TIDMBOIL

RNS Number : 2575T

Baron Oil PLC

24 March 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF IRELAND,

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH

SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (WHICH FORMS PART OF

DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 ("EUWA")) ("UK MAR"). IN ADDITION, MARKET SOUNDINGS (AS

DEFINED IN UK MAR) WERE TAKEN IN RESPECT OF CERTAIN OF THE MATTERS

CONTAINED WITHIN THIS ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN

PERSONS BECAME AWARE OF INSIDE INFORMATION (AS DEFINED UNDER UK

MAR). UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY

INFORMATION SERVICE, THOSE PERSONS THAT RECEIVED INSIDE INFORMATION

IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF SUCH INSIDE

INFORMATION, WHICH IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN

.

24 March 2021

Baron Oil Plc

("Baron" or the "Company")

Proposed Earn In to increase indirect interest in the Chuditch

discovery and prospects

Placing and subscription to raise GBP3.0 million

and

Notice of General Meeting

Baron Oil Plc (AIM:BOIL), the AIM-quoted oil and gas exploration

company, is pleased to announce that it has entered into a

conditional agreement whereby upon completion Baron will increase

its shareholding in SundaGas (Timor-Leste Sahul) Pte. Ltd ("

SundaGas TLS" ) from 33.33% to 85%, and thereby increase its

indirect interest in the TL-SO-19-16 PSC (the "Chuditch PSC" or the

"PSC"), offshore Democratic Republic of Timor-Leste ("Timor-Leste")

from 25% to 63.75% (the "Earn In"). Upon completion, the Earn In

will result in a 255% increase in Baron's net share of the

currently estimated aggregate Mean prospective resources for the

PSC to 2,248 BCF, equivalent to approximately 375 MMBOE. It is

noted that the above estimates are not fully compliant with the

2018 SPE PRMS Prospective Resources standard.

As part of the Earn In, it is intended that SundaGas TLS' wholly

owned subsidiary SundaGas Banda Unipessoal, Lda. (" SundaGas Banda

" ) will enter into an agreement with Spectrum Geo Australia Pty

Ltd., a wholly owned subsidiary of TGS-NOPEC Geophysical Company

ASA, for the licensing and reprocessing of the 3D seismic data that

is required under the Chuditch PSC work programme (the "

Reprocessing Agreement "). The Board believes that the Reprocessing

Agreement will enable the PSC work programme to be driven forward

by unlocking access to the data and allowing the Company to input

directly into the reprocessing project.

In order to fund, inter alia, the Earn In and the Chuditch PSC

work programme until the end of the Firm Commitment Period ("FCP")

in November 2022, Baron also announces that it has conditionally

raised GBP3.0 million (before expenses) by way of a placing and

subscription (together the "Fundraising") of a total of

6,000,000,000 new ordinary shares of 0.025p each ("Ordinary

Shares") in the Company (the "New Ordinary Shares") at a price of

0.05 pence per share (the "Issue Price"), to be undertaken in two

tranches. Allenby Capital Limited ( " Allenby Capital " ) and

Turner Pope Investments (TPI) Limited ( " TPI " ) are acting as

joint brokers in connection with the Fundraising.

HIGHLIGHTS

-- Completion of the Earn In will result in a 255% increase in

Baron's net share of Mean prospective resources to 375 MMBOE and

increase its indirect interest in the Chuditch PSC to 63.75%

-- Baron has agreed to fund the remainder of the estimated

US$3.5m Chuditch work programme to November 2022, which includes

the licensing and processing of the 3D seismic data

-- Timor-Leste gas exploitation activity has been accelerating

both regionally and locally, including plans for existing

infrastructure to be extended

-- The Board considers this move to be timely in order to gain

prospective exposure to the South-East Asian liquid natural gas

(LNG) market where demand for LNG is forecast to exceed supply in

the medium to long term

-- Each of the directors is participating in the Fundraising

Andy Yeo, CEO of Baron, commented:

"There has been a marked increase in Timor-Leste gas

exploitation activity recently and we are delighted to have had

both the opportunity to increase our indirect interest in the

Chuditch asset as well as the support of new and existing investors

to fund this exciting project. We look forward to updating

shareholders on progress."

The Chuditch PSC

SundaGas Banda holds a 75% interest in the Chuditch PSC, with

the remaining 25% interest in the PSC held by a subsidiary of the

Timor-Leste state oil company Timor Gap, E.P., with its interest

carried by SundaGas Banda. The PSC contains the Chuditch-1 gas

discovery.

Gas in Timor-Leste is a strategic resource, and the Board is

aware that gas exploitation activity has been accelerating both

regionally and locally, including plans for existing infrastructure

to be extended. The Board considers the Earn In to be timely in

order to gain prospective exposure to the South-East Asian liquid

natural gas (LNG) market, as LNG import gas prices in South-East

Asia are currently above pre-COVID levels and the medium to long

term demand for LNG is forecast by, amongst others, Royal Dutch

Shell to exceed supply.

On 8 January 2021, Baron announced a significant upgrade in the

gross estimated Mean Prospective Resources to 3,527 BCF. The

prospective resource base within the Chuditch PSC licence area

consists of the Chuditch-1 discovery, three adjacent prospects

(Chuditch West, Chuditch South West and Chuditch North), and a

previously unrecognised, significantly sized lead (Chuditch North

East). There is technical evidence indicating that the mapped

limits of the prospects and lead may coincide with the gas water

contact interpreted in the Chuditch-1 discovery, which leads the

Board to believe that there is the potential for a single, large

accumulation within the Chuditch PSC licence area. The seismic

reprocessing work programme is required to confirm the structural

configuration of the Chuditch discovery and adjacent prospective

areas prior to further drilling. It is noted that the above

estimates are not fully compliant with the 2018 SPE PRMS

Prospective Resources standard.

The significant gas accumulations in Timor-Leste waters,

Bayu-Undan and Greater Sunrise, are both known to contain

condensate in addition to gas. The Directors believe that there is

the potential for condensate to be within the Chuditch PSC licence

area, which has yet to be evaluated.

On 26 February 2021, Baron announced that SundaGas Banda had

been granted a 12-month extension to Contract Year 1 of the

Chuditch PSC. Accordingly, the expiry date of Year 1 of the 3-year

initial licence phase (the "Initial Period") is 8 November 2021.

The extension is expected to allow SundaGas Banda to complete the

PSC commitment technical work programme and assess the viability of

drilling of an appraisal well and potentially further exploration

wells in a timely manner.

The work programme for the current Initial Period of the

Chuditch PSC includes an obligation to reprocess 800 sq. kilometres

of 3D and 2,000 kilometres of 2D seismic data in the first two-year

period. Subject to satisfactory results from the 3D seismic

reprocessing, the subsequent commitment is for a minimum of one

well to be drilled in the third and final year of the Initial

Period of the PSC, effectively a 'drill or drop' decision to be

made by 19 December 2022.

The Earn In

Baron has entered into a conditional Amended and Res tated

Shareholders Agreement (the "Amended SHA ") with SundaGas Resources

Pte. Ltd (" SundaGas "), which outlines the terms of the Earn In

and governs the future operation of SundaGas TLS . Upon completion

of the Amended SHA , Baron will increase its shareholding in

SundaGas TLS from 33.33% to 85% and thus its indirect interest in

the Chuditch PSC from 25% to 63.75%. The Amended SHA is conditional

upon SundaGas and Baron authorising SundaGas Banda to enter into

the Reprocessing Agreement . Timor-Leste's oil and gas regulator,

Autoridade Nacional do Petróleo e Minerais (ANPM) has already

confirmed its approval to the Reprocessing Agreement and the

proposed conditional increase in Baron's interest in the Chuditch

PSC.

In order to effect the Earn In, via the Amended SHA, Baron has

agreed to make a payment of approximately US$ 1.2 million towards

the Chuditch PSC work programme. In addition, Baron has agreed to

fund all future costs associated with the Chuditch PSC until the

end of the FCP in November 2022, estimated to be approximately

US$3.5 million including the aforementioned payment of

approximately US$1.2 million.

Following the Earn In, Baron and SundaGas will have indirect

63.75% and 11.25% interests in the Chuditch PSC respectively . The

existing US $1 million bank guarantee ("BG") in relation to the

Chuditch PSC will remain in place. Baron contributed US$ 333,333 to

the BG in 2020, with the remainder being provided by SundaGas.

There will be no change in the operator of the Chuditch PSC , which

will remain as SundaGas Banda.

For the year ended 31 March 2020, SundaGas TLS's unaudited total

comprehensive loss was US$393,206 and its unaudited total assets as

at 31 March 2020 were US$1,604,171.

The Board views the Earn In as a low-cost means to secure a

majority interest in a project that has a sufficient level of

prospective resource to be of interest to major regional gas

players and other potential funding partners. The Earn In

represents the first step in the Board's new strategy, whereby the

Company intends to acquire significant equity interests in oil and

gas projects which present opportunities for high potential impact

exploration and appraisal activity at low entry costs into

established petroleum provinces.

Chuditch PSC project strategy and anticipated milestones

The Board expects that the 3D seismic reprocessing work under

the Reprocessing Agreement will deliver data 7 to 12 months from

commencement. The Board intends that seismic data interpretation,

geological and other studies will occur in parallel during this

period, and further expects that the results of the studies may

have the potential to reclassify the resources in the Chuditch-1

discovery from Prospective to Contingent, as defined by the Society

of Petroleum Engineers' ("SPE") Petroleum Resources Management

System ("PRMS").

The Board believes that the following events represent key

potential value inflection points for the Chuditch PSC project:

(i) the final results of seismic reprocessing anticipated in the first quarter of 2022;

(ii) the decision to enter into a drilling phase anticipated in

the fourth quarter of 2022; and

(iii) the potential drilling of high impact appraisal and

exploration wells anticipated in 2023.

Baron's other assets

Peru: Block XXI, Onshore Licence - Baron 100% interest

COVID restrictions remain in place in Peru, which continue to

prevent activity in relation to progressing the El Barco-3X

drilling project. Block XXI remains in Force Majeure until the

Company is able to conclude workshops and reach agreement regarding

access to the site with the local community, which cannot occur

until COVID restrictions are eased and free movement is allowed.

Baron intends to make a decision on the future drilling strategy

for the El Barco-3X project later in 2021, following the easing of

the COVID restrictions. The Company is seeking a three-year licence

extension option in relation to Block XXI .

UK: Inner Moray Firth, Offshore Licence P2478 - Baron 15%

interest

Baron and its partners in Offshore Licence P2478 intend to

reprocess existing 3D and 2D seismic data over 2021 and 2022, which

is the outstanding obligation in relation to the licence before a

"drill or drop" decision by July 2023.

Use of the Fundraising's net proceeds and planned activity in

2021

As at 28 February 2021, Baron had net cash of approximately GBP1

million. The Board believes that an approximately US$3.5 million

budget is required over the next two years in order to complete the

outstanding Chuditch PSC firm work programme and arrive at a

drilling decision. The majority of the net proceeds of the

Fundraising will therefore be applied towards the Chuditch PSC

project.

The Board currently anticipates that approximately 65% of

Baron's 2021 expenditure will be applied to the Chuditch PSC

project, 5% to other assets, and 30% to Baron's general and

administrative costs.

Details of the Fundraising

The Fundraising comprises a placing of 5,195,600,000 New

Ordinary Shares and a subscription of 804,400,000 New Ordinary

Shares. Of this, GBP 762,500 has been raised using the authority

granted to the Board at the annual general meeting held on 29 June

2020 , through the proposed issue of 1,525,000,000 New Ordinary

Shares (the "First Fundraising Shares") at the Issue Price (the

"First Fundraising") on a non-pre-emptive basis. A further GBP

2,237,500 has been raised through the proposed issue of

4,475,000,000 New Ordinary Shares (the "Second Fundraising Shares")

at the Issue Price (the "Second Fundraising"), which is

conditional, inter alia, on obtaining approval from Shareholders of

the necessary resolutions (the "Resolutions") at a General Meeting

of the Company (the "General Meeting"), to provide sufficient

authority to enable allotment of the Second Fundraising Shares and

disapply statutory pre-emption rights which would otherwise apply

to the allotment of the Second Fundraising Shares.

The First Fundraising is not conditional on the Second

Fundraising. Therefore, should the Resolutions at the General

Meeting not be passed, then the Second Fundraising will not

proceed. In this instance, the Directors believe that the Company

will have sufficient funds to complete the seismic reprocessing

component of the PSC's work programme (so enabling the Company to

complete the Earn In), following which the Directors may seek for

the Company to raise additional funds, if appropriate. Even if the

Second Fundraising does not proceed, the First Fundraising will

still complete following First Admission (as defined below).

Neither the completion of the First Fundraising nor the Second

Fundraising is conditional on the completion of the Earn In.

Director participation in the Fundraising

Andrew Yeo, Jon Ford and John Wakefield have subscribed for a

total of 97,600,000 New Ordinary Shares at the Issue Price in the

Fundraising (the "Director Participations"). The Director

Participations form part of the Second Fundraising Shares. Details

of the Director Participations are outlined in the table below.

Director Position New Ordinary Shareholding Percentage

Shares being following of enlarged

subscribed Second Admission share capital

following

Second Admission

Andrew Yeo Chief Executive 62,600,000 168,850,000 1.61%

-------------------- -------------- ------------------ ------------------

Jon Ford Technical Director 15,000,000 22,500,000 0.22%

-------------------- -------------- ------------------ ------------------

Non-Executive

John Wakefield Chairman 20,000,000 20,000,000 0.19%

-------------------- -------------- ------------------ ------------------

General Meeting

The Company expects to publish shortly a circular to

Shareholders which will contain notice of the General Meeting which

is to be held at the offices of Armstrong Teasdale LLP at 200

Strand, London, WC2R 1DJ at 10:00 a.m. (UK time) on 12 April

2021.

Admission and total voting rights

Application has been made for the 1,525,000,000 First

Fundraising Shares to be issued pursuant to the First Fundraising

to be admitted to trading on AIM ("First Admission") and the date

on which First Admission is expected to become effective is on or

around 26 March 2021.

Upon First Admission, the Company's issued ordinary share

capital will consist of 5,951,409,576 Ordinary Shares with one

voting right each. The Company does not hold any Ordinary Shares in

treasury. Therefore, the total number of Ordinary Shares and voting

rights in the Company will be 5,951,409,576. With effect from First

Admission, this figure may be used by Shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the Company under the FCA's Disclosure

Guidance and Transparency Rules.

Application will also be made to the London Stock Exchange for

the 4,475,000,000 Second Fundraising Shares to be issued pursuant

to the Second Fundraising to be admitted to trading on AIM ("Second

Admission") and, conditional, inter alia, on the approval of

Shareholders at the General Meeting, the date on which Second

Admission is expected to become effective is on or around 14 April

2021.

Upon Second Admission, the Company's issued ordinary share

capital will consist of 10,426,409,576 Ordinary Shares with one

voting right each. The Company does not hold any Ordinary Shares in

treasury. Therefore, the total number of Ordinary Shares and voting

rights in the Company upon Second Admission will be 10,426,409,576.

With effect from Second Admission, this figure may be used by

Shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the FCA's Disclosure Guidance and Transparency Rules.

Qualified Person's Statement

Pursuant to the requirements of the AIM Rules - Note for Mining

and Oil and Gas Companies, the technical information and resource

reporting contained in this announcement has been reviewed by Jon

Ford BSc, Fellow of the Geological Society, Technical Director of

the Company. Mr Ford has more than 39 years' experience as a

petroleum geoscientist. He has compiled, read and approved the

technical disclosure in this regulatory announcement and indicated

where it does not comply with the Society of Petroleum Engineers'

standard.

Other

Forward Looking Statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"anticipates", "targets", "aims", "continues", "expects",

"intends", "hopes", "may", "will", "would", "could" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements include matters that

are not facts. They appear in a number of places throughout this

announcement and include statements regarding the Directors'

beliefs or current expectations. By their nature, forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Investors should not place undue

reliance on forward-looking statements, which speak only as of the

date of this announcement.

Notice to Distributors

Solely for the purposes of the temporary product intervention

rules made under sections S137D and 138M of the FSMA and the FCA

Product Intervention and Product Governance Sourcebook (together,

the "Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance

Requirements) may otherwise have with respect thereto, the New

Ordinary Shares have been subject to a product approval process,

which has determined that the New Ordinary Shares are: (i)

compatible with an end target market of retail investors and

investors who meet the criteria of professional clients and

eligible counterparties, as defined under the FCA Conduct of

Business Sourcebook COBS 3 Client categorisation, and are eligible

for distribution through all distribution channels as are permitted

by the FCA Product Intervention and Product Governance Sourcebook

(the "Target Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the New Ordinary Shares may decline

and investors could lose all or part of their investment; the

Fundraising offer no guaranteed income and no capital protection;

and an investment in the Fundraising is compatible only with

investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Fundraising. Furthermore, it is noted that, notwithstanding

the Target Market Assessment, Allenby Capital and TPI will only

procure investors who meet the criteria of professional clients and

eligible counterparties. For the avoidance of doubt, the Target

Market Assessment does not constitute: (a) an assessment of

suitability or appropriateness for the purposes of the FCA Conduct

of Business Sourcebook COBS 9A and 10A respectively; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase, or take any other action whatsoever with respect to

the New Ordinary Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

Glossary

BCF Billion cubic feet of gas .

Mean Reflects a mid-case volume estimate of resource derived using probabilistic methodology. This

is the mean of the probability distribution for the resource estimates and may be skewed by

high resource numbers with relatively low probabilities.

MMBOE Million barrels of oil equivalent. Volume derived by dividing the estimate of the volume of

natural gas in billion cubic feet by six in order to convert it to an equivalent in million

barrels of oil and, where relevant, adding this to an estimate of the volume of oil in millions

of barrels.

Prospective Resources Quantities of petroleum that are estimated to exist originally in naturally occurring

reservoirs,

as of a given date. Crude oil in-place, natural gas in-place, and natural bitumen in-place

are defined in the same manner.

SPE PRMS The Society of Petroleum Engineers' ("SPE") Petroleum Resources Management System ("PRMS")

is a system developed for consistent and reliable definition, classification, and estimation

of hydrocarbon resources prepared by the Oil and Gas Reserves Committee of SPE and approved

by the SPE Board in June 2018 following input from six sponsoring societies: the World

Petroleum

Council, the American Association of Petroleum Geologists, the Society of Petroleum Evaluation

Engineers, the Society of Exploration Geophysicists, the European Association of Geoscientists

and Engineers, and the Society of Petrophysicists and Well Log Analysts.

For further information, please contact:

Baron Oil Plc +44 (0) 20 7117 2849

Andy Yeo, Chief Executive

Allenby Capital Limited +44 (0) 20 3328 5656

Nominated Adviser and Joint Broker

Alex Brearley, Nick Harriss, Nick Athanas (Corporate

Finance)

Kelly Gardiner (Sales and Corporate Broking)

Turner Pope Investments (TPI) Limited +44 (0) 20 3657 0050

Joint Broker

Andy Thacker, Zoe Alexander

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1. Details of the person discharging managerial responsibilities/person

closely associated

(a) Full name of person Dealing Andrew Yeo

----------------------------------------- ------------------------------------------

2. Reason for notification

-------------------------------------------------------------------------------------

(b) Position/status Chief Executive

----------------------------------------- ------------------------------------------

(c) Initial notification/ Amendment Initial notification

----------------------------------------- ------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

(d) Name of entity Baron Oil Plc

----------------------------------------- ------------------------------------------

(e) LEI 213800MBSOS9UZ5SW712

----------------------------------------- ------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------------------------

(a) Description of the financial instrument, Ordinary shares of

type of instrument 0.025 pence each in

the Company

----------------------------------------- ------------------------------------------

(b) Identification code GB00B01QGH57

----------------------------------------- ------------------------------------------

(c) Nature of the transaction Placing of ordinary

shares

----------------------------------------- ------------------------------------------

(d) Price(s) and volume(s) Prices(s) Volume(s)

0.05 pence 62,600,000

-----------

----------------------------------------- ------------------------------------------

(e) Aggregated information: Single transaction

- Aggregated volume as in 4(d) above Prices(s) Volume(s)

- Price 0.05 pence 62,600,000

-----------

----------------------------------------- ------------------------------------------

(f) Date of transaction 24 March 2021

----------------------------------------- ------------------------------------------

(g) Place of transaction Outside a trading venue

----------------------------------------- ------------------------------------------

1. Details of the person discharging managerial responsibilities/person

closely associated

(a) Full name of person Dealing Hugh Jonathan Ford

----------------------------------------- ------------------------------------------

2. Reason for notification

-------------------------------------------------------------------------------------

(b) Position/status Technical Director

----------------------------------------- ------------------------------------------

(c) Initial notification/ Amendment Initial notification

----------------------------------------- ------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

(d) Name of entity Baron Oil Plc

----------------------------------------- ------------------------------------------

(e) LEI 213800MBSOS9UZ5SW712

----------------------------------------- ------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------------------------

(a) Description of the financial instrument, Ordinary shares of

type of instrument 0.025 pence each in

the Company

----------------------------------------- ------------------------------------------

(b) Identification code GB00B01QGH57

----------------------------------------- ------------------------------------------

(c) Nature of the transaction Placing of ordinary

shares

----------------------------------------- ------------------------------------------

(d) Price(s) and volume(s) Prices(s) Volume(s)

0.05 pence 15,000,000

-----------

----------------------------------------- ------------------------------------------

(e) Aggregated information: Single transaction

- Aggregated volume as in 4(d) above Prices(s) Volume(s)

- Price 0.05 pence 15,000,000

-----------

----------------------------------------- ------------------------------------------

(f) Date of transaction 24 March 2021

----------------------------------------- ------------------------------------------

(g) Place of transaction Outside a trading venue

----------------------------------------- ------------------------------------------

1. Details of the person discharging managerial responsibilities/person

closely associated

(a) Full name of person Dealing John Wakefield

----------------------------------------- ------------------------------------------

2. Reason for notification

-------------------------------------------------------------------------------------

(b) Position/status Non-Executive Chairman

----------------------------------------- ------------------------------------------

(c) Initial notification/ Amendment Initial notification

----------------------------------------- ------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------------

(d) Name of entity Baron Oil Plc

----------------------------------------- ------------------------------------------

(e) LEI 213800MBSOS9UZ5SW712

----------------------------------------- ------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------------------------

(a) Description of the financial instrument, Ordinary shares of

type of instrument 0.025 pence each in

the Company

----------------------------------------- ------------------------------------------

(b) Identification code GB00B01QGH57

----------------------------------------- ------------------------------------------

(c) Nature of the transaction Placing of ordinary

shares

----------------------------------------- ------------------------------------------

(d) Price(s) and volume(s) Prices(s) Volume(s)

0.05 pence 20,000,000

-----------

----------------------------------------- ------------------------------------------

(e) Aggregated information: Single transaction

- Aggregated volume as in 4(d) above Prices(s) Volume(s)

- Price 0.05 pence 20,000,000

-----------

----------------------------------------- ------------------------------------------

(f) Date of transaction 24 March 2021

----------------------------------------- ------------------------------------------

(g) Place of transaction Outside a trading venue

----------------------------------------- ------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUPCWUPGPGW

(END) Dow Jones Newswires

March 24, 2021 03:00 ET (07:00 GMT)

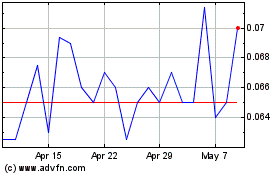

Baron Oil (LSE:BOIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baron Oil (LSE:BOIL)

Historical Stock Chart

From Apr 2023 to Apr 2024