TIDMPSY

RNS Number : 8929R

Psych Capital PLC

31 October 2023

PSYCH CAPITAL PLC

("Psych", "Psych Capital", or "the Company"),

AUDITED ANNUAL REPORT AND ACCOUNTS

FOR THE YEARED 30 APRIL 2023

Psych Capital Plc (AQUIS: PSY), the first listed pure-play

psychedelic company in London, is pleased to announce its results

for the year ended 30 April 2023.

Highlights:

-- The successful inaugural PSYCH Symposium was held at The

National Gallery on the 11 May 2022, with leaders from science,

advocacy, regulation, and finance in attendance, generating over

GBP150,000 in revenues.

-- Admission to the Aquis Growth Market on 09 June 2022, listing

the first pure-play psychedelic company in London, raising gross

proceeds of GBP810,000.

-- Investee company Awakn announces Phase III clinical trial

approved for CA$2.5m, with the National Institute for Health and

Care Research (NIHR) covering 66% of the costs.

-- In November 2022, PSYCH published the fourth 'Psychedelics as

a Medicine Report', the flagship information source for the

industry, and hosted an event in London for 'Emerging Innovations

in Psychedelic Healthcare', generating a combined GBP25,000 in

revenue.

-- The PSYCH platform grew the subscriber base by 2.3% to

38,000, an effective growth rate of 8% - 10% when taking account of

standard industry churn metrics.

Post year end:

-- In June 2023, the Company announced the agreement to acquire

100% of the issued share capital of Shortwave Pharma Inc.

("Shortwave Pharma"), a biopharmaceutical drug-development company,

developing breakthrough therapies to address unmet medical needs in

the field of mental health, with focus on the area of eating

disorders, for GBP3.5m through a combination of cash and new

ordinary shares.

-- Hosted the second PSYCH Symposium at The British Museum on

6(th) July 2023, with over 300 delegates in attendance, with

Shortwave Pharma CEO Rivki Stern joining Christian Angermayer,

Robin Carhart-Harris, Charlotte Nichols, MP and Mikuláš Peksa MEP

on stage. The event was supported by Cybin, Compass Pathways,

Clerkenwell Health, FTI Consulting and Negev Capital.

DIRECTORS' STATEMENT

We are pleased to present the results for Psych Capital Plc for

the year ended 30 April 2023.

Psych's mission is to support and operate a new wave of

scientific innovations that challenge the status quo and

revolutionise how society deals with mental health conditions, and

during the year the Company has continued to focus on two core

strategies.

-- Identify, fund, and support the building of future companies

conducting clinical research programs to develop psychedelic drug

development and therapeutic treatments; and

-- Develop its business-to-business media and content platform

(PSYCH) for the psychedelic science and healthcare industry.

Overview

During the year, the management team and the Psychedelic

Medicines Technical Advisory Board ("PMTAB"), have invested

significant time and resources in analysing potential disruptive

psychedelic healthcare delivery models in the UK and Europe, and

assessed M&A opportunities via the Company's network of

experts, proprietary market intelligence, and access to deal flow.

This range of expertise allowed the Company to critically evaluate

the viability of potential target in terms of the strength of their

scientific offering, intellectual property strategy, and

operational viability within the UK and European regulatory

frameworks. With delay in regulation that would pave the way for

greater patient access, combined with rising costs of running

patient centric business models, Psych Capital focused its efforts

on early-stage drug development leveraging it's global scope for

deal flow.

As part of this exercise, the Company signed an exclusivity

agreement in November 2022 with

Shortwave Pharma Inc. ("Shortwave Pharma"), a biopharmaceutical

drug-development company, developing breakthrough therapies to

address unmet medical needs in the field of mental health, and

subsequently conducted extensive due-diligence process and

commercial negotiations. The conclusion of the deal was announced

by the Company post year end.

The Company held its inaugural PSYCH Symposium at the National

Gallery on 11 May 2022 in London, generating over GBP150,000 in

revenue, and with over 350 delegates in attendance, incorporating

thought leaders from science, advocacy, regulation, and finance. In

November PSYCH published the fourth 'Psychedelics as a Medicine

Report', and hosted a PSYCH event in London for 'Emerging

Innovations in Psychedelic Healthcare', attended by 60 industry

leaders to evaluate milestones in the commercialisation of

psychedelic medicine. The event and fourth edition of the report

generated a combined GBP25,000 in corporate sponsorship revenue.

The PSYCH platform grew the gross subscriber base by 2.3% to

38,000, equating to an effective growth rate of 8% - 10% when

taking account of standard industry churn metrics.

Our investee company, Awakn Life Sciences Corp. ("Awakn"),

obtained approval of Phase III of its Ketamine assisted therapy for

alcohol use disorder program, with the National Institute for

Health and Care Research (NIHR) providing funding of CA$2.5m. At 30

January 2023, the Company held a stake of approximately 1.3% in

Awakn.

We strengthened the depth and experience of our management and

advisory teams; with the appointment of an independent

non-executive director and a CFO, and the appointment of the

Conservative Party Drug Policy Reform Group ("CDPRG"), to the

Company's Psychedelic Medicines Technical Advisory Board

("PMTAB").

Post year end

On 19(th) June 2023, the Company announced the agreement to

acquire 100% of the issued share capital of Shortwave Pharma Inc.

("Shortwave Pharma"), a biopharmaceutical drug-development company,

developing breakthrough therapies to address unmet medical needs in

the field of mental health, with focus on the area of eating

disorders, for GBP3.5m through a combination of cash and new

ordinary shares. Details are outlined in the announcement of 19

June 2023.

Shortwave Pharma's initial program is a transformative therapy

for anorexia nervosa, the most fatal eating disorder, a complex and

often underserved area of healthcare. Eating disorders, including

anorexia nervosa, bulimia nervosa, and binge-eating disorder,

affect millions of individuals worldwide. According to the World

Health Organization, it is estimated that approximately 9% of the

global population suffers from an eating disorder, highlighting the

significant market opportunity for effective treatments.

Shortwave Pharma developed a novel delivery method and drug

combination for its initial eating disorders programme for anorexia

nervosa. It has completed the preliminary early-stage activities

that demonstrate the chemistry, manufacturing, and controls ("CMC")

and preclinical abilities of its drug delivery product. The final

product meets regulatory requirements for the early phases of the

clinical studies. The preclinical programme has so far demonstrated

not only the safety profile of the drug, but also the ability of

the Shortwave Pharma's product to bring the active ingredients to

the blood flow without the first pass metabolism, which, Shortwave

Pharma believes, will dramatically improve the efficacy of the drug

and will allow a better safety profile.

Shortwave Pharma is continuing with pre-clinical studies to

complete the profiling of the drug, which should support the design

of the clinical studies coming up later this year.

The terms of the deal incorporated an initial consideration of

71,170,131 new Ordinary Shares, 9,015,100 new Ordinary shares

pursuant to deferred consideration shares 9,015,100, new Ordinary

Shares of 7,499,998 pursuant to deferred guarantee shares of

7,499,998, and a cash payment of US$120,000. The consideration

shares are due to be issued for trading on the AQSE Growth

imminently, subject to the completion of regulatory filings with

the tax authorities in Israel.

As part of the deal, Rivki Stern Youdkevich will join as CEO of

the Company, and Shortwave have the right to appoint an additional

board director to the Company within six months of the Completion

Date. The management team of the enlarged group look forward to

updating the market in the coming weeks.

Outlook and prospects

The Psychedelic industry, alongside the biotech sector as a

whole, faces headwinds in terms of access to capital and associated

wider macroeconomic pressures. The sector has experienced early

sign of consolidation, such as Cybin Inc.'s acquisition of Small

Pharma Inc., as management teams look to share resources and cut

overhead; however inward investment continues to flow into the

emerging sector, ranging from traditional pharma (exemplified by

Otsuka Pharmaceutical's acquisition of Mindset Pharma Inc.), to

multimillion positions from activist investors such Steve Cohen and

Antonio Gracias supporting further research and clinical

trials.

The directors are confident that the investment in Shortwave

Pharma futureproofs the Company's strategy and is set to benefit

from the growth in the psychedelic industry that is expected to

grow from US$650 million in 2022 and exceed US$3 billion by 2026

according to the 4(th) Edition of The Psychedelics as Medicine

Report.

Financial Review

Psych Capital Plc is pleased to announce the Company's annual

results for the year to 30 April 2023.

Revenues of GBP188,882 were reported in the year, representing

an increase of over 200% on the prior year (2022: GBP62,228),

relating to ticket sales and sponsorship of the PSYCH Symposium,

the fourth edition of the "The Psychedelics as a Medicine Report",

and other PSYCH events, derived from clients in the United States

of America, UK, Europe and the rest of the world. The gross profit

margin increased by 6.2 basis points to 70.4% (2022: 64.2%).

Administrative expenses increased by GBP164,022 to GBP678,957

(2022: GBP514,935), incorporating a full-year of expenditure on

areas such as advertising and marketing, legal and audit, and a

non-cash charge of GBP75,000 (2022: GBP62,500) relating to the

amortisation of intangible assets. Expenditure on exceptional items

of GBP83,459 (2022: GBP107,510) related to professional fees on the

Admission to the AQSE. A share based payment non-cash charge of

GBP334,277 (2022: GBPnil) was recorded in the year, due to the

award of share options to directors, senior management and advisors

in May 2022 prior to Admission.

An operating loss of GBP963,755 (2022: 582,474) was recorded in

the year. Non-cash fair value loss on the investment in Awakn Life

Sciences Corp of GBP247,037 (2022: gain of GBP38,541), combined

with an impairment charge of GBP49,507, results in a statutory

pre-tax loss of GBP1,260,299 reported in the year (2022: 543,933),

and a basic loss per share of GBP0.0045 (2022: GBP0.0035).

Net assets totalled GBP805,445 at 30 April 2023 (2022:

GBP476,067), incorporating GBP479,491 in cash and cash equivalents

(2022: GBP322,634). The fair value of the investment in Awakn

declined by GBP247,037 to GBP91,505 at the year end (2022:

GBP338,542). Intangible assets, relating to the acquisition of the

PSYCH platform, had a net book value of GBP262,993 (2022:

GBP387,500), after amortisation and impairment. Trade and other

receivables declined to GBP64,266 (2022: GBP150,568), predominately

relating to reduction in prepayments for the PSYCH Symposium event

in the prior year. Trade and other payables reduced significantly

to GBP92,810 (2022: GBP723,177), predominantly due to a balance of

GBP450,000 in the prior year relating to shares issued to

Prohibition Holdings Ltd upon the Company's Admission to AQSE, in

relation to the acquisition of the PSYCH assets, and lower deferred

revenues due to the timing of the Symposium.

The Company incurred net cash outflows from operations of

GBP623,543 (2022: GBP397,365), an increase of GBP226,178, as the

Company incurred a full-year of directors salaries, outsourced

bookkeeping function, and higher advertising costs. The Company

raised net proceeds from the issue of shares of GBP780,400, net of

GBP29,600 in transaction costs.

The Directors have prepared a cashflow forecast which indicates

that additional funds will be required during the year to continue

to operate as per the forecast. There are ongoing activities to

raise the necessary funds but in the absence of the required

funding being in place this condition indicates the existence of a

material uncertainty which may cast significant doubt over the

company's ability to continue as a going concern.

The Company has over 290 million shares in issue.

Going concern

The Company's business activities, together with the factors

likely to affect its future development, performance and position,

are set out in the Company financial review, together with the

financial position of the Company, its cash flows, liquidity

position and borrowing facilities. The Independent Auditor's Report

was unqualified. We draw attention to Note 2.3 on going concern in

the financial statements, which indicates that the Company is

looking to raise funds in the coming months to continue its

operations over the foreseeable future. Whilst there are no

guarantees of the Company being able to raise such funds, the

directors are confident of obtaining further funding or

investments. Accordingly, the directors consider that it is

appropriate to continue to prepare the financial statements on a

going concern basis. However, in the absence of the required

funding being in place these conditions indicate the existence of a

material uncertainty which may cast significant doubt over the

company's ability to continue as a going concern.

Media inquiries : PsychSymposium@fticonsulting.com

The Directors of the Company accept responsibility for the

contents of this announcement.

Enquiries:

Company:

Joseph Colliver: +44 20 3838 7621

William Potts: +44 20 3838 7621

info@psych.capital

https://psych.capital

Peterhouse Capital Limited:

Corporate Adviser:

Guy Miller / Narisha Ragoonanthun: + 44 (0) 20 7469 0930

Corporate Broker

Lucy Williams: +44 (0) 20 7469 0930

Duncan Vasey: +44 (0) 20 7220 9797 (Direct)

PSYCH CAPITAL PLC

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 APRIL 2023

Year ended Year ended

30 April 2023 30 April 2022

GBP GBP

Revenue 188,882 62,228

Cost of sales (55,944) (22,257)

--------------- ---------------

Gross profit 132,938 39,971

Administrative expenses (678,957) (514,935)

Exceptional operating items (83,459) (107,510)

Share based payments (334,277)

--------------- ---------------

Operating loss (963,755) (582,474)

Fair value (loss)/gain on fixed asset investments (247,037) 38,541

Impairment loss on intangible assets (49,507) -

--------------- ---------------

Loss on ordinary activities before taxation (1,260,299) (543,933)

Income tax - -

--------------- ---------------

Total comprehensive loss for the financial year (1,260,299) (543,933)

=============== ===============

(restated)

Basic loss per share attributable to owners of the company (0.0045) (0.0035)

PSYCH CAPITAL PLC

STATEMENT OF FINANCIAL POSITION

FOR THE YEARED 30 APRIL 2023

As at As at

30 April 2023 30 April 2022

GBP

Non-current Assets

Intangible assets 262,993 387,500

Investments 91,505 338,542

---------------- ---------------

Total Non-current Assets 354,498 726,042

================ ===============

Current Assets

Cash and cash equivalents 479,491 322,634

Trade and other receivables 64,266 150,568

---------------- ---------------

Total Current Assets 543,757 473,202

================ ===============

Current Liabilities

Trade and other payables 92,810 723,177

---------------- ---------------

Total Liabilities 92,810 723,177

================ ===============

Net Current Assets/(Liabilities) 450,947 (249,975)

Net Assets 805,445 476,067

================ ===============

Equity

Issued share capital 290,033 183,333

Share premium 1,680,832 836,667

Share based payments reserve 638,812 -

Retained earnings (1,804,232) (543,933)

----------------

Total Equity 805,445 476,067

================ ===============

These financial statements were approved and authorised by the

Board on 30(th) October 2023 and signed on its behalf by:

William Potts

Director

PSYCH CAPITAL PLC

STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 30 APRIL 2023

Share Share Share based payments reserve Retained Total

capital premium earnings equity

GBP GBP GBP GBP

Transactions with equity owners

At incorporation - issue of

share capital

2 ordinary shares at GBP0.0001

each - - - - -

Ordinary Shares issued

39,998 shares at GBP0.0001 each 4 - - - 4

Ordinary Shares issued 183,329 836,667 - - 1,019,996

Total comprehensive income

Total comprehensive income

for the year ended 30 April 2022 - - - (543,933) (543,933)

--------- ---------- ----------------------------- ------------ ------------

As at 30 April 2022 183,333 836,667 - (543,933) 476,067

Transactions with equity owners

Share-based payments 90,500 384,500 - - 475,000

Ordinary shares issued 16,200 793,800 - - 810,000

Transaction costs - (29,600) - - (29,600)

Share options/warrants issued - (304,535) 638,812 - 334,277

Total comprehensive income for

the year ended 30 April 2023 - - - (1,260,299) (1,260,299)

--------- ---------- ----------------------------- ------------ ------------

As at 30 April 2023 290,033 1,680,832 638,812 (1,804,232) 805,445

========= ========== ============================= ============ ============

PSYCH CAPITAL PLC

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 30 APRIL 2023

Year ended Year ended

30 April 2023 30 April 2022

GBP

Cash flows from operating activities

Loss before tax (1,260,299) (543,933)

Adjusted for:

Fair value loss/(gain) on investments 247,037 (38,541)

Amortisation of intangible assets 75,000 62,500

Impairment of intangible assets 49,507 -

Share-based payments - share options and warrants 334,277 -

Decrease/(increase) in trade and other receivables 86,302 (150,568)

(Decrease)/increase in trade and other payables (155,367) 273,177

--------------- ---------------

Net cash used in operating activities (623,543) (397,365)

Cash flows from investing activities

Purchase of investments - (240,001)

--------------- ---------------

Net cash used in investing activities - (240,001)

Cash flows from financing activities

Proceeds from the issue of shares 780,400 960,000

--------------- ---------------

Net cash generated from financing activities 780,400 960,000

Net increase in cash and cash equivalents 156,857 322,634

Cash and cash equivalents at beginning of year 322,634 -

--------------- ---------------

Cash and cash equivalents at end of year 479,491 322,634

=============== ===============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXBDBDGSGXDGXB

(END) Dow Jones Newswires

October 31, 2023 08:04 ET (12:04 GMT)

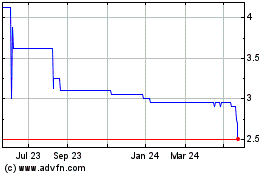

Shortwave Life Sciences (AQSE:PSY)

Historical Stock Chart

From May 2024 to Jun 2024

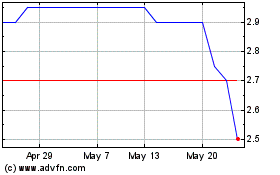

Shortwave Life Sciences (AQSE:PSY)

Historical Stock Chart

From Jun 2023 to Jun 2024