TIDMLPA

RNS Number : 5123D

LPA Group PLC

22 June 2023

LPA Group Plc

Interim Unaudited Group Results for the six months ended 31

March 2023

LPA Group plc ("LPA" or the "Group"), the high reliability LED

lighting, electronic and electro-mechanical system designer and

manufacturer , announces its results for the six months to 31 March

2023.

KEY POINTS

6 months 6 months Year to

to to 30 Sept

31 March 31 March 2022

2023 2022

Unaudited Unaudited Audited

Order Book GBP34.9m GBP30.8m GBP27.8m

Order Entry GBP16.2m GBP12.1m GBP19.7m

Revenue GBP9.1m GBP8.6m GBP19.3m

(Loss) / Profit Before Tax GBP(0.6m) GBP(0.6m) GBP1.1m

Basic (Loss) / Earnings Per

Share (3.38)p (2.84)p 8.99p

Loss Before Tax and Exceptional GBP(0.6m) GBP(0.6m) GBP(0.2m)

Items

Adjusted Loss Per Share (excluding

exceptional items) (3.38)p (2.77)p (1.05)p

Net Debt at period end GBP1.0m GBP2.5m GBP0.5m

Paul Curtis, CEO, commented:

"I'm pleased to report that we have made good strategic

progress, a good acquisition and a record order book with an

exceptional order entry year to 31 March 2023.

We look ahead with confidence as we continue to deliver progress

on our strategy. We expect to return to profitability in line with

market expectations for FY23."

Enquiries:

+44 (0) 1799

LPA Group plc 512 800

Robert B Horvath, Chairman

Paul Curtis, Chief Executive

Officer

Stuart Stanyard, Chief Financial

Officer

+44 (0) 20 7220

finnCap (NOMAD and Broker) 0500

Ed Frisby / Abigail Kelly

(Corporate Finance)

Tim Redfern / Charlotte Sutcliffe

(ECM)

Hudson Sandler (Financial +44 (0) 20 7796 lpagroup@hudsonsandler.com

PR) 4133

Dan de Belder

Nick Moore

Harry Griffiths

About LPA

LPA Group plc (AIM: LPA) is a market leading designer,

manufacturer and supplier of high reliability LED lighting,

electronic and electro-mechanical systems, and a distributor of

engineered components.

Focused on transport (rail and aviation), defence,

infrastructure and industrial markets and supplying into hostile

and challenging environments, LPA is known for engineering

solutions to improve product reliability, reducing maintenance and

life cycle costs.

The Group has three sites across the UK, selling to customers in

the UK and overseas. Two of these are design and manufacturing

sites: LPA Connection Systems - electro-mechanical systems for

rail, aviation and industrial, and LPA Lighting Systems - LED

lighting and electronic systems for rail and infrastructure. The

third site is LPA Channel Electric - a value added distributer of

engineered components for rail, aerospace and defence.

With over 160 years of UK design and manufacture, and with

origins in the first ever light installed in 'Electric Avenue',

Brixton; innovation is core to LPA and to the products and services

supplied to our customers worldwide.

For more information visit www.lpa-group.com

Regulatory Information

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

CHAIRMAN'S STATEMENT

The half year has broadly been in line with what we expected for

the period under review. We believe that the recent initiatives we

have put in place to drive the bottom line will take a few months

to start bearing results, consequently we anticipate a return to

full year profitability during FY 2023. I am delighted to say that

there is light at the end of the tunnel, and we look forward to

seeing growth in FY 2024.

As I mentioned at our AGM, and in the Annual Report, we are

seeing the impact of the new executives we have recruited into the

business as well as the emphasis on targeting more products for the

aftercare markets. The workload and activity level in both

Connection Systems and Channel have picked up markedly. Our

Lighting business, which has a number of longer-term contracts,

continued to frustrate with slippage in delivery schedules for New

Train sets; albeit less markedly than a year ago. We were pleased

to announce a further GBP2m lighting order for ÖBB last month which

will support our Lighting business next year and beyond.

Last year we stated our intention to rebalance the business

between project work and routine products. The acquisition of the

'Inter-car jumper' product line from Amphenol that we announced in

March 2023 is part of our strategy and will support production

volumes at Connections Systems for the next three years and beyond.

We will continue to seek other opportunities to add intellectual

property to the Group to fill capacity in our factories and become

more productive.

We have rightly been cautious with our cash enabling us to

remain flexible and to quickly respond to potential opportunities.

We sold surplus land last year which will help us pay for the

acquisition from Amphenol and to support an expanding working

capital growth which inevitably will be required with the

anticipated step up in activity levels over the next 18 months. Our

net debt is down to GBP1m (31 March 2022: GBP2.5m) providing us

with good headroom in our existing bank facilities and allowing us

to continue our strategy of acquiring and developing further

product lines. Our normal bank facilities are renewable early next

year and we will begin those discussions later this summer.

As I commented at the time of the AGM, and there is no reason to

change this statement, the Board anticipates a return to dividend

payment for FY2023.

We continue to look closely at our Environment, Social and

Governance ("ESG") policies. Our 'Guiding Light Principle',

published on our website and in our Annual Report, sets out our

commitments as does our adoption of the QCA Corporate Governance

Code. We continue to strive for continuous improvement in all areas

as we work to become a more sustainable business and we have gained

further recognition of this through our enhanced certification at

Connection Systems.

The second half of the year has begun well and turnover across

the Group is beginning to rise in line with expectations.

Macroeconomic factors (notably the impact of higher wages and

inflation) are generally challenging and interest rates may yet

rise still further which will no doubt stifle confidence, but our

order book is strong. We believe we have competitive advantage in

our local manufacturing facilities and can deliver quality product

both in the UK and across Europe. We have put in place hedging

strategies to safeguard our profitability vis a vis Euro

denominated order book activity most notably in our Lighting

business. The Board remains confident in the long-term prospects

for LPA Group.

Robert B Horvath

Chairman

22 June 2023

Chief Executive's Report

We are pleased to report a strong order intake in H1 2023

resulting in a record order book of GBP34.9m. As expected, trading

in the first half of the year started slowly, as we continued to

experience delays to some of our rail projects. It is however

encouraging to see an uptick as we move forward, and we expect to

see a less volatile trading profile as we progress through the

remainder of the current year and into the next.

Revenues during the half were up 5.8% at GBP9.1m when compared

to the equivalent period last year (H1 2022: GBP8.6m). Inflationary

pressures on energy and materials, plus the investment in people to

support our longer-term strategy, offset these gains resulting in a

loss before tax for the period of GBP0.6m (H1 2022: loss before tax

of GBP0.6m). Where possible these inflationary pressures have been

passed on and the added value across the Group remains at target

levels.

The acquisition of the Amphenol range of Inter-car jumpers has

now been fully integrated within our Connection Systems business,

with deliveries ongoing and the quality of products being well

received by our customers. In addition to the opportunity this

brings us for the supply of additional products to some 3,000 Rail

cars over the coming decade, the acquisition has also enhanced our

product offering, therefore enabling more technical options when

proposing product solutions to new projects. The acquisition of

product ranges such as this are perfect for our well-invested

factories and the Group remains vigilant in seeking out other

opportunities of this nature.

During the period our Connection Systems facility obtained the

prestigious EN/AS9100 certification, which now qualifies the site

for the manufacture of goods for both the Aviation and Defence

industries. This certification is testament to the systems now in

place and means that all Group sites are now running enhanced

quality systems in support of their business.

Alongside this, Connection Systems also achieved ISO14001

certification in the period and, with our Channel division also on

their ISO14001 journey, all sites will soon be fully compliant to

this important environmental standard.

Expanding the Group's sales channels around the world has been a

key focus for the last 18 months. This has, in particular,

benefited our Aircraft Ground Support product range, which

continues to trade strongly and deliver on the strategy and goals

set. This sector will continue to benefit from an enhanced focus on

sales channels and product development, with the aim of becoming a

more significant part of the Connection Systems business and,

therefore, lessening the reliance on rail projects as we move

forward over the coming years.

Our distribution business has seen a considerable increase in

order intake over the period and has now returned to levels of

pre-pandemic status. The new MD is now firmly onboard, bringing

with him a wealth of knowledge and experience, and is progressing

well with a full strategy review of the business. This division

currently benefits from a healthy business split between the

Aviation / Defence and Rail sectors. However, moving forward, more

emphasis on Aviation / Defence and new markets will be the key

focus, with a view to delivering growth and a diverse spread of

revenues across different market sectors.

Current trading and outlook

The second half of the year has started well with a number of

contracts secured and in the pipeline. As we move through the

second half and into next year, we look forward to benefiting from

increasing and more stable revenue streams. With key positions

across the Group now mostly filled, strong order book levels and a

commitment to our strategic goals, we are confident in the Group's

ability to deliver further progress through the remainder of the

year and beyond.

Paul Curtis

CEO

22 June 2023

CONSOLIDATED INCOME STATEMENT

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 23 22 22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Revenue 5 9,131 8,625 19,325

Cost of Sales (7,373) (7,206) (14,925)

----------- ----------- ---------

Gross Profit 1,758 1,419 4,400

Distribution Costs (932) (714) (1,781)

Administrative Expenses (1,451) (1,292) (2,865)

Administrative Expenses - Exceptional

Items - - 1,323

Other Operating Income - - 7

Underlying Operating (Loss)/Profit (614) (568) (226)

Share Based Payments (11) (8) (13)

Exceptional Items - (11) 1,323

--------------------------------------- ----------- ----------- ---------

Operating (Loss)/Profit (625) (587) 1,084

Finance Income 100 40 78

Finance Costs (68) (42) (88)

(Loss)/Profit before Tax (593) (589) 1,074

Taxation 148 215 111

(Loss)/Profit for the Period (445) (374) 1,185

=========== =========== =========

Attributable to:

- Equity holders of the parent (445) (374) 1.185

=========== =========== =========

(Loss)/Earnings per share 6

- Basic (3.38)p (2.84)p 8.99p

- Diluted (3.38)p (2.84)p 8.99p

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Restated

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 23 22 22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

(Loss)/Profit for the Period (445) (374) 1,185

----------- ----------- ---------

Other comprehensive income

Items that will not be reclassified

to profit or loss:

Actuarial Gain / (Loss) on Pension

Scheme 184 512 (219)

Restriction of pension asset (99) (194) 49

Other Comprehensive Income 85 318 (170)

----------- ----------- ---------

Total Comprehensive Income

for the Period (360) (56) 1,015

=========== =========== =========

The restatement is explained

in Note 1.

CONSOLIDATED BALANCE SHEET

As at Restated As at

As at

31 Mar 23 31 Mar 30 Sept

22 22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Non-Current Assets

Intangible Assets 1,955 1,452 1,473

Tangible Assets 4,784 5,156 4,774

Right of Use Assets 1,131 1,259 1,211

Retirement Benefits 2,656 2,921 2,471

Deferred Tax Assets 377 315 229

10,903 11,103 10,158

---------- ---------- --------

Current Assets

Inventories 4,748 4,780 4,567

Trade and Other Receivables 4,380 3,755 5,095

Current Tax Receivable 41 218 41

Cash and Cash Equivalents 1,520 501 2,199

---------- ---------- --------

10,689 9,254 11,902

---------- ---------- --------

Total Assets 21,592 20,357 22,060

Current Liabilities

Bank Loan (2,032) (189) (190)

Lease Liabilities (293) (358) (356)

Trade and Other Payables (4,624) (3,698) (4,584)

(6,949) (4,245) (5,130)

---------- ---------- --------

Non-Current Liabilities

Bank Loan - (2,030) (1,934)

Lease Liabilities (236) (394) (240)

(236) (2,424) (2,174)

---------- ---------- --------

Total Liabilities (7,185) (6,669) (7,304)

Net Assets 14,407 13,688 14,756

========== ========== ========

Equity

Share Capital 1,348 1,348 1,348

Investment in Own Shares (324) (324) (324)

Share Premium Account 943 943 943

Share-Based Payment Reserve 60 64 49

Merger Reserve 230 230 230

Retained Earnings 12,150 11,427 12,510

Equity Attributable to Shareholders

of the Parent 14,407 13,688 14,756

========== ========== ========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Restated

6 months 6 months

to to Year to

31 Mar 30 Sept

31 Mar 23 22 22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Opening equity 14,756 13,719 13,719

---------- ---------- --------

(Loss)/Profit for the period (445) (374) 1,185

Other Comprehensive income 85 318 (170)

---------- ---------- --------

Total comprehensive income

for the period (360) (56) 1,015

---------- ---------- --------

Transactions with owners:

Proceeds from issue of shares - 17 17

Share-based payments 11 8 13

Tax on share-based payments - - (8)

---------- ---------- --------

Closing equity 14,407 13,688 14,756

========== ========== ========

CONSOLIDATED CASH FLOW STATEMENT

6 months 6 months

to to Year to

31 Mar 23 31 Mar 30 Sept

22 22

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

(Loss)/Profit Before Tax (593) (589) 1,074

Finance Costs 68 42 88

Finance Income (100) (40) (78)

Operating (Loss)/Profit (625) (587) 1,084

Adjustments for:

Amortisation of Intangible Assets 65 41 95

Depreciation of Tangible Assets 219 246 497

Depreciation of Right of Use

Assets 120 114 202

(Gain) on disposal of Tangible

Assets - - (1,496)

Equity settled Share Based Payments 11 8 13

Operating cash flow before

movements in

working capital (210) (178) 395

Movements in Working Capital:

(Increase) / Decrease in Inventories (181) (78) 135

Decrease/(Increase) in Trade

and Other Receivables 715 356 (984)

(Decrease)/Increase in Trade

and Other Payables (458) (479) 372

Cash (outflow) generated from

operations (134) (379) (82)

Income Taxes Received - - 159

Net cash (outflow)/inflow from

operating activities (134) (379) 77

---------- ---------- --------

Purchase of Property, Plant

& Equipment (141) (67) (88)

Proceeds from Sale of Property,

Plant & Equipment - - 1,666

Expenditure on Capitalised Development

Costs (71) (89) (163)

Net cash (outflow) / inflow

in investing activities (212) (156) 1,415

---------- ---------- --------

Repayment of Bank Loan (92) (94) (190)

Principal elements of Lease

Liabilities (182) (203) (390)

Interest Paid (59) (42) (88)

Proceeds from Issue of Share

Capital - 17 17

Net cash outflow in financing

activities (333) (322) (651)

---------- ---------- --------

Net (decrease)/increase in Cash

and Cash Equivalents (679) (857) 841

Cash and Cash Equivalents at

start of the period 2,199 1,358 1,358

Cash and Cash Equivalents at

end of the Period 1,520 501 2,199

========== ========== ========

Reconciliation of cash and

cash equivalents

Cash and Cash Equivalents in

Current Assets 1,520 501 2,199

========== ========== ========

NET DEBT

An analysis of the change in net debt is shown below:

Bank Lease Cash and

Loan Liabilities Cash Equivalents Net Debt

GBP000 GBP000 GBP000 GBP000

At 1 October 2022 2,124 596 (2,199) 521

New Lease Obligations & Modifications - 115 - 115

Interest Costs 50 9 - 59

Repayment of Borrowings/Lease

Liabilities (142) (191) - (333)

Other Cash Absorbed - - 679 679

At 31 March 2023 2,032 529 (1,520) 1,041

Notes to the financial statements

----------------------------------

Note 1 BASIS OF PREPARATION

These interim financial statements are for the six months ended

31 March 2023. They do not include all the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Group for the

year ended 30 September 2022.

These interim financial statements have been prepared in

accordance with the requirements of UK-adopted International

Accounting Standards . These financial statements have been

prepared under the historical cost convention with the exception of

certain items which are measured at fair value.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 30 September 2022. The

accounting policies have been applied consistently throughout the

Group for the purposes of preparation of these interim financial

statements and are expected to be followed throughout the year

ending 30 September 2023.

Under UK tax legislation a tax deduction of 35% is applied to a

refund from a UK pension scheme, before it is passed to the

employer. The consolidated income statement and balance sheet for

the 6 months ended 31 March 2022 have been restated to restrict the

pension scheme assets by the 35% tax which is netted off the

amounts that would be refunded. Given no further taxes will be

payable by the Group, the deferred tax provision held in relation

to the pension scheme has also been reversed.

Note 2 Summary of Significant Accounting Policies

Use of judgements and estimates

In preparing these interim financial statements management is

required to make judgements on the application of the Group's

accounting policies and make estimates about the future. Actual

results may differ from these assumptions. The significant

judgements made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty were the

same as those described in the consolidated financial statements

for the year ended 30 September 2022.

New standards and interpretation adopted by the Group

There has been no impact of new standards and interpretations

adopted in the period.

NOTE 3 ACQUISTION OF PRODUCT LINE

As announced on 27 March 2023, LPA made the conditional purchase

of a product line from Amphenol Limited for GBP500,000. This has

been treated as an intangible asset in the interim accounts and a

fair exercise will be carried out in the second half of the year.

The consideration of GBP500,000 will be split into two payments of

GBP250,000 payable in H2 2023 and GBP250,000 payable in H1

2024.

NOTE 4 GOING CONCERN

The Group's business activities and the factors likely to affect

its future performance together with the Group's treasury policy,

its approach to the management of financial risk, and its exposure

to liquidity and credit risks are outlined fully in the Annual

Report & Accounts 2022 which details macro-economic impacts

including those related to inflation and supply chain

disruption.

These economic uncertainties however continue to make

forecasting more difficult. Significant rail project delays have

continued in the period that could not have been foreseen. In

addition, the Russian invasion of Ukraine creating heightened

inflationary pressures, whilst the Group has no trade directly with

either Country. The Directors have assessed these and sensitised

forecasts accordingly.

In assessing going concern the Directors note that whilst

current economic conditions continue to create uncertainty, with a

particular focus on the supply chain and inflationary pressures,

the Group: (i) is expected to return to profitability through the

second half of its 2023 financial year and continue to trade

profitably in the near term; (ii) has in place adequate working

capital facilities for its forecast needs; (iii) has a strong

current order book with significant further opportunities in its

market place; and (iv) has proven adaptable in past periods of

adversity over many years. Therefore, the Directors believe that it

is well placed to manage its business risks successfully.

Having assessed all aspects of the business and the likely

effectiveness of mitigating actions that the Directors would

consider undertaking or have undertaken, the going concern basis

has been adopted in preparing these interim financial

statements.

In reaching this conclusion, the Directors, after making

enquiries, inclusive but not limited to updated forecasts and

expectations, liabilities and risks and ongoing support from the

Group's bank, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future.

NOTE 5 Operating Segments

All the Group's operations and activities are based in, and its

assets located in, the United Kingdom. For management purposes the

Group comprises three product groups (in accordance with IFRS 8) -

electro-mechanical systems, engineered component distribution and

lighting & electronic systems (which collectively design,

manufacture and market industrial electrical and electronic

products) - less centre costs, which operate across three market

segments - Rail; Aerospace & Defence, Industrial & Other.

It is on this basis that the Board of Directors assess Group

performance. The split is as follows:

6 months 6 months

to to Year to

31 Mar 31 Mar 30 Sept

23 22 22

Unaudited Unaudited Audited

Electro-Mechanical Systems 3,204 2,972 6,533

Engineered Component Distribution 1,655 1,663 3,342

Lighting & Electronic systems 4,272 3,990 9,450

Operational Revenue 9,131 8,625 19,325

========== ========== ========

All revenue originates in the UK. An analysis by market segments

and geographical markets is given below:

6 months 6 months

to to Year to

31 Mar 31 Mar 30 Sept

23 22 22

Unaudited Unaudited Audited

Rail 73% 70% 72%

Aerospace & Defence 21% 13% 13%

Industrial & Other 6% 17% 15%

100% 100% 100%

========== ========== ========

United Kingdom 55% 70% 65%

Rest of Europe 29% 20% 24%

Rest of the World 16% 10% 11%

100% 100% 100%

===== ===== =====

NOTE 6 (Loss) / EARNINGS PER SHARE

The calculations of earnings per share are based upon the

(loss)/profit after tax attributable to ordinary equity

shareholders and the weighted average number of ordinary shares in

issue during the period, less investment in own shares.

Details are as follows:

6 months 6 months

to to Year to

31 Mar 31 Mar 30 Sept

23 22 22

Unaudited Unaudited Audited

(Loss)/Profit for the period

- GBP000 (445) (374) 1,185

---------- ---------- --------

Weighted average number of ordinary

shares in issue during the period

(million) 13.183 13.161 13,172

Dilutive effect of share options

(million) - - 0.007

Number of shares for diluted

earnings per share (million) 13,183 13.161 13,179

========== ========== ========

Basic (loss)/earnings per share (3.38)p (2.84)p 8.99p

Diluted (loss)/earnings per share (3.38)p (2.84)p 8.99p

Basic and diluted earnings per share are based on the weighted

average number of ordinary shares and share options in issue during

the period. For the period ended 31 March 2022 and 31 March 2023,

the basic and diluted loss per share are equal since where a loss

is incurred the effect of outstanding share options and warrants is

considered anti-dilutive and is ignored for the purpose of the loss

per share calculation.

Basic Adjusted Earnings per share

Adjusted earnings per share is a key financial performance

measure which discloses the underlying financial performance of the

group by excluding exceptional items. Adjusted basic earnings per

share is determined as the (loss)/profit attributable to the equity

holders of LPA Group Plc excluding the impact of exceptional items

divided by the weighted average number of ordinary shares in issue

during the year.

6 months 6 months

to to Year to

31 Mar 31 Mar 30 Sept

23 22 22

Unaudited Unaudited Audited

(Loss) / Profit attributable

to equity holders of LPA Group

Plc - GBP000 (445) (374) 1,185

Add back exceptional items -

GBP000

Tax on exceptional items - GBP000 - 11 (1,323)

- (2) -

---------- ---------- --------

(Loss) attributable to equity

holders of LPA Group Plc before

exceptional items - GBP000 (445) (365) (138)

Weighted average number of ordinary

shares in issue during the period

(million) 13.183 13.161 13.172

Adjusted Loss per share (3.38)p (2.77)p (1.05)p

NOTE 7 INFORMATION

LPA Group Plc is the Group's ultimate parent company. It is

incorporated in England and Wales and domiciled in the UK, Company

Number 686429. The address of LPA Group Plc's registered office,

which is also its principal place of business, is Light & Power

House, Shire Hill, Saffron Walden, CB11 3AQ, UK. LPA Group Plc's

shares are quoted on the AIM market of the London Stock

Exchange.

LPA Group Plc's consolidated interim financial statements are

presented in Pounds Sterling (GBP000), which is also the functional

currency of the parent company. These interim financial statements

have been approved for issue by the Board of Directors on 22 June

2023. The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 30 September 2022 have been filed with the Registrar

of Companies. The auditor's report on those financial statements

was unmodified and did not contain statements under Section 498(2)

or Section 498(3) of the Companies Act 2006.

Copies of this Interim Report are being sent to shareholders who

have requested to receive a hard copy. Shareholders are encouraged

to access copies which are available on the Company's website (

www.lpa-group.com ). Interim Reports will no longer be published as

the Company continues to focus on the reduction of waste and carbon

footprint. A printout of the Interim Report will also be available

by request from the Company's Registrar, or the Company's

registered office, address as above or by email:

investors@lpa-group.com .

Shareholders are encouraged to visit our website where useful

links and assistance have been provided including our Registrars to

assist utilisation of digital channels and receipt of future

dividends and our Brokers who provide equity research.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUMAQUPWGRG

(END) Dow Jones Newswires

June 22, 2023 02:00 ET (06:00 GMT)

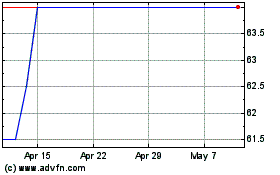

Lpa (LSE:LPA)

Historical Stock Chart

From Apr 2024 to May 2024

Lpa (LSE:LPA)

Historical Stock Chart

From May 2023 to May 2024