Thwaites (Daniel) Plc AGM Statement and Covid-19 update

September 04 2020 - 3:03AM

UK Regulatory

TIDMTHW

Daniel Thwaites PLC

AGM Statement and Covid-19 update

3 September 2020

Dear Shareholder,

I am writing to provide a further update to the one published in May on how

Daniel Thwaites PLC is faring in the current economic environment and to

appraise you on our plans for the Annual General Meeting and the process for

approving the Annual Report and Accounts.

Covid-19 Impact

The Company closed all its pubs, inns and hotels on 20 March 2020 following the

directive from the UK Government that all hospitality businesses should shut.

The Company then quickly took all possible steps to secure the business,

protect cash flow and take advantage of the support measures put in place by

the Government. These included:

* Putting over 90% of the workforce on furlough leave;

* Only allowing staff in key roles and those securing our properties to work

- which meant that the business was operating and being safeguarded by a

skeleton team;

* The Board and Executive team all taking pay cuts of up to 30%;

* Taking advantage of business rate exemptions across its retail properties,

which are available for the 2020/21 business rate period;

* Assisting pub tenants to claim grants across all the tenanted pub estate

which assisted the tenanted pubs to survive and come through the crisis;

* Claiming pub grants directly where they were available for the pubs that we

operate on a managed basis;

* Negotiating either suspension of contracts with suppliers, or reduced costs

during the period of disruption;

* Agreeing payment deferrals with HMRC for VAT and PAYE;

* Temporarily pausing deficit contributions to its defined benefit pension

funds; and

* Putting all non-essential capital expenditure on hold.

Liquidity and Financing

The Company renewed its banking facilities in Q1 2020 and at 31 March 2020 had

net debt of GBP65.4m with total facilities of GBP82m giving it liquidity headroom

of over GBP16m. During the period of closure, the Company monitored its cash flow

very closely and at the end of June 2020 net debt had increased to GBP71.8m.

Whilst this was an increase of GBP6.4m during the period of closure, GBP12m of

headroom remained against the Company's existing facilities and with the

support of its banks its banking covenants were relaxed.

The Company is currently giving consideration as to whether it is necessary to

increase facilities further as a prudent measure to ensure that it has

sufficient facilities to deal with the ongoing uncertainties that might arise

over the winter period.

Reopening

The Company reopened all its pubs, inns and hotels on 4 July 2020 or shortly

thereafter and the leisure facilities, swimming pools and spas reopened towards

the end of July.

Since reopening trade has built steadily, aided by the significant measures of

government support in the form of the VAT reduction on accommodation, food and

soft drinks from 20% to 5%, which took effect on 15 July 2020 and remains in

place until 12 January 2021. In addition, the Eat Out to Help Out scheme ran

during August and boosted customers coming to eat in the early part of the

week. The fine weather and the increase in staycations due to the travel

restrictions put in place to prevent UK citizens from going abroad has also

assisted our recovery.

Reopening the business, under our "Stay Safe" covid-friendly operating

procedures, has been a significant challenge for our teams, but they have done

an amazing job of getting going and starting on the road to rebuild our

position. I would like to thank them for the way in which they have helped to

build a rigorous, safe and comfortable environment for our customers whilst

balancing that with our fundamental objective of providing a warm and welcoming

environment, being hospitable and making our guests feel at ease.

In our pubs our Area Business Managers have been a tremendous support for our

tenanted pubs, helping them to understand the new environment that we are all

operating in. They have assisted, where needed, in helping our tenanted pub

partners to access grants, plan for re-opening and providing clear guidance on

the full range of support that the Company is able to offer, including rent

concessions and the restocking of spoilt beer. It has been our underling

objective that wherever possible, and in the overwhelming majority of cases,

that the Company will do everything we can to give our tenanted pubs the best

chance of coming out the other side of the crisis able to re-establish their

business and thrive once more.

Our suppliers have also faced some major challenges in restarting a supply

chain that had been shut down for over three months, and whilst there have been

some minor issues, their efforts in supplying us during reopening have been

greatly appreciated.

What has become very clear in reopening is that the visibility we had last year

on forward bookings has been greatly shortened, and we see no sign that this

will change as we enter the winter. Against this background, we have taken the

unwelcome decision to initiate a programme of redundancies to ensure our cost

base reflects the environment that we expect to operate in over the coming

months and protect the business against significant ongoing uncertainty.

Dividend

The preservation of cash continues to be an absolute priority, as a result the

Company took the decision that it will not pay a final dividend for the year

ending 31 March 2020. Future dividends will be reviewed when normal trading

levels resume.

Annual General Meeting

In normal times we would have had our AGM in July and invited shareholders to

meet the Board and ask questions.

Having taken into consideration the current measures published by the UK

Government restricting public gatherings, the Board is in the unprecedented

position that it is forced to take the decision that shareholders will not be

invited physically to attend this meeting.

The AGM will therefore be conducted as a closed meeting on 30 September 2020

with the business of the AGM limited to the formal business section only and a

necessary quorum established by the Company and its Directors.

Ahead of the meeting I would ask you to return the proxy form indicating your

votes for the resolutions. Any questions that you have should either be sent

with the proxy form or by e-mail to susanwoodward@thwaites.co.uk. A summary of

the questions and answers together with the results of the resolutions will be

published on our website after the AGM.

Annual Report and Shareholder Meeting

It is was not possible to have the year-end results audited whilst the business

was closed and staff were furloughed, therefore the Company has taken advantage

of the extra-ordinary three-month extension to the normal filing deadline for

Annual Report and Accounts by Companies House. This means that these documents

will be filed at Companies House by the end of December 2020.

We expect to publish our Annual Report and Accounts in mid-October; it is

important to us to see those shareholders who like to attend our general

meetings and if it is by then possible we will hold a shareholder meeting to

approve the Annual Report and Accounts, for shareholders to be able to attend

in person, during November. We will confirm dates in due course.

Outlook

The Company was trading very strongly prior to this crisis. Since reopening we

have seen steady growth in sales and are encouraged that our net debt has

stabilised and begun to reduce. However, whilst social distancing rules are in

place the capacities and permitted activities in our properties are restricted

and therefore sales will not be capable of returning to pre-crisis levels until

those restrictions are no longer required.

Our hotels business is dependent on both corporate and leisure customers, and

whilst there are a significant number of people still working from home, the

former are likely to be present in lower numbers which will most likely

adversely impact our business over the winter months; we are hopeful that some

of this will be partially mitigated by the continuing trend for people to stay

in the UK and take leisure breaks.

The Company benefits from the fact that it owns the freeholds of all of its

properties and is therefore not under pressure to pay third party landlords

rent, as others in the industry are having to do. However, it does have

financing obligations in the form of interest payments to its funders. We are

committed to taking those difficult and necessary decisions in the short term

to preserve the long-term future of the business and once again flourish for

the benefit of all our stakeholders.

I understand that the decision to pass on the final dividend will be an

unpopular one, it is not one that has been taken lightly, nor without thought

of the impact that it might have on our shareholders. I would like to thank all

of our shareholders for their support as we come through this crisis. I would

also like to thank our dedicated teams throughout the Company who are working

so hard to re-establish the strong position that we were in at the start of the

year.

Whilst this pandemic is unexpected, the Company embarked upon Covid-19 and

shutdown in good health. Our initial experience upon reopening has been better

than we had at first hoped, however the coming months are likely to test us

again. The Company has been through troubled times before and has a strong

asset base and an experienced management team to assist in finding a pathway

through the challenges we face.

Yours faithfully,

Richard Bailey

Executive Chairman, Daniel Thwaites PLC

END

(END) Dow Jones Newswires

September 04, 2020 04:03 ET (08:03 GMT)

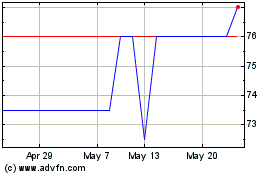

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From May 2024 to Jun 2024

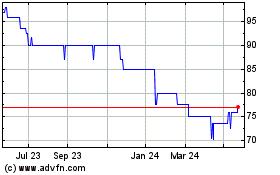

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jun 2023 to Jun 2024