonne of ore milled.

QME then carried out a detailed mine planning exercise utilising this $48 per

tonne as a cut-off cost. They applied this to each of the mineralised zones at

Parys Mountain as identified by Micon in 2012 including both Indicated as well

as Inferred material to estimate tonnages into stoping blocks that would be

available for mining. Some of these cases were based only on the White Rock

and Engine Zones that lie adjacent to the existing infrastructure at Parys

Mountain including the Morris Shaft, whilst one particular case looked at the

greater tonnages available in the more distant Lower Engine, Garth Daniel and

Northern Copper zones.

Having identified these stoping blocks, QME produced detailed mining schedules

for a number of cases. These schedules include all the necessary access and

production development required as well as production by tonnage and grade for

the relevant timing periods. As a result, a number of differing production

rates were selected based on the overall tonnages to ensure that the optimum

overall mine life for each case. QME then applied its expected development and

production cost estimates to each work unit to generate overall time and cost

forecasts by period for each of the cases developed.

Micon Preliminary Economic Assessment

Resource Estimate

As part of the development of the PEA, Micon reviewed the work carried out by

QME including the mine planning and the capital and operating cost estimates.

In general, Micon concurred with the QME work but did make some amendments when

considered necessary. Having accepted the $US48 per tonne cut-off level, Micon

produced a revised resource estimate at this value. This estimate used the

same parameters including metal prices utilised in its 2012 estimate. While

there has been some movement in the prices in the intervening period Micon

concluded that using current prices would not significantly amend this

estimate.

Parys Mountain Mineral Resources Estimate.

Zone Category Tonnes Cu Pb Zn Ag Au

(%) (%) (%) (g/t) (g/t)

Engine Indicated 496,000 1.36 2.59 4.94 91.8 0.5

Inferred 121,000 1.73 3.42 6.73 69.9 0.5

Deep Engine Inferred 620,000 1.95 1.90 4.21 22.6 0.2

White Rock Indicated 4,712,000 0.25 1.23 2.30 23.1 0.3

Inferred 1,258,000 0.28 1.26 2.56 27.5 0.3

Garth Daniel Inferred 340,000 1.89 2.76 5.78 66.3 0.1

Northern Copper Inferred 9,375,000 1.27 0.24 0.38 5.0 0.1

Total Indicated 5,208,000 0.36 1.36 2.55 29.7 0.3

Inferred 11,714,000 1.22 0.54 1.04 10.8 0.2

1. Dr Robin Bernau, employee of Micon International Co Ltd, is a competent

person for the Mineral Resource Estimate. The effective date of the

estimate is 15th December 2020.

2. There are reasonable prospects for eventual economic extraction under

assumptions of a gold price US$1,275/oz, a silver price of US$17.50/oz, a

zinc price of US$1.25/lb, a copper price of US$2.5/lb and a lead price of

US$1.0/lb employing underground mining techniques.

3. Micon reported the mineral resources by category following the guidelines

of JORC (2012)

4. An operating cut-off of US$48/t has been applied and no allowance has been

made for dilution or loss.

5. Rounding as required by reporting guidelines may result in apparent

summation differences between tonnes, grade and contained metal content.

Mine Development Cases

As part of the Optimisation Study, QME evaluated a number of differing

development scenarios. On review of the QME Study, Micon selected three of

these scenarios to best describe the potential for the Parys Mountain

deposits. Each case utilised both Indicated as well as Inferred resources and,

on the basis of the increased tonnage available for mining, selected higher

planned production rates than the 1,000 tonnes per day ("tpd"), used in the

2017 study.

These three cases selected by Micon are summarised as:

Case A - Utilising only the White Rock and Upper Engine zones (as in the 2017

study) with Inferred material included at a planned production rate of

1,500tpd.

Case B - As Case A but with some initial production coming from a proposed

small open cut, again at a production rate of 1,500tpd.

Case C - Utilising all the reported resources in the White Rock and Upper

Engine Zones but also including the inferred resources in the Lower Engine

Zone, the Garth Daniel Zone and the Northern Copper Zone. In this Case C with

the increased mineable tonnage, the planned production rate was increased to

3,000tpd.

Mine Planning

Micon reviewed the mine layout and the stope planning produced by QME and

generally were in accord. In Case B, Micon carried out its own design,

planning and costing for the suggested small open pit and utilised these

results rather than the estimates made by QME given Micon's experience in open

pits compared to the underground speciality of QME.

Micon agreed with QME's conclusions that the existing Morris Shaft would be

used only for ventilation in Cases A and B but would be fully utilised as a

hoisting shaft in Case C and agreed with the QME cost estimates to put the

shaft back into service.

Micon therefore accepted the majority of the detailed production timing and

cost estimates and timing produced by QME and adopted them into the financial

review.

The total tonnages from each of cases that were then included in the financial

review are shown below.

These tonnages include material derived from both Indicated and Inferred

resources as well internal dilution at zero grade of material outside of these

resources necessarily included within stoping blocks.

Stope Tonnages and Grades

Tonnage Copper Zinc Lead Silver Gold Copper

(Mt) (Cu%) (Zn%) (Pb%) (g/t Ag) (g/t Au) Equivalent %

Case A 5.87 0.34 2.42 1.27 27.27 0.28 2.25

Case B 5.45 0.36 2.49 1.30 28.40 0.29 2.33

Case C 11.42 0.84 1.82 0.97 18.63 0.24 2.29

The comparable figures in the 2017 study were:

Tonnage Copper Zinc Lead Silver Gold Copper

(Mt) (Cu%) (Zn%) (Pb%) (g/t Ag) (g/t Au) Equivalent %

Base Case 2.23 0.54 3.66 1.89 40.78 0.35 3.36

The Copper Equivalent figures shown in both tables above are determined using

the metal prices utilised in the PEA.

There is a significant increase in the tonnage available for mining and

processing beyond the tonnages in the 2017 study. This is as a result of using

the new estimated cut-off cost and the inclusion of Inferred resources in the

selection of mining blocks. Although this results in some reduction in overall

grades but as demonstrated in the PEA this does have a very significant

beneficial effect on the total project financial outcome.

Processing and Infrastructure

The Micon 2017 Scoping Study included extensive work by Fairport Engineering

regarding the process plant design, efficiencies and costs. This study

recommended a Dense Media Separation ("DMS") facility ahead of the main

processing plant and this continues to be utilised for all three of the current

cases. Similarly, FEL reviewed and costed the site infrastructure

requirements.

Micon incorporated all of FEL's recommendations from 2017 into the current PEA

but with some additions and modifications as now deemed appropriate.

Project Costing and Financial Results

Micon produced a detailed financial model incorporating its own inputs as well

as those from QME and FEL. The model is constructed on yearly periods using

the QME mine production forecasts and the FEL processing characteristics. The

model assumes that the mine will produce three base metal concentrates namely

copper, zinc and lead. In addition, some gold will be produced in concentrate

from the free gold that has been identified in the mineral resource. Relevant

concentrate transport and treatment and refining costs have been applied

individually to each concentrate.

Costs within the model are defined as mid-2020 costs to match the estimates

produced by QME. Processing infrastructure costs produced by FEL in 2017 have

been escalated to a mid-2020 equivalent.

Mining costs for each case were determined directly by QME. Processing and

Infrastructure capital and operating costs were based on the 2017 production

rate of 1,000tpd and these were factored by Micon to reflect the higher

1,500tpd or 3,000tpd production rates as appropriate.

In addition to the mining costs generated by QME, Micon included additional

initial exploration costs for $1.6 million for Cases A and B and $7.5 million

for Case C.

Within the financial model Micon incorporated all known and relevant project

charges including licences, fees and royalties. All values are based on

constant 2020 prices and no allowance has been made for any escalation in

either costs or commodity prices. No allowance has been made for corporate

costs or for any interest charges of any project financing. The financial

results derived are therefore to be read at a project level basis. Micon

calculated financial results on both a pre-tax and a post-tax basis after

incorporating appropriate carry forward expenses and utilising current UK tax

rates.

Micon considered it appropriate to utilise three-year trailing metal prices in

the financial evaluation. These were determined to the end of the September

2020 quarter and amounted to $US1.20 per pound for zinc, $US2.81 per pound for

copper, $US0.95 per pound for lead, $US16.67 per ounce for silver and $US1,459

per ounce for gold. A fixed exchange rate of GBP1.00 = $US1.25 was used.

Anglesey believes that these metal prices used are conservative and notes that

current prices are $1.29/lb for zinc, $3.64/lb for copper, $0.93/lb for lead,

$27.21/oz for silver and $1930/lb for gold. With the exchange rate at GBP1.00 =

$US1.35.

Micon reviewed the appropriate discount rate to utilise and after considering

the Weighted Average Cost of Capital and applying this through a Capital Asset

Pricing Model elected to apply a discount a rate of 10% per annum for all

cases.

The operating and financial results for each case are shown in the table

below.

Life of Mine Operating and Cash Flow Summary

Parameter Case A Case B Case C

(US$ 000) (US$ 000) (US$ 000)

Life of Mine (Years) 12 11 12

Throughput Capacity (Tonnes per Day) 1,500 1,500 3,000

Total Tonnes Mined and Processed (Mt) 5.9 5.5 11.4

Net Smelter Returns

Zinc Concentrate 235,173 217,593 341,131

Copper Concentrate 87,294 83,676 433,577

Lead Concentrate 129,602 120,319 189,024

Gold Concentrate 26,010 24,384 51,238

Total Net Smelter Returns 478,078 445,973 1,014,970

Operating Expenses

Mining 110,611 100,396 240,374

Processing (including Tailings 123,587 110,328 230,885

Disposal)

G&A 8,402 7,702 8,402

Sub-Total Cash Operating Costs 242,600 218,426 479,661

Royalties and Production Taxes 9,575 8,708 23,792

Total Operating Costs 252,176 227,134 503,454

Operating Cash Flow (EBITDA) 225,903 218,839 511,516

Pre-Production Capital 70,438 57,519 99,015

Expenditure

Ongoing Capital Expenditure 33,809 52,983 76,034

Total Capital Expenditures Life of 104,247 110,502 175,049

Mine

Net Cash Flow Before Tax 121,655 108,337 336,467

Corporation Tax 23,796 22,521 67,375

Net Cash Flow After Tax 97,859 85,816 269,092

Net Present Value Before Tax (Disc. 36,123 41,843 120,321

10%)

Net Present Value After Tax (Disc. 25,991 30,370 92,144

10%)

Internal Rate of Return (Before Tax) 19.6% 26.4% 26.0%

Internal Rate of Return (After Tax) 17.5% 22.7% 23.6%

Payback Period - Undiscounted (Years) 5.5 4.5 5.1

Payback Period - Discounted at 10% 7.2 6.1 6.2

(Years)

In summary the most attractive option is Case C. Including some $99 million of

pre-production capital expenditure this shows a total cash operating surplus

over the 12 year mine life of more than $510 million, which translates to a Net

Present Value discounted at 10% pa of over $120 million (GBP96 million) with an

IRR of 26%.

Using January 2021 metal prices and exchange rate would increase this NPV10 to

$238 million (GBP176 million) and at a more conservative 12% discount rate this

would result in an NPV12 of $195 million (GBP144 million).

Future Work

Micon has outlined a series of recommendations for future work including some

extra exploration drilling to bring some Inferred Resources into the Indicated

category. The timing of this will be dependent upon the way forward for the

project. The majority of this additional drilling for Case C would be carried

out from an underground drill drive from the area around the bottom of the

shaft and would not be commenced until some years into the project. Some

limited surface drilling has been recommended to increase the confidence in

some parts of the White Rock zone ahead of first underground development.

The Parys Mountain property has a high potential for the discovery of

additional mineral resources There are drill intercepts outside of the

planned mining blocks indicating mineralisation may extend into other areas of

sparse drilling immediately adjacent to the reported Mineral Resources.

Micon also made recommendations regarding other technical studies to better

quantify some aspects of the mining and processing operations and trade-off

studies to determine the best overall mining schedules, metallurgical

flow-sheet and infrastructure design to further optimise the project which

should led to improved economics to be included in the eventual feasibility

study. In addition, Micon noted that further environmental base-line studies

will be required ahead of any formal decision to commence operations.

Conclusions

Anglesey is incredibly pleased with the results of the QME Optimisation Studies

and the Micon PEA. This PEA demonstrates that Anglesey Mining's Parys Mountain

project is much more substantial than previously considered; that it has a

larger mineable resource base; can support a longer mine life and can generate

significantly enhanced financial returns even at metal prices well below

today's levels.

Several areas for further improvement have been identified as we continue to

evaluate and optimise the alternative cases and initiate the necessary work to

move towards completing a Preliminary or a Definitive Feasibility Study.

About Micon

Micon is an independent consulting firm of geologists, mining engineers,

metallurgists and environmental consultants, all of whom have extensive

experience in the mining industry. The firm has offices in Norwich (United

Kingdom), Toronto and Vancouver (Canada). Micon is internally owned and is

entirely independent of Anglesey Mining plc and its affiliated companies.

Micon offers a broad range of consulting services to clients involved in the

mining industry. The firm maintains a substantial practice in the geological

assessment of prospective properties, the independent estimation of resources

and reserves, the compilation and review of feasibility studies, the economic

evaluation of mineral properties, due diligence reviews and the monitoring of

mineral projects on behalf of financing agencies.

Micon's practice is worldwide and covers all of the precious and base metals,

the energy minerals and industrial minerals. The firm's clients include major

mining companies, most of the major United Kingdom and Canadian banks and

investment houses, and a large number of financial institutions in other parts

of the world. Micon's technical, due diligence and valuation reports are

typically accepted by regulatory agencies such as the London Stock Exchange,

the US Securities and Exchange Commission, the Ontario Securities Commission,

the Toronto Stock Exchange, and the Australian Stock Exchange.

Cautionary Statement:

The Preliminary Economic Assessment summarised in this news release is

preliminary in nature and is intended to provide an assessment of the project's

economic potential and design options. The PEA mine plans and economic models

include numerous assumptions and the use of Inferred Resources. Inferred

Resources are considered to be too speculative geologically to have economic

considerations applied to them that would enable them to be categorised as

mineable reserves. Mineral resources that are not mineral reserves do not have

demonstrated economic viability. There is no assurance that the results

projects in the PEA will be realised.

About Anglesey Mining plc

Anglesey Mining is listed on the London Stock Exchange and currently has

211,975,732 ordinary shares in issue.

Anglesey is developing its 100% owned Parys Mountain copper-zinc-lead deposit

in North Wales, UK with a 2020 reported resource of 5.2 million tonnes at 4.3%

combined base metals in the Indicated category and 11.7 million tonnes at 2.8%

combined base metals in the Inferred category.

Anglesey holds a 20% interest, and management rights to the Grangesberg Iron

project in Sweden, together with a right of first refusal to increase its

interest by a further 50.1%. Anglesey also holds 12% of Labrador Iron Mines

Holdings Limited which holds direct shipping iron ore deposits in Labrador and

Quebec.

Anglesey is also currently and actively reviewing other compatible base metal

projects at advanced stages suitable for incorporation into the Anglesey Group.

For further information, please contact:

Bill Hooley, Chief Executive +44 (0)7785 572517

billhooley@angleseymining.co.uk

Danesh Varma, Finance Director +44 (0)7740 932766

danesh@angleseymining.co.uk

END

(END) Dow Jones Newswires

January 11, 2021 02:00 ET (07:00 GMT)

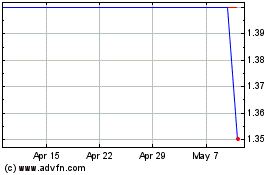

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Apr 2023 to Apr 2024