U.S. Dollar Rises As Fed Considers March Rate Cut Unlikely

January 31 2024 - 10:27PM

RTTF2

The U.S. dollar strengthened against other major currencies in

the European session on Thursday, after the U.S. Federal Reserve

signaled openness to future rate cuts, adding a March rate cut is

unlikely.

The U.S. Federal Reserve kept key rates unchanged but indicated

that cuts to interest rates are not imminent in view of elevated

inflation.

Trading later in the day may also be impacted by reaction to the

release of reports on weekly jobless claims, manufacturing activity

and construction spending ahead of the all-important January jobs

report, due Friday.

In the Asian trading now, the U.S. dollar rose to nearly a

2-month high of 1.0781 against the euro and nearly a 2-1/2-month

high of 0.6521 against the Australian dollar, from yesterday's

closing quotes of 1.0822 and 0.6579, respectively. If the greenback

extends its uptrend, it is likely to find resistance around 1.06

against the euro and 0.64 against the aussie.

Against the pound and the Swiss franc, the greenback advanced to

a 2-day high of 1.2643 and a 3-day high of 0.8651 from Wednesday's

closing quotes of 1.2698 and 0.8619, respectively. The greenback

may test resistance around 1.25 against the pound and 0.88 against

the franc.

The greenback edged up to 147.09 against the yen, from

yesterday's closing value of 146.47. On the upside, 150.00 is seen

as the next support level for the greenback.

Against the New Zealand and the Canadian dollars, the greenback

to 3-day highs of 0.6096 and 1.3464 from Wednesday's closing quotes

of 0.6141 and 1.3420, respectively. The next support levels for the

greenback is seen around 0.59 against the kiwi and 1.36 against the

loonie.

Looking ahead, PMI reports from various European economies and

U.K. for January, Eurozone flash inflation data for January and

unemployment data for December.

At 7:00 am ET, the Bank of England's monetary policy

announcement is due. The central bank is widely expected to leave

its benchmark rate unchanged at 5.25 percent. The current rate is

the highest since early 2008.

In the New York session, U.S. weekly jobless claims, U.S. and

Canada PMI reports for January and U.S. construction spending for

December are slated for release.

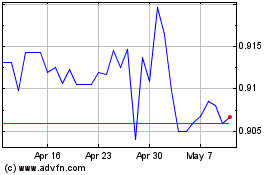

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Jun 2024 to Jul 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Jul 2023 to Jul 2024