Consolidated Water Co. Ltd. (NASDAQ Global Select Market: CWCO), a

leading designer, builder and operator of advanced water supply and

treatment plants, today issued the following statement commenting

on the reports issued by Institutional Shareholder Services (“ISS”)

and Glass Lewis regarding the Company’s May 28,

2024 Annual General Meeting of Shareholders:

The Company strongly disagrees with the

recommendations to withhold votes from Linda Beidler-D’Aguilar,

Brian E. Butler and Leonard J. Sokolow for re-election to the

Company’s Board of Directors (the “Board”). For the reasons

provided below, as well as those provided in the Company’s

definitive proxy statement filed on April 18, 2024 (the “Proxy

Statement”) with the Securities and Exchange Commission (the

“SEC”), the Company urges shareholders to vote “FOR” each of the

nominees for election, including Ms. Beidler-D’Aguilar, Mr. Butler

and Mr. Sokolow.

Linda Beidler-D’Aguilar

The ISS and Glass Lewis recommendations against

the re-election of Ms. Beidler-D’Aguilar are due to her attendance

at less than 75% of the aggregate number of (a) the total

number of meetings of the Board and (b) the total number of

meetings of all committees of the Board on which she served

(collectively, the “Aggregate Meetings”) held during 2023. Despite

not meeting the 75% threshold, Ms. Beidler-D’Aguilar attended 69%

of the Aggregate Meetings. Importantly, one of the meetings that

she missed was convened on only two days’ notice, and she already

had a previous commitment that could not be changed. Had she been

able to attend that one meeting, she would have attended over 75%

of the Aggregate Meetings held during 2023. Further, shareholders

should know that Ms. Beidler-D’Aguilar has attended 87% of the

Aggregate Meetings held from November 2018 to the date of this

press release.

Ms. Beidler-D’Aguilar has made a commitment to

the Company to attend at least 75% of the Aggregated Meetings

during 2024 and each following year. As evidence of that

commitment, Ms. Beidler-D’Aguilar has attended 100% of the

Aggregate Meetings held to date during 2024.

The Board believes that it is important that

Ms. Beidler-D’Aguilar be re-elected because of her more than

35 years of experience as an attorney; her legal, business and

financial knowledge acquired during that period; and her knowledge

of, and business contacts in, the Caribbean. Although

Ms. Beidler-D’Aguilar has served on the Board for coming up on

six years, she has been involved with the Company’s operations in

The Bahamas since 1994, resulting in over 30 years’ experience,

history and knowledge with the Company.

Additionally, the Board believes that

Ms. Beidler-D’Aguilar adds diversity of thought and experience

to the Board. She also brings gender diversity to the Board, being

the only director on the Board to identify as a female. This is

particularly important in light of Nasdaq’s diversity rule, which

requires Nasdaq-listed companies, such as the Company, to disclose

information about board diversity statistics and either include

women and minority directors on their boards or disclose why they

do not. The Board believes that the failure to re-elect Ms.

Beidler-D’Aguilar will diminish the capability and effectiveness of

the Board and negatively impact the Board’s progress with respect

to diversity and inclusion efforts.

Brian E. Butler

The Glass Lewis recommendation against Mr.

Butler is due to their concerns relating to board refreshment and

gender diversity coupled with Mr. Butler’s position as Chair of the

Company’s Nominations and Corporate Governance Committee (the “NCG

Committee”). While the Company and the NCG strongly support routine

director evaluation and understand the perceived value of periodic

board refreshment, they also believe that this must be balanced by

the need for changes to board composition based on an analysis of

skills and experience necessary for the Company, and must be viewed

from the perspective of the results of the Company and value

creation for shareholders, as opposed to relying solely on age or

tenure. In the Company’s view, and in light of the Company’s

business in a specialized field, a director’s experience can be a

valuable asset to shareholders because of the complex, critical

issues that the Board faces.

The Company believes that it is precisely

because of, and not in spite of, the average director’s tenure

being 24 years, that the Company has been able to thrive these past

several years where companies have faced unprecedented

challenges on a global scale. Throughout this time, the Board and

the Company’s executive management collaborated closely to ensure

the Company met its commitments to a broad range of stakeholders,

including employees, customers, the communities in which the

Company operates, suppliers, and of course the Company’s

shareholders. Amidst the challenges, the past fiscal year offered

another year for quality financial performance, and the Company

delivered positive results for its shareholders, including

returning approximately $5.5 million to shareholders in the

form of dividends and increasing the stock price by over 100%.

Further, the Company and the NCG believe that

the directors represent a wide range of backgrounds and expertise,

with one director identifying as female and three directors

identifying as “two or more races or ethnicities” under The NASDAQ

Stock Market’s diversity rules. This means that over 50% of the

non-executive members of the Board identify as a female or other

minority. The Company and the NCG believe that the diversity of

backgrounds, experiences, perspectives, and skills of the directors

contributes to the Board’s effectiveness in managing risk and

providing guidance that positions the Company for long-term

success. Further, of the eight directors, seven are independent,

including the Chairman of the Board, and the sole executive

director is Frederick W. McTaggart, who is the Chair of the

Company’s Environmental and Social Governance Committee.

The Company, the Board and the NCG are very

satisfied with the composition of the Board and would be hesitant

to make a change solely based upon age, tenure or diversity

consideration.

The Board believes that it is important that Mr.

Butler be re-elected because of his over 50 years of experience as

a property developer (over 45 of those years in the Caribbean); his

business and financial knowledge acquired during that period; and

his knowledge of, and business contacts in, the Cayman Islands. The

Board believes that the failure to re-elect Mr. Butler based upon

concerns relating to board refreshment and gender diversity would

not only be unwarranted, but would diminish the capability and

effectiveness of the Board.

Leonard J. Sokolow

The ISS recommendation against Mr. Sokolow is

due to him serving as the chief executive officer of a public

company and as a director of more than two additional public

companies, including the Company. As of the date the Proxy

Statement was filed with the SEC, in addition to serving as a

director of the Company, Mr. Sokolow served as Co-Chief Executive

Officer and a director of SKYX Platforms Corp. (Nasdaq: SKYX) and

served as a director of Vivos Therapeutics, Inc. (Nasdaq: VVOS) and

Agrify Corporation. However, since the filing of the Proxy

Statement, Mr. Sokolow has resigned as a director of Agrify

Corporation. Accordingly, as of the date hereof, Mr. Sokolow serves

as the chief executive officer of a public company and as a

director of only two other public companies, including the Company,

and, thus, is within the acceptable ISS parameters of additional

board directorship.

The Board believes that it is important that Mr.

Sokolow be re-elected because of his experience as a director and

principal executive officer; his legal, accounting, auditing and

consulting background; and his qualifications to serve as the

Company’s “audit committee financial expert.” With his background

in accounting, audit and finance (including his experience as a

Certified Public Accountant for Ernst & Young and KPMG Peat

Marwick), Mr. Sokolow serves as the Chair of the Company’s Audit

Committee and is the only current director of the Company who

qualifies as an “audit committee financial expert.” The Board

believes that the failure to re-elect Mr. Sokolow will diminish the

capability and effectiveness of the Board, and cause the Board to

operate without the benefit of an “audit committee financial

expert” unless or until another individual with similar

qualification is identified.

We urge stockholders to follow the

Board’s recommendation and vote “FOR” all the proposals in the

proxy statement, including the re-election of Ms.

Beidler-D’Aguilar, Mr. Butler and Mr. Sokolow. If you previously

voted “against” or withheld your vote any proposal, you may change

that vote simply by voting again TODAY. Only your latest-dated vote

will count!

Your vote is important, please vote your shares today.

- By

Internet: Go to www.proxyvote.com and follow the

instructions (have your proxy card available).

- By

Telephone: Call 1-800-690-6903 and follow the voice

prompts (have your proxy card available).

- By

Mail: If shareholders have received a proxy card,

shareholders should mark their vote, sign their name exactly as it

appears on the proxy card, date the card and return it in the

envelope provided.

About Consolidated Water Co. Ltd.

Consolidated Water Co. Ltd. develops and

operates advanced water supply and treatment plants and water

distribution systems. The Company designs, constructs and operates

seawater desalination facilities in the Cayman Islands, The Bahamas

and the British Virgin Islands, and designs, constructs and

operates water treatment and reuse facilities in the United States.

The Company recently entered the U.S. desalination market with a

contract to design, constructs, operate and maintain a seawater

desalination plant in Hawaii.

The Company also manufactures and services a

wide range of products and provides design, engineering,

management, operating and other services applicable to commercial

and municipal water production, supply and treatment, and

industrial water and wastewater treatment. For more information,

visit cwco.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release includes statements that may

constitute “forward-looking” statements, usually containing the

words “believe”, “estimate”, “project”, “intend”, “expect”,

“should”, “will” or similar expressions. These statements are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements

inherently involve risks and uncertainties that could cause actual

results to differ materially from the forward-looking statements.

Factors that would cause or contribute to such differences include,

but are not limited to (i) continued acceptance of the Company’s

products and services in the marketplace; (ii) changes in its

relationships with the governments of the jurisdictions in which it

operates; (iii) the outcome of its negotiations with the Cayman

government regarding a new retail license agreement; (iv) the

collection of its delinquent accounts receivable in The Bahamas;

and (v) various other risks, as detailed in the Company’s periodic

report filings with the SEC. For more information about risks and

uncertainties associated with the Company’s business, please refer

to the “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” and “Risk Factors” sections of the

Company’s SEC filings, including, but not limited to, its annual

report on Form 10-K and quarterly reports on Form 10-Q, copies of

which may be obtained by contacting the Company’s Secretary at the

Company’s executive offices or at the “Investors – SEC Filings”

page of the Company’s website at http://ir.cwco.com/docs. Except as

otherwise required by law, the Company undertakes no obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise.

Important Shareholder

Information

The Company filed the Proxy Statement and a

proxy card on April 18, 2024 with the SEC in

connection with its solicitation of proxies for the 2024 Annual

General Meeting of Shareholders. THE COMPANY’S SHAREHOLDERS ARE

STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT, THE ACCOMPANYING

PROXY CARD, AND ANY AMENDMENTS AND SUPPLEMENTS TO THESE DOCUMENTS

WHEN THEY BECOME AVAILABLE, AS THEY CONTAIN IMPORTANT INFORMATION.

Stockholders may obtain the Proxy Statement, any amendments or

supplements to the Proxy Statement, and other documents, as and

when they become available, without charge from the SEC’s

website at www.sec.gov.

Participant Information

The Company, its directors, director nominees,

certain of its officers, and other employees are or will be

“participants” (as defined in Section 14(a) of

the U.S. Securities Exchange Act of 1934, as amended) in

the solicitation of proxies from the Company’s shareholders in

connection with the matters to be considered at the 2024 Annual

General Meeting of Shareholders. The identity, their direct or

indirect interests (by security holdings or otherwise), and other

information relating to the participants is available in the Proxy

Statement filed with the SEC on April 18, 2024, in

the section titled “Security Ownership of Certain Beneficial Owners

and Management and Related Shareholders Matters” (beginning on page

17). To the extent the holdings by the “participants” in the

solicitation reported in the Proxy Statement have changed, such

changes have been or will be reflected on “Statements of Change in

Ownership” on Forms 3, 4 or 5 filed with the SEC (where

applicable). All these documents are or will be available free of

charge at the SEC’s website at www.sec.gov.

Company Contact:David W. SasnettExecutive Vice

President and CFOTel (954) 509-8200Email Contact

Investor Relations Contact:Ron Both or Grant

StudeCMA Investor RelationsTel (949) 432-7566Email Contact

Media Contact:Tim RandallCMA Media RelationsTel

(949) 432-7572Email Contact

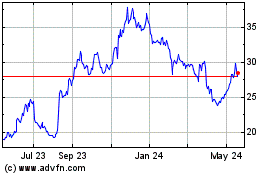

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

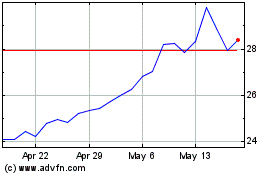

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Dec 2023 to Dec 2024