TIDMGRI

RNS Number : 4535Y

Grainger PLC

13 May 2021

13 May 2021

Grainger plc

Half year financial results

for the six months ended 31 March 2021

Strong performance and continued growth trajectory

-- Adjusted Earnings up +11%

-- Like-for-like rental growth of +1.7%

-- Strong rent collection at 98%

-- Dividend maintained

-- Occupancy held at 89%

-- Lettings enquires up +86% since beginning of January

-- Pipeline delivery set to accelerate with 1,021 new homes this year

Helen Gordon, Chief Executive of Grainger, the UK's largest

listed residential landlord with 9,109 operational rental homes and

a GBP2.1bn pipeline of a further 8,851 rental homes, said:

"We have delivered a strong performance over the past six months

despite the impact of Covid-19. It has been a period of intense

operational activity, supporting our customers in their homes.

Adjusted earnings grew 11% over the period and our strong sales

performance more than offset a reduction in occupancy in our PRS

portfolio (89%) caused by Covid-19 lockdown restrictions. Our

rental income continued to prove resilient with very high levels of

rent collection at 98% and continued rental growth of 1.7%. We are

therefore maintaining our interim dividend at 1.83p(1) .

"We continue to progress our well-established growth strategy,

with new acquisitions for 490 new rental homes, major planning

approvals secured for a further 618 new rental homes, and over

1,000 new rental homes to be delivered this year.

"During the six-month period we have driven customer retention,

lettings and rental growth ahead of the market, leveraging our

in-house operating platform. There is positive market evidence,

including the +86% rise in lettings enquiries we have generated

since the beginning of the year, which suggests a strong lettings

market to come as we enter the peak summer period and all remaining

lockdown restrictions are lifted. This provides us with increasing

confidence for an improved performance for the second half of the

year subject to the UK economy reopening as currently expected.

"The many actions we have taken from the outset of our strategy

in 2016, focusing the business to what it is today and setting us

up for significant future growth and earnings potential, but also

the actions we took in the past six months, gives us a high level

of assurance that we are ready to capitalise on the UK's reopening

over the coming months, and pursue our long term growth plans."

Key highlights

-- +11% growth in Adjusted Earnings(2) , driven by +30% increase

in sales profits

-- Robust rental performance and positive outlook, evidenced by

+86% increase in enquiry levels since January

o Net rental income(3) of GBP34.7m (HY20: GBP37.0m), reflecting

planned asset recycling, lower occupancy and delays in pipeline

completions

o +1.7% like-for-like rental growth(4) in H1 across our total

portfolio (HY20: 3.4%)

-- 1.0% like-for-like rental growth in our PRS portfolio (HY20:

3.0%), reflecting our focus on customer retention, with rental

growth achieved across all regions, with a marginally stronger

performance outside London

-- 4.0% like-for-like rental growth in our regulated tenancy

portfolio (HY20: 4.5%), which contributes 27% of our total net

rental income

o Strong rent collection of 98%

o 1,086 new lets and 1,244 renewals secured in the period,

representing GBP12m and GBP15m of gross rent respectively, a strong

performance in a challenging market

o 4,974 prospective customer enquiries in H1

o +86% increase in enquiries since January, with month on month

growth

o Occupancy successfully maintained at 89% despite ongoing

lockdown restrictions; our regional portfolio experienced

marginally higher occupancy

-- Strong sales performance

o Sales profit up 30% to GBP29.6m (HY20: GBP22.8m)

-- Vacant sales from our regulated tenancy portfolio delivered

10% profit growth, with vacant sales achieving prices 0.6% ahead of

valuations. Sales took c.4 months to complete, H1 sales prices

achieved are typically more modest compared to H2.

-- The remainder of the growth in sales profit was delivered as

a result of our successful asset recycling activity (sale of

tenanted properties) to take advantage of strong market

conditions

-- H2 vacant sales expected to be stronger than H1 based on

current sales pipeline

-- Delivering growth with 1,021 new homes to be delivered this

year (508 homes delivered in H1 and 513 in H2), totalling c.GBP12m

of targeted net rental income once stabilised

o We have worked hard with our supply chain to overcome the

challenges of Covid-19 and have minimised disruption to our

pipeline delivery. Where delays are unrelated to Covid-19, Grainger

benefits from receiving compensation for lost rent through our

forward funding contract terms, totalling GBP0.8m for the

period.

-- Expanding our c.GBP2.1bn pipeline with new acquisitions and

planning contents secured, totalling 1,108 new homes

o Acquired Millwrights Place, Bristol - GBP63m, 231 homes

o Acquired Becketwell, Derby - GBP38m, 259 homes

o Planning secured at Nine Elms, London (TfL JV) - 479 homes

o Planning secured at Montford Place, Oval, London (TfL JV) -

139 homes

-- Achieved investment grade credit rating from Fitch for the

corporate and reaffirmed investment grade rating for our bond

Key actions

Our leading operating platform and the recent actions we have

taken to enhance it, ensure that we are well positioned to

capitalise on the summer rental momentum and continue to

successfully grow our portfolio and outperform the market.

-- Full roll out of Digital Leasing via our CONNECT technology

platform

-- Creation of a centralised customer service team, supporting

customer satisfaction and retention

-- Enhanced customer offering including doubled internet speed

to 250MB for free for all eligible customers

-- Expansion of our direct lettings activity and enhanced

digital marketing, increasing conversion rates and supporting lease

up of new schemes:

o Solstice Apartments, Milton Keynes, fully let, having launched

at the start of the pandemic

o Gatehouse Apartments, Southampton, 54 homes let / reserved

(41%) in six weeks

o The Filaments, Manchester, 54 homes let / reserved (14%) in

six weeks

-- ESG Leadership: We are continually building on Grainger's

positive social impact business model of delivering good quality,

mid-market rental homes with support for our customers and local

communities. We are reducing our environmental impact toward net

zero carbon and enhancing the diversity and inclusivity of our

workforce. We retained our top ESG benchmark scores.

Financial Highlights

Income returns HY20 HY21 Change

------------------------------------ --------- --------- ----------

Rental growth (like-for-like) 3.4% 1.7% (170) bps

- PRS 3.0% 1.0% (200) bps

- Regulated tenancies (annualised) 4.5% 4.0% (50) bps

Net rental income (Note 5) GBP37.0m GBP34.7m (6)%

Adjusted earnings (Note 2) GBP33.7m GBP37.5m +11%

Profit before tax (Note 2) GBP49.6m GBP50.3m +1%

Earnings per share (diluted, after

tax) (Note 9) 6.4p 6.0p (6)%

Dividend per share (Note 10) 1.83p 1.83p +0%

------------------------------------ --------- --------- ----------

Capital returns FY20 HY21 Change

----------------------------- ---------- ---------- ---------

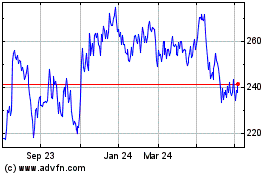

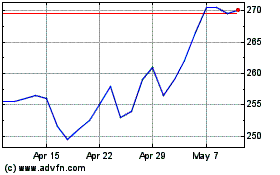

EPRA NTA per share (Note 3) 285p 286p +0%

Net debt GBP1,032m GBP1,098m +6%

Group LTV 33.4% 34.5% +111 bps

Cost of debt (average) 3.1% 3.1% +3 bps

Reversionary surplus GBP301m GBP286m (5)%

----------------------------- ---------- ---------- ---------

Secured pipeline

---------------------------- ----------

Total investment value GBP1,078m

Total homes 4,293

Targeted net rental income c.GBP52m

---------------------------- ----------

(1) Dividend - The dividend of 1.83p per share (gross) amounting

to GBP12.3m will be paid on 2 July 2021 to shareholders on the

register at the close of business on 28 May 2021. Shareholders will

again be offered the option to participate in a dividend

re-investment plan and the last day for election is 11 June 2021 -

refer also to Note 10.

(2) Refer to Note 2 for profit before tax and adjusted earnings

reconciliation.

(3) Refer to Note 5 for net rental income calculation.

(4) Rental growth is the average increase in rent charged across

our portfolio on a like-for-like basis.

Future reporting dates

-- Trading update - September 2021

-- Full year results - 18 November 2021

Half year results presentation

Grainger plc will be holding a virtual presentation of the

results at 9:30am (UK time) today, 13 May 2021, via webcast and a

telephone dial-in facility (details below), which will be followed

by a live Q&A session for sell side analysts and

shareholders.

Webcast details:

To view the webcast, please go to the following URL link.

Registration is required.

https://webcasting.brrmedia.co.uk/broadcast/606edb6b0386285386cc6056

The webcast will be available for six months from the date of

the presentation.

Conference call details:

Call: +44 (0)330 336 9434

Confirmation Code: 2203372

A copy of the presentation slides will also be available to

download on Grainger's website (

http://corporate.graingerplc.co.uk/ ) from 09:00am (UK time).

For further information, please contact:

Investor relations

Kurt Mueller, Grainger plc: +44 (0) 20 7940 9500

Media

Ginny Pulbrook / Geoffrey Pelham-Lane, Camarco: +44 (0) 20 3757 4992 / 4985

Forward-looking statements disclaimer

This publication contains certain forward-looking statements.

Any statement in this publication that is not a statement of

historical fact including, without limitation, those regarding

Grainger plc's future financial condition, business, operations,

financial performance and other future events or developments

involving Grainger, is a forward-looking statement. Such statements

may, but not always, be identified by words such as 'expect',

'estimate', 'project', 'anticipate', 'believe', 'should', 'intend',

'plan', 'could', 'probability', 'risk', 'target', 'goal',

'objective', 'may', 'endeavour', 'outlook', 'optimistic',

'prospects' and similar expressions or variations on these

expressions. By their nature, forward-looking statements involve

inherent risks, assumptions and uncertainties as they relate to

events which occur in the future and depend on circumstances which

may or may not occur and go beyond Grainger's ability to control.

Actual outcomes or results may differ materially from the outcomes

or results expressed or implied by these forward-looking

statements. Factors which may give rise to such differences include

(but are not limited to) changing economic, financial, business,

regulatory, legal, political, industry and market trends, house

prices, competition, natural disasters, terrorism or other social,

political or market conditions.

Grainger's principal risks are described in more detail in its

Annual Report and Accounts, set out in the Risk Management report

on pages 47-50 of the 2020 Annual Report and Accounts.

A number of risks faced by the Group are not directly within our

control such as the wider economic and political environment.

In line with our risk management approach detailed on pages

44-46 of the 2020 Annual Report and Accounts, the key risks to the

business are under regular review by the Board and management,

applying Grainger's risk management framework. The Covid-19

pandemic has had a substantial impact on many aspects of society,

including business, with the duration and depth of the impact being

uncertain. Specifically in relation to Grainger, it is currently

considered that the principal risks previously reported remain our

principal risks. However, it is recognised that a pandemic, and

consequently Government restrictions and societal behavioural

changes flowing therefrom increase the likelihood of such risks

being accelerated or becoming more acute. This would include, but

is not limited to market, regulatory and supplier risks. The risks

to Grainger will continue to be monitored closely as well as the

potential controls and mitigants that may be applied during this

unprecedented period.

These risks and other factors could adversely affect the outcome

and financial effects of the events specified in this publication.

The forward-looking statements reflect knowledge and information

available at the date they are made and Grainger plc does not

intend to update on the forward-looking statements contained in

this publication.

This publication is for information purposes only and no

reliance may be placed upon it. No representative or warranty,

either expressed or implied, is provided in relation to the

accuracy, completeness or reliability of the information contained

in this publication. Past performance of securities in Grainger plc

cannot be relied upon as a guide to the future performance of such

securities.

This publication does not constitute an offer for sale or

subscription of, or solicitation of any offer to buy or subscribe

for, any securities of Grainger plc.

Chief Executive's review

Overview - well positioned for continued growth and reopening of

UK

Our PRS growth strategy, focused on the mid-market and supported

by our active asset recycling, has enabled us to maintain high

levels of performance during challenging times, but also to invest

and grow further at the same time.

The success of our strategy and the hard work of the Grainger

team has delivered a strong performance for the period. We

leveraged our regulated tenancy portfolio and asset recycling

activity to capitalise on the buoyant sales market, more than

compensating for the short-term, Covid-19-driven reduction in

occupancy in our PRS portfolio.

Overall, we delivered a strong financial performance with

Adjusted Earnings up 11%, driven primarily by a 30% increase in

sales profits, while our leading operating platform continues to

prove its value, delivering 1.7% like-for-like rental growth and

98% rent collection.

We are beginning to see a number of positive signs pointing to

increasing momentum in the lettings market over the coming months.

To prepare for this, the past six months has been a period of

intense operational activity for us to enable us to capitalise on

the summer rental momentum; and we are beginning to see the early

results of this with enquiries up +86% since January and a steady

rise in lettings activity.

If the UK remains on track with its vaccination programme and

the reopening of the economy continues as planned, we anticipate a

strong rental market over the second half of the year, backed by

strong consumer confidence. We are well-positioned to benefit, with

over 1,000 new homes being delivered this year.

We remain highly convictional on the fundamental drivers for our

market, with the pandemic accelerating trends in renting and a

flight to quality which we will benefit from.

Key highlights and actions

Investment highlights

The investment market for new, high quality rental buildings

(build-to-rent) is strong, with CBRE reporting record high

investment of GBP3.5bn in 2020.

Our in-house research and cities strategy enable us to allocate

shareholder capital effectively by anticipating longer term trends

that will affect the rental market and taking first mover advantage

in target locations. Our asset allocation between London and the

regions (35:65) is by design, and is in part the reason for our

strong performance during the pandemic, as does our mid-market

positioning, which provides good value for money to our customers,

leading to less pricing volatility.

Despite the short-term market challenges in London of the past

year, our portfolio performed well and our conviction in London's

rental market remains. As a leading city, London will continue to

be an attractive location to live in and it will experience

population and economic growth in both the near term as

restrictions are lifted, and in the longer term, which will

underpin rental growth and support valuations.

At the same time, regional cities are seeing a revival, which

began with the Conservative Government's Levelling Up agenda and

this has been accelerated in part by the pandemic. Our early moves

into key target regional cities (e.g. Sheffield, Manchester,

Bristol) has enabled us to outcompete, grow swiftly, acquire

attractively, and see the early benefits of this regional revival.

In the period we secured another great scheme in Bristol,

Millwrights Place, which is adjacent to our existing asset, Hawkins

& George, and our first investment in Derby for 259 new rental

homes.

Covid-19 has led to an acceleration of rental trends which we

identified five years ago and play to our core strengths. After

more than a year of lockdowns and 'stay at home' orders, we are

seeing a flight to quality and a greater emphasis placed on

professional management, building amenities including home-working

spaces and connectivity, and health & safety assurances, all of

which play to Grainger's strengths.

Development & pipeline highlights

We successfully completed two schemes just at the end of this

six-month period, The Filaments in Manchester and Gatehouse

Apartments in Southampton, totalling 508 homes, both of which are

letting up well. Over the second half of the year, we plan to

deliver a further 513 homes across a further three schemes.

We continued with our development activity successfully during

the period with only a few minor delays on site. Where we

experienced delays that were not Covid-related, we were compensated

in part by the contractor, partly making up for lost rent.

We are very pleased with the success we've had in our joint

venture with Transport for London, Connected Living London. The JV

was established a little over 18 months ago and set out to deliver

3,000 homes. To date, I am pleased to announce that we have already

secured planning consent to deliver a third of that pipeline. Last

year we successfully secured consent to build 460 homes at our

scheme in Southall. So far this year, we've gained planning

approval for our scheme at Montford Place for 139 homes and most

recently for our scheme at Nine Elms, above the new tube station,

for 479 homes.

The development team are overseeing a total of 13 live

development projects which are on site, and are responsible for the

delivery of 8,851 new rental homes across our total pipeline.

Operational highlights

Our leading operating platform has again proven its value over

the past year, delivering consistently strong performance with

continued like-for-like rental growth, high rent collection and

high occupancy on a relative basis. Over the period, there has been

a significant level of activity within the operations team to

continually improve and enhance our service and offering to our

customers.

The lockdown restrictions meant the team had to work extra hard

and think creatively to successfully hold occupancy steady at 89%,

focusing on customer retention while also attracting new customers.

Over the period in our PRS portfolio, the operations team renewed

tenancies for 1,244 customers (GBP15m of gross rent) and generated

c.5,000 enquiries which led to 1,086 new lets (GBP12m of gross

rent), a tremendous effort and a significant volume of activity

considering the circumstances.

To prepare for the economy to reopen and the subsequent boost to

the lettings market, we have undertaken a number of initiatives to

capitalise in the short term and to enable long term growth.

We restructured our operations team, creating a central customer

service team, based in our Newcastle office, enabling us to improve

customer service, thereby increase customer retention rates, and

also increasing our scalability further as we grow over the coming

years. We increased our direct lettings capacity, which led to

higher conversion rates and increased lettings performance. We

enhanced our marketing activity, using new and innovative ways to

reach new customers, driving higher levels of enquiries.

As part of our CONNECT technology programme we rolled out our

Digital Leasing platform across our entire portfolio, having

successfully trialled it and refined it over 2020 on our newly

launched schemes. This enables new customers to go through the full

leasing process entirely online, including referencing, contract

signing and payments, speeding up lettings, reducing the number of

customers who drop out through the process and creating a fully

scalable leasing process to support our growth.

We are seeing the benefits of these actions with increased

enquiry levels, improved conversion rates and increased retention

rates.

Dividend

As a result of our successful strategy and the hard work of the

Grainger team to deliver a strong performance over the period, we

are pleased to confirm that we will maintain our interim dividend

at 1.83p per share.

ESG

Our integrated ESG strategy remains at the top of our agenda.

The whole Grainger team recognises the importance of the positive

social impact we have on creating good quality, mid-market rental

homes and in addition, we are progressing well against our

long-term commitments:

1. Net zero carbon in the operations of our buildings (Scope 1 & 2) by 2030

2. Integrated ESG investment decisions

3. Diverse and inclusive workforce

4. Make a positive social impact

Alleviating homelessness and addressing housing

affordability

Highlights over the period include a series of pro bono work our

team provided to homelessness charities introduced to us by our

charity partner, LandAid; and our commitment to be a foundation

partner for a new capital project by LandAid to create new

accommodation to young vulnerable people in North Tyneside near our

Newcastle office. In addition to the charitable work we do, we are

also directly delivering affordable homes across our pipeline

programme, which amount to more than 3,000 affordable homes for low

income households.

Encouraging a diverse pool of talent for future generations

In partnership with Transport for London, we helped launch a new

Schools Engagement Programme for the Built Environment, aimed at

reaching a wide spectrum of young Londoners, providing career

development support and virtual work experience opportunities. Our

apprenticeship and graduate programmes continue to enhance their

outreach to more and more diverse backgrounds. Going one step

further, we have decided to support a leading bursary programme

which will support young people from disadvantaged backgrounds

through their studies in the built environment, property field.

Encouraging greater diversity and awareness within our

workforce

On diversity and inclusion, our employee-led D&I Network

continues to energetically promote diversity initiatives across the

business. To mark International Women's Day, we held a week-long

campaign, "Celebrating women at Grainger", sharing insights,

thoughts and opinions on the challenges and opportunities for women

in business. To support awareness on topics of gender and

sexuality, we held a session for employees with the Mermaids

Charity to discuss gender pronouns, terminology and workplace best

practice. We are proud that one of our employees has been selected

to be a delegate for UN Women UK to attend the "Commission of the

Status of Women".

Supporting local communities and encouraging healthy living

To support our local communities and residents, we rolled out a

community events programme across our build-to-rent schemes. We

expanded our mental health first training programme, including

suicide prevention support, to include all our resident services

teams to ensure they are equipped to support their customers and

each other. We run a series of wellness events across our portfolio

for residents, including Wellness Wednesdays, which include free

virtual yoga classes.

Reducing our carbon footprint and helping lead the way toward

net zero carbon for the industry

On our journey to net zero carbon, we completed the roll-out of

renewable energy to all landlord supplies, and we contributed to a

review by HM Treasury on net zero carbon and UK Green Building

Council's whole life carbon roadmap project. We are proud

signatories to the World Green Building Council's Net Zero Carbon

Buildings Commitment.

Providing help to our stakeholders during the Covid-19

pandemic

We are aware that in this this challenging time, being in a good

home, supported by a good landlord, can make all the difference as

to how people feel. Through the pandemic we have been determined to

do what we can to help support our customers, employees and

suppliers as best we can, putting a wide range of support in place,

including caring responsibilities, loneliness, elderly

vulnerability, mental health & suicide prevention training, and

financial support.

We are pleased that our ESG efforts are recognised across a

series of external third-party benchmarks:

-- FTSE4Good

-- EPRA's Sustainability Best Practice Reporting - Gold Award

-- CDP - 'B' rating (outperformance v. peers)

-- ISS ESG - Prime rating

-- MSCI ESG - 'AA' rating

-- Sustainalytics - 'Low risk' rating

Awards

Grainger's market leading position was recognised over the

period with three prestigious awards at the RESI Awards, the

leading awards within the UK residential sector: Residential

Landlord of the Year, Asset Manager of the Year, and PRS Deal of

the Year for our partnership with TfL, Connected Living London.

Political engagement update

As a market leader we hope to leverage our expertise and

experience to help improve the rental housing market and the

Government deliver on its housing supply ambitions. To this end,

Grainger continues to work closely with the UK Government on issues

impacting and relating to private rented housing. Over the period,

we had numerous meetings with Ministers and officials to discuss

matters ranging from net zero carbon, fire safety, housing supply

and delivery, planning and viability for build-to-rent.

It was a pleasure to accept an invitation from the Secretary of

State to join the Government's Urban Centre Recovery Taskforce, a

small group of industry and local government experts who have been

tasked with identifying short term interventions to help revive

urban centres in the wake of the pandemic.

The Government remains supportive of the UK build-to-rent sector

and the benefits it can bring.

Outlook

We have spent considerable time analysing the market and key

drivers, considering the impact the pandemic may have on it. Our

conclusion is that Covid-19 does not change the long-term market

fundamentals nor does it change the highly compelling investment

case for the professional, large-scale private rented sector and

build-to-rent. More and more people will continue to choose to rent

for longer periods of their lives and they will become increasingly

discerning, looking for quality and service, which plays to

Grainger's core strengths. If anything, Covid-19 is accelerating

these rental trends.

In the shorter term, we have been closely monitoring live

economic data to fully understand the shape and velocity of the

UK's newly emerging economic recovery, and how this will flow

through to the rental market and, in particular, lettings activity.

Comparing this to international examples where vaccine programmes

and economic reopening's are more advanced than ours, gives us

confidence that the chances of the UK keeping to its roadmap of

easing restrictions is looking increasingly likely. Green shoots

seem to be appearing, with increased city centre footfall,

increased leisure spending and a gradual return to more normal

levels of economic activity. This analysis has led us to our

positive market outlook.

The many actions we have taken from the outset of our strategy

in 2016, rotating the business to what it is today and setting us

up for significant future growth and earnings potential, but also

the actions we took in the past six months such as our digital

leasing platform, gives us a high level of assurance that we are

ready to capitalise on the UK's reopening over the coming months,

and pursue our longer term growth plans.

We remain excited for our future growth and look forward to

leading the evolution of the UK's rental housing market over the

years to come.

Helen Gordon

Chief Executive

13 May 2021

Financial review

The past six months have seen the business continue to deliver

on our PRS growth strategy. Whilst the challenges of Covid-19

related restrictions and the related economic disruption have been

numerous we have continued to invest in our buildings, technology

and people as well as continue to deliver strong earnings

growth.

Our rental income stream yet again proved its resilience with

very high levels of rent collection at 98% and continued rental

growth at 1.7%. Whilst our occupancy was impacted by a temporary

demand reduction as a result of lockdown restrictions, we

significantly outperformed the wider market as our high-quality

mid-market offering and inhouse operating platform proved a

significant differentiator. We had a strong sales performance with

profits up 30% on the prior year, more than offsetting the

temporary occupancy reduction in our PRS portfolio.

Our balance sheet remains strong with significant headroom of

GBP587m and an LTV of 34.5% ensuring our committed pipeline is

fully funded and we are well positioned for further growth. The

robust nature of our business model and capital structure is

gaining wider recognition with Fitch initiating coverage with an

investment grade rating for both our corporate and bond rating.

With the easing of lockdown restrictions underway, we are seeing

positive trends in enquiries and lettings and are well placed to

capitalise on this continued momentum. With a strong half year

performance and a positive outlook for the remainder of the year we

are maintaining our interim dividend at 1.83p per share.

Highlights

Income returns HY20 HY21 Change

------------------------------------ --------- --------- ----------

Rental growth (like-for-like) 3.4% 1.7% (170) bps

- PRS 3.0% 1.0% (200) bps

- Regulated tenancies (annualised) 4.5% 4.0% (50) bps

Net rental income (Note 5) GBP37.0m GBP34.7m (6)%

Adjusted earnings (Note 2) GBP33.7m GBP37.5m +11%

Adjusted EPRA earnings (Note 3) GBP16.0m GBP9.4m (41)%

Profit before tax (Note 2) GBP49.6m GBP50.3m +1%

Earnings per share (diluted, after

tax) (Note 9) 6.4p 6.0p (6)%

Dividend per share (Note 10) 1.83p 1.83p +0%

------------------------------------ --------- --------- ----------

Capital returns FY20 HY21 Change

----------------------------- ---------- ---------- ---------

EPRA NTA per share (Note 3) 285p 286p +0%

Net debt GBP1,032m GBP1,098m +6%

Group LTV 33.4% 34.5% +111 bps

Cost of debt (average) 3.1% 3.1% +3 bps

Reversionary surplus GBP301m GBP286m (5)%

----------------------------- ---------- ---------- ---------

Income statement

Adjusted earnings increased by 11% to GBP37.5m (HY20: GBP33.7m)

as a result of a strong sales performance more than offsetting the

temporary decline in net rental income. Overheads remained flat

demonstrating our inherent operational leverage as we continue to

grow our pipeline and invest in our operating platform.

Income statement (GBPm) HY20 HY21 Change

------------------------------- ------- ------- -------

Net rental income 37.0 34.7 (6)%

Profit from sales 22.8 29.6 +30%

Mortgage income (CHARM) (Note

15) 2.6 2.4 (8)%

Management fees 1.6 2.3 +44%

Overheads (13.8) (13.9) +1%

Pre-contract costs (0.2) (0.3) +50%

Joint ventures and associates 0.1 (0.2) (300)%

Net finance costs (16.4) (17.1) +4%

------- ------- -------

Adjusted earnings 33.7 37.5 +11%

Valuation movements 14.6 12.8

Other adjustments 1.3 -

------- ------- -------

Profit before tax 49.6 50.3 +1%

------------------------------- ------- ------- -------

Rental income

Net rental income decreased by 6% to GBP34.7m (HY20: 37.0m) as a

result of the continuation of our planned asset recycling

programme, along with delays in delivery of new developments, as

well as lower occupancy at 89% in our stabilised portfolio (HY20:

97%). We continued to deliver like-for-like rental growth across

the portfolio at +1.7%, with +1.0% like-for-like rental growth from

our PRS portfolio. The regulated tenancy portfolio also continued

to deliver strong annualised growth of +4.0%. Our rental growth

performance is well above the market average of +0.1% (average

based on ONS and Hometrack) as our in-house operational platform

and mid-market offering continues to drive performance.

Our focus on cost control ensured that we continue to deliver

strong rental margins with stabilised gross to net leakage

(excluding voids) down to 24.7% compared to the prior period (HY20:

24.9%). Including voids, stabilised gross to net stood at 27.0%, a

reflection of the temporary occupancy reduction caused by

Covid-19.

GBPm

------------------------ ------

HY20 Net rental income 37.0

Disposals (2.0)

PRS investment 2.1

Rental growth 1.0

Voids (3.4)

HY21 Net rental income 34.7

------

YoY movement (6)%

------------------------ ------

Sales

We had a strong sales performance in the period with an 30%

increase in profits to GBP29.6m (HY20: GBP22.8m). Vacant sales

profit was 10% ahead of the prior year, with a significant increase

in tenanted and other sales the primary driver of the overall sales

performance. Development profits from legacy schemes are now

largely realised as we move our focus away from build-for-sale

activity.

Residential sales

Vacant property sales in the period delivered GBP14.8m of profit

(HY20: GBP13.5m) from GBP26.7m of revenue (FY20: GBP21.6m). This

increase was supported by strong momentum in the UK residential

property market, combined with a higher regulated tenancy vacancy

rate in the period of 7.3% (HY20: 6.6%). We continued to

demonstrate strong sales values with prices achieving 0.6% ahead of

the previous vacant possession valuations. With the high volume of

transactions in the market causing some delays in completions, our

sales transaction velocity slowed slightly with our keys to cash

metric at 120 days compared to 113 days in the prior year. We have

good visibility on our sales pipeline for the second half and would

envisage a similar 40%:60% H1:H2 split as we have experienced in

previous years.

Sales of tenanted and other properties delivered GBP14.6m of

profit (HY20: GBP5.2m) from GBP55.0m of revenue (HY20: GBP16.0m) as

we continued to execute on our asset recycling programme.

Sales

HY20 HY21

------------------------- -------------------------

Revenue Profit Revenue Profit

------ ------

Units Units

sold GBPm GBPm sold GBPm GBPm

---------------------- ------ -------- ------- ------ -------- -------

Residential sales

on vacancy 54 21.6 13.5 73 26.7 14.8

Tenanted and other

sales 42 16.0 5.2 360 55.0 14.6

------ -------- ------- ------ -------- -------

Residential sales

total 96 37.6 18.7 433 81.7 29.4

Development activity - 5.3 4.1 0.2 0.2

---------------------- ------ -------- ------- ------ -------- -------

Overall sales 96 42.9 22.8 433 81.9 29.6

---------------------- ------ -------- ------- ------ -------- -------

Overheads

Overheads remained flat in the period at GBP13.9m (HY20:

GBP13.8m) illustrating the inherent leverage in our operating

platform and the potential to enhance earnings substantially

through our growth plans.

Financing costs

Finance costs increased by 4% on the prior year to GBP17.1m

(HY20: GBP16.4m), reflecting an increase in net debt as a result of

the continued investment in our PRS pipeline. Our average cost of

debt remained consistent with the full year at 3.1% (FY20 3.1%),

with our marginal cost of debt at 1.7%.

Balance sheet

Ensuring our growth strategy is underpinned by a strong balance

sheet has always been a key focus for the business. With a

conservative LTV at 34.5% and a very strong liquidity position with

GBP587m of cash and available facilities, we are in a position of

real strength to continue the disciplined growth of the

business.

Market value balance sheet (GBPm) FY20 HY21

---------------------------------------------- ------- -------

Residential - PRS 1,624 1,749

Residential - regulated tenancies 968 943

Residential - mortgages (CHARM) 73 74

Forward Funded - PRS work in progress 231 193

Development work in progress 147 176

Investment in JVs/associates 42 43

------- -------

Total investments 3,085 3,178

Net debt (1,032) (1.098)

Other liabilities - (16)

------- -------

EPRA NRV 2,053 2,064

Deferred and contingent tax - trading assets (109) (108)

Exclude: intangible assets (23) (28)

------- -------

EPRA NTA 1,921 1,928

Add back: intangible assets 23 28

Deferred and contingent tax - investment

assets (24) (25)

Fair value of fixed rate debt and derivatives (57) (51)

-------

EPRA NDV 1,863 1,880

---------------------------------------------- ------- -------

EPRA NRV pence per share 304 306

EPRA NTA pence per share 285 286

EPRA NDV pence per share 276 279

Reversionary surplus (excluded from NAV -

GBPm) 301 286

Reversionary surplus (pence per share) 45 42

---------------------------------------------- ------- -------

EPRA NTA increased by 1p from the year end to 286p per share

(FY20: 285p per share), we consider this to be the most appropriate

NAV metric for the business. Other NAV measures showed larger

uplifts with EPRA NRV increasing by 1% during the period to 306p

per share (FY20: 304p per share) whilst EPRA NDV increased by 1% to

279p per share (FY20: 276p per share). Excluded from all these EPRA

NAV measures is the reversionary surplus of GBP286m or 42p per

share (FY20: GBP301m).

The following table shows the movement in EPRA NTA in the period

with the largest positive contributors being adjusted earnings and

valuation uplifts.

EPRA NTA movement

----------------------------------------------------------------------

GBPm Pence per share

------ ----------------

EPRA NTA at 30 September 2020 1,921 285

Adjusted earnings 38 6

Valuations (trading & investment property) 35 5

Disposals (trading assets) (28) (4)

Tax (current, deferred & contingent) (8) (1)

Dividends (25) (4)

Intangible assets (5) (1)

EPRA NTA at 31 March 2021 1,928 286

-------------------------------------------- ------ ----------------

Property portfolio valuations

The market value of our property portfolio increased by +1.3%

over the six month period (HY20: +1.6%). Both our PRS and Regulated

portfolios saw positive valuation performances with the PRS

portfolio seeing a 0.9% uplift (HY20: +1.5%), and the regulated

portfolio delivering a 2.0% uplift (HY20: +1.8%). Different

valuation methods are applied across our portfolio, with the

majority of our PRS valuations based on a net rent and yield basis,

while the regulated portfolio is largely based on a discount to

vacant possession value.

Financing and capital structure

With GBP587m of cash and available committed undrawn facilities,

we are a very well capitalised business with enough liquidity to

fund all of the committed capex in our investment pipeline. We have

an average debt maturity of 6.1 years, the next debt maturity being

GBP50m due in November 2022.

FY20 HY21

--------------------------- ---------- ----------

Net debt GBP1,032m GBP1,098m

Loan to value 33.4% 34.5%

Cost of debt (average) 3.1% 3.1%

Incremental cost of debt 1.6% 1.7%

Fully drawn cost of debt 2.8% 2.8%

Interest cover 3.4x 3.5x

Headroom GBP650m GBP587m

Weighted average facility

maturity (years) 6.6 6.1

Hedging 100% 100%

--------------------------- ---------- ----------

Cashflow and investment

Net debt increased to GBP1,098m (FY20: GBP1,032m) as we invested

GBP119m into our pipeline during the period and paid our final

dividend of GBP25m. This was offset by positive operating cashflow

of GBP39m and asset recycling of GBP52m.

Dividend

We are maintaining our interim dividend at 1.83p on a per share

basis (HY20: 1.83p) reflecting our strong performance and positive

outlook for the remainder of the year. Our policy is to distribute

the equivalent of 50% of annual net rental income as a dividend,

with a one-third payment at the interim stage. And while our net

rental income has reduced as a result of planned asset recycling

activity, reduced occupancy and development delays, we receive

compensation in respect of lost rent due to development delays

unrelated to Covid-19, enabling us to maintain the dividend.

Summary and outlook

The first half of the year has seen us deliver a strong set of

results as we continue to invest for the future. Our operating

platform has been key to outperforming the market during the

Covid-19 lockdowns and will continue to be a key focus of

investment from a process, people and technology perspective.

It is our efficient, scalable operating platform that will

enable a large proportion of our future growth in net rents to flow

through to earnings. Our balance sheet is in good shape and we are

in a position to continue our growth strategy and take advantage of

acquisition opportunities as they arise.

With the easing of lockdown restrictions looking set to continue

into the summer, the actions we have taken position us well to

capitalise on the short term lettings market momentum and our

longer-term growth plans. The attractiveness of the

professionalised rental market in the UK is coming to the fore

following the challenges of the last year and we will continue to

leverage our market leadership from a position of strength.

Toby Austin

Interim Group Finance Director

13 May 2021

Responsibility statement of the directors in respect of the

half-yearly financial report

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union ;

-- the interim management report includes a fair review of the

information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last annual report that could do

so.

Helen Gordon

Chief Executive Officer

13 May 2021

Independent Review Report to Grainger plc

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 March 2021 which comprises the Condensed

Consolidated Income Statement, the Condensed Consolidated Statement

of Other Comprehensive Income, the Condensed Consolidated Statement

of Financial Position, the Condensed Consolidated Statement of

Changes in Equity, the Condensed Consolidated Statement of Cash

Flows and the related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

March 2021 is not prepared, in all material respects, in accordance

with IAS 34 Interim Financial Reporting adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the European Union

and the Disclosure Guidance and Transparency Rules ("the DTR") of

the UK's Financial Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly financial report and consider whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

As disclosed in note 1, the latest annual financial statements

of the group were prepared in accordance with International

Financial Reporting Standards as adopted by the EU and the next

annual financial statements will be prepared in accordance with

International Financial Reporting Standards adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the European Union

and in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006. The

directors are responsible for preparing the condensed set of

financial statements included in the half-yearly financial report

in accordance with IAS 34 adopted pursuant to Regulation (EC) No

1606/2002 as it applies in the European Union.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

Richard Kelly

for and on behalf of KPMG LLP

Chartered Accountants

15 Canada Square

Canary Wharf

London

E145GL

13 May 2021

Consolidated income statement

Unaudited

2021 2020

For the 6 months ended 31 March Notes GBPm GBPm

----------------------------------------------------------------- ------ --------- --------

Group revenue 4 101.3 86.9

----------------------------------------------------------------- ------ --------- --------

Net rental income 5 34.7 37.0

Profit on disposal of trading property 6 29.8 22.1

(Loss)/profit on disposal of investment property 7 (0.1) 0.7

Income from financial interest in property assets 15 4.7 2.0

Fees and other income 8 2.3 3.2

Administrative expenses (13.9) (13.8)

Other expenses (0.3) (0.2)

Reversal of impairment of inventories to net realisable value 12 0.1 0.1

Operating profit 57.3 51.1

Net valuation gains on investment property 11 10.3 15.6

Finance costs (17.2) (16.8)

Finance income 0.1 0.1

Share of loss of associates after tax 13 - (0.5)

Share of (loss)/profit of joint ventures after tax 14 (0.2) 0.1

----------------------------------------------------------------- ------ --------- --------

Profit before tax 2 50.3 49.6

Tax charge for the period 20 (10.2) (9.5)

----------------------------------------------------------------- ------ --------- --------

Profit for the period attributable to the owners of the Company 40.1 40.1

----------------------------------------------------------------- ------ --------- --------

Basic earnings per share 9 6.0p 6.4p

Diluted earnings per share 9 5.9p 6.4p

----------------------------------------------------------------- ------ --------- --------

Consolidated statement of comprehensive income

Unaudited

2021 2020

For the 6 months ended 31 March Notes GBPm GBPm

---------------------------------------------------------------------------------------- ------ --------- ---------

Profit for the period 2 40.1 40.1

---------------------------------------------------------------------------------------- ------ --------- ---------

Items that will not be transferred to the consolidated income statement:

Actuarial gain on BPT Limited defined benefit pension scheme 21 3.7 0.1

Items that may be or are reclassified to the consolidated income statement:

Changes in fair value of cash flow hedges 7.4 (0.1)

---------------------------------------------------------------------------------------- ------ --------- ---------

Other comprehensive income and expense for the period before tax 11.1 -

---------------------------------------------------------------------------------------- ------ --------- ---------

Tax relating to components of other comprehensive income:

Tax relating to items that will not be transferred to the consolidated income statement 20 (0.7) 0.1

Tax relating to items that may be or are reclassified to the consolidated income

statement 20 (1.4) 0.3

Total tax relating to components of other comprehensive income (2.1) 0.4

---------------------------------------------------------------------------------------- ------ --------- ---------

Other comprehensive income and expense for the period after tax 9.0 0.4

---------------------------------------------------------------------------------------- ------ --------- ---------

Total comprehensive income and expense for the period attributable to the owners of the

Company 49.1 40.5

---------------------------------------------------------------------------------------- ------ --------- ---------

Consolidated statement of financial position

Audited

Unaudited 31 March 2021 30 Sept 2020

As at Notes GBPm GBPm

---------------------------------------------- ------ ------------------------ --------------

ASSETS

Non-current assets

Investment property 11 1,891.3 1,778.9

Property, plant and equipment 2.1 2.0

Investment in associates 13 14.7 14.7

Investment in joint ventures 14 28.3 27.3

Financial interest in property assets 15 73.7 73.3

Deferred tax assets 20 5.4 7.8

Intangible assets 16 28.3 22.5

----------------------------------------------- ------ ------------------------ --------------

2,043.8 1,926.5

---------------------------------------------- ------ ------------------------ --------------

Current assets

Inventories - trading property 12 642.1 657.4

Trade and other receivables 17 25.5 31.3

Retirement benefits 21 1.5 -

Current tax assets 4.6 6.4

Cash and cash equivalents 257.6 369.1

931.3 1,064.2

---------------------------------------------- ------ ------------------------ --------------

Total assets 2,975.1 2,990.7

----------------------------------------------- ------ ------------------------ --------------

LIABILITIES

Non-current liabilities

Interest-bearing loans and borrowings 19 1,346.2 1,391.9

Trade and other payables 18 1.0 1.3

Retirement benefits 21 - 2.4

Provisions for other liabilities and charges 1.2 1.2

Deferred tax liabilities 20 36.7 36.7

----------------------------------------------- ------ ------------------------ --------------

1,385.1 1,433.5

---------------------------------------------- ------ ------------------------ --------------

Current liabilities

Trade and other payables 18 88.5 73.3

Provisions for other liabilities and charges - 0.3

Derivative financial instruments 19 13.2 20.6

----------------------------------------------- ------ ------------------------ --------------

101.7 94.2

---------------------------------------------- ------ ------------------------ --------------

Total liabilities 1,486.8 1,527.7

----------------------------------------------- ------ ------------------------ --------------

NET ASSETS 1,488.3 1,463.0

----------------------------------------------- ------ ------------------------ --------------

EQUITY

Issued share capital 33.8 33.8

Share premium account 616.3 616.3

Merger reserve 20.1 20.1

Capital redemption reserve 0.3 0.3

Cash flow hedge reserve (10.6) (16.6)

Retained earnings 828.4 809.1

----------------------------------------------- ------ ------------------------ --------------

TOTAL EQUITY 1,488.3 1,463.0

----------------------------------------------- ------ ------------------------ --------------

Consolidated statement of changes in equity

Cash

Issued Share Capital flow

share premium Merger redemption hedge Retained Total

capital account reserve reserve reserve earnings equity

Notes GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Balance as at 1

October 2019 30.7 436.5 20.1 0.3 (14.3) 750.2 1,223.5

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Profit for the period 2 - - - - - 40.1 40.1

Other comprehensive

income for the period - - - - 0.2 0.2 0.4

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Total comprehensive

income - - - - 0.2 40.3 40.5

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Issue of share capital 24 3.1 179.4 - - - - 182.5

Award of SAYE shares - 0.2 - - - - 0.2

Purchase of own

shares - - - - - (0.2) (0.2)

Share-based payments

charge 22 - - - - - 1.0 1.0

Dividends paid 10 - - - - - (21.2) (21.2)

IFRS 16 transition

adjustment - - - - - (0.5) (0.5)

Total transactions

with owners recorded

directly in equity 3.1 179.6 - - - (20.9) 161.8

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Balance as at 31

March 2020 33.8 616.1 20.1 0.3 (14.1) 769.6 1,425.8

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Profit for the period - - - - - 52.7 52.7

Other comprehensive

loss for the period - - - - (2.5) (1.1) (3.6)

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Total comprehensive

income - - - - (2.5) 51.6 49.1

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Award of SAYE shares - 0.2 - - - - 0.2

Purchase of own

shares - - - - - 0.1 0.1

Share-based payments

charge - - - - - 0.1 0.1

Dividends paid - - - - - (12.3) (12.3)

Total transactions

with owners recorded

directly in equity - 0.2 - - - (12.1) (11.9)

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Balance as at 30

September 2020 33.8 616.3 20.1 0.3 (16.6) 809.1 1,463.0

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Profit for the period 2 - - - - - 40.1 40.1

Other comprehensive

income for the period - - - - 6.0 3.0 9.0

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Total comprehensive

income - - - - 6.0 43.1 49.1

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Purchase of own

shares - - - - - (0.2) (0.2)

Share-based payments

charge 22 - - - - - 0.9 0.9

Dividends paid 10 - - - - - (24.5) (24.5)

Total transactions

with owners recorded

directly in equity - - - - - (23.8) (23.8)

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Balance as at 31

March 2021 33.8 616.3 20.1 0.3 (10.6) 828.4 1,488.3

------------------------- ------ --------- --------- --------- ------------ --------- ---------- --------

Consolidated statement of cash flows

Unaudited

2021 2020

For the 6 months ended 31 March Notes GBPm GBPm

------------------------------------------------------ ------ -------- --------

Cash flow from operating activities

Profit for the period 2 40.1 40.1

Depreciation and amortisation 0.4 0.8

Net valuation gains on investment property 11 (10.3) (15.6)

Net finance costs 17.1 16.7

Share of loss of associates and joint ventures 13,14 0.2 0.4

Loss/(profit) on disposal of investment property 7 0.1 (0.7)

Share-based payment charge 22 0.9 1.0

Income from financial interest in property assets 15 (4.7) (2.0)

Tax 20 10.2 9.5

Cash generated from operating activities before

changes in working capital 54.0 50.2

Decrease in trade and other receivables 5.8 14.1

Increase/(decrease) in trade and other payables 20.3 (5.8)

Decrease in provisions for liabilities and charges (0.3) (0.2)

Decrease/(increase) in inventories 15.3 (2.1)

------------------------------------------------------ ------ -------- --------

Cash generated from operating activities 95.1 56.2

Interest paid (21.2) (17.6)

Tax paid (8.1) (20.5)

Payments to defined benefit pension scheme 21 (0.2) (0.3)

------------------------------------------------------ ------ -------- --------

Net cash inflow from operating activities 65.6 17.8

------------------------------------------------------ ------ -------- --------

Cash flow from investing activities

Proceeds from sale of investment property 7 30.3 8.9

Proceeds from financial interest in property

assets 15 4.3 4.9

Investment in joint ventures 14 (0.9) (4.7)

Loans advanced to associates and joint ventures 13,14 (0.3) (3.4)

Acquisition of investment property 11 (132.5) (79.6)

Acquisition of property, plant and equipment

and intangible assets (6.3) (6.3)

------------------------------------------------------ ------ -------- --------

Net cash outflow from investing activities (105.4) (80.2)

------------------------------------------------------ ------ -------- --------

Cash flow from financing activities

Net proceeds from issue of share capital 24 - 182.5

Awards of SAYE options - 0.2

Purchase of own shares (0.2) (0.2)

Proceeds from new borrowings - 299.4

Payment of loan costs - (0.6)

Repayment of borrowings (47.0) (330.0)

Dividends paid 10 (24.5) (21.2)

------------------------------------------------------ ------ -------- --------

Net cash (outflow)/inflow from financing activities (71.7) 130.1

------------------------------------------------------ ------ -------- --------

Net (decrease)/increase in cash and cash equivalents (111.5) 67.7

Cash and cash equivalents at the beginning of

the period 369.1 189.3

Cash and cash equivalents at the end of the

period 257.6 257.0

------------------------------------------------------ ------ -------- --------

Notes to the unaudited interim financial results

1. Accounting policies

1a Basis of preparation

These condensed interim financial statements are unaudited and

do not comprise statutory accounts within the meaning of Section

434 of the Companies Act 2006. This condensed set of financial

statements has been prepared in accordance with IAS 34 Interim

Financial Reporting adopted pursuant to Regulation (EC) No

1606/2002 as it applies in the European Union. The annual financial

statements of the group for the year ended 30 September 2021 will

be prepared in accordance with International Financial Reporting

Standards (IFRSs) adopted pursuant to Regulation (EC) No 1606/2002

as it applies in the European Union and in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006. As required by the

Disclosure Guidance and Transparency Rules of the Financial Conduct

Authority, the condensed set of financial statements has been

prepared applying the accounting policies and presentation that

were applied in the preparation of the company's published

consolidated financial statements for the year ended 30 September

2020 which were prepared in accordance with IFRSs as adopted by the

EU.

The accounting policies used are consistent with those contained

in the Group's last annual report and accounts for the year ended

30 September 2020 which is available on the Group's website (

www.graingerplc.co.uk ). The Grainger business is not judged to be

highly seasonal, therefore comparatives used for the six month

period ended 31 March 2021 Consolidated Income Statement are the

six month period ended 31 March 2020 Consolidated Income Statement.

It is therefore not necessary to disclose the Consolidated Income

Statement for the full year ended 30 September 20 (available in the

last annual report).

The comparative figures for the financial year ended 30

September 2020 are not the Company's statutory accounts for that

financial year. Those accounts have been reported on by the

Company's auditor and delivered to the registrar of companies. The

report of the auditor was (i) unqualified, (ii) did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying their report, and (iii) did not

contain a statement under section 498(2) or (3) of the Companies

Act 2006.

The financial information included in this announcement has been

prepared in accordance with EU endorsed IFRS, IFRS IC

interpretations and those parts of the Companies Act 2006

applicable to companies reporting under IFRS.

All property assets are subject to a Directors' valuation at the

half year end, supported by an independent external valuation.

External valuations at the half year are conducted by the Group's

valuers, Allsop LLP and CBRE Limited, as well as Avison Young (UK)

Limited in respect of property held by Vesta LP. The valuation

process is in line with the approach set out on pages 111-113 of

the 2020 Annual Report and Accounts, with the exception being the

Group's Residential portfolio valued by Allsop LLP. At the half

year, Allsop LLP inspected 10.0% of the Residential portfolio, with

the movement extrapolated over the non-sampled assets to form 50%

of the valuation movement for these portfolios. The remaining 50%

is based on a blended rate arrived at by taking Halifax, Nationwide

and Acadata indices (16.6% weighting each), applied on a regional

IPD basis.

The Group's financial derivatives were valued as at 31 March

2021 in-house by a specialised treasury management system, using a

discounted cash flow model and market information. The fair value

is derived from the present value of future cash flows discounted

at rates obtained by means of the current yield curve appropriate

for those instruments.

1b Adoption of new and revised International Financial Reporting Standards

New standards and interpretations in the year

A number of new standards, amendments to standards and

interpretations have been issued but are not yet effective for the

Group and have not been early adopted. The application of these new

standards, amendments and interpretations are not expected to have

a material impact on the Group's financial statements.

1c Group risk factors

The principal risks and uncertainties facing the Group are set

out in the Risk Management report on pages 47-50 of the 2020 Annual

Report and Accounts.

A number of risks faced by the Group are not directly within our

control such as the wider economic and political environment.

In line with our risk management approach detailed on pages

44-46 of the 2020 Annual Report and Accounts, the key risks to the

business are under regular review by the Board and management,

applying Grainger's risk management framework.

1d Forward-looking statements

Certain statements in this interim announcement are

forward-looking. Although the Group believes that the expectations

reflected in these forward-looking statements are reasonable, we

can give no assurance that these expectations will prove to have

been correct.

Because these statements involve risks and uncertainties, actual

results may differ materially from those expressed or implied by

these forward-looking statements. We undertake no obligation to

update any forward-looking statements whether as a result of new

information, future events or otherwise.

1e Significant judgements and estimates

Full details of critical accounting estimates are given on pages

111-114 of the 2020 Annual Report and Accounts. This includes

detail of the Groups approach to valuation of property assets and

the use of external valuers in the process.

The valuations exercise is an extensive process which includes

the use of historical experience, estimates and judgements. The

Directors are satisfied that the valuations agreed with our

external valuers are a reasonable representation of property values

in the circumstances known and evidence available at the reporting

date. Actual results may differ from these estimates. Estimates and

assumptions are reviewed on an on-going basis with revisions

recognised in the period in which the estimates are revised and in

any future periods affected.

1f Going concern assessment

The Directors are required to make an assessment of the Group's

ability to continue to trade as a going concern for the foreseeable

future. Given the significant impact of Covid-19 on the

macro-economic conditions in which the Group is operating, the

Directors have placed a particular focus on the appropriateness of

adopting the going concern basis in preparing the interim financial

statements for the period ended 3 1 March 202 1 .

In making the going concern assessment, the Directors have

considered the Group's principal risks and their impact on

financial performance. The Directors have assessed the future

funding commitments of the Group and compared these to the level of

committed loan facilities and cash resources over the medium term.

In making this assessment, consideration has been given to

compliance with borrowing covenants along with the uncertainty

inherent in future financial forecasts and, where applicable,

severe sensitivities have been applied to the key factors affecting

financial performance for the Group.

The going concern assessment is based on the first 18 months of

the Group's viability model, covering the period from 1 April 2021

to 30 September 2022, and is based on a severe downside scenario

including an extreme impact of Covid-19, reflecting the following

key assumptions:

-- Reducing PRS occupancy to 80% by 30 September 2021, to 75% by

31 March 2022 and to 70% by 30 September 2022

-- Reducing property valuations over the 18 months to 30

September 2022, driven by either yield expansion or house price

deflation

-- 10% development cost inflation

-- Operating cost inflation of 10% per annum

-- An increase in finance costs by 1.25% from 1 April 2021

No new financing is assumed in the assessment period, but

existing facilities are assumed to remain available. Even in this

severe downside scenario, the Group has sufficient cash reserves,

with the loan-to-value covenant remaining no higher than 48%

(facility maximum covenant ranges between 70% - 75%) and interest

cover above 2. 48x (facility minimum covenant ranges between 1.35x

- 1.75x) for the 18 months to September 2022, which covers the

required period of at least 12 months from the date of

authorisation of the interim financial statements.

Based on these considerations, together with available market

information and the Directors experience of the Group's property

portfolio and markets, the Directors continue to adopt the going

concern basis in preparing the interim financial statements for the

period ended 31 March 2021 .

2. Analysis of profit before tax

The table below provides adjusted earnings, which is one of

Grainger's key performance indicators. The metric is utilised as a

key measure to aid understanding of the performance of the

continuing business and excludes valuation movements and other

adjustments that are one-off in nature, which do not form part of

the normal ongoing revenue or costs of the business and, either

individually or in aggregate, are material to the reported Group

results.

For the 6

months ended

31 March

(Unaudited) 2021 2020

------------------------------------------------- -------------------------------------------------

Other Adjusted Other Adjusted

GBPm Statutory Valuation adjustments earnings Statutory Valuation adjustments earnings

---------------- ---------- ---------- ------------- ---------- ---------- ---------- ------------- ----------

Group revenue 101.3 - 101.3 86.9 - (1.6) 85.3

---------------- ---------- ---------- ------------- ---------- ---------- ---------- ------------- ----------

Net rental

income 34.7 - - 34.7 37.0 - - 37.0

Profit on

disposal

of trading

property 29.8 (0.1) - 29.7 22.1 - - 22.1

(Loss)/profit

on disposal

of investment

property (0.1) - - (0.1) 0.7 - - 0.7

Income from

financial

interest in

property

assets 4.7 (2.3) - 2.4 2.0 0.6 - 2.6

Fees and other

income 2.3 - - 2.3 3.2 - (1.6) 1.6

Administrative

expenses (13.9) - - (13.9) (13.8) - - (13.8)

Other expenses (0.3) - - (0.3) (0.2) - - (0.2)

Reversal of

impairment

of inventories

to

net realisable

value 0.1 (0.1) - - 0.1 (0.1) - -

Operating

profit 57.3 (2.5) - 54.8 51.1 0.5 (1.6) 50.0

Net valuation

gains

on investment

property 10.3 (10.3) - - 15.6 (15.6) - -

Finance costs (17.2) - - (17.2) (16.8) - 0.3 (16.5)

Finance income 0.1 - - 0.1 0.1 - - 0.1

Share of loss

of associates

after tax - - - - (0.5) 0.5 - -

Share of

(loss)/profit

of joint

ventures

after tax (0.2) - - (0.2) 0.1 - - 0.1

---------------- ---------- ---------- ------------- ---------- ---------- ---------- ------------- ----------

Profit before

tax 50.3 (12.8) - 37.5 49.6 (14.6) (1.3) 33.7

Tax charge for

the

period (10.2) (9.5)

---------------- ---------- ---------- ------------- ---------- ---------- ---------- ------------- ----------

Profit for the

period

attributable

to the

owners of the

Company 40.1 40.1

---------------- ---------- ---------- ------------- ---------- ---------- ---------- ------------- ----------

Diluted

earnings per

share -

adjusted 4.5p 4.3p

---------------- ---------- ---------- ------------- ---------- ---------- ---------- ------------- ----------

Adjusted earnings is one of Grainger's key performance

indicators. The metric is utilised as a key measure to aid

understanding of the performance of the continuing business and

excludes valuation movements and other adjustments that are one-off

in nature, which do not form part of the normal ongoing revenue or

costs of the business and, either individually or in aggregate, are

material to the reported Group results. The classification of

amounts as other adjustments is a significant judgement made by

management and is a matter referred to the Audit Committee for

approval.

Profit before tax in the adjusted columns above of GBP37.5m

(2020: GBP33.7m) is the adjusted earnings of the Group. Adjusted

earnings per share assumes tax of GBP7.1m (2020: GBP6.4m) in line

with the current standard UK corporation tax rate of 19.0% (2020:

19.0%), divided by the weighted average number of diluted shares as

shown in Note 9.

Other adjustments in 2020 of GBP1.3m were comprised of GBP1.6m

relating to the write-back of provisions relating to historic

non-core businesses, offset by GBP0.3m refinancing costs.

3. Segmental Information

IFRS 8, Operating Segments requires operating segments to be

identified based upon the Group's internal reporting to the Chief

Operating Decision Maker ('CODM') so that the CODM can make

decisions about resources to be allocated to segments and assess

their performance. The Group's CODM is the Chief Executive