TIDMTRAK

RNS Number : 0865G

Trakm8 Holdings PLC

23 November 2020

23 November 2020

TRAKM8 HOLDINGS PLC

("Trakm8" or the "Group")

Half Year Results

Trakm8 Holdings plc (AIM: TRAK), the global telematics and data

insight provider, announces its unaudited results for the six

months ended 30 September 2020:

Financial Highlights

6 months 6 months Year to Change

to to 31

30 Sept 30 Sept March 2020

2020 2019

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

-------------- -------------- -------------- -------

Revenue 7,321 8,867 19,550 -17%

-------------- -------------- -------------- -------

of which, recurring revenue(1) 4,635 4,885 9,753 -5%

-------------- -------------- -------------- -------

Loss before tax (845) (2,197) (1,705) -62%

-------------- -------------- -------------- -------

Adjusted loss before tax(2) (314) (1,583) (224) -80%

-------------- -------------- -------------- -------

Loss after tax (732) (1,787) (1,093) -59%

-------------- -------------- -------------- -------

Cash generated from operations 2,055 1,432 4,115 +44%

-------------- -------------- -------------- -------

Net Debt(3) 5,574 6,095 5,643 -9%

-------------- -------------- -------------- -------

Basic (loss)/ earnings per

share (1.46p) (3.57p) (2.19p) -59%

-------------- -------------- -------------- -------

Adjusted basic (loss)/ earnings

per share (0.56p) (2.53p) 0.28p -78%

-------------- -------------- -------------- -------

1 Recurring revenues are generated from ongoing service and

maintenance fees

2 Before exceptional costs and share based payments

3. Total borrowings less cash excluding IFRS 16 adjustment for

leased property and motor vehicles

Operational Overview

-- H1 2020 results:

o Significant reduction in losses despite revenue decline as a

result of Covid-19

o Improving revenues later in the period, following significant

drop in April and May upon Covid-19 lockdown

o Significantly improved gross margins due to lower hardware,

labour, communications and installation costs

o Reduced overheads as a result of efficiency improvements

implemented in FY2020, which includes lower payroll costs

o Improved cash generation from operations due to significant

reduction in losses, PAYE & VAT deferments and strong working

capital actions

o Launch of extended range of self-fit telematics devices

-- Continuation of new contract wins and renewals:

o Optimisation contract awarded by major UK food retailer

o Strong period of contract renewals in the Fleet business,

despite Covid-19 all significant contracts due for renewal in the

period have been renewed

o Installed base increases in Insurance from existing and new

customers offset in part by Fleet reductions

o Approximately 253,000 connections (March 2020: 245,000

connections), an increase of 8,000 connections, a 3% increase in

the six month period since last year end

-- Stronger H2 and FY2021 outlook:

o Major automotive customer committed to a further 24,000 units

over next 12 months following their European launch

o Strong level of orders, post period, from existing and new

Fleet customers

o Additional efficiency savings implemented

o Investment in engineering to deliver additional gross margin

improvements over the next 6 months

Outlook

Revenues picked up during the first half with revenues in the

second quarter 23% higher than in the first quarter. This

improvement continued into October in both Insurance and Fleet,

resulting in this being the highest revenue month to date this

financial year. The Insurance business benefitted from increasing

device shipments to both existing and recently won customers

resulting in both September and October 2020 shipments being 50%

higher than March 2020. Fleet sales team performance has returned

to pre Covid-19 levels, with the total value of orders in the first

half 16% up on the first half of the prior year. Orders in October

2020 were 12% up on October 2019.

However due to the second lockdown there is a softening in the

market and increased uncertainty that means the Group is still not

able to provide guidance for the full financial year at this time.

However the Group expects revenue in the second half to be

significantly higher than the first half given current orders, even

with a reasonable downside scenario taken into account for the

ongoing impact of Covid-19.

- Ends -

For further information:

Trakm8 Holdings plc

John Watkins, Executive Chairman Tel: +44 (0) 167 543 4200

Jon Furber, Finance Director www.trakm8.com

Arden Partners plc (Nominated Adviser Tel: +44 (0) 20 7614 5900

& Broker)

Paul Shackleton, Head of Corporate www.arden-partners.com

Finance

Simon Johnson, Head of Sales

About Trakm8

Trakm8 is a UK based technology leader in fleet management,

insurance telematics, connected car, and optimisation. Through IP

owned technology, the Group analyses data collected by its

installed base of telematics units to fine tune the algorithms that

are used to produce its solutions; these monitor driver behaviour,

identify crash events and monitor vehicle health to provide

actionable insights to continuously improve the security and

operational efficiency of both company fleets and private

drivers.

The Group's product portfolio includes the latest data analytics

and reporting portal (Trakm8 Insight), integrated

telematics/cameras, self-installed telematics units and one of the

widest ranges of installed telematics devices. Trakm8 has over

253,000 connections.

Headquartered in Coleshill near Birmingham alongside its

manufacturing facility, the Group supplies to the Fleet,

Optimisation, Insurance and Automotive sectors to many well-known

customers in the UK and internationally including the AA, Saint

Gobain, EON, Iceland Foods, Direct Line Group and Ingenie.

Trakm8 has been listed on the AIM market of the London Stock

Exchange since 2005.

www.trakm8.com / @Trakm8

Executive Chairman's Statement

Results

I am pleased to report Trakm8's results for the six months ended

30 September 2020.

The first half of the financial year was significantly impacted

by the Covid-19 pandemic. In the early months of the period Fleet

activity reduced very significantly. Sales of insurance policies

reduced dramatically as vehicles were "sorned", driving lessons and

tests cancelled. Gradually over the period both Fleet and Insurance

demand levels improved. I am pleased that overall we secured new

orders some 10% higher than the same six months of last year.

However, overall revenues reduced by 17% in the period to

GBP7.32m (H1 2019: GBP8.87m). There was a reduction of GBP0.53m in

Insurance and Automotive revenues and a reduction in Fleet and

Optimisation revenues of GBP1.02m.

Total recurring revenues decreased by 5% during the period to

GBP4.63m (H1 2019: GBP4.89m), as a result of the decline in the

connected base in the Fleet market. The reduction in service fees

year on year took place in the early months of the period and have

since recovered. Recurring revenues represent 63% of Group revenues

(H1 2019: 55%). Covid-19 materially increased Fleet attrition

during the period and the slow start for new orders meant new

deployments were substantially lower than normal, overall reducing

connections by 7,000 units since March 2020 to 70,000 (9%).

Despite the large reduction in telematics insurance policies

being written across the market, our success in rolling out

solutions to a number of additional clients has resulted in device

shipments 14% ahead of the same period last year with the month of

September being 177% greater than April. As a result, Insurance

& Automotive connections increased by 15,000 since March 2020,

to 183,000 (9%). We estimate that the impact of Covid-19 has

resulted in circa 33,000 connections less than it would have

been.

Gross profit margin has increased to 62% (H1 2019: 53%). This is

due in part to the higher recurring revenues as a percentage of

sales but also due to the vigorous actions taken over the past 24

months to introduce hardware with lower costs, reduce the direct

labour costs and to reduce the cost of communications and

installations. This trend is expected to continue as further cost

improvements are delivered.

Total overhead costs, excluding exceptional costs and share

based payments reduced by GBP1.61m to GBP4.71m (H1 2019: GBP6.32m).

This is the result of the cost actions taken over the last 12

months along with GBP0.77m of furloughed staff costs which have

been charged to exceptional costs, which have been offset by

GBP0.55m of furlough grant received. In addition to this GBP1.61m

reduction in overheads the level of R&D expenditure capitalised

has reduced by GBP0.27m. Exceptional costs in the period of

GBP0.44m include headcount reduction activity undertaken during the

period and costs associated with the impact of Covid-19.

Despite the challenges of Covid-19, I am pleased to report that

the Group adjusted loss reduced by 80% to GBP0.31m (H1 2019:

GBP1.58m). Loss before Tax reduced by 62% to GBP0.85m (H1 2019:

GBP2.20m). We estimated if it had not been for the significant

impact of Covid-19 that we would have been profitable under both

profit measures.

Financial position

Net cash inflow from operating activities was GBP2.06m (H1 2019:

GBP1.43m). During the period the R&D tax claim of GBP0.86m was

offset against agreed PAYE/NI deferments. At the 30 September

GBP1.10m of VAT and PAYE/NI deferments have been agreed, with a

repayment schedule that runs into next financial year. The

improvement in cash inflow from operating activities is a good

result, reflective of the significant reduction in losses and

continued strong working capital management, which includes a

GBP0.34m reduction in inventory since last financial year end.

The overall cash outflow for the period was GBP0.12m, which was

an improvement of GBP0.39m from the prior period. This resulted

from the improvement in the cash inflow from operating activities

detailed above, and GBP0.27m reduction in capitalised development

costs.

Net debt as at 30 September 2020 excluding the impact of the

IFRS16 lease recognition was lower than both September last year

and the end of the last financial year at GBP5.57m (H1 2019:

GBP6.10m) (31 March 2020: GBP5.64m) including GBP1.54m of cash (H1

2019: GBP0.69m). In addition, the Group at 30 September 2020 held

an undrawn credit facility of GBP0.50m at HSBC. Net Debt including

IFRS 16 reduced to GBP7.27m (H1 2019: GBP8.42m), (31 March 2020:

GBP7.95m).

The revolving credit facility with HSBC of which GBP4.50m was

drawn at 30 September 2020 is due for renewal on 30 September 2021,

therefore still had 12 months to run from 30 September 2020. As a

result this is now reported within current liabilities on the

balance sheet and the reason why they increased from GBP7.43m to

GBP11.70m. The Group expects to extend this facility before year

end.

Strategy

The Group has been following the strategy outlined in the 2020

Annual Report. Our focus is to provide ever more meaningful

insights to our customers using the data generated by our installed

devices and other connections so that they can run their operations

more efficiently and safely.

Our primary strategy going forward is to return to growth of our

business through more connections, increased device sales and

higher service fees. Due to the high level of new contract wins in

the Insurance space the number of connections have increased

overall by 5% in the past 12 months and by 3% in past 6 months. The

number of devices sold has increased by 11% to 49,000 (H1 2019:

44,000). Increased market share is anticipated following the

introduction of additional self-fit devices.

Trakm8 has focused on delivering market leading technology and

ensuring that the solutions are generating the best possible ROI's

for our customers. We have, for another year, further reduced the

levels of expenditure in R&D but believe we have appropriate

levels of resource to continue to invest heavily to meet the

demands of the market and customers. We will continue to own the

majority of IP in our value chain. The technical challenges of the

RH600 product experienced in previous years have been resolved and

new generations of the product will have significant additional

features.

Our third strategy has been to improve the efficiencies of our

business in every possible way. We have been extremely successful

in delivering the GBP1.5m reduction on all costs year-on-year

promised last year (on top of the GBP2.0m savings delivered in the

previous year). We have continued to focus on this and have

implemented a further GBP0.6m of annualised cost reductions by the

end of the period. We will continue to seek efficiencies as we go

forward.

JOHN WATKINS

Executive Chairman

Unaudited Consolidated Statement of Comprehensive Income for the

six months to 30 September 2020

Six months Six months Year to

to 30 September to 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Note

Revenue 3 7,321 8,867 19,550

Cost of sales (2,804) (4,174) (7,991)

Gross profit 4,517 4,693 11,559

Other income 4 103 213 364

Administrative expenses excluding

exceptional costs (4,800) (6,435) (11,926)

Exceptional administrative

costs 7 (442) (501) (1,296)

Total administrative costs (5,242) (6,936) (13,222)

Operating loss (622) (2,030) (1,299)

Finance income 39 3 12

Finance costs 8 (262) (170) (418)

Loss before taxation (845) (2,197) (1,705)

Income tax 113 410 612

Loss for the period (732) (1,787) (1,093)

Other Comprehensive Income

Items that may be subsequently reclassified

to profit or loss:

Exchange differences on translation of

foreign operations 5 1 (7)

Total other comprehensive income 5 1 (7)

-------------------- ------------------ -------------

Total Comprehensive Loss for the

period attributable to owners of

the parent 5 (727) (1,786) (1,100)

-------------------- ------------------ -------------

Adjusted operating loss before

tax 6 (314) (1,583) (224)

Loss before taxation (845) (2,197) (1,705)

Exceptional administrative

costs 442 501 1,296

IFRS2 Share based payments charge 89 113 185

-------------------- ------------------ -------------

Loss per ordinary share (pence) attributable to

owners of the Parent

Basic 9 (1.46) (3.57) (2.19)

Diluted 9 (1.46) (3.57) (2.19)

Adjusted basic loss per share

(pence) 9 (0.56) (2.53) 0.28

Adjusted diluted loss per share

(pence) 9 (0.56) (2.53) 0.28

---------------------------------------- ----- -------------------- ------------------ -------------

The results relate to continuing operations.

Unaudited Consolidated Statement of Changes in Equity for the

six months to 30 September 2020

Share Share Merger Translation Treasury Retained Total

capital premium reserve reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at

1 April

2019 500 14,691 1,138 203 (4) 5,566 22,094

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Comprehensive income

Loss for the

period - - - - - (1,787) (1,787)

Other comprehensive income

Exchange

differences

on

translation

of overseas

operations - - - 1 - - 1

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Total

comprehensive

income - - - 1 - (1,787) (1,786)

Transactions with owners

IFRS 2

Share-based

payments - - - - - 113 113

Transactions

with owners - - - - - 113 113

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Balance as at

30 Sept

2019 500 14,691 1,138 204 (4) 3,892 20,421

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Comprehensive income

Loss for the

period - - - - - 694 694

Other comprehensive income

Exchange

differences

on

translation

of overseas

operations - - - (8) - - (8)

Total

comprehensive

income - - - (8) - 694 686

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Transactions with owners

IFRS2

Share-based

payments - - - - - 72 72

Transactions

with owners - - - - - 72 72

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Balance as at

31 March

2020 500 14,691 1,138 196 (4) 4,658 21,179

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Comprehensive income

Loss for the

period - - - - - (732) (732)

Other comprehensive income

Exchange

differences

on

translation

of overseas

operations - - - 5 - - 5

Total

comprehensive

income - - - 5 - (732) (727)

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Transactions

with owners

IFRS2 Share

based

payments - - - - - 89 89

Transactions

with owners - - - - - 89 89

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Balance as at

30 Sept

2020 500 14,691 1,138 201 (4) 4,015 20,541

-------------- --------------- --------------- -------------- -------------------- ---------- --------------

Unaudited Consolidated Statement of Financial Position as at 30

September 2020

As at 30 As at 30 As at

September September 31 March

2020 2019 2020

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 10 22,230 21,337 21,997

Plant, property and

equipment 831 716 717

Right of use assets 14 2,838 3,073 3,004

Deferred income tax

asset - 39 -

Amounts receivable under finance

leases 65 65 41

25,964 25,230 25,759

------------------- ------------------ --------------

Current assets

Inventories 1,701 2,119 2,043

Trade and other receivables 7,171 6,710 7,854

Corporation tax receivable 317 1,320 863

Cash and cash equivalents 1,541 692 1,665

10,730 10,841 12,425

------------------- ------------------ --------------

Current liabilities

Trade and other payables (5,574) (5,750) (6,180)

Borrowings 11 (5,417) (1,013) (1,125)

Right of use liability 14 (679) (639) (656)

Provisions (26) (26) (27)

(11,696) (7,428) (7,988)

------------------- ------------------ --------------

Current assets less current

liabilities (966) 3,413 4,437

------------------- ------------------ --------------

Total assets less current

liabilities 24,998 28,643 30,196

------------------- ------------------ --------------

Non-current liabilities

Trade and other payables (593) (630) (713)

Borrowings 11 (1,231) (5,198) (5,675)

Right of use liability 14 (1,941) (2,257) (2,162)

Provisions (179) (137) (157)

Deferred income tax

liability (513) - (310)

(4,457) (8,222) (9,017)

------------------- ------------------ --------------

Net assets 20,541 20,421 21,179

------------------- ------------------ --------------

Equity

Share capital 12 500 500 500

Share premium 14,691 14,691 14,691

Merger reserve 1,138 1,138 1,138

Translation reserve 201 204 196

Treasury reserve (4) (4) (4)

Retained earnings 4,015 3,892 4,658

Total equity attributable to owners

of the parent 20,541 20,421 21,179

------------------- ------------------ --------------

Unaudited Consolidated Cash Flow Statement for the six months to

30 September 2020

Six months Six months Year

to to to

30 September 30 September 31 March

2020 2019 2020

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Net cash generated from operating activities 13 2,055 1,432 4,115

---------------------- --------------------- -----------

Cash flows from investing activities

Purchases of property, plant and

equipment (183) - (20)

Purchases of software (24) (1) (23)

Capitalised Development costs (1,220) (1,488) (3,156)

Net cash used in investing activities (1,427) (1,489) (3,199)

---------------------- --------------------- -----------

Cash flows from financing activities

New bank loan - 500 2,000

Repayment of bank loans (171) (505) (1,440)

Repayment of obligations under lease

agreements (344) (281) (630)

Interest paid (237) (170) (386)

Net cash generated from financing activities (752) (456) (456)

---------------------- --------------------- -----------

Net (decrease)/ increase in cash and

cash equivalents (124) (513) 460

Cash and cash equivalents at beginning

of period 1,665 1,205 1,205

Cash and cash equivalents at end of

period 1,541 692 1,665

---------------------- --------------------- -----------

Notes To The Unaudited Consolidated Financial Statements

1. Basis of preparation

The Group's interim results for the 6 months to 30 September 2020 (prior

period 30 September 2019) were approved by the Board of Directors on

20 November 2020.

As permitted this Interim Report has been prepared in accordance with

UK AIM Rules for Companies and not in accordance with IAS 34 "Interim

Financial Reporting" and therefore is not fully in compliance with

IFRS.

Trakm8 Holdings PLC ("Trakm8") is a public limited company incorporated

in the United Kingdom under the Companies Act 2006. Trakm8 is domiciled

in the United Kingdom and its ordinary shares are traded on AIM, the

market operated by the London Stock Exchange plc.

The accounting policies adopted in the preparation of the interim financial

statements are the same as those set out in the Group's annual financial

statements for the year ended 31 March 2020. The Group adopted IFRS16

on a modified retrospective basis, this is disclosed in note 14. The

financial statements have been prepared on the historical cost basis

except for certain liabilities and share based payment liabilities

which are measured at fair value.

The interim financial statements have not been audited or reviewed

by Group's auditors pursuant to the Auditing Practice Board guidance

on 'Review of Interim Financial Information' and do not include all

of the information required for full annual financial statements.

The financial information contained in this report is condensed and

does not constitute statutory accounts of the Group within the meaning

of Section 434(3) of the Companies Act 2006. Statutory accounts for

the year ended 31 March 2020 have been delivered to the Registrar of

Companies. The audit report of those accounts was unqualified, but

did include an emphasis of matter due to the financial uncertainty

created within the economy by the Coronavirus pandemic resulting in

increased difficulty in forecasting future results for the Group. The

audit report did not contain a statement under Section 498(2) or (3)

of the Companies Act 2006.

Going concern

The consolidated interim financial statements are prepared on a going

concern basis. The directors report that, having reviewed current performance

and projections of its working capital and long term funding requirements,

including assessments against the covenants agreed with our bank and

downward sensitivity analysis, they are satisfied that the Group has

sufficient resources to continue in operation for the foreseeable future,

a period of not less than 12 months from the date of this report. Accordingly,

they continue to adopt the going concern basis in preparing the condensed

financial statements.

Exceptional Items

Exceptional items are those items that, in the Directors' view, are

required to be separately disclosed by virtue of their size or incidence

to enable a full understanding of the Group's financial performance.

See note 7 for further details.

2. Risks and uncertainties

The Board has considered the principal risks and uncertainties for the

second half of the financial year and determined that the risk presented

in the 31 March 2020 Annual Report, described as follows, also remain

relevant to the rest of the financial year: Significant operational

system failure; Cyber-attack and data security; Brexit and a deteriorating

economic climate; Operating in a fast-moving technology industry where

we will always be at risk from new products; Adverse mobile network

changes; Attracting and maintaining high-quality employees; Access to

long term and working capital; Electronic supply chain under constraint

and Covid-19 impacting internal and operational capacity and significant

economic impact. These are detailed on pages 20 to 22 of the 2020 Annual

Report, a copy of which is available on the Group's website at www.trakm8.com.

3. Segmental Analysis

The chief operating decision maker ("CODM") is identified as the Board.

It continues to define all the Group's trading under the single Integrated

Telematics Technology segment and therefore review the results of

the group as a whole. Consequently all of the Group's revenue, expenses,

assets and liabilities are in respect of one Integrated Telematics

Technology segment.

The Board as the CODM review the revenue streams of Integrated Fleet,

Optimisation, Insurance and Automotive Solutions (Solutions) as part

of their internal reporting. Solutions represents the sale of the

Group's full vehicle telematics and optimisation services, engineering

services, professional services and mapping solutions to customers.

A breakdown of revenue within these streams Six months Six months

are as follows: to to Year to

30 September 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Solutions: 7,321 8,867 19,550

Fleet and optimisation 4,419 5,435 12,034

Insurance and automotive 2,902 3,432 7,516

------------- ------------- ---------

4. Other income

Six months Six months

to to Year to

30 September 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Grant income 103 213 361

R&D tax credit - - 4

R&D tax credit adjustment in respect

of prior periods - - (1)

103 213 364

-------------------- ------------------ ---------

5. Loss per ordinary share attributable to the owners of the parent

Six months Six months

to to Year to

30 September 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss attributable to the owners

of the parent (727) (1,786) (1,100)

------------- ------------- ---------

6. Adjusted loss before tax

Adjusted Loss Before Tax is monitored by the Board

and measured as follows:

Six months Six months

to to Year to

30 September 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss Before Tax (845) (2,197) (1,705)

Exceptional administrative costs 442 501 1,296

Share based payments 89 113 185

Adjusted loss before tax (314) (1,583) (224)

-------------- ------------- ----------

7. Exceptional costs

Six months Six months

to to Year to

30 September 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Acquisition costs - 41 52

Integration and restructuring

costs 97 227 602

Covid-19 costs 891 - 200

Furlough grant income (546) - -

New product component refit costs - 233 442

442 501 1,296

------------- ------------- ---------

The integration and restructuring costs in the current year

relate to an ongoing project to streamline and rationalise the

operations of the business.

The Group has also incurred exceptional costs in the current

financial year relating to the Covid-19 pandemic. These costs

relate to a variety of overheads including employee costs,

cancelled marketing events and bad debts resulting from

Covid-19.

Furlough grant income relates to other income received from the

Coronavirus Job Retention Scheme for employees furloughed as a

result of Covid-19.

Detailed explanation of prior year exceptional costs are

detailed on page 64 of the 2020 Annual Report, a copy of which is

available on the Group's website at www.trakm8.com .

8. Finance costs

Six months Six months

to to Year to

30 September 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest on bank loans 191 106 284

Amortisation of debts issue costs 21 14 32

Interest on Hire Purchase and similar

agreements 50 50 102

262 170 418

------------- ------------- ---------

9. Earnings Per Ordinary Share

The earnings per Ordinary share have been calculated in

accordance with IAS 33 using the profit for the period and the

weighted average number of Ordinary shares in issue during the

period as follow:

Six months Six months

to to Year to

30 September 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss the year after taxation (732) (1,787) (1,093)

Exceptional administrative

costs 442 501 1,296

Share based payments 89 113 185

Tax effect of adjustments (84) (95) (246)

Adjusted (loss)/profit after

taxation (285) (1,268) 142

------------------- ---------------- -------------

No. No. No.

'000 '000 '000

Number of Ordinary shares of

1p each 50,004 50,004 50,004

Basic weighted average number of Ordinary

shares of 1p each 50,004 50,004 50,004

Diluted weighted average number of Ordinary

shares of 1p each 50,004 50,004 50,004

------------------- ---------------- -------------

Basic loss per share (1.46p) (3.57p) (2.19p)

Diluted loss per share (1.46p) (3.57p) (2.19p)

Adjust for effects of:

Exceptional costs 0.72p 0.81p 2.10p

Share based payments 0.18p 0.23p 0.37p

Adjusted basic (loss)/earnings

per share (0.56p) (2.53p) 0.28p

Adjusted diluted (loss)/earnings per share (0.56p) (2.53p) 0.28p

10. Intangible Assets

Goodwill Intellectual Customer Development Software Total

property Relationships costs

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

As at 31 March 2019 10,417 1,920 100 14,034 2,033 28,504

Additions - Internal development - - - 1,378 - 1,378

Additions - External purchases - - - 110 23 133

Reclassification of right

of use assets (153) (153)

-------- ------------ -------------- ----------- -------- --------

As at 30 September 2019 10,417 1,920 100 15,522 1,903 29,862

Additions - Internal development - - - 1,385 - 1,385

Additions - External purchases - - - 283 - 283

-------- ------------ -------------- ----------- -------- --------

As at 31 March 2020 10,417 1,920 100 17,190 1,903 31,530

Additions - Internal development - - - 1,200 - 1,200

Additions - External purchases - - - 20 24 44

-------- ------------ -------------- ----------- -------- --------

As at 30 September 2020 10,417 1,920 100 18,410 1,927 32,774

-------- ------------ -------------- ----------- -------- --------

Amortisation

As at 31 March 2019 - 1,849 89 4,632 769 7,339

Charge for period - 30 11 1,007 138 1,186

-------- ------------ -------------- ----------- -------- --------

As at 30 September 2019 - 1,879 100 5,639 907 8,525

Charge for period - 31 - 840 137 1,008

-------- ------------ -------------- ----------- -------- --------

As at 31 March 2020 - 1,910 100 6,479 1,044 9,533

Charge for period - 10 - 867 134 1,011

-------- ------------ -------------- ----------- -------- --------

As at 30 September 2020 - 1,920 100 7,346 1,178 10,544

-------- ------------ -------------- ----------- -------- --------

Net book amount

As at 30 September 2020 10,417 - - 11,064 749 22,230

-------- ------------ -------------- ----------- -------- --------

As at 31 March 2020 10,417 10 - 10,711 859 21,997

-------- ------------ -------------- ----------- -------- --------

As at 30 September 2019 10,417 41 - 9,883 996 21,337

-------- ------------ -------------- ----------- -------- --------

As at 31 March 2019 10,417 71 11 9,402 1,264 21,165

-------- ------------ -------------- ----------- -------- --------

11. Borrowings

As at 30 September As at 30 September As at 31 March

2020 2019 2020

---------------------- ---------------------- ----------------------

Current Non-Current Current Non-Current Current Non-Current

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Borrowings 5,417 1,231 1,013 5,198 1,125 5,675

Right of use liability 679 1,941 639 2,257 656 2,162

Totals 6,096 3,172 1,652 7,455 1,781 7,837

-------- ------------ -------- ------------ -------- ------------

All borrowings are held in sterling and the Directors consider their

carrying amount approximates to their fair values.

Borrowings comprise of the following loans:

A GBP5.0m term loan with HSBC. The loan is secured by a fixed and floating

charge on all the assets of the Group. It is repayable by monthly instalments

until 2021 and bears interest at a floating rate of 1.95% over base

rate. As at 30 September 2020 the Group owed GBP0.7m (30 Sept 2019:

GBP1.4m, 31 Mar 2020: GBP0.9m).

A GBP5.0m revolving credit facility with HSBC which is repayable in

full on 30 September 2021. The loan bears an interest rate of 4.5%

over LIBOR on the drawn amount and a fee of 0.8% on the undrawn facility.

As at 30 September 2020 the Group had drawn down GBP4.5m of this credit

facility (30 Sept 2019: GBP4.9m, 31 Mar 2020: GBP4.5m).

GBP1.5m growth capital loan with MEIF WM Debt LP. The loan bears a

fixed interest rate of 8% per annum and is repayable in 13 quarterly

instalments commencing on 30 June 2021. As at 30 September 2020 the

Group owed GBP1.5m (30 Sept 2019: GBPnil, 31 Mar 2020: GBP1.5m).

The Group's obligations under right of use assets are secured by the

lessors' title to the leased assets (see note 14).

12. Share Capital

As at 30 September As at 30 September As at 31 March

2020 2019 2020

--------------------- --------------------- ------------------

No's No's No's

000's GBP'000 000's GBP'000 000's GBP'000

Authorised:

Ordinary shares of 1p each 200,000 200,000 200,000 200,000 200,000 200,000

Allotted, issued and fully

paid:

Ordinary shares of 1p each 50,004 500 50,004 500 50,004 500

Movement in share capital: GBP'000

As at 1 April 2019 500

--------

As at 30 September 2019 500

--------

As at 31 March 2020 500

As at 30 September 2020 500

--------

The Company currently holds 29,000 Ordinary shares in treasury

representing 0.06% (2018: 0.08%) of the Company's issued share

capital. The number of 1 pence Ordinary shares that the Company has

in issue less the total number of Treasury shares is

49,975,002.

13. Cash Generated from Operations

Six months Six months

to to Year to

30 September 30 September 31 March

2020 2019 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Net loss before taxation (845) (2,197) (1,705)

Depreciation 380 334 699

Amortisation of intangible assets 1,011 1,186 2,194

Exchange movements - - (7)

Interest received (39) (3) -

Bank and other interest charges 262 170 406

Share based payments 89 113 185

------------------- ------------- ---------

Operating cash flows before movement in

working capital 858 (397) 1,772

Movement in inventories 342 617 693

Movement in trade and other receivables 659 1,750 589

Movement in trade and other payables (726) (573) (21)

Movement in provisions 21 21 42

Cash generated from operations 1,154 1,418 3,075

Interest received 39 3 12

Income taxes received 862 11 1,028

Net cash inflow from operating

activities 2,055 1,432 4,115

------------------- ------------- ---------

14. IFRS 16 Leases

This note explains the impact of the adoption of IFRS16 Leases

which the Group adopted with effect from 1 April 2019 on the

group's financial statements. The Group principally leases real

estate and vehicles. Leases are recognised as a right of use asset

with a corresponding liability recorded at the date at which the

leased asset is available for use by the Group.

The movements in right of use assets were as follows:

Furniture,

Freehold fixtures Computer Motor

property and equipment equipment vehicles Software Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 April 2019 2,098 - - 412 - 2,510

Reclassification* - 446 140 - 153 739

Lease additions - 63 35 - - 98

Lease terminated - - - (13) - (13)

Depreciation of right

of use assets (132) (24) (31) (74) - (261)

As at 30 September 2019 1,966 485 144 325 153 3,073

Lease additions - - - 244 - 244

Lease terminated - - - (24) - (24)

Depreciation of right

of use assets (132) (25) (31) (101) - (289)

As at 31 March 2020 1,834 460 113 444 153 3,004

Lease additions - - 76 79 - 155

Lease terminated - - - (10) - (10)

Depreciation of right

of use assets (132) (46) (16) (117) (311)

As at 30 September 2020 1,702 414 173 396 153 2,838

---------- --------------- ----------- ---------- --------- --------

*Amounts previously recognised as finance lease assets have been

reclassified to right of use assets upon transition to IFRS 16 on 1

April 2019.

Lease liabilities by category at 30 September

2020 were as follows:

Furniture,

Freehold fixtures Computer Motor

property and equipment equipment vehicles Software Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Current 272 117 15 204 71 679

Non-current 1482 166 44 196 53 1941

Total 1,754 283 59 400 124 2,620

---------- --------------- ----------- ----------- --------- --------

The maturity of lease liabilities at 30 September 2020

were as follows:

Furniture,

Freehold fixtures Computer Motor

property and equipment equipment vehicles Software Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Within 1 year 272 117 15 204 71 679

1 to 2 years 297 91 15 147 46 596

2 to 5 years 805 75 29 49 7 965

More than 5 years 380 - - - - 380

Total 1,754 283 59 400 124 2,620

---------- --------------- ----------- ---------- ---------------- -------------

15. Further Copies

This statement, full text of the Stock Exchange announcement and

the results presentation can be found on the Group's website

www.trakm8.com and also from the registered office of Trakm8

Holdings PLC. The address of the registered office is: Roman Way,

Roman Park, Coleshill, North Warwickshire, B46 1HG.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BBBDBUUDDGGB

(END) Dow Jones Newswires

November 23, 2020 02:00 ET (07:00 GMT)

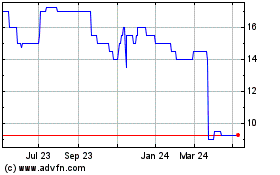

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

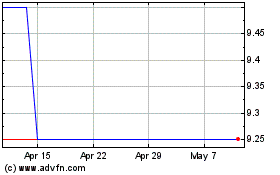

Trakm8 (LSE:TRAK)

Historical Stock Chart

From Apr 2023 to Apr 2024