BlackRock Grtr Eur Portfolio Update

January 16 2019 - 4:11AM

UK Regulatory

TIDMBRGE

BLACKROCK GREATER EUROPE INVESTMENT TRUST plc (LEI - 5493003R8FJ6I76ZUW55)

All information is at 31 December 2018 and unaudited.

Performance at month end with net income reinvested

One Three One Three Launch

Month Months Year Years (20 Sep 04)

Net asset value (undiluted) -5.8% -14.2% -5.6% 29.5% 319.6%

Net asset value* (diluted) -5.8% -14.2% -5.6% 30.7% 320.0%

Share price -5.7% -13.3% -7.6% 25.1% 303.6%

FTSE World Europe ex UK -4.6% -10.9% -9.5% 27.4% 211.9%

* Diluted for treasury shares and subscription shares.

Sources: BlackRock and Datastream

At month end

Net asset value (capital only): 321.78p

Net asset value (including income): 322.20p

Net asset value (capital only)1: 321.78p

Net asset value (including income)1: 322.20p

Share price: 307.00p

Discount to NAV (including income): 4.7%

Discount to NAV (including income)1: 4.7%

Net cash: 3.0%

Net yield2: 1.9%

Total assets (including income): GBP275.1m

Ordinary shares in issue3: 85,373,101

Ongoing charges4: 1.09%

1 Diluted for treasury shares.

2 Based on a final dividend of 4.00p per share and an interim dividend of

1.75p per share for the year ended 31 August 2018.

3 Excluding 24,955,837 shares held in treasury.

4 Calculated as a percentage of average net assets and using expenses,

excluding interest costs, after relief for taxation, for the year ended

31 August 2018.

Sector Analysis Total Country Analysis Total

Assets Assets

(%) (%)

Industrials 29.7 Switzerland 18.2

Health Care 23.6 France 15.7

Technology 11.8 Germany 11.9

Financials 11.6 Denmark 11.7

Consumer Goods 9.8 Netherlands 8.7

Consumer Services 5.2 Italy 6.0

Basic Materials 3.5 United Kingdom 4.2

Telecommunications 1.8 Sweden 3.8

Net Current Assets 3.0 Israel 3.5

----- Russia 3.1

100.0 Finland 2.5

Ireland 2.4

Spain 2.4

Belgium 1.9

Greece 1.0

Net Current Assets 3.0

-----

100.0

=====

Ten Largest Equity Investments

Company Country % of

Total Assets

Safran France 6.8

Lonza Group Switzerland 6.7

Novo Nordisk Denmark 6.2

SAP Germany 5.8

Sika Switzerland 4.9

RELX United Kingdom 4.2

Unilever Netherlands 3.8

Thales France 3.3

Sberbank Russia 3.1

ASML Netherlands 3.1

Commenting on the markets, Stefan Gries, representing the Investment Manager

noted:

During the month, the Company's NAV and share price fell by 5.8% and 5.7%

respectively. For reference, the FTSE World Europe ex UK Index returned -4.6%

during the period.

European ex UK markets fell sharply in December as concerns around global

growth and political agendas plagued the market. Across the market index, all

sectors produced a negative performance except utilities which was buoyed by

capital flow into perceived defensive assets, those with less exposure to the

economic cycle.

The Eurozone December flash Purchasing Manager Index was lower than expected,

partially dragged down by the collapse in industrial production in Germany as a

result of poor auto production in recent months due to emissions regulations.

Political tension in France, and indeed globally from the continued trade war

rhetoric, weighed on both business and consumer confidence.

Whilst inflation remains at bay, The European Central Bank confirmed to end its

net asset purchases in December, and clarified that it will continue with

reinvestments until at least after its first interest rate hike.

Stock selection was the main driver of the Company's underperformance over the

month versus the reference index. Sector allocation was broadly neutral. Whilst

the lower allocation to the utilities sector was a drag on returns, the

Company's lower weighting towards financials was beneficial.

The largest detractor over the month was a position in Lonza, which fell

sharply ahead of its 2019 guidance due at the end of January. Investors appear

nervous that there will be a repeat of last year's experience in which guidance

disappointed and the shares sold off aggressively. At the same time, new

accounting methodology and the disposal of its Water Care business are both

leading to further uncertainty. We were conscious of the potential for small

downgrades going into the event, but believe the long-term structural growth of

the company remains robust.

The Company also experienced a loss in health care position Fresenius Medical

Care. The company released an ad hoc guidance update for 2019 which was viewed

negatively by the market. While there are many moving parts, we believe the

long-term investment case is intact and see good value in the shares at this

price.

A number of other positions which are mid-cap and exhibit a richer valuation,

but do offer, we believe, strong potential growth in earnings, also suffered

underperformance. This included positions in Ferrari and LVMH.

Positively, a holding in Novo Nordisk aided returns as trials for

cardiovascular outcomes on their oral semaglutide drug were favourable. This

should allow the company to apply to the Food and Drug Administration for a

cardiovascular label for their existing injectable drug, which could prove a

boost to sales in the future.

At the end of the period, the Company had a higher allocation than the

reference index towards industrials, technology, consumer services and health

care. A lower allocation was held in financials, consumer goods, utilities,

telecommunications, basic materials and oil & gas.

Outlook

The range of potential economic outcomes is widening. Whilst stimulus has

helped to push US growth ahead, pockets of slower growth are appearing across

regions and industries. Overall, as with the onset of this year, we think

global growth will become more moderate, but do not yet believe we are moving

towards a recessionary environment, either in Europe or globally. In saying

this, we are increasingly sceptical of the situation in Italy and believe there

is greater downside risk emanating from this region. Increased risks of

contagion may dampen our view on European fundamentals. At present, however, we

continue to see a relatively robust environment for the consumer, who is

enjoying wage increases but a low level of inflation, as well as strength in

certain industries such as construction, where order books are improving.

Following the market re-set, valuation risk also appears less extended and

intra-market positioning less extreme. As the economic situation unfolds in the

global arena and fixed income markets potentially stabilise, there may be

opportunities to add to attractively valued companies which are exhibiting

strong earnings power. In the near-term, we have moved our portfolio to be more

defensive at the margin acknowledging potential risks on the horizon.

16 January 2019S

Latest information is available by typing www.brgeplc.co.uk on the internet,

"BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

January 16, 2019 05:11 ET (10:11 GMT)

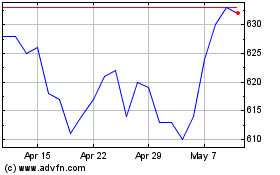

Blackrock Greater Europe... (LSE:BRGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

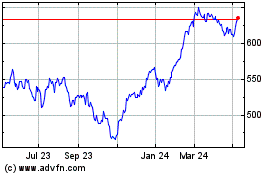

Blackrock Greater Europe... (LSE:BRGE)

Historical Stock Chart

From Apr 2023 to Apr 2024