NextEnergy Solar Fund Limited Acquisition (0697P)

August 29 2017 - 1:01AM

UK Regulatory

TIDMNESF

RNS Number : 0697P

NextEnergy Solar Fund Limited

29 August 2017

29 August 2017

NextEnergy Solar Fund Limited ("NESF" or the "Company")

Acquisitions

-- Acquisition of two operating solar plants totalling 21.7MWp

with an investment value of GBP26.4m

-- Since IPO in 2014, NESF has now secured a portfolio of 50

solar PV assets with a total capacity of 505MWp and a total

investment value of GBP581m.

NESF is pleased to announce the signing and completion of a

share purchase agreement for the acquisition of two operating solar

plants for a total installed capacity of 21.7MWp. The plants were

acquired were from one counterparty and comprise Bay Farm (8.1MWp,

Suffolk) and Honnington (13.6MWp, Suffolk). Both plants were

connected to the grid during March 2014 and are accredited under

the 1.6 Renewable Obligation Certificate regulation. The

acquisition will be funded by the Company's existing resources.

NESF continues to pursue further transactions from its pipeline

of acquisition opportunities and expects to announce further

investments in due course.

For further information, please contact:

NextEnergy Capital Limited 020 3893 1500

Michael Bonte-Friedheim

Aldo Beolchini

Cantor Fitzgerald Europe 020 7894 7667

Sue Inglis

Fidante Capital 020 7832 0900

Robert Peel

Justin Zawoda-Martin

Macquarie Capital (Europe)

Limited 020 3037 2000

Nick Stamp

Shore Capital 020 7408 4090

Bidhi Bhoma

Anita Ghanekar

MHP Communications 020 3128 8100

Andrew Leach

Ivana Petkova

Luke Briggs

Ipes (Guernsey) Limited 01481 713 843

Nick Robilliard

Notes to Editors:

NESF is a specialist investment company that invests in

operating solar power plants in the UK. Its objective is to secure

attractive shareholder returns through RPI-linked dividends and

long-term capital growth. The Company achieves this by acquiring

solar power plants on agricultural, industrial and commercial

sites.

NESF has raised equity proceeds of GBP586m since its initial

public offering on the main market of the London Stock Exchange in

April 2014. It also has credit facilities of GBP269.8m in place

(GBP150m from a syndicate including MIDIS, NAB and CBA; MIDIS:

GBP54.3m; Bayerische Landesbank: GBP43.8m; and NIBC: GBP21.7m).

NESF is differentiated by its access to NextEnergy Capital Group

(NEC Group), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division, providing solar asset management, monitoring and other

services to over 1,300 utility-scale solar power plants with an

installed capacity in excess of 1.8 GW.

Further information on NESF, NEC Group and WiseEnergy is

available at www.nextenergysolarfund.com, www.nextenergycapital.com

and www.wise-energy.eu.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQUVUNRBOAWUAR

(END) Dow Jones Newswires

August 29, 2017 02:01 ET (06:01 GMT)

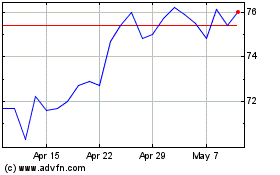

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Apr 2024 to May 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From May 2023 to May 2024