TIDMCCT

RNS Number : 9949W

Character Group PLC

29 April 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("UK MAR"), and is disclosed in accordance

with the Company's obligations under Article 17 of UK MAR. Upon the

publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the

public domain.

The Character Group plc

Designers, developers and international distributor of toys,

games, and giftware

HALF YEARLY FINANCIAL REPORT

for the six months ended 28 February 2021

KEY PERFORMANCE INDICATORS

CONTINUING OPERATIONS Half-year Half-year Year

ended ended ended

28 February 29 February 31 August

2021 2020 2020

------------------ ------------------

Revenue up 44% GBP74.5m GBP51.7m GBP108.9m

Underlying operating profit* GBP6.1m GBP2.7m GBP5.4m

Underlying pre-tax profit* GBP6.1m GBP2.5m GBP5.0m

Underlying basic earnings per share* 23.0p 9.60p 18.12p

Underlying diluted earnings per share* 22.93p 9.58p 18.08p

Profit before tax GBP7.6m GBP2.2m GBP3.9m

Basic earnings per share 28.76p 8.57p 14.76p

Diluted earnings per share 28.67p 8.55p 14.73p

Dividend per share 6.0p 2.0p 5.0p

EBITDA GBP7.9m GBP4.3m GBP8.2m

Cash and cash equivalents increased substantially GBP34.9m GBP16.8m GBP19.1m

Net assets GBP39.6m GBP32.8m GBP34.0m

--------------------------------------------------- ------------------ ------------------ ----------------

*Excludes

Mark to market (loss) adjustments on FX

derivative positions GBP(0.48)m GBP(0.27)m GBP(2.0)m

Profit on sale of property GBP2.02m - -

Gain on buy back on loan - - GBP0.90m

----------------------------------------- ----------- ----------- ----------

-- Following the successful alignment of its product offering with the

rest of the Group, Character's Scandinavian business returned a profit

-- Sale of freehold property, Vernon Mill in January 2021 returned a gain

of GBP2m

-- The Group has one of the strongest portfolios that it has ever taken

to both domestic and international markets and this performance is

expected to continue through the second half of the financial year

and beyond Christmas 2021

-- Character's top brands have all shown significant sales growth. Goo

Jit Zu is now the Group's Number One brand and is penetrating all major

international markets, with distribution so far achieved in over 40

countries. Other major brands ( Peppa Pig , Pok émon , Little

Live Pets , Shimmer 'n Sparkle Instaglam , Stretch Armstrong , Fireman

Sam , Scooby Doo ) are also all out-performing expectations

-- Character appointed Master Toy Partner by Moonbug Entertainment, the

creator of the My Magic Pet Morphle brand, to collaborate on the design

and roll out of a full and sustainable toy products programme for this

new brand

-- Focus on developing a sustainable, Eco-friendly range of products over

numerous brands as well as the Group's Eco-Plush multi-licenced ranges

(products manufactured from recycled materials)

-- New product and range launches to build on the Group's success are

scheduled to take place throughout the summer and into the autumn.

Crucial to maintaining a fresh and vibrant portfolio, the planning

and design of new concepts and developments for 2022 is now well advanced

and close to fruition

"The performance of our current portfolio of products, coupled

with our success in further building sales growth momentum in our

international and domestic markets, has resulted in a very strong

performance by the Group in the period under review."

"We have continued to see a strong performance in sales of our

product portfolio in all our territories from the commencement of

the second half of the year. This growth is forecast to continue

through to and beyond Christmas 2021 and we are on target to

deliver the best performance in any calendar year in the Group's

history. Accordingly, we expect the 2021 full financial year's

underlying profit before tax will be materially ahead of the

published market consensus of GBP10.5m."

"Regardless of market challenges, the resilience of the Group's

cash-generative business has been proved and its powerful

performance will be further enhanced with the reopening of

non-essential retail shops in the UK and will be further supported

beyond Christmas 2021 and into 2022 by the anticipated global

relaxation of restrictions in coming months."

Enquiries to:

The Character Group plc

Jon Diver, Joint Managing Director

Kiran Shah, Joint Managing Director & Group Finance Director

Office: +44 (0) 208 329 3377

Mobile: +44 (0) 7831 802219 (JD)

Mobile: +44 (0) 7956 278522 (KS)

Email: info@charactergroup.plc.uk

Panmure Gordon (Nominated Adviser and Joint Broker)

Atholl Tweedie, Investment Banking

Charles Leigh-Pemberton, Corporate Broking

Rupert Dearden, Corporate Broking

Tel: +44 (0) 20 7886 2500

Allenby Capital Limited (Joint Broker)

Nick Athanas, Corporate Finance

Amrit Nahal, Sales & Corporate Broking

Tel: +44 (0) 20 3328 5656

TooleyStreet Communications Limited (Investor and media relations)

Fiona Tooley

Tel: +44 (0) 7785 703523

Email: fiona@tooleystreet.com

The Character Group plc

FTSE sector : leisure goods:

FTSE AIM All-share: symbol: CCT

Market cap : GBP100.9m

Group website: www.thecharacter.com

Product ranges can also be viewed at www.character-online.co.uk

The Character Group plc

(the "Company" or "Group" or "Character")

Designers, developers and international distributor of toys,

games and giftware

HALF YEARLY FINANCIAL REPORT

for the six months ended 28 February 2021

INTRODUCTION

Character presents its results for the half-year ended 28

February 2021.

The sales achieved from our current portfolio of products,

coupled with our success in further building sales growth momentum

in our international and domestic markets, has resulted in a very

strong performance by the Group in the period under review.

Underlying profit before tax was GBP6.1m, substantially higher

than the previous period (HY 2020: GBP2.5m), and turnover for the

period was also increased by 44% to GBP74.5m (HY 2020: GBP51.7m).

Further, following the successful alignment of its product offering

with the rest of the Group, our Scandinavian business also posted

an operating profit for the period.

Cash and cash equivalents at 28 February 2021 increased

substantially to GBP34.9m (HY 2020: GBP16.8m).

During the period, the Group also made a gain of GBP2m on the

sale of one of its freehold properties (Vernon Mill).

The period under review has witnessed a combination of unique

events (the further global COVID-19 lockdowns and the end of the

Brexit transition period) which have resulted in seismic challenges

being faced by traditional retail customers and generally in the

global goods transportation sector. Whilst these factors have had

their effect, the Directors are delighted to report that the

Group's business has seen healthy growth in all its markets in the

period.

This has been an astounding achievement all round and the Board

is extremely proud of how effectively the individuals and teams

throughout the business have pulled together to achieve this

result.

OUR PORTFOLIO

As always, our portfolio of brands and products is key to our

prospects and we are delighted to report that the Group's

performance in the first six months demonstrates that we currently

have one of the strongest portfolios that we have ever taken to

both our domestic and international markets. This performance is

expected to continue through the second half of the financial year

and beyond Christmas 2021. Our top brands have all shown

significant sales growth. Goo Jit Zu is now our Number One brand

and is penetrating all major international markets, with

distribution so far achieved in over 40 countries. Our other major

brands ( Peppa Pig , Pok émon , Little Live Pets , Shimmer 'n

Sparkle Instaglam , Stretch Armstrong , Fireman Sam , Scooby Doo )

are also out-performing management's expectations.

Our move to focus on developing a sustainable, Eco-friendly

range of products over numerous brands with our World of Licensed

Wood range of figures, vehicles and playsets (which includes

products produced under the Peppa Pig , Disney Princess , Batman

and Fireman Sam brands) as well as our Eco-Plush multi-licenced

ranges (products manufactured from recycled materials) are being

enthusiastically embraced by the industry and consumers alike.

The Group's product portfolio also continues to be strengthened

through the development of new and exciting additions that will

further enhance its breadth and appeal. This momentum in evolving

the Group's product offering not only builds and supports the

existing and new brands it also reassures the Company that the

performance of the Group's portfolio is not overly dependent on any

one brand .

The Group continues successfully to source licences for brands

and characters that inspire and have substantial followings amongst

young children. Trends in the development of these brands and

characters have changed considerably in recent years. Whilst in the

past, many of these have emerged from films, television series,

books or comics, now YouTube, popular social media and dedicated

digital channels are fast emerging as platforms that children are

drawn to and engage with. The trends and characters originating

from these sources are now very much part of the focus for our

attention. An exciting example of this phenomenon is My Magic Pet

Morphle (an energetic little red creature who can transform into

anything). Over 300 episodes of his adventures have been released

to date on non-traditional, digital media and there has been a

growing international audience for this enchanting character. Based

on the Group's expertise and successes in toy brand management,

Moonbug Entertainment, the creator of My Magic Pet Morphle , has

selected Character as its Master Toy Partner to collaborate with it

to design and roll out a full and sustainable toy products

programme for this new brand. This is proving to be a great working

relationship and we look forward to launching this exciting new

range in the coming autumn.

New product and range launches to build on the Group's success

are scheduled to take place throughout the summer and into the

autumn. Crucial to maintaining a fresh and vibrant portfolio, the

planning and design of new concepts and developments for 2022 is

now well advanced and close to fruition.

To view our full current portfolio of products and brands, go to

www.character-online.co.uk .

GROUP TRADING

As anticipated, the first half of the current year was the

beneficiary of the deferral of the strong trading that, prior to

the onset of the pandemic, had been projected for the second half

of the last financial year.

Revenue in the period was up 44% on the same period last year at

GBP74.5m (HY 2020 GBP51.7m; FY 2020: GBP108.9m).

The Group is reporting an underlying profit before tax for the

period of GBP6.1m (HY 2020: GBP2.45m; FY 2020: GBP5.0m). In

addition, the Group made a gain of GBP2.0m from the sale of the

Vernon Mill freehold property in January 2021. Underlying earnings

before interest, tax, depreciation and amortisation (EBITDA) were

GBP 7.9 m (HY 2020 GBP4.3m; FY 2020: GBP8.2m) .

Gross profit margin in the period came in at 29.2%, compared to

33.2% in the same 2020 period and 27.7% for the August 2020

financial year. The reduction in margin reflects the increased

proportion of lower margin, international FOB sales in the first

half compared with the same period in 2020, with some measure of

pressure on the margin on domestic sales caused by container

shortages and reduced shipping capacity resulting in substantial

increases in freight rates on our domestic imports.

Underlying basic earnings per share amounted to 23.0p (HY 2020:

9.6p; FY 2020: 18.12p). Diluted earnings per share, on the same

basis, were 22.93p (HY 2020: 9.58p; FY 2020: 18.08p).

A significant proportion of the Group's purchases are made in US

dollars. The business is therefore exposed to foreign currency

fluctuations and manages the associated risk through the purchase

of forward exchange contracts and derivative financial instruments.

Under International Financial Reporting Standards (IFRS), at the

end of each reporting period the Group is required to make an

adjustment in its financial statements to incorporate a 'mark to

market' valuation of such financial instruments. The 'mark to

market' adjustment for the financial period under review results in

a charge of GBP0.48m. This compares to a charge of GBP0.27m shown

in the corresponding period in 2020 and a charge of GBP2.0m

reported in the year to 31 August 2020. These 'mark to market'

adjustments are non-cash items, calculated by reference to

unpredictable and sometimes volatile currency spot rates at the

respective balance sheet dates.

FINANCIAL POSITION, WORKING CAPITAL & CASH FLOW

The Group's capital base remained solid, with net assets at 28

February 2021 of GBP39.6m (HY 2020: GBP32.8m; FY 2020: GBP34.0m).

Inventories at 28 February 2021 reduced to GBP9.1m (HY 2020:

GBP10.6m; FY 2020: GBP14.7m). During the period, the Group

generated cash from operations of GBP21.3m (HY 2020: GBP15.1m; FY

2020: GBP19.6m).

The Group has no long-term debt. Net interest charges on the use

of working capital facilities during the period were GBP0.1m (HY

2020: GBP0.2m; FY 2020: GBP0.34m). After making dividend payments,

the Group had cash and cash equivalents of GBP34.9m (HY 2020:

GBP16.8m; FY 2020: GBP19.1m) at the end of the first-half period.

In addition, the Group had unutilised headroom of over GBP50m under

its banking and other finance facilities.

DIVID

The Board remains committed to maintaining a progressive

dividend policy. Reflecting its confidence in the Company's ability

to continue to grow profits and generate and develop further

sustainable cash flow, t he Board is declaring an interim dividend

of 6.0p per share (HY 2020: 2.0p; final dividend 2020: 3.0p).This

interim dividend, which is covered 3.8 times by the underlying

earnings (HY 2020: 4.8 times), will be paid on 30 July 2021 to

shareholders on the Register as at the close of business on 16 July

2021. The shares will be marked ex-dividend on 15 July 2021.

SHARE BUYBACK PROGRAMME

Although no share buybacks were achieved in the period under

review, shareholders passed a resolution at the Company's Annual

General Meeting held in January 2021 authorising the Company to

effect buybacks (including by way of tender offers) of up to

3,200,000 issued ordinary shares of 5p each in the Company

("Ordinary Shares"). T he Board believes that it is in the

interests of all shareholders to provide investors who wish to

realise part or all their investment in the Group with an

opportunity to access liquidity that is not otherwise available in

the market and to return excess capital to shareholders.

The Board has therefore resolved to pursue a new buyback

initiative to purchase Ordinary Shares to a value of up to

GBP10.0m. This new share buyback initiative is consistent with the

Group's approach to capital allocation and reflects the Group's

strong, ongoing cash generation. Further details will be announced

in the coming weeks.

The Group continues to have considerable financial flexibility

to fund its growth strategy and is supported by its robust

financial position.

TOTAL VOTING RIGHTS (TVR)

As at today's date. the Company's issued share capital consists

of 23,608,501 Ordinary Shares. The Company holds 2,228,720 Ordinary

Shares in treasury which do not carry voting rights and,

accordingly, the total number of voting rights in Character is

21,379,781. The figure of 21,379,781 may be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest, or change to their

interest, in the Company under the FCA's Disclosure Guidance and

Transparency Rules.

OUR PEOPLE

The efforts of, and results delivered by, our experienced and

dedicated teams across our bases of operations in the UK,

Scandinavia and Asia to overcome the challenges posed by the

pandemic to our supply chain and fulfilment capabilities have been

truly inspiring. By working tirelessly and in close partnership

with our customers, suppliers and brand owners, our personnel have

delivered a seamless, efficient and safe transition from the old to

the new "normal". This experience has stress-tested our

collaborative culture, business processes and relationships,

however, the results achieved in the period under review have

delivered a ringing endorsement of their effectiveness. Every one

of our team members has played a significant role in this

achievement and the Directors wish to express their gratitude to

them on behalf of all the Group's stakeholders.

COVID-19

Whilst the current relaxation of restrictions in the UK and

those that have been implemented in other territories throughout

the world have been greatly welcomed, it is clear from the further

COVID-19 waves fast developing in India and which are already being

experienced in parts of the EU and elsewhere that it will be

necessary for all people and organisations to continue to be

vigilant and act responsibly with appropriate safety and distancing

measures. The COVID-19 procedures that have been in place at all

our sites for many months now (in line with government guidelines

and other good practice) will remain in place for the foreseeable

future to ensure the safety and wellbeing of our staff and visitors

to our premises. Although it is not possible to determine what, if

any significant, impact the threat of further COVID-19 "spikes"

will have in the coming months, the Board is reassured by the

Group's proven ability to continue to operate effectively in these

challenging conditions and confident that the business is well

positioned and robust in its stance to deal with future

developments with this virus.

OUTLOOK

Building further on the substantial increase in Group sales in

the first half, we have continued to see a strong performance in

sales of our product portfolio in all our territories from the

commencement of the second half of the year. This growth is

forecast to continue through to and beyond Christmas 2021 and we

are on target to deliver the best sales performance in any calendar

year in the Group's history. Accordingly, we expect the 2021 full

financial year's underlying profit before tax will be materially

ahead of the published market consensus of GBP10.5m.

In the short term, the Group will face challenges with the

ongoing delays at ports, shipping shortages and opportunistic

pricing on freight rates (all principally fall-out resulting from

the COVID-19 pandemic) together with mounting pressure on the costs

of production in China. Gross profit margins will also reduce with

the anticipated growth in FOB sales to our international

customers.

Regardless of these market challenges, the resilience of the

Group's cash-generative business has been proved and its powerful

performance in the first half and into the second of the financial

year will be further enhanced with the reopening of non-essential

retail shops in the UK and will be further supported beyond

Christmas 2021 and into 2022 by the anticipated global relaxation

of restrictions in coming months.

The Board looks forward to updating shareholders with further

news of these developments in due course.

29 April 2021

The Character Group plc

Consolidated Income Statement

Six months ended 28 February 2021

6 months 6 months 6 months 6 months 6 months 6 months 12 months 12 months 12 months

ended ended ended ended ended ended ended ended ended

28 February 28 February 28 February 29 February 29 February 29 February 31 August 31 August 31 August

2021 2021 2021 2020 2020 2020 2020 2020 2020

Result Result Result

before *highlighted before *highlighted before *highlighted

*highlighted items *highlighted items *highlighted items

items items items

(unaudited) (unaudited) (unaudited) (unaudited) (audited) (audited)

(unaudited) GBP'000 GBP'000 (unaudited) GBP'000 GBP'000 (audited) GBP'000 GBP'000

GBP'000 GBP'000 GBP'000

------------- -------------- ------------- -------------- ------------- -------------

Revenue 74,543 - 74,543 51,732 - 51,732 108,867 - 108,867

Cost of sales (52,751) - (52,751) (34,554) - (34,554) (78,704) - (78,704)

---------------- ------------- -------------- ------------ ------------- -------------- ------------ ------------- ------------- ----------

Gross profit 21,792 - 21,792 17,178 - 17,178 30,163 - 30,163

Other income 256 - 256 244 - 244 501 - 501

Selling and

distribution

expenses (5,469) - (5,469) (5,472) - (5,472) (7,355) - (7,355)

Administrative

expenses (10,468) - (10,468) (9,297) - (9,297) (17,949) - (17,949)

Profit on sale

of

property - 2,016 2,016 - - - - - -

---------------- ------------- -------------- ------------ ------------- -------------- ------------ ------------- ------------- ----------

Operating

profit 6,111 2,016 8,127 2,653 - 2,653 5,360 - 5,360

Finance income 15 - 15 9 - 9 47 - 47

Finance costs (66) - (66) (208) - (208) (388) - (388)

Changes in fair

value

of financial

instruments - (482) (482) - (265) (265) - (1,980) (1,980)

Gain on buy

back of

loan - - - - - - - 886 886

Profit before

tax 6,060 1,534 7,594 2,454 (265) 2,189 5,019 (1,094) 3,925

Income tax (1,095) (303) (1,398) (651) 45 (606) (1,312) 376 (936)

---------------- ------------- -------------- ------------ ------------- -------------- ------------ ------------- ------------- ----------

Profit for the

period 4,965 1,231 6,196 1,803 (220) 1,583 3,707 (718) 2,989

---------------- ------------- -------------- ------------ ------------- -------------- ------------ ------------- ------------- ----------

*highlighted items comprise material items that are disclosed

separately by virtue of their size or incidence and because they

are considered relevant to an understanding of the overall

performance of the company.

The Character Group plc

Consolidated Income Statement

Six months ended 28 February 2021

6 months 6 months 12 months

ended ended ended

28 February 29 February 31 August

2021 2020 2020

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

------- -------------- ---------------

Attributable to:

--------------------------------------- ------- -------------- --------------- -----------

Owners of the parent 6,148 1,831 3,154

Non- controlling interest 48 (248) (165)

--------------------------------------- ------- -------------- --------------- -----------

Profit for the period 6,196 1,583 2,989

--------------------------------------- ------- -------------- --------------- -----------

Earnings per share before significant

items (pence) 4

Basic earnings per share 23.00p 9.60 18.12p

Diluted earnings per share 22.93p 9.58 18.08p

--------------------------------------- ------- -------------- --------------- -----------

Earnings per share after significant

items (pence) 4

--------------------------------------- ------- -------------- --------------- -----------

Basic earnings per share 28.76p 8.57 14.76p

Diluted earnings per share 28.67p 8.55 14.73p

Dividend per share (pence) 3 3.00p 13.00p 15.00p

--------------------------------------- ------- -------------- --------------- -----------

EBITDA

(earnings before interest, tax,

depreciation and amortisation) 7,889 4,318 8,158

--------------------------------------- ------- -------------- --------------- -----------

The Character Group plc

Consolidated Statement of Comprehensive Income

Six months ended 28 February 2021

6 months 6 months 12 months

ended ended ended

28 February 29 February 31 August

2021 2020 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---- ------------- ---------------

Profit for the period after tax 6,196 1,583 2,989

--------------------------------------------------- ------------- --------------- ------------

Items that will not be reclassified

subsequently to profit and loss

Current tax credit relating to exercised

share options - - -

Deferred tax relating to share options 19 (15) (6)

--------------------------------------------------- ------------- --------------- ------------

19 (15) (6)

-------------------------------------------------- ------------- --------------- ------------

Items that may be reclassified subsequently

to profit and loss

Net exchange differences on translation

of foreign operations (247) (296) (98)

--------------------------------------------------- ------------- --------------- ------------

Total comprehensive income for the period 5,968 1,272 2,885

--------------------------------------------------- ------------- --------------- ------------

Total comprehensive income for the period

attributable to:

--------------------------------------------------- ------------- --------------- ------------

Equity holders of the parent 5,925 1,499 3,050

Non-controlling interest 43 (227) (165)

--------------------------------------------------- ------------- --------------- ------------

5,968 1,272 2,885

--------------------------------------------------- ------------- --------------- ------------

The Character Group plc

Consolidated Balance Sheet

at 28 February 2021

28 February 29 February 31 August

2021 2020 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---- ------------- -------------

Non-current assets

Intangible assets - product development 446 447 891

Investment property 1,551 1,616 1,584

Property, plant and equipment 7,422 3,351 3,226

Right of use assets 1,718 1,068 2,069

Deferred tax assets 658 502 704

----------------------------------------------- ------------- ------------- -----------

11,795 6,984 8,474

---------------------------------------------- ------------- ------------- -----------

Current assets

Inventories 9,145 10,563 14,736

Trade and other receivables 11,651 13,508 23,013

Current income tax receivable 244 - 244

Derivative financial instruments 206 66 75

Cash and cash equivalents 35,037 19,582 22,292

----------------------------------------------- ------------- ------------- -----------

56,283 43,719 60,360

---------------------------------------------- ------------- ------------- -----------

Current liabilities

Short term borrowings (140) (1,891) (3,168)

Trade and other payables (22,589) (12,142) (26,432)

Lease liabilities (538) (236) (550)

Income tax payable (951) (1,331) (777)

Derivative financial instruments (2,906) (570) (2,293)

----------------------------------------------- ------------- ------------- -----------

(27,124) (16,170) (33,220)

---------------------------------------------- ------------- ------------- -----------

Net current assets 29,159 27,549 27,140

----------------------------------------------- ------------- ------------- -----------

Non - current liabilities

Deferred tax (90) - (21)

Lease liabilities (1,221) (848) (1,547)

Long term borrowings - (921) -

----------------------------------------- ---- ------------- ------------- -----------

Net assets 39,643 32,764 34,046

----------------------------------------------- ------------- ------------- -----------

Equity

Called up share capital 1,181 1,181 1,181

Shares held in treasury (1,870) (1,870) (1870)

Capital redemption reserve 1,776 1,776 1,776

Share based payment reserve 3,640 3,276 3,369

Share premium account 17,324 17,324 17,324

Merger reserve 651 651 651

Translation reserve 590 855 727

Profit and loss account 16,351 10,215 11,231

----------------------------------------------- ------------- ------------- -----------

Attributable to equity holders of

the parent 39,643 33,408 34,389

Non-controlling interest - (644) (343)

----------------------------------------------- ------------- ------------- -----------

Total equity 39,643 32,764 34,046

----------------------------------------------- ------------- ------------- -----------

The Character Group plc

Consolidated Statement of Cash Flows

Six months ended 28 February 2021

6 months 6 months 12 months

ended ended ended

28 February 29 February 31 August

2021 2020 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------- --------------

Cash flow from operating activities

Profit before taxation for the period 7,594 2,189 3,925

---------------------------------------------- ------------- -------------- ------------

Adjustments for:

Depreciation of property, plant and

equipment 284 347 544

Depreciation of investment property 33 33 65

Depreciation of right of use assets 278 - 412

Amortisation of intangible assets 1,187 1,285 1,783

Gain on buyback of loan - - (886)

(Profit)/loss on disposal of property,

plant and equipment (2,020) (2) (9)

Interest expense 51 199 341

Financial instruments fair value adjustments 482 265 1,980

Share based payments 271 96 189

Decrease in inventories 5,591 5,842 1,669

Decrease in trade and other receivables 11,362 21,465 11,960

Decrease in trade and other creditors (3,843) (16,624) (2,334)

---------------------------------------------- ------------- -------------- ------------

Cash generated from operations 21,270 15,095 19,639

---------------------------------------------- ------------- -------------- ------------

Interest paid (51) (199) (341)

Income tax paid (1,065) (347) (1,728)

---------------------------------------------- ------------- -------------- ------------

Net cash inflow from operating activities 20,154 14,549 17,570

---------------------------------------------- ------------- -------------- ------------

Cash flows from investing activities

Payments for intangible assets (742) (829) (1,771)

Payments for property, plant and equipment (5,918) (360) (528)

Proceeds from disposal of property,

plant and equipment 3,450 4 12

Net cash outflow from investing activities (3,210) (1,185) (2,287)

---------------------------------------------- ------------- -------------- ------------

Cash flows from financing activities

Reduction of borrowings - - 1,408

Buyback of loan - - (521)

Payment of leasing liabilities (338) (86) (378)

Proceeds from issue of share capital - 205 205

Purchase of own shares for cancellation - (163) (163)

Dividends paid (642) (2,779) (3,207)

Net cash used in financing activities (980) (2,823) (2,656)

---------------------------------------------- ------------- -------------- ------------

Net increase in cash and cash equivalents 15,964 10,541 12,627

Cash, cash equivalents and borrowings

at the beginning of the period 19,124 6,504 6,504

Effects of exchange rate movements (191) (275) (7)

---------------------------------------------- ------------- -------------- ------------

Cash, cash equivalents and borrowings

at the end of the period 34,897 16,770 19,124

---------------------------------------------- ------------- -------------- ------------

Cash, cash equivalents and borrowings

consist of:

Cash, cash equivalents 35,037 19,582 22,292

Short term borrowings (140) (2,812) (3,168)

--------------------------------------- ------- -------- --------

Cash, cash equivalents and borrowings

at the end of the period 34,897 16,770 19,124

--------------------------------------- ------- -------- --------

The Character Group plc

Consolidated Statement of Changes in Equity

Six months ended 28 February 2021

Called Capital Share Share Profit Non-

up Treasury redemption premium Merger based Translation and controlling

share shares reserve account reserve payment reserve loss interest Total

capital GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 account GBP'000 GBP'000

GBP'000 GBP'000

-------- ---------- ----------- -------- --------- -------- ------------- -------- ------------

Balance as

at

31 August 2019

(unaudited) 1,183 (1,912) 1,774 17,161 651 3,180 1,223 11,290 (417) 34,133

------------------ -------- ---------- ----------- -------- --------- -------- ------------- -------- ------------ ---------

Profit/(loss)

for the period - - - - - - - 1,831 (248) 1,583

Exchange

differences

on translation

of foreign

operations - - - - - - (368) 51 21 (296)

Deferred tax

relating to

share options - - - - - - - (15) - (15)

------------------ -------- ---------- ----------- -------- --------- -------- ------------- -------- ------------ ---------

Total

comprehensive

income/(expense)

for the period - - - - - - (368) 1,867 (227) 1,272

------------------ -------- ---------- ----------- -------- --------- -------- ------------- -------- ------------ ---------

Transactions

with owners

Dividend paid - - - - - - - (2,779) - (2,779)

Share based

payment - - - - - 96 - - - 96

Shares issued - 42 - 163 - - - - - 205

Shares cancelled (2) - 2 - - - - (163) - (163)

Six months

ended

29 February

2020 1,181 (1,870) 1,776 17,324 651 3,276 855 10,215 (644) 32,764

------------------ -------- ---------- ----------- -------- --------- -------- ------------- -------- ------------ ---------

Balance as

at

1 September

2019

(audited) 1,183 (1,912) 1,774 17,161 651 3,180 1,223 11,293 (416) 34,137

---------------------- ------ -------- ------ ------- ---- ------ ------ -------- ------ --------

Profit/(loss)

for the year

after tax - - - - - - - 3,154 (165) 2,989

Net exchange

differences

on translation

of foreign

operations - - - - - - (496) 398 - (98)

Deferred tax

debit relating

to share options - - - - - - - (6) - (6)

Total comprehensive

income/(expense)

for the year - - - - - - (496) 3,546 (165) 2,885

---------------------- ------ -------- ------ ------- ---- ------ ------ -------- ------ --------

Transactions

with owners

Change in non

controlling

interest - - - - - - - (238) 238 -

Share based

payment - - - - - 189 - - - 189

Dividends - - - - - - - (3,207) - (3,207)

Shares issued - 42 - 163 - - - - - 205

Shares cancelled (2) - 2 - - - - (163) - (163)

---------------------- ------ -------- ------ ------- ---- ------ ------ -------- ------ --------

At 31 August

2020 1,181 (1,870) 1,776 17,324 651 3,369 727 11,231 (343) 34,046

---------------------- ------ -------- ------ ------- ---- ------ ------ -------- ------ --------

Profit for

the period - - - - - - - 6,148 48 6,196

Exchange differences

on translation

of foreign

operations - - - - - - (137) (105) (5) (247)

Deferred tax

relating to

share options - - - - - - - 19 - 19

---------------------- ------ -------- ------ ------- ---- ------ ------ -------- ------ --------

Total comprehensive

income/(expense)

for the period - - - - - - (137) 6,062 43 5,968

---------------------- ------ -------- ------ ------- ---- ------ ------ -------- ------ --------

Transactions

with owners

Change in non

controlling

interest - - - - - - - (300) 300 -

Dividend paid - - - - - - - (642) - (642)

Share based

payment - - - - - 271 - - - 271

---------------------- ------ -------- ------ ------- ---- ------ ------ -------- ------ --------

Six months

ended

28 February

2021 1,181 (1,870) 1,776 17,324 651 3,640 590 16,351 - 39,643

---------------------- ------ -------- ------ ------- ---- ------ ------ -------- ------ --------

The Character Group plc

Notes to the Financial Statements

1. Basis of Preparation

The financial information set out in this Half Yearly Financial Report

has been prepared in accordance with the recognition and measurement principles

of International Financial Reporting Standards (IFRS) in conformity with

the Companies Act 2006 and in accordance with the accounting policies which

will be adopted in presenting the Group's Annual Report and Financial Statements

for the year ending 31 August 2021. These are consistent with the accounting

policies used in the financial statements for the year ended 31 August

2020 as described in those annual financial statements.

As permitted, this Half Yearly Financial Report has been prepared in accordance

with the AIM rules and not in accordance with IAS 34 'Interim Financial

Reporting'.

The consolidated financial statements are prepared under the historical

cost convention, as modified by the revaluation of certain financial instruments

and share based payments at fair value.

These Half Yearly Financial Statements and the financial information for

the six months ended 28 February 2021 do not constitute full statutory

accounts within the meaning of section 434 of the Companies Act 2006 and

are unaudited. These unaudited Half Yearly Financial statements were approved

by the Board of Directors on 28 April 2021.

The information for the year ended 31 August 2020 is based on the consolidated

financial statements for that year on which the Group's auditor's report

was unqualified and did not contain a statement under section 498 (2) or

(3) of the Companies Act 2006.

2. Going concern

The Directors acknowledge the Financial Reporting Council's 'Guidance for

companies on Corporate Governance Reporting' issued in December 2020.

In assessing the Group and Company's ability to continue as a going concern,

the Board reviews and approves the annual budget and updated forecasts,

including forecasts of cash flows, borrowing requirements and headroom.

The Board reviews the Group's sources of available funds and the level

of headroom available against its committed borrowing facilities. The Group's

financial forecasts, taking into account possible sensitivities in trading

performance including the potential impact of Covid-19, indicate that the

Group will be able to operate within the level of its committed borrowing

facilities for the foreseeable future. The banks remains supportive of

the Group and in the UK has an ongoing invoice discount facility of GBP20m,

together with overdraft and trade finance facilities of GBP21m which were

renewed in April 2020.The Directors have a reasonable expectation that

the Group and Company have adequate resources to continue their operational

existence for the foreseeable future. Accordingly, they continue to adopt

the going concern basis of accounting in preparing the Interim report.

3. Dividends

6 months ended 6 months ended 12 months ended

28 February 29 February 31 August

2021 2020 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

--------------- ---------------

On equity shares:

Final dividend paid for the year

ended 31 August 2020

* 3.00p (2019: 13.00p) per share 642 2,779 2,777

* Interim - - 430

------------------------------------------------ --------------- --------------- ----------------

642 2,779 3,207

------------------------------------------------ --------------- --------------- ----------------

4. Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable

to ordinary shareholders by the weighted average number of ordinary shares

during the period.

Diluted earnings per share is calculated by adjusting the weighted average

number of ordinary shares in issue on the assumption of conversion of all

dilutive potential ordinary shares. The Group has one category of dilutive

potential ordinary shares, being share options granted where the exercise

price is less than average price of the company's ordinary shares during

this period.

An adjusted earnings per share has also been calculated as, in the opinion

of the directors, this will allow shareholders to gain a clearer understanding

of the trading performance of the Group.

The calculations are based on the following:

six months six months ended 12 months ended

ended

28 February 29 February 31 August

2021 2020 2020

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------- ------------------- ------------- ----------------- ----------------

Profit attributable to equity

shareholders of the parent 6,148 1,831 3,154

----------------------------------------- ------------- ----------------- ----------------

Financial instruments fair value

adjustments net of tax 391 220 1,604

----------------------------------------- ------------- ----------------- ----------------

Gain on buyback of loan - - (886)

----------------------------------------- ------------- ----------------- ----------------

Gain on sale of property net of (1,622) - -

tax

----------------------------------------- ------------- ----------------- ----------------

Profit for adjusted earnings per

share 4,917 2,051 3,872

----------------------------------------- ------------- ----------------- ----------------

Weighted average number of shares

In issue during the year - basic 21,379,781 21,355,507 21,367,710

Dilutive potential ordinary shares 66,078 60,164 50,590

----------------------------------------- ------------- ----------------- ----------------

Weighted average number of ordinary

for diluted earnings per share 21,445,859 21,415,671 21,418,300

----------------------------------------- ------------- ----------------- ----------------

Earnings per share

Basic earnings per share (pence) 28.76 8.57 14.76

------------------------------------ ------ ----- ----------

Diluted earnings per share (pence) 28.67 8.55 14.73

------------------------------------ ------ ----- ----------

Adjusted earnings per share

Basic earnings per share (pence) 23.00 9.60 18.12

------------------------------------ ------ ----- ------

Diluted earnings per share (pence) 22.93 9.58 18.08

------------------------------------ ------ ----- ------

5. Electronic Communications

The Half Yearly Financial Report for the six months ended 28 February

2021 will shortly be available for viewing and download on the Group's

website , www.thecharacter.com .

--- ------------------------------------------------------------------------

Independent Review Report to The Character Group plc

-------------------------------------------------------------------------------------

Introduction

We have been engaged by The Character Group plc (the Company) to review

the condensed set of financial statements in the Half Yearly Financial

Report for the six months ended 28 February 2021 which comprises the Consolidated

Income Statement, the Consolidated Statement of Comprehensive Income, the

Consolidated Balance Sheet, the Consolidated Statements of Cash flows,

the Consolidated Statement of Changes in Equity, and related notes 1 to

4. We have read the other information contained in the Half Yearly Financial

Report and considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set of financial

statements.

This report is made solely for the Company in accordance with guidance

contained in International Standard on Review Engagements 2410 (UK and

Ireland) "Review of Interim Financial Information Performed by the Independent

Auditor of the Entity" issued by the Auditing Practices Board. To the fullest

extent permitted by law, we do not accept or assume responsibility to anyone

other than the Company, for our work, for this report, or for the conclusions

we have formed.

Directors' responsibilities

The Half Yearly Financial Report is the responsibility of, and has been

approved by, the Directors. The Directors are responsible for preparing

the Half Yearly Financial Report in accordance with the AIM rules of the

London Stock Exchange which requires that the accounting policies and presentation

applied to the financial information in the Half Yearly Financial Report

are consistent with those which will be adopted in the annual accounts

having regard to the accounting standards applicable for such accounts.

Our Responsibility

Our responsibility is to express to the Company a conclusion on the condensed

set of financial statements in the Half Yearly Financial Report based on

our review.

Scope of Review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410, "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the Auditing

Practices Board for use in the United Kingdom. A review of interim financial

information consists of making enquiries, primarily of persons responsible

for financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would become

aware of all significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion .

Conclusion

Based on our review, nothing has come to our attention that causes us to

believe that the condensed set of financial statements in the Half Yearly

Financial Report for the six months ended 28 February 2021 is not prepared,

in all material respects, in accordance with the AIM rules of the London

Stock Exchange.

Other matter

As disclosed in note 1, the annual financial statements of the Group are

prepared using the recognition and measurement principles of International

Financial Reporting Standards in conformity with the Companies Act 2006.

In preparing these interim condensed financial statements the directors

have not applied the requirements of IAS 34 - Interim Financial Reporting.

The directors have instead applied the requirements of the AIM rules of

the London Stock Exchange.

Our conclusion is not modified in this respect.

MHA MacIntyre Hudson

Statutory Auditors and Chartered

Accountants

2 London Wall Place

London EC2Y 5AU

28 April 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EADLPAAKFEAA

(END) Dow Jones Newswires

April 29, 2021 02:00 ET (06:00 GMT)

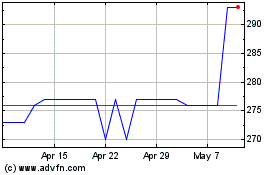

Character (LSE:CCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Character (LSE:CCT)

Historical Stock Chart

From Apr 2023 to Apr 2024