TIDMEVA

THE DIRECTORS OF EVRIMA PLC CONSIDER THIS ANNOUNCEMENT TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF REGULATION (EU) NO. 594/2014 OF

THE EUROPEAN PARLIAMENT AND THE COUNCIL OF 16 APRIL 2014 ON MARKET ABUSE AS IT

FORMS PART OF RETAINED EU LAW AS DEFINED IN THE EUROPEAN UNION (WITHDRAWAL) ACT

2018. BY PUBLICATION OF THIS ANNOUNCEMENT, THE INFORMATION SET OUT WITHIN IT IS

DEEMED NOW TO BE IN THE PUBLIC DOMAIN.

Evrima PLC

("Evrima" or the "Company")

AQSE: EVA

Interim Results for the Six Months Ended 30th June 2021

Chairman's Statement

I am pleased to present the unaudited interim results for Evrima plc (AQSE:

EVA) for the period ended 30th June 2021. The financial statements below have

not been reviewed by the Company's auditors.

The Company has committed to creating an investment entity focused primarily on

opportunities in the natural resource industry with a focused and coherent

investment strategy that the Board believes provides shareholders with unique

optionality.

Evrima seeks to evaluate investment opportunities offering attractive entries

and which, if successful, result in valuation uplifts sufficient to reduce the

onus of maintaining its investment position through successive capital rounds

and therefore of the Company itself needing to access ever-further capital

through equity and debt financings. The Company has focused its efforts on the

identification of base and industrial mineral opportunities in Botswana and has

successfully executed several investments during the first half of 2021.

Premium Nickel Resources Corporation ("PNRC")

In the period ended 30th June 2021, the Company increased its holding in PNRC.

Under the Company's investment commitment and the terms of the subscription

agreement entered into with PNRC, Evrima has accumulated through private

placement participation 1,000,000 shares of PNRC representing, 1.37% of the

latter's issued share capital.

In February 2021, PNRC announced that it had been selected as the preferred

bidder for the Botswana nickel-copper-cobalt ("Ni-Cu-Co") assets formerly

operated by BCL Limited ("BCL"), and currently in liquidation. In June 2020,

PNR had submitted an indicative offer to the BCL Liquidator, to acquire the

formerly- producing Selebi-Phikwe, Tati Phoenix and Selkirk Mines as well as

regional exploration joint ventures on highly prospective Ni-Cu-Co projects

located in Botswana. On February 10th 2021 the Honourable Moagi Lefoko, the

Minister of Mineral Resources, Green Technology and Energy Security of

Botswana, affirmed in Parliament the press release by the Liquidator for the

BCL Group of Companies, stating that PNRC had been selected as the preferred

bidder to acquire the assets formerly owned by BCL.

Eastport Ventures Inc ("Eastport Ventures")

During the period under review the Company also entered into a non-binding

investment memorandum with Eastport Ventures in which the Company conditionally

agreed that, following the commissioning of an independent valuation opinion

on Eastport Ventures, it would proceed with a cornerstone investment in

Eastport Ventures prior to the latter company embarking on the process of a

public listing.

Following the balance sheet date, Evrima has acquired a 1.62% interest

in Eastport Ventures through a subscription for new ordinary shares of Eastport

Ventures. Evrima has subscribed for 523,667 units in this pre-IPO financing

with each unit having a subscription price of $0.30¢ and consisting of one new

share and one subscription warrant ("Warrant"). The Warrants have a strike

price of $0.60¢ and a life of five years.

The Company has also secured an exclusive subscription agreement that entitles

Evrima to subscribe for up to a further 2,000,000 new shares on like terms for

a period of 45 business days from the date of its original subscription.

Eastport Ventures is now entering an extremely active period of exploration as

it commenced its maiden drill campaign at Jwaneng North, a diamond project

adjacent to the Jwaneng Mine owned by Debswana where, earlier this year, the

third-largest diamond discovery in Botswana was made. On completion of its

drilling programme at Jwaneng, Eastport is also scheduled to undertake a 2,500m

- 5,000m diamond drilling programme at the Matsitama Copper Project, where

historic drill intercepts report over mineable widths and depths copper grades

of greater than 4%.

I look forward to updating the market on the developments with this new

investee company as it seeks to augment the value of its underlying assets

through strategic exploration and development and it works to consummate a

successful going-public transaction, the current preference being for a reverse

takeover or initial public offering on a recognised investment exchange.

Kalahari Key Mineral Exploration ("Kalahari Key")

In September 2020, the Company entered into an option agreement with two of the

four founders of Kalahari Key to acquire these founders' equity interests in

Kalahari Key. The terms of the option allowed Evrima to acquire a further 17.2%

equity interest. In addition to increasing Evrima's exposure to a pre-existing

investment it enabled the Company to develop a strong working relationship with

the two Kalahari Key founders mentioned and to welcome them as notifiable

shareholders of Evrima. Evrima owns 19.6% of Kalahari Key and is now the

second-largest shareholder of that company.

Simon Grant-Rennick,

Chairman,

30th September 2021

Income Statement for the 6 months ended 30 June 2021

30 June 2021

Unaudited 31 30 June 2020

December Unaudited

2020

Audited

£ £ £

Revenue 20,141 10,090

Administrative expenses (85,541) (257,860) (16,194)

Fair value movement 47,811 69,769 -

Loss on sale of fixed asset investment (4,436) (4,436)

Interest payable and similar expense (5,959) (5,000)

Profit/(loss) before taxation (133,352) (178,345) (15,540)

Taxation - (35,621) -

Profit/(Loss) for the period (133,562) (213,966) (15,540)

Basic earnings per share (0.001) 0.003 (0.002)

Diluted earnings per share (0.001) 0.002 (0.002)

Balance Sheet as at 30 June and 31 December

30 June 31 December 30 June

2021 2020 2020

Unaudited Audited Unaudited

£ £ £

Fixed Assets

Tangible assets - - 200,000

Investments 391,094 344,976 65,250

391,094 344,976 265,250

Current assets

Trade and other receivables 68,895 42,604

72,325

Cash and cash equivalents 14,130 163,607 2,038

81,576 232,502 44,642

Creditors: amounts falling due (152,161) (118,750) (74,307)

within one year

(65,706) 113,752 (29,665)

Net current assets

325,387 458,738 190,943

Total Assets less current

liabilities

Capital and reserves

Called up share capital 229,667 229,668 119,234

Share premium account 673,448 673,448 336,482

Other reserves 27,821 27,821 -

Profit and loss reserve (605,549) (472,199) (264,773)

Total equity 325,387 458,738 190,943

Statement of Changes in Equity as at 30 June and 31 December

Share Share Other Profit and

loss

capital premium Reserves Reserves Total

£ £ £ £ £

For the 6 months ended

30 June 2020

Balance at 1 January 20 119,234 336,482 - (249,233) 206,483

Loss for the period - - - (15,540) (15,540)

Balance at 30 June 2020 119,234 336,482 - (264,773) 190,943

Reclassification (15,000) 24,000 (9,000) -

Issue of share capital 110,434 351,966 3,821 466,221

Profit for the period - - - (213,966) (213,966)

Balance at 31 December 229,668 673,448 27,821 (472,199) 458,738

2020

Loss for the period - - - (133,352) (135,562)

Balance at 30 June 2021 229,668 673,448 27,821 (605,550) (325,387)

The Directors of the Company, who have issued this RIS announcement after due

and careful enquiry, accept responsibility for its content.

REGULATORY ANNOUNCEMENT ENDS

Enquiries:

Company:

Burns Singh Tennent-Bhohi (CEO & Director)

burns@evrimaplc.com;

Simon Grant-Rennick (Executive Chairman)

simon@evrimaplc.com

Keith, Bayley, Rogers & Co. Limited (AQSE Corporate Adviser):

Graham Atthill-Beck: +44 (0) 7506 43 41 07; Graham.Atthill-Beck@kbrl.co.uk;

blackpearladvisers@gmail.com

Peterhouse Capital Limited (Corporate Stockbroker):

Lucy Williams: +44 (0) 20 7469 0930

Duncan Vasey: +44 (0) 20 7220 9797 (Direct)

END

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

Evrima (AQSE:EVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

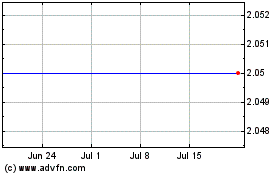

Evrima (AQSE:EVA)

Historical Stock Chart

From Jul 2023 to Jul 2024