The global economic uncertainties revolving around the European

debt crisis and the general slowdown in most economies have

resulted in an increase in volatility in many stock markets. The

currency market is no exception to this phenomenon, especially

given the shaky position of many national balance sheets (read

Three Low Beta ETFs for the Uncertain Market).

Deepening worries over the overall health of the global economy

has caused massive sell offs in the risky asset segment. As a

result, the equity markets could not extend their gains that they

posted in the first quarter of 2012.

This risk aversion had increased the demand for the U.S Dollar

(USD) denominated Treasury bonds due to their ‘safe haven’ nature.

Due to this, the yields were depressed and the USD appreciated

against other major currencies (see Where Do You Go For

Yield?).

In particular, from the currency ETF space, things have not been

at their best this fiscal year. Most exchange traded products from

this segment have slumped badly on a year-to-date basis. However,

some ETF from this space have shown resilience in the face of

troubled times and have managed to beat out the dollar in

year-to-date terms.

Below, we highlight three funds that have had a solid start to

the year and could be worth a closer look by investors searching to

either short some strong performers or go long based on strong

momentum:

CurrencyShares Australian Dollar Trust ETF

(FXA)

Launched in June of 2006, FXA tracks the relative movement of

the Australian dollar (AUD) relative to the USD. The funds in this

product are denominated in AUD and kept in a bank account, and the

interest thus received is used to pay for the expenses and fees of

the fund. The fund looks to generate returns through the bank

interest and any capital appreciation that may occur on account of

AUD appreciating versus the USD.

As far as the current scenario is concerned, the benchmark

interest rate is 3.50% and the Consumer Price Index has jumped by

10 basis points for the March 2012 quarter. The Reserve Bank of

Australia (RBA) had slashed interest rates four times since

November 2011 onwards.

The rate cuts add up to 1.25% cumulative. From its 3 year high

at 4.75%, the interest rates have come down to 3.50% on account of

these four subsequent rate cuts.

The falling commodity prices have gone a long way in hurting the

Australian economy as industrial consumption demand for these

commodities have significantly reduced from manufacturing

powerhouses like China (read China Small Cap ETFs Holding Their

Ground).

Still, due to the relatively high interest rate, the RBA will

have a number of policy options going forward, giving it more room

than many of its counterparts.

Nevertheless, FXA has risen by about 4.2% year-to-date, a solid

figure given the uncertainty in the Australian market.

Additionally, due to the high interest rate, the yield on this fund

looks to also be supportive of further gains.

Yet with that being said, the product does have Zacks ETF Rank

of 4 or ‘Sell’ so gains may be hard to come by in the near future.

However, it does remain one of the best options for investing in

the space, charging just 40 basis points in fees and possessing a

relatively high average trading volume as well (see Four Vanguard

ETFs for Long-Term Investors).

Market Vectors Indian Rupee/USD ETN

(INR)

Launched in March of 2008, the Market Vectors Indian Rupee/USD

is an Exchange traded note issued by Morgan Stanley that seeks to

capture the essence of the S&P Indian Rupee Total Return Index.

The index tracks the performance of the Rupee relative to the

USD.

The Indian economy has been under some pressure as of late

although the rupee has held up rather well. INR has added about

2.4% so far in 2012, which is relatively solid given the

uncertainty in the country’s economy (see Indian Rupee ETFs: Is The

Slide Over?).

However, unlike many other economies in the region, India’s

problems are mainly home driven rather than due to external

factors. Policy paralysis, weak infrastructure and little to no

structural reforms in the nation are all cited as some of the

biggest roadblocks to more Indian growth and do not appear to be

going away anytime soon.

Furthermore, a GDP growth rate at a nine year low of 5.3% for

the January-March quarter proves this, while a high current account

and fiscal deficit do not help matters either.

Amidst all negativity, it is believed that the worst for the

Indian Rupee might be over. The currency is showing signs of

recovery and the Indian stock markets are consolidating and

bottoming out on market rallies.

Growth in Industrial production also hints towards an economic

recovery. However, little can be said about its implications in the

actual GDP numbers (read Emerging Market Small Cap ETFs: Freefall

Continues).

Given these facts, INR might be an interesting choice for

investors. The product has $2.62 million in total assets and

charges investors 55 basis points in fees and expenses. The product

being an Exchange traded note, it will not have any tracking error

as it does not incur buying and selling of securities. However, it

is subject to credit risk of the issuer.

The senior debt credit rating of the issues stands at A+ and A2

by rating agencies Standard and Poor and Moody’s, respectively, but

S&P has a negative outlook towards its long-term debt. Year to

date, the note has added about 2.4% and currently has a Zacks ETF

Rank of Strong Buy or 1, suggesting it could be poised for more

gains in the months ahead as well.

PowerShares Deutsche Bank G10 Currency Harvest ETF

(DBV)

DBV is an actively managed ETF, which relies on a long short

portfolio strategy. It works with a small universe of currencies of

countries that comprise the G-10 nations. These currencies include

U.S Dollars, Euro, Japanese Yen, Canadian Dollars, Swiss Francs,

British Pound, Australian Dollar, New Zealand Dollar, Norwegian

Krone and Swedish Krona.

It basically tries to profit from the difference in interest

rates of these countries. The strategy involves borrowing funds in

a currency offering low interest rate and parks the proceeds in a

currency that offer high interest rates.

Thus the ETF tends to profit from this discrepancy in the

interest rates between the various economies. This type of trade is

known as “Carry Trade” which involves active portfolio monitoring

(read Bet Against the dollar with These Three Currency ETFs).

This could be an intriguing investment style as some studies

have found that high yielding currencies tend to hold up better

than their low rate counterparts. If this trend continues, it could

provide the fund with solid returns that are generally uncorrelated

to the broad market. In fact, DBV is up by about 4.2% so far in

2012.

The ETF debuted in September of 2006 and since then has managed

to amass $294.05 million. It charges a steep expense ratio of 75

basis points mainly thanks to its actively management. The product

also has a solid volume level as, on average, approximately 187,000

shares of DBV exchange hands on a daily basis.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-DB G10 CU (DBV): ETF Research Reports

CRYSHS-AUS DOLR (FXA): ETF Research Reports

MKT VEC-RUPEE (INR): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

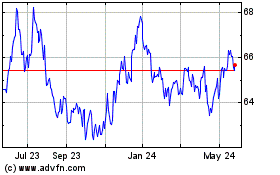

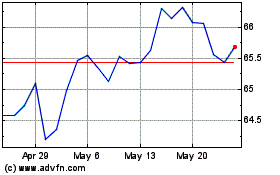

Invesco CurrencyShares A... (AMEX:FXA)

Historical Stock Chart

From May 2024 to Jun 2024

Invesco CurrencyShares A... (AMEX:FXA)

Historical Stock Chart

From Jun 2023 to Jun 2024