TIDMDKL

RNS Number : 5700B

Dekel Agri-Vision PLC

09 October 2020

Dekel Agri-Vision Plc / Index: AIM / Epic: DKL / Sector: Food

Producers

Dekel Agri-Vision Plc ('Dekel' or the 'Company')

September & Q3 2020 Palm Oil Production Update

Dekel Agri-Vision Plc, the West African focused agriculture

company, is pleased to report a production update for its

vertically integrated palm oil project at Ayenouan in Côte d'Ivoire

for September 2020 and also for the three month period ended 30

September 2020.

Crude palm oil ('CPO') production at the Company's mill at

Ayenouan increased 54% to 1,965 tonnes in September 2020 compared

to the 1,274 tonnes produced in September 2019. Following

September's strong performance, Q3 2020 saw 5,280 tonnes of CPO

produced at Ayenouan, a 10% increase on Q3 2019's 4,803 tonnes. In

addition, September 2020 saw a continuation of the recent trend of

improved global CPO pricing and higher extraction rates with CPO

prices up 38% to EUR604 per tonne (Sept 2019: EUR438 per tonne) and

extraction rates up to 21.2% (Sept 2019: 18.7%). As a result, the

Company's H2 2020 results remain on course to post a material

improvement on H2 2019.

Sep-20 Sep-19 Change Q3 2020 Q3 2019 Change

FFB processed (tonnes) 9,274 6,802 36.33% 24,243 24,665 -1.71%

CPO production (tonnes) 1,965 1,274 54.28% 5,280 4,803 9.94%

CPO Sales (tonnes) 1,977 1,465 34.92% 5,278 7,138 -26.05%

Average CPO price

per tonne EUR604 EUR438 37.96% EUR550 EUR456 20.67%

PKO production (tonnes) 149 165.10 -9.75% 422 538 -21.61%

PKO Sales (tonnes) 204 179.34 13.53% 543 819 -33.66%

Average PKO price

per tonne EUR564 EUR485 16.32% EUR568 EUR487 16.64%

PKC production (tonnes) 236 380 -37.93% 838 1,158 -27.63%

PKC Sales (tonnes) 189 424 -55.46% 764 1,459 -47.64%

Average PKC price

per tonne EUR59 EUR56 6.04% EUR60 EUR56 7.14%

Production

-- 54% increase in CPO production to 1,965 tonnes in September

2020 compared to 1,274 tonnes in September 2019

o Follows 36% increase in fresh fruit bunches ('FFB') delivered

to the mill for processing during the month compared to 2019

-- 10% increase in Q3 CPO produced to 5,280 tonnes compared to 4,803 tonnes in Q3 2019

o Follows higher extraction rates and stable FFB volumes

delivered to the mill during the quarter compared to Q3 2019 - Q3

2020 extraction rate came in at 21.2% (Q3 2019: 18.7%)

-- Palm Kernel Oil ('PKO') and Palm Kernel Cake ('PKC')

production lower in September 2020 and Q3 2020 compared to

equivalent periods in 2019

o Follows planned decrease in external nut purchases due to weak

margins

Sales and Pricing

-- 20.67% increase in CPO prices to EUR550 per tonne in Q3 2020

(Q3 2019: EUR456) offset lower volumes sold - Q3 2020: 5,278 tonnes

of CPO sold (Q3 2019: 7,138 tonnes)

-- Recovery in global CPO prices from COVID-19 lows continued in September 2020

o 37.96% increase in CPO prices in September 2020 to EUR604

compared to EUR438 in September 2019

-- Year on year PKO sales continue to remain distorted due to

807 tonnes of oil awaiting collection which are currently being

stored at Ayenouan

Dekel Agri-Vision Plc Executive Director Lincoln Moore said:

"September's excellent numbers have driven an improved set of Q3

figures in line with expectations, which in turn builds on the

material uplift in performance we reported for H1 2020. At the time

of our half year numbers, we said we expect to report a material

improvement in H2 2020 results compared to H2 2019. Today's figures

only serve to increase our confidence further.

"With the next peak palm oil harvest season due to commence in

January 2021 and the commissioning of our large scale cashew

processing project at Tiebissou expected in Q2 2021, the next few

months promise to be an exciting period for shareholders, as we

look to take a major step towards building a multi-project,

multi-commodity agriculture business."

Production Updates

The Company is issuing CPO production figures on a monthly basis

to provide shareholders with increased visibility on operations and

trading during the global COVID-19 pandemic. The Company will

continue to provide monthly data until 31 December 2020, at which

point it will consider reverting to quarterly data.

Issue of Equity

In addition, application has been made to the London Stock

Exchange for the admission of a total of 438,201 ordinary shares of

EUR0.0003367 each ("Ordinary Shares") issued to certain advisers in

settlement of fees for services provided ("Admission"). It is

expected that Admission will become effective on or around 16

October 2020. Following Admission, the Company's issued share

capital will consist of 424,651,486 Ordinary Shares.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR'). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

** ENDS **

For further information please visit the Company's website

www.dekelagrivision.com or contact:

Dekel Agri-Vision Plc

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

Arden Partners Plc (Nomad and Joint Broker)

Paul Shackleton / Ruari McGirr /

Dan Gee-Summons (Corporate Finance)

Simon Johnson (Corporate Broking) +44 (0) 207 614 5900

Optiva Securities Limited (Joint Broker)

Christian Dennis

Jeremy King +44 (0) 203 137 1903

St Brides Partners Ltd (Investor Relations)

Frank Buhagiar

Cosima Akerman

Megan Dennison +44 (0) 207 236 1177

Notes:

Dekel Agri-Vision Plc is a multi-project, multi-commodity

agriculture company focused on West Africa. It has a portfolio of

projects in Côte d'Ivoire at various stages of development: a fully

operational palm oil project in Ayenouan where fruit produced by

local smallholders is processed at the Company's 60,000tpa crude

palm oil mill; a cashew processing project in Tiebissou, which is

due to commence production in Q2 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLFSWFWAESSEDS

(END) Dow Jones Newswires

October 09, 2020 02:00 ET (06:00 GMT)

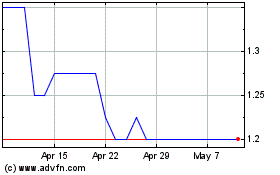

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dekel Agri-vision (LSE:DKL)

Historical Stock Chart

From Apr 2023 to Apr 2024